Life Insurance Corporation of India still has brokerages optimistic about a recovery in annual premium equivalent growth, despite caution over ongoing margin compression and a decline in value of new business during December quarter.

LIC's value of new business dropped by 27% year-on-year due to weaker APE growth, but the margin of 19.4% was better than expected.

Goldman Sachs maintains a 'neutral' rating with a target price of Rs 900, citing a topline miss primarily due to a 38% year-on-year decline in individual participating business and an 18% drop in group business.

Despite these challenges, the brokerage remains optimistic about LIC's focus on non-participating products, which is expected to improve margins in the medium term.

Macquarie keeps an 'outperform' rating on LIC with a target price of Rs 1,215. The brokerage noted a large VNB miss in third quarter, driven by low growth and margin pressures, particularly from a reduction in the non-participating margin.

Macquarie emphasises the importance of balancing growth with margins and sees future trends in this area as crucial for the company's performance.

Citi has lowered LIC's target price to Rs 1,180 from Rs 1,385, while maintaining its 'buy' rating after the third quarter results. The decline in VNB was driven by a 24% drop in APE, but Citi remains optimistic about LIC's future growth prospects, especially with the ongoing shift towards non-participating products.

Emkay, too, highlights a healthy VNB margin of 19.4% in third quarter, driven by an increased share of non-par products, though APE growth fell by 24%. The brokerage has retained its 'add' rating but has lowered its target price to Rs 1,100 from Rs 1,150. Despite sluggish growth, it expects a recovery for LIC in the coming quarters driven by higher policy sales and larger ticket sizes.

Meanwhile, JPMorgan has raised its target price for LIC to Rs 1,115 from Rs 1,075 while maintaining an 'overweight' rating. It attributes this target price increase to steady progress in enhancing product mix, despite a temporary slowdown in new business growth.

JPMorgan believes the APE decline has bottomed out, predicting a recovery in the fourth quarter and next fiscal year, with a 20% VNB growth forecast for the next financial year due to a shift towards higher ticket segments and a favorable age mix.

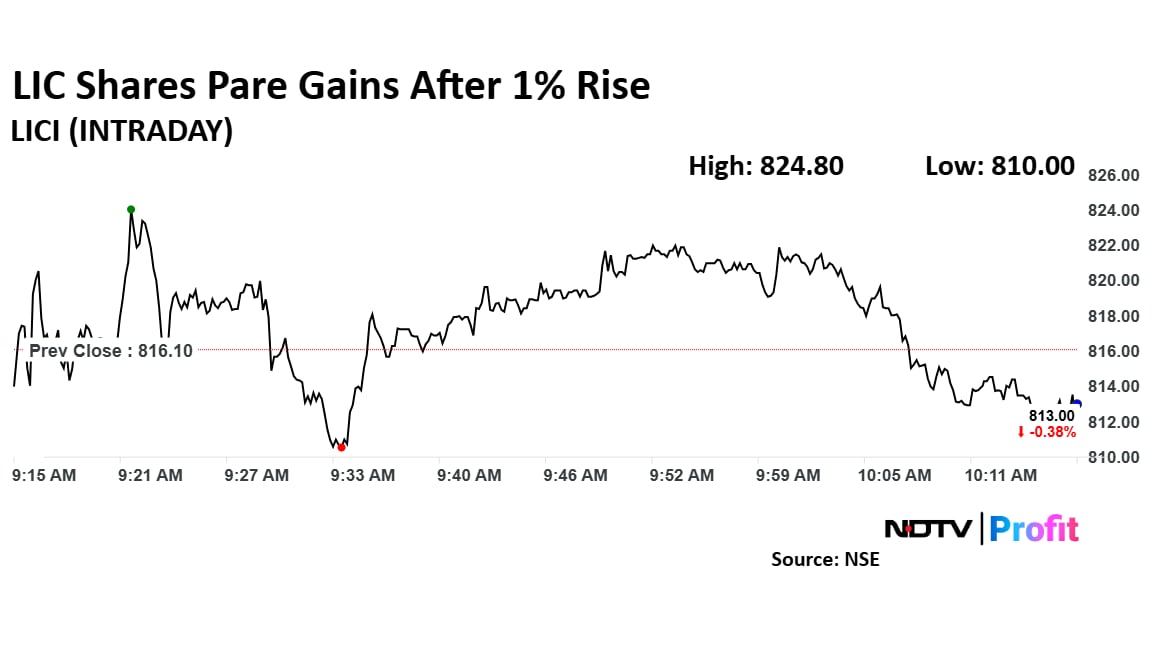

LIC Shares Rise Over 1%

Shares of LIC rose as much as 1.07% to Rs 824.80 apiece, the highest level since Feb. 7. It pared gains to trade 0.07% higher at Rs 816.65 apiece, as of 10:20 a.m. This compares to a 0.77% decline in the NSE Nifty 50.

The stock has fallen 20.33% in the last 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 39.

Out of 20 analysts tracking the company, 15 maintain a 'buy' rating, four recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 32.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.