If you fall under the taxable income bracket, you are liable to pay a certain portion of your net income as tax. However, calculating your taxable income as per your income and investments can be a cumbersome task. This is where an income tax calculator can be useful.

The income tax calculator is an online tool on the Income Tax Department's e-filing portal. This IT calculator helps you to calculate your income tax as per the provisions of the Income Tax Act, 1961, based on your income. Here is a step-by-step guide to using this income tax calculator.

Steps To Use Income And Tax Calculator On The Income Tax Website

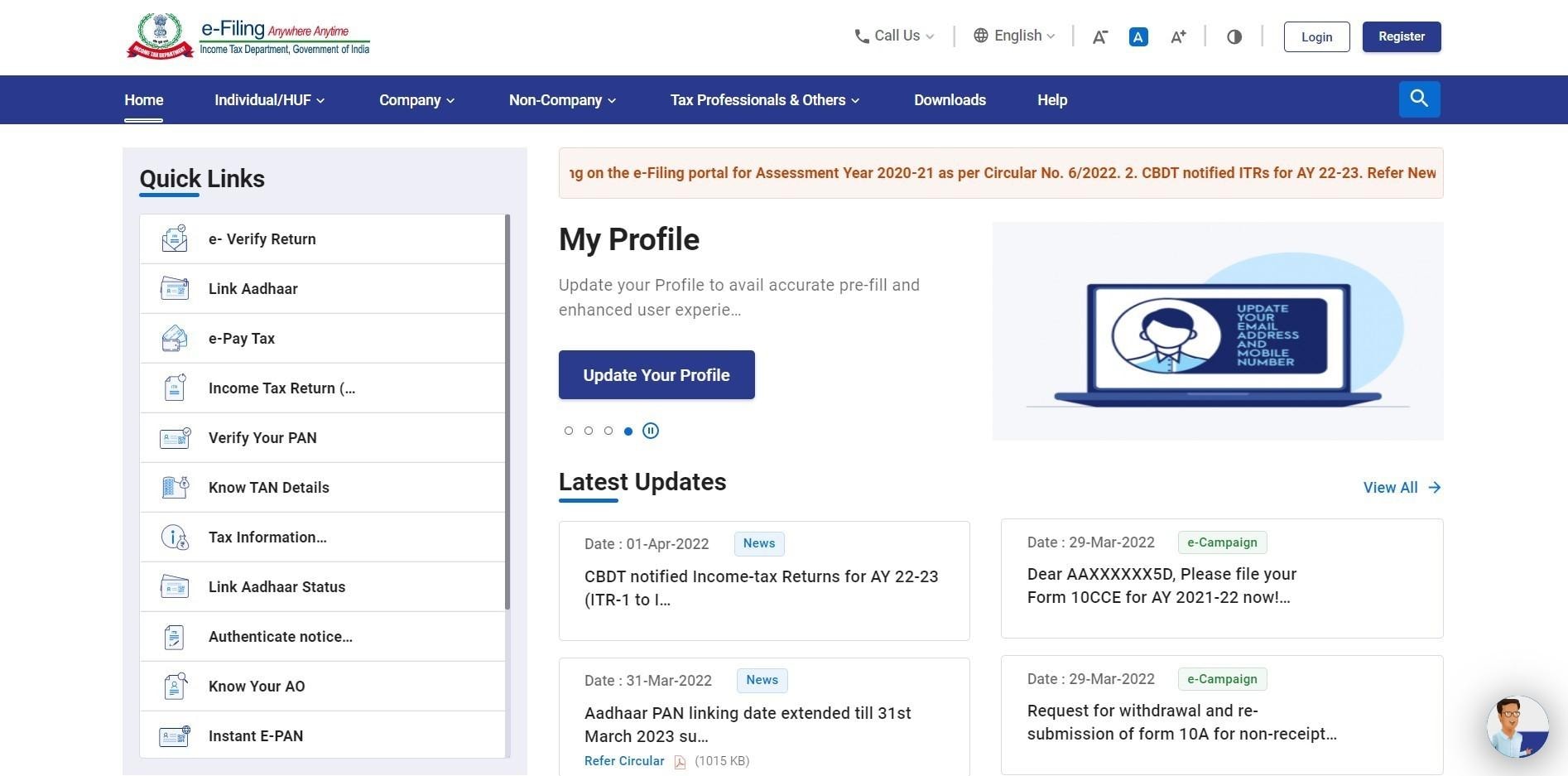

1. Visit the official e-filing website.

2. Move to the ‘Quick Links' section and select the ‘Income and Tax Calculator' option.

