The Department of Posts has issued new rules for small savings schemes (SCS) accounts, the violation of which can lead to their closure. Account holders should take note that the authorities will now freeze the accounts if they remain unclosed for even three years after the end of the maturity period.

These new rules apply to small savings schemes accounts like the Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS), National Savings Certificate (NSC), Kisan Vikas Patra (KVP), Post Office Monthly Income Scheme (MIS), Post Office Time Deposit (TD), and Post Office Recurring Deposit (RD).

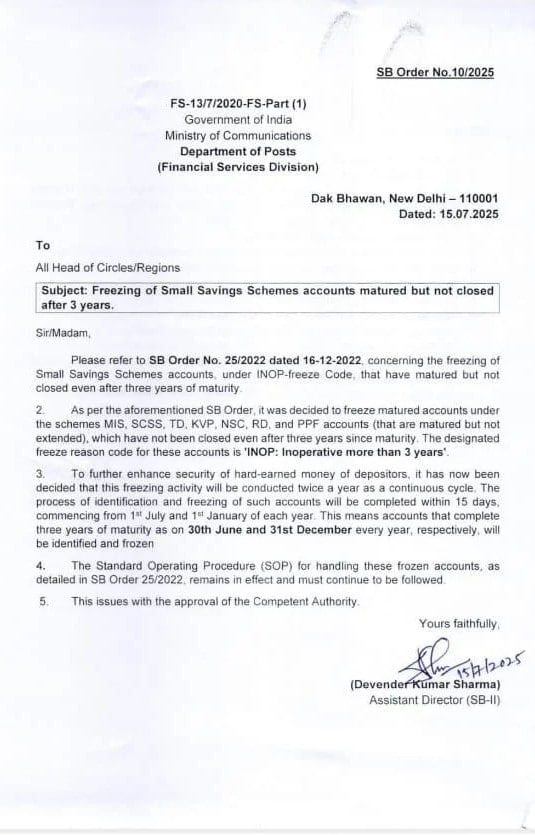

In an order dated July 15, the Department of Posts issued the new rules to freeze small savings scheme accounts that are not closed after three years of maturity. The move is aimed at protecting the investors' money. Under the new rules, the Post Office will now identify and freeze the inactive and matured small savings accounts twice a year if they are not formally extended by subscribers.

image: https://utilities.cept.gov.in/dop/pdfbind.ashx?id=11918

"To further enhance the security of the hard-earned money of depositors, it has now been decided that this freezing activity will be conducted twice a year as a continuous cycle," the Department said.

This process will take place in two phases, starting on January 1 and July 1. The identification and freezing will be completed within 15 days of these dates. Accounts that complete three years past maturity by June 30 and December 31 will be identified and frozen, according to the Department of Posts.

"The process of identification and freezing of such accounts will be completed within 15 days, commencing from July 1 and Jan. 1 of each year. This means accounts that complete three years of maturity as on June 30 and Dec. 31 every year, respectively, will be identified and frozen," the notification added.

To avoid getting a small savings account frozen, subscribers will need to submit requests for formal extension of the deposit scheme.

The revised rules come days after the government announced keeping the interest rates for all small savings schemes unchanged for the July to September quarter of FY 2025-26.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.