Mazagon Dock Shipbuilders Ltd. reported a 30% surge in net profit for the third quarter of the financial year 2025. JPMorgan raised its target price on the stock as the performance surpassed expectations. However, new order margins have the brokerage cautious.

The state-run firm posted a consolidated net profit of Rs 768 crore for the quarter ended Dec. 31, 2024, compared to Rs 591 crore in the same period last year. This performance exceeded the consensus estimate of Rs 706 crore tracked by Bloomberg.

The company's revenue for the quarter stood at Rs 3,144 crore, reflecting a 33.1% year-on-year growth from Rs 2,362 crore in the previous year. This growth was primarily driven by the delivery of the P15 Bravo destroyer, which significantly contributed to the overall revenue.

JPMorgan has maintained a 'neutral' rating on Mazagon Dock, but has raised its target price to Rs 2,262 from Rs 2,124 per share. The third-quarter performance was ahead of margin expectations, with large orders on the horizon, it said. However, it pointed out that the order book has stagnated and margins on new orders might be lower.

The brokerage also highlighted that while revenue growth has been strong, it could temporarily slow if large awards are delayed.

The brokerage noted that orders for submarines and warships are typically large and take considerable time to materialise. Currently, Mazagon Dock Shipbuilders Ltd. is in contention for significant orders, but the order book fell to Rs 348 billion at the end of Q3 FY25, marking a 9% year-on-year decline due to the absence of new large orders in recent years, JPMorgan noted.

The current high margins in the profit and loss statement are due to cost and efficiency savings on older orders. However, these savings will likely be passed on to customers, as new nominated orders are awarded, normalising margins over the medium term (approximately 2.5 years, once the current order book is substantially executed), the brokerage said.

JPMorgan expects MDL's revenue to grow at an 18% compound annual growth rate over FY20-24, driven by a very high (11 times) starting book-to-bill ratio. While MDL is in the running for several large orders, these can take a long time to come to fruition and require additional time to ramp up execution. Consequently, MDL's revenue growth rate could decelerate, if there is a longer-than-expected delay in awarding large orders.

Nirmal Bang Institutional Research upgraded Mazagon Dock to a 'buy' rating, following the company's strong quarterly performance. Revenue, Ebitda and PAT grew by 33.1%, 51.5% and 28.8%, respectively year-on-year, it noted. The delivery of the P15 Bravo destroyer played a crucial role in this growth.

The company executed a stock split, reducing the face value from Rs 10 to Rs 5 per share, effective Dec. 27, 2024, it noted.

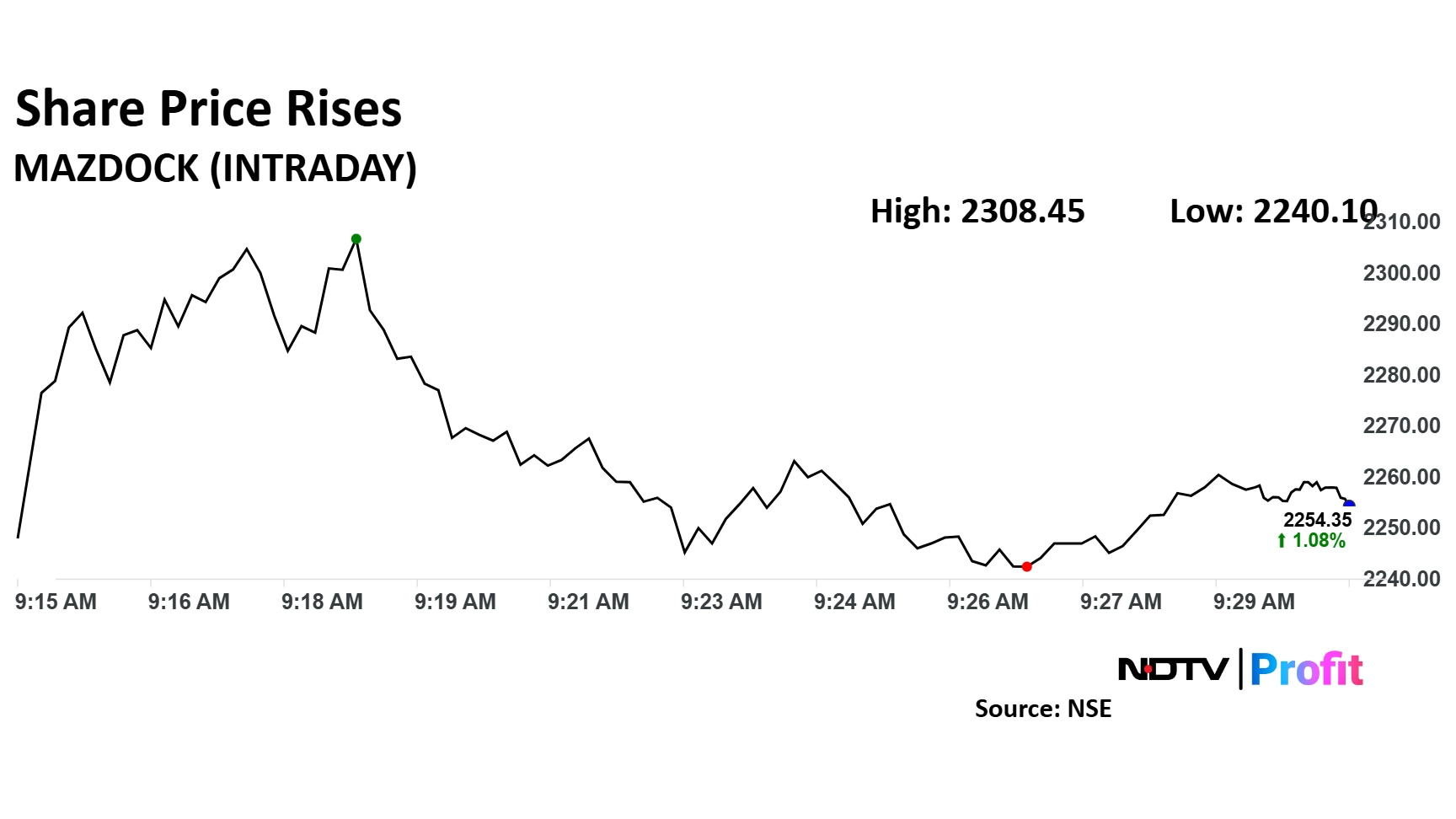

Mazagon Dock Share Price

Shares of Mazagon Dock rose as much as 3.51% to Rs 2,308 apiece. They pared gains to trade 0.71% higher at Rs 2,247 apiece, as of 09:29 a.m. This compares to a 0.35% decline in the NSE Nifty 50.

The stock has risen 109% in the last 12 months. Total traded volume so far in the day stood at 0.28 times its 30-day average. The relative strength index was at 49.84.

Out of five analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold' and one suggest 'sell', according to Bloomberg data. The average of 12-month analysts' consensus price target implies an upside of 21.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.