Source: https://www.incometax.gov.in/iec/foportal/income-tax-calculator

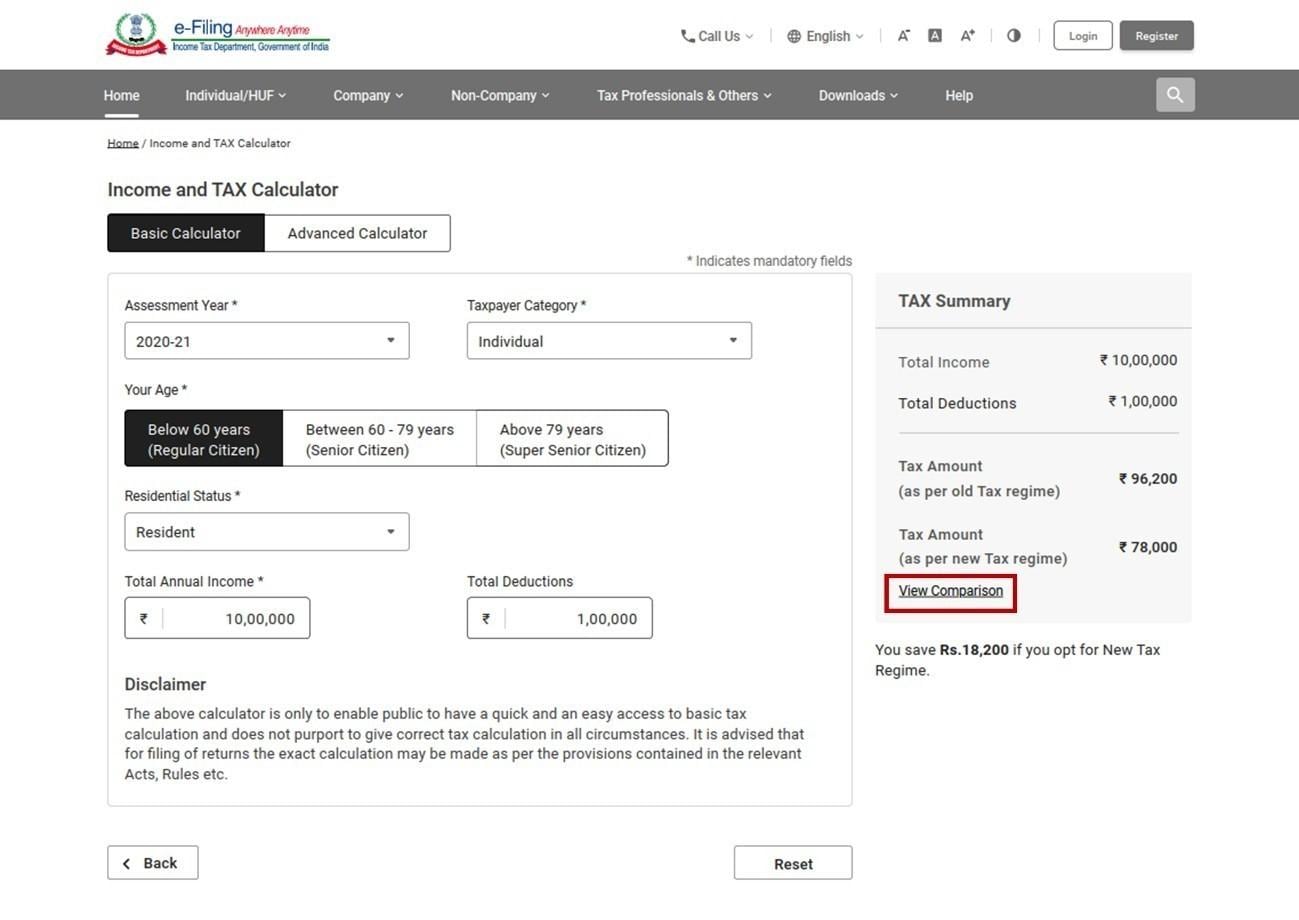

3. You will be redirected to the Income and Tax calculator page which has two tabs – basic calculator and advanced calculator. The basic calculator tab is selected as the default IT calculator.

4. Basic Income Tax Calculator:

Enter all the necessary details like assessment year, taxpayer category, age, residential status, total annual income, and total deductions.

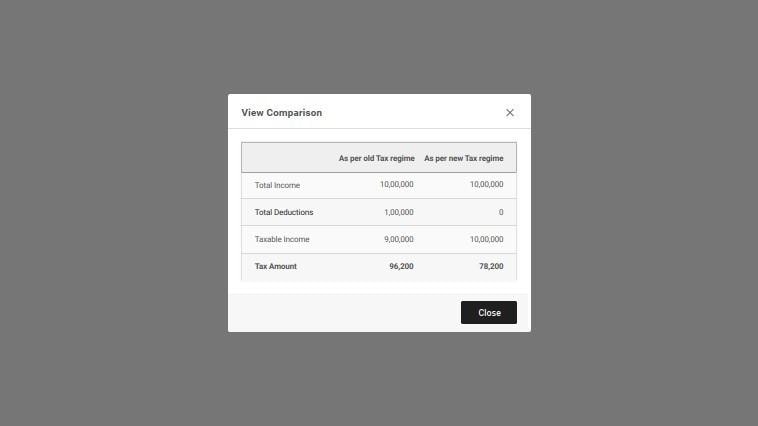

The income tax calculation will appear in the ‘Tax Summary' section. This will be based on the details you have provided. You can click on the ‘View Comparison' option to get a more detailed comparison of your income tax under the old regime and the new tax regime.

