Mumbai Suburban, Kolhapur and Chennai have emerged as top districts in terms of consumer spend through credit cards, according to a study of credit card outstanding. The study was done by Akara Research & Technologies Pvt.

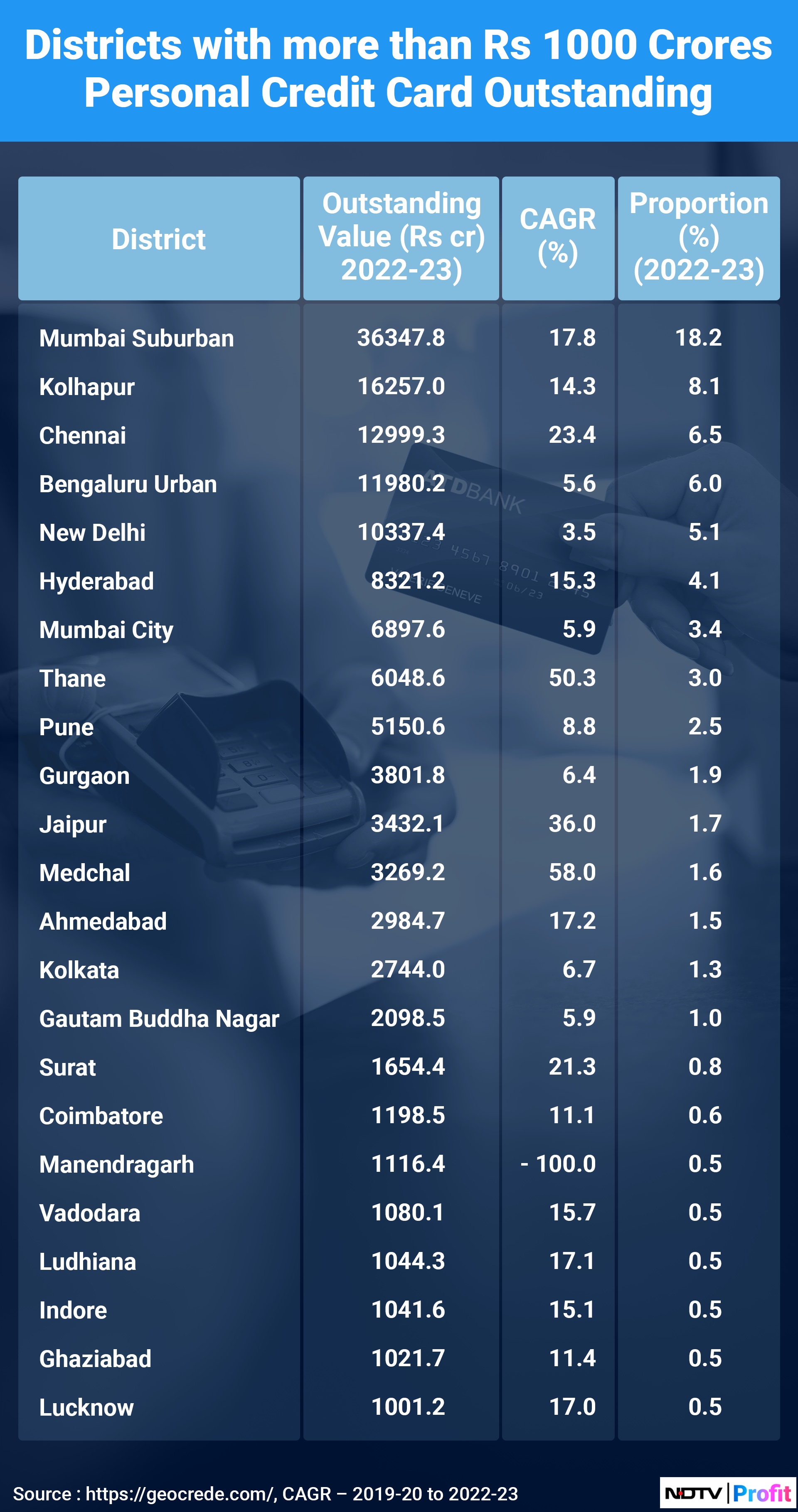

Akara used its Geo-Crede service and conducted a granular district-wise analysis — compound annual growth rate (2019–20 to 2022–23) and share of outstanding personal credit cards over the last three years. The study covered districts with more than Rs. 1,000 crore personal credit card outstanding.

According to the study, credit card outstanding is urban-centric in large cities. The study reveals that the top eight districts account for about 50% of scheduled-commercial-bank outstanding credit card loans of Rs 1,98,862.5 crore as of March 2023.

Mumbai Suburban (with a card outstanding of Rs 36,347.8 crore), tops the list, accounting for 18% of the outstanding personal credit cards (overall) and also growing at a CAGR of around 18%.

Surprisingly enough, Kolhapur takes the second spot in card outstanding (Rs 16,257 crore) with a share of 8.1%. The card outstanding in Kolhapur is growing at a CAGR of 14.3%.

Chennai (Rs 12,999 crore) edges past Bengaluru Urban to occupy the third position with a share of 6.5%. Significantly, the study finds the CAGR of card outstanding in Chennai to be growing at 23.4%. This growth appears to reflect the changing lifestyle in Chennai, which has turned a lot more cosmopolitan.

The share of Bengaluru Urban in credit card outstanding (Rs.11,980 crore) is 6%. Surprisingly, the CAGR of card outstanding of Bengaluru Urban is 5.6%.

Thane (Rs. 6,048 crore) has the Mumbai effect with a CAGR growth of 50% in card outstanding, establishing itself as one of the foremost urban centres after the metros for consumerism. Jaipur (Rs 3,432 crore), too, has reported a higher CAGR of 36%, indicating life-style changes in the wake of rising job opportunities in IT and ITES fields.

The study finds Medchal (Rs 3,269 core) in Telangana reporting a higher CAGR of card outstanding at 54% though its share in the total is just 1.6%.

The findings of the study come at a time when the Reserve Bank of India has consistently expressed its concern over the rise in personal loans. As of September 2023, personal loans accounted for one-third (33.2%) of the SCB loan portfolio and is the fastest growing loan segment — 31% as of the quarter ended September 2023 — compared to agriculture (16.8%), industry (6.1%) and services (23.5%).

In November last year, the central bank increased the risk weightage on consumer credit, excluding home, vehicle, education and gold loans. The focus of its concern was largely on unsecured loans, such as an unsecured personal loan and personal credit-card loans.

"While Reserve Bank of India may have its concerns, it is raining good times for consumer goods' firms that can focus on the right-mix of products in markets such as Chennai, Thane and Jaipur, which have shown high growth in credit card spends," said Rohit Sabherwal, co-founder of Akara Research & Technologies, which developed https://geocrede.com/ where all banking data on deposits and credits sourced from RBI is housed.

KT Jagannathan is a senior financial journalist based in Chennai. He has been in business journalism for over three decades, covering corporate developments and critical industry verticals. He is the co-founder of www.carnaticdarbar.com, a news website for Carnatic music, a niche art form.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.