The National Pension Scheme (NPS) is a long-term voluntary investment scheme introduced by the central government in India. This retirement scheme is administered and regulated by the Pension Fund Regulatory and Development Authority (PFRDA). Let's take a closer look at the NPS scheme and learn how you can opt for it.

What Is NPS?

The NPS is a voluntary retirement investment scheme for Indian citizens. The scheme was earlier open only to Central Government employees. However, the PFRDA has now made the NPS scheme open to all Indian citizens from the public, private and unorganised sectors, except those from the armed forces. An individual falling in the age group of 18-65 years can opt to open an NPS account.

If you open an NPS account, you can invest in the scheme at regular intervals during the course of your employment. The NPS scheme then invests your funds into various market-linked instruments like equities and debts. After retirement, you can opt to withdraw a certain percentage of your invested corpus from your NPS account. The remaining amount will be paid to you as a monthly pension post-retirement.

Asset Classes Under NPS Investments

While calculating NPS asset allocation, you can opt from the following asset classes:

Asset Class E: Equity market instruments

Asset Class C: Fixed income instruments

Asset Class G: Government securities

Asset Class A: Alternate assets like InVITs, REITs, etc

Tax Benefits Of NPS

If you are a subscriber under the NPS scheme, you can claim income tax benefits on investments in the scheme up to ₹1.5 lakh under Section 80C of the Income Tax Act, 1961.

You can also claim an additional income tax benefit on investments up to ₹50,000 over and above the limit of ₹1.5 lakh under Section 80CCD (1b) of the Income Tax Act, 1961.

If your employer contributes to your NPS account, you can claim tax benefits on the contributions from your employer. The maximum amount eligible for deduction under this section will be the lowest of the following:

Actual NPS contribution by your employer

10% of Basic salary + Dearness allowance

Gross total income

Types of NPS Accounts

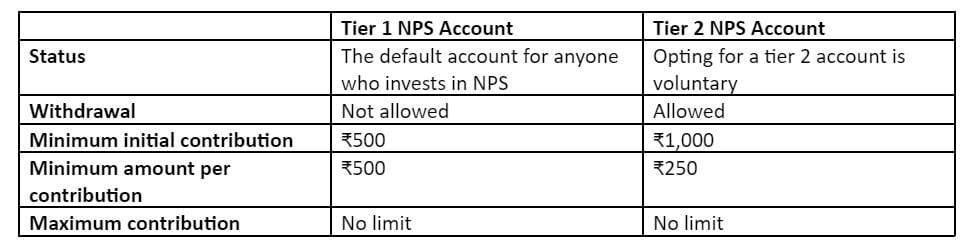

Under the NPS scheme, you can choose from two types of accounts: tier 1 account and tier 2 account. Let's understand the difference between the two accounts:

How to Open an NPS Account

There are two ways to open an NPS account- online and offline.

To open an NPS account offline, you can visit any authorised Points of Presence - Service Providers (POP-SP) and submit the duly filled Permanent Retirement Account Number (PRAN) application form along with your KYC documents. Currently, most public and private sector banks are enrolled as POP-SPs.

If you wish to open an NPS account online, you can visit the eNPS portal and open your NPS account using your Aadhaar card, PAN card and your bank account details.

Who Should Invest in NPS?

NPS is an ideal investment option for you if you are looking for the following benefits:

Low-cost investment

Tax benefits under Section 80C and Section 80CCD

Market-linked returns

Management of invested funds by experienced fund managers

Long-term investment

Flexibility in the selection of asset allocation

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.