(6).jpeg?downsize=773:435)

Delhivery, the logistics and supply chain giant, has reported its third-quarter fiscal year 2025 results, revealing a mixed performance. While the company saw revenue growth and rise in profitability, earnings fell short of analyst estimates, prompting several brokerages to revise their outlook on the stock.

Concerns about weak express parcel volume growth, margin pressures, and limited near-term growth visibility have led to downgrades and target price cuts.

Delhivery's third quarter revenue rose 8.4% year-on-year to Rs 2,378 crore. The company also reported a net profit of Rs 25 crore, compared to Rs 12 crore in the same period last year.

However, Ebitda declined by 6.3% to Rs 102 crore, with margins contracting to 4.3% from 4.9% year-on-year.

The company cited pre-festive season capacity expansion and higher vehicle rental costs as factors impacting margins. While PTL (Part Truck Load) business showed robust growth, the Express Parcel segment — a key driver for Delhivery — faced headwinds.

Goldman Sachs

Goldman Sachs maintained a 'neutral' rating on Delhivery, but lowered its target price to Rs 370 from Rs 400. The brokerage highlighted that Q3 volumes and margins missed estimates, particularly in the Express Parcel segment.

They expressed concern over the weak performance of express parcel volumes, attributing it to increased in-sourcing, by key clients and competition from quick-commerce platforms.

Operating leverage in PTL volumes is crucial for driving incremental margins, the brokerage said. It will be closely monitoring this segment's performance in the coming quarters.

Morgan Stanley

Morgan Stanley took a more bearish stance, downgrading Delhivery's stock to 'equal-weight' from 'overweight' and reducing the target price to Rs 320 from Rs 450 per share.

The brokerage cited a sharp earnings miss and limited growth visibility for the industry as reasons for the downgrade. It expressed concerns about the slowdown in e-commerce growth and continued share shift by key customers away from 3PL (Third-Party Logistics) service providers.

While acknowledging Delhivery's competitive strengths and potential for consolidation, Morgan Stanley said the uncertainty surrounding the timeline for such consolidation makes the risk-reward less attractive at this point. They also highlighted the push-out of profitability expectations, now anticipating high-single-digit adjusted Ebitda margins beyond FY27.

Emkay

Emkay maintained a 'buy' rating on Delhivery, but reduced its target price to Rs 425 from Rs 475 per share. Ebitda fell short due to higher vehicle rental costs during the festive season, the brokerage said.

It expects PTL performance to remain strong in Q4, but acknowledged the headwinds faced by the B2C segment due to broader industry challenges and insourcing by Meesho.

Delhivery could benefit from marketplaces deciding to outsource logistics, given the losses of captive units. Emkay highlighted the growth in Delhivery's D2C and SME portfolios and the company's focus on intra-city logistics and dark stores.

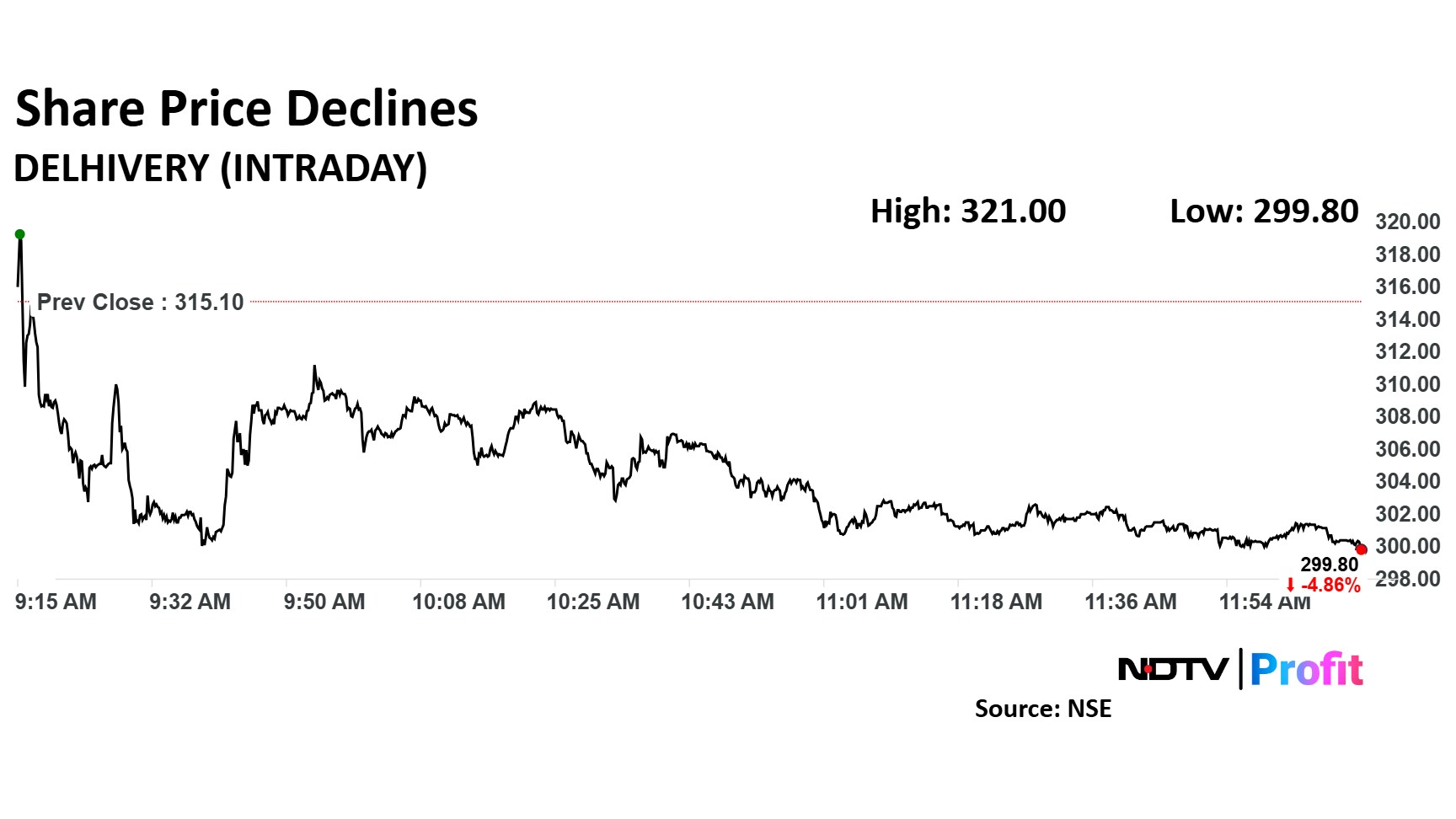

Delhivery Share Price Today

Shares of Delhivery fell as much as 4.86% to Rs 299 apiece. They pared losses to trade 4.51% lower at Rs 300 apiece, as of 12:08 p.m. This compares to a 0.89% decline in the NSE Nifty 50.

The stock has fallen 28.25% in the last 12 months. Total traded volume so far in the day stood at 7.3 times its 30-day average. The relative strength index was at 31.

Out of 23 analysts tracking the company, 17 maintain a 'buy' rating and six recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 41.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.