Hindenburg Research has announced the plans to disband just days before Donald Trump takes over as the US president for the second time. The US short-seller founder Nate Anderson announced, "I write this from a place of joy. Building this has been a life's dream."

"I did not know at the outset if it would be possible to find a fulfilling path. This wasn't an easy option, but I was naïve to the danger and felt drawn to it magnetically," he added in an elaborate letter, announcing the winding-up plans.

The announcement comes after the company, that published reports with allegations against the Adani Group leading to investor losses in the market, faced regulatory heat from the Securities and Exchange Board of India.

Trump To Take Over, Hindenburg Winds Up

Interestingly, though the Hindenburg founder did not mention a specific reason for the decision to shut down, it comes before President Biden's term ends and Donald Trump takes over.

The US market regulator, Securities and Exchange Commission has been cracking down on short-sellers and with Trump taking over as the president of the United States this month, the scrutiny might only intensify.

Among the recent developments, Trump had reacted to reports of plans to sell shares of Trump Media & Technology Group, calling for a probe from "the appropriate authorities" into "market manipulators or short sellers".

Trump's appointment as president means that, in addition to overseeing the various federal agencies, he will also handle the appointment of the chief of the SEC.

In fact, according to a report by Institutional Investor published on Wednesday, short-sellers that have been hitting the solar companies for years, might be looking at uncertain future prospects as Donald Trump is set to take over as the president.

On The Radar, In India And US

Regulators recently raised the heat against short-sellers in both, India as well as US. Last year, the US authorities charged renowned short-seller Andrew Left with being involved in fraud through his trades, research reports and social media.

SEC, the regulatory authority, had accused Left of operating illegally through his firm Citron and making approximately $20 million in profits from trading activities that involved 24 companies.

Back home, SEBI in November completed all 24 investigations in Adani-Hindenburg case. The regulator had found that its disclaimer on positions in Adani Group "only through non-Indian traded securities was misleading since it concealed the complete extent of its financial interest in companies which were the subject of its research report due to Hindenburg's direct stake in profits from positions taken by the FPI in the future of AEL on the Indian stock exchange."

SEBI had alleged that prior to the release of report by Hindenburg in Jan 2023 against the Adani Group, short-selling activity was seen in the futures of Adani Enterprises and the share lost 59% between Jan. 24, 2023 and Feb. 22, 2023 after the report was published.

Adani Stocks Gain

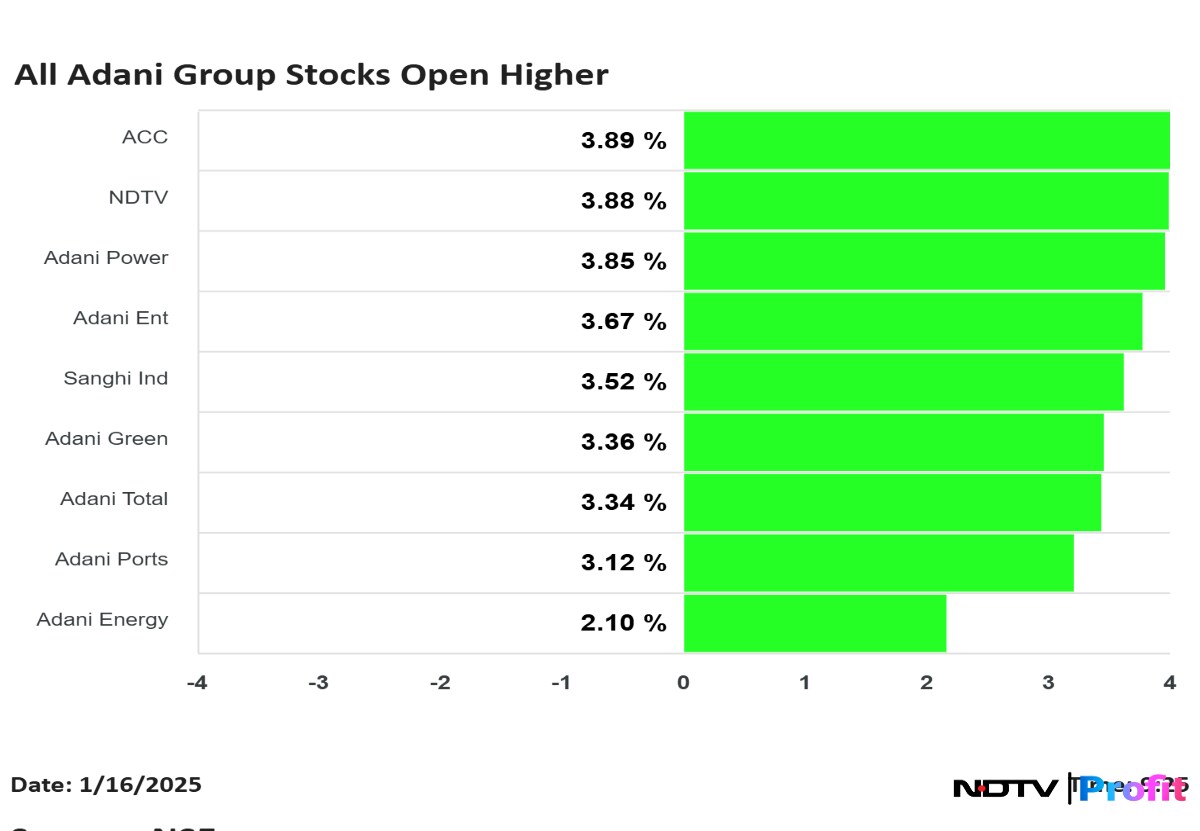

Shares of Adani Group companies surged on Thursday, with sharp gains in Adani Power Ltd. and Adani Green Energy Ltd. The ten listed stocks under the conglomerate added Rs 51,100.62 crore to investors' wealth, taking the market capitalisation between them to Rs 12.79 lakh crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.