July end is fast approaching which means every individual who is eligible for ITR (income tax return) must now prepare to file their income tax returns on the income tax e-filing portal. Your tax liabilities and tax returns will be calculated as per the Income-tax Act, 1961, the income tax slab that you fall under and other variables.

ITR Filing Last Date

The deadline for filing ITR is July 31, 2023. As per the changed rules notified under section 234F of the Income Tax Act, filing your ITR post the deadline, can make you liable to pay a maximum penalty of Rs 5,000 - this is for people having an annual income of over Rs 5 lakh.

If you're new to income tax filing and are wondering how to file ITR or simply need a reminder, then read on.

How To File ITR Online?

In this era of digitisation, filing your income tax returns is also extremely simple. Learn how to file ITR in a few easy steps.

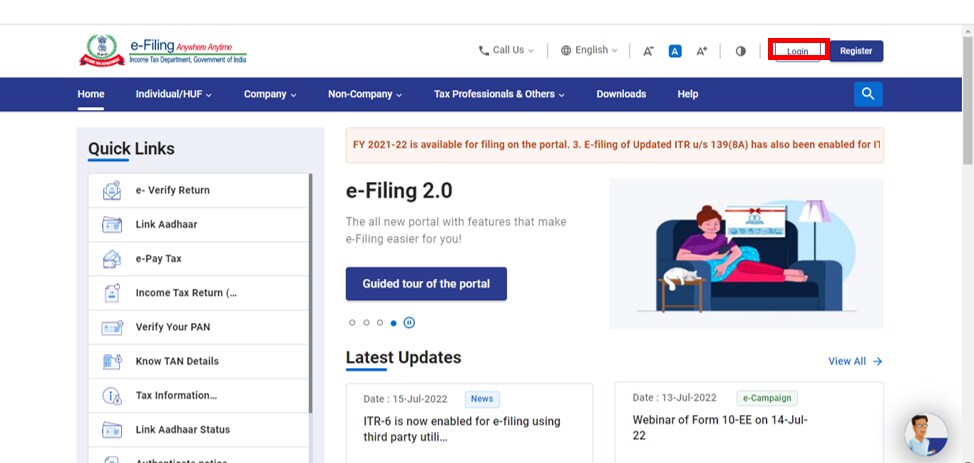

Step 1: Click on - https://www.incometax.gov.in/iec/foportal/ and go to the e-Filing portal. Sign up with the required details if you don't already have your credentials.

Source: Income Tax e-Filing Website

Step 2: Click on the Login tab on your right and log in to the portal using your user ID, which is the same as your PAN, and password.

Source: Income Tax e-Filing Website

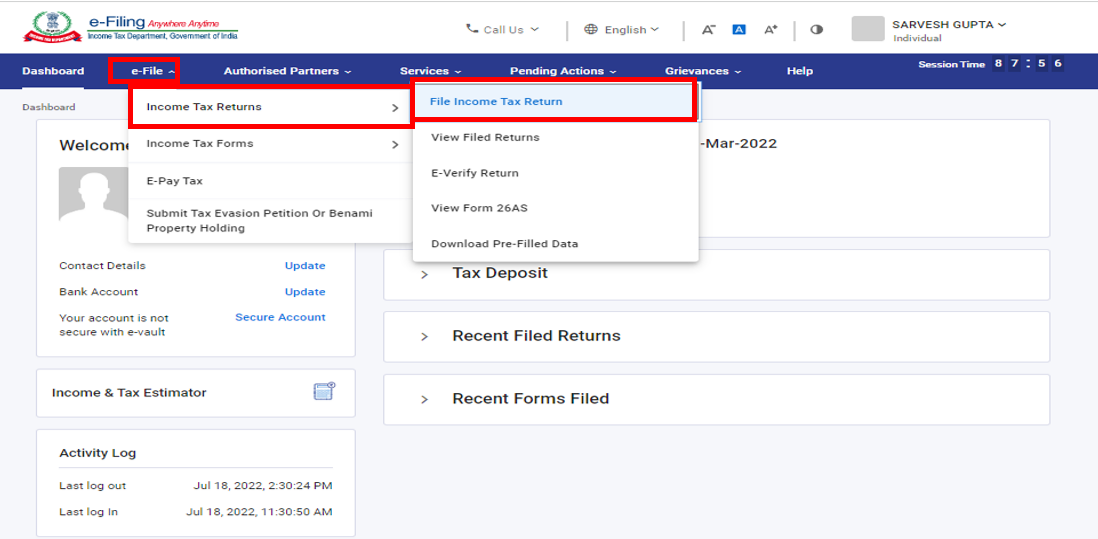

Step 3: On your Dashboard, click on e-File, then on Income Tax Returns then on File Income Tax Return.

