Paras Defence & Space Tech Q1 Results: Paras Defence & Space Technologies announced its April-June quarter results for fiscal 2025-26 (Q1FY26) on Friday, July 25, reporting a consolidated net profit of Rs 15 crore, almost flat compared to the corresponding period last year.

The smallcap defence company's topline (revenue from operations) in the first quarter of current fiscal rose 11.5% to Rs 93.2 crore compared to Rs 83.6 crore in the year-ago period. Paras Defence had announced its first-ever stock split on July 3 in the ratio 1:2, wherein one share of face value of Rs 10 was split into two Rs 5 shares. The record date was set as July 4.

Paras Defence & Space Tech Q1 FY26 Highlights (Cons, YoY)

Revenue rises 11.5% to Rs 93.2 crore versus Rs 83.6 crore

EBITDA rises 9% to Rs 22 crore versus Rs 24.1 crore

Margin at 23.6% versus 28.9%

Net profit (bottomline) flat at Rs 14.9 crore

Paras Defence fixes record date for final dividend of FY25

Paras Defence announced in their regulatory filing to the stock exchanges, "The Board of Directors at their meeting held on April 30, 2025, had recommended the payment of final dividend of Rs. 0.50 per equity share of Rs. 5 each for the financial year ended March 31, 2025. 11."

"It was also inter alia mentioned that the record date for the purpose of the final dividend and the date from which dividend, if approved by the shareholders, will be paid, shall be communicated in due course," it added. The defence company has fixed August 8, 2025 as the record date for the purpose of the dividend.

The record date is for determining the eligibility of the members to receive the proposed dividend of Rs. 0.50 per equity share (i.e., 10%), subject to the approval of the shareholders at the ensuing annual general meeting (AGM). "Once approved, the dividend will be paid within 30 days from the date of the AGM," it added.

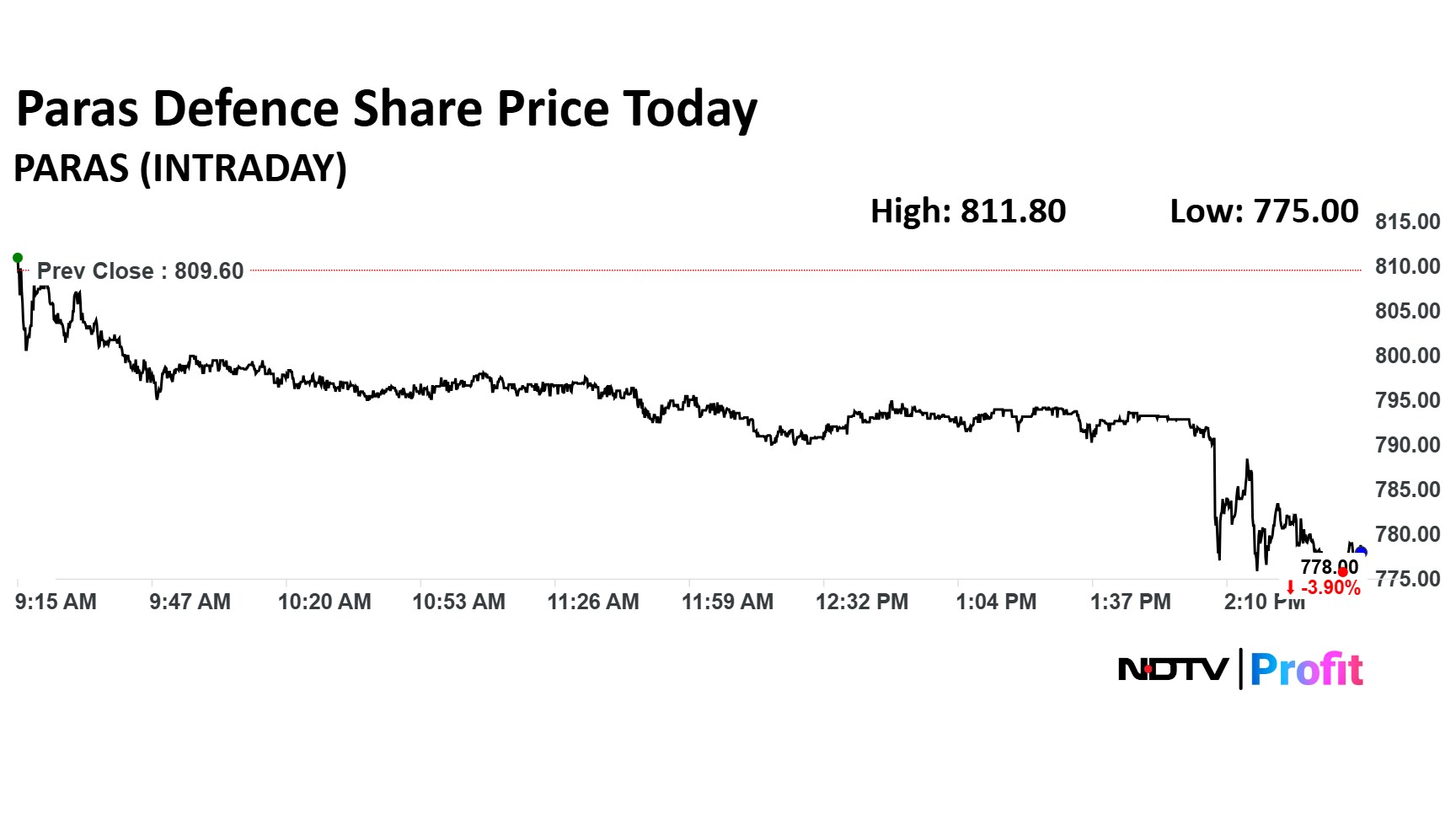

Paras Defence Share Price Movement

Paras Defence share price dropped 3.85% intraday to Rs 775 apiece. The scrip was trading 3.57% lower by 2.49 p.m. The benchmark NSE Nifty 50 was down 0.94%. The relative strength index was 45.82.

Shares of Paras Defence and Space Technologies have risen 2% this week. In the past month, the stock has dropped 1.81%. However, in the last six months, shares of the company have jumped 47%.

On a year-to-date basis, the defence stock has grown 55%, while rising 23% in 12 months. The stock hit a 52-week high of Rs 972.5 apiece on the NSE on May 19, 2025, and a 52-week low of Rs 404.7 on March 3. Paras Defence has delivered multibagger 190% returns in the last three years and 247.55% in five years.

Paras Defence provides products and solutions for the defence sector. It is primarily engaged in designing, developing, manufacturing and testing of a wide range of engineering products and system solutions for the defence sector. The company primarily operates in two verticals of Optics and Optronic Systems, and Defence Engineering.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.