Source: https://www.incometax.gov.in/iec/foportal/income-tax-calculator

Source: https://www.incometax.gov.in/iec/foportal/income-tax-calculator

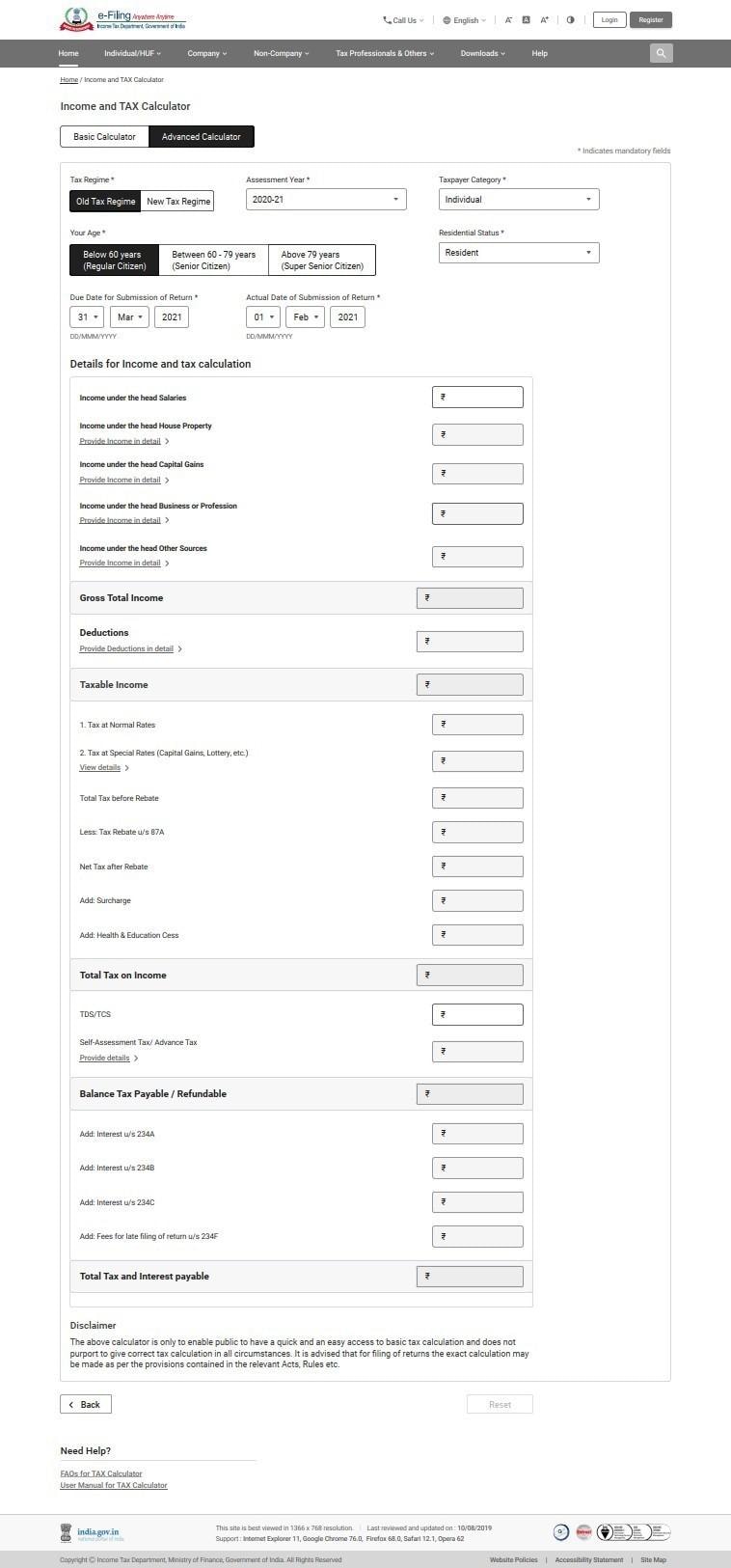

5. Advanced Tax Calculator

Enter your preferred income tax regime, assessment year, taxpayer category, age, residential status, the due date for submission of IT returns, and the actual date of submission.

Enter the following details under ‘Details for Income and tax calculation':

a. Income from salaries,

b. Income from house property,

c. Income from capital gains,

d. Income from business or profession,

e. Income from other sources.

Under the ‘Deductions' section, enter all the relevant income tax deductions applicable to you. This will include PPF, life insurance, home loan, NPS, medical insurance, etc.

In the ‘Taxable Income' section, enter or edit your TDS/TCS details.

Your total income tax liability will be displayed at the end of the page.

Source: https://www.incometax.gov.in/iec/foportal/income-tax-calculator

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.