Source: Income Tax e-Filing Website

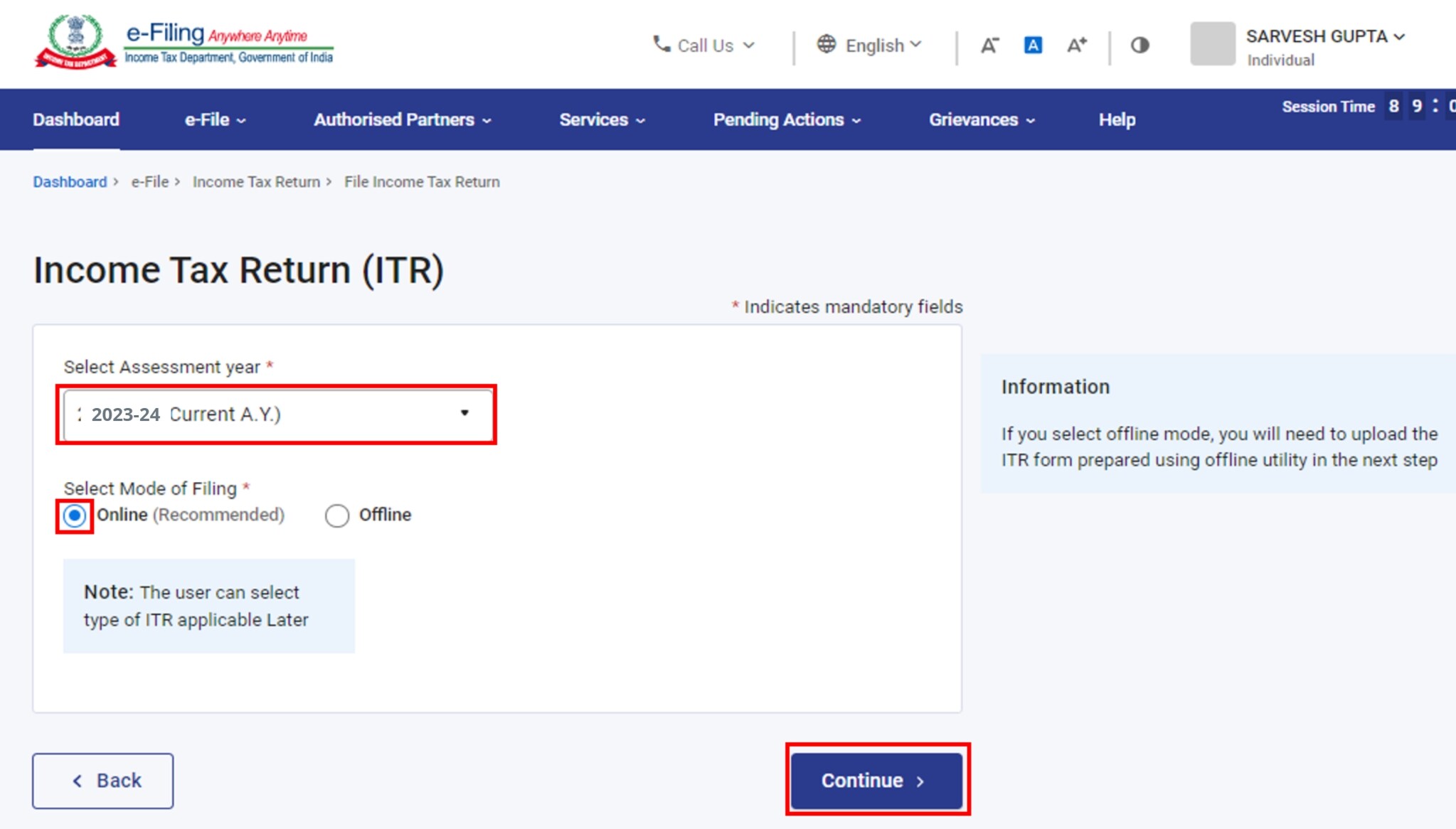

Step 4: Select the Assessment Year as 2023 - 24 which is the current Assessment Year and choose the Mode of Filing as Online. Now, click on Continue.

Source: Income Tax e-Filing Website

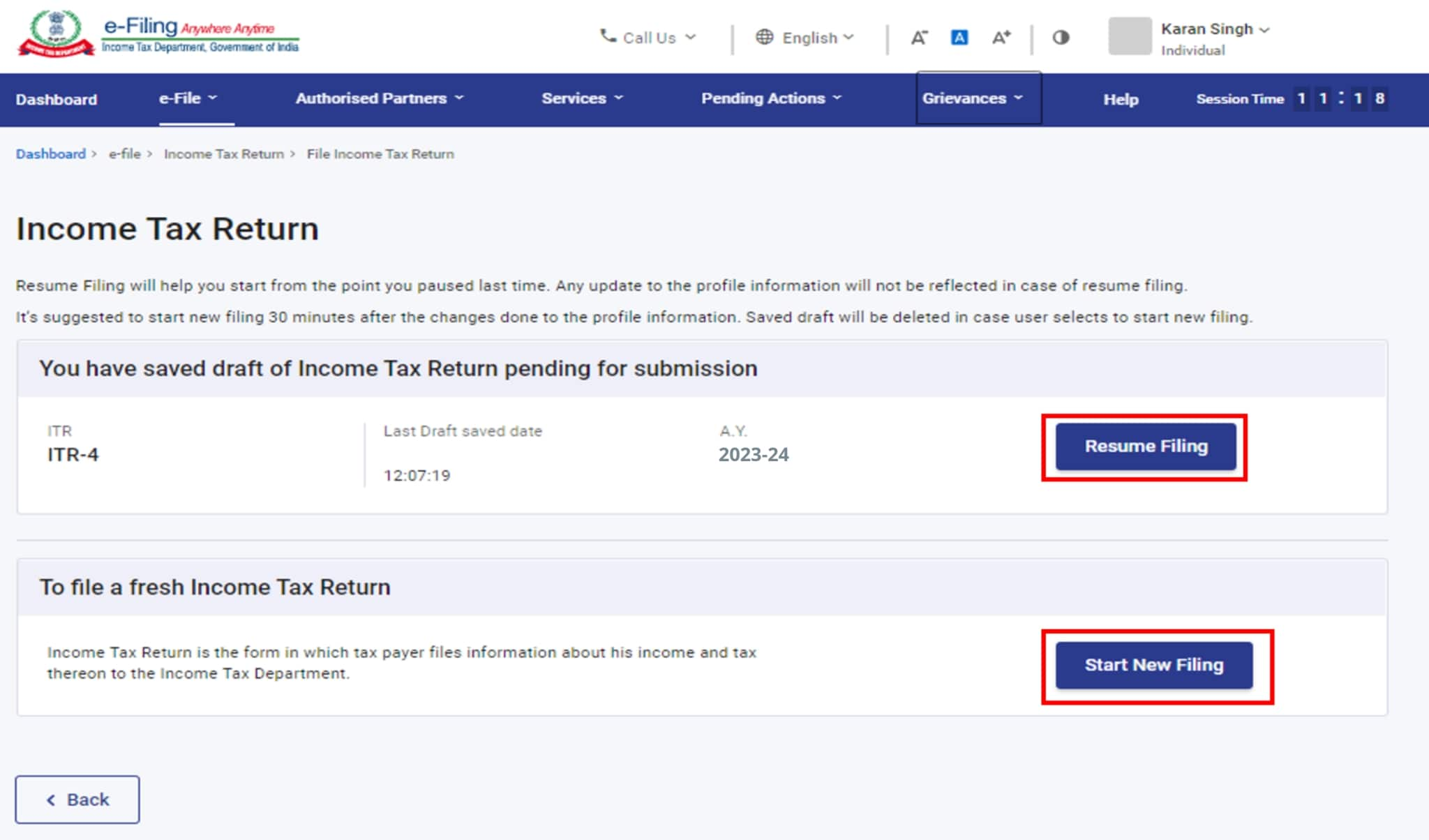

Step 5: If you are filing for the first time your screen will see the “Start New Filing” option. Click on it. However, if you have already started with your income tax filing, but haven't submitted it yet, you will see two options. Click on “Resume Filing” if you want to continue with the existing details, or click on “Start New Filing” if you want to discard and start afresh.

Source: Income Tax e-Filing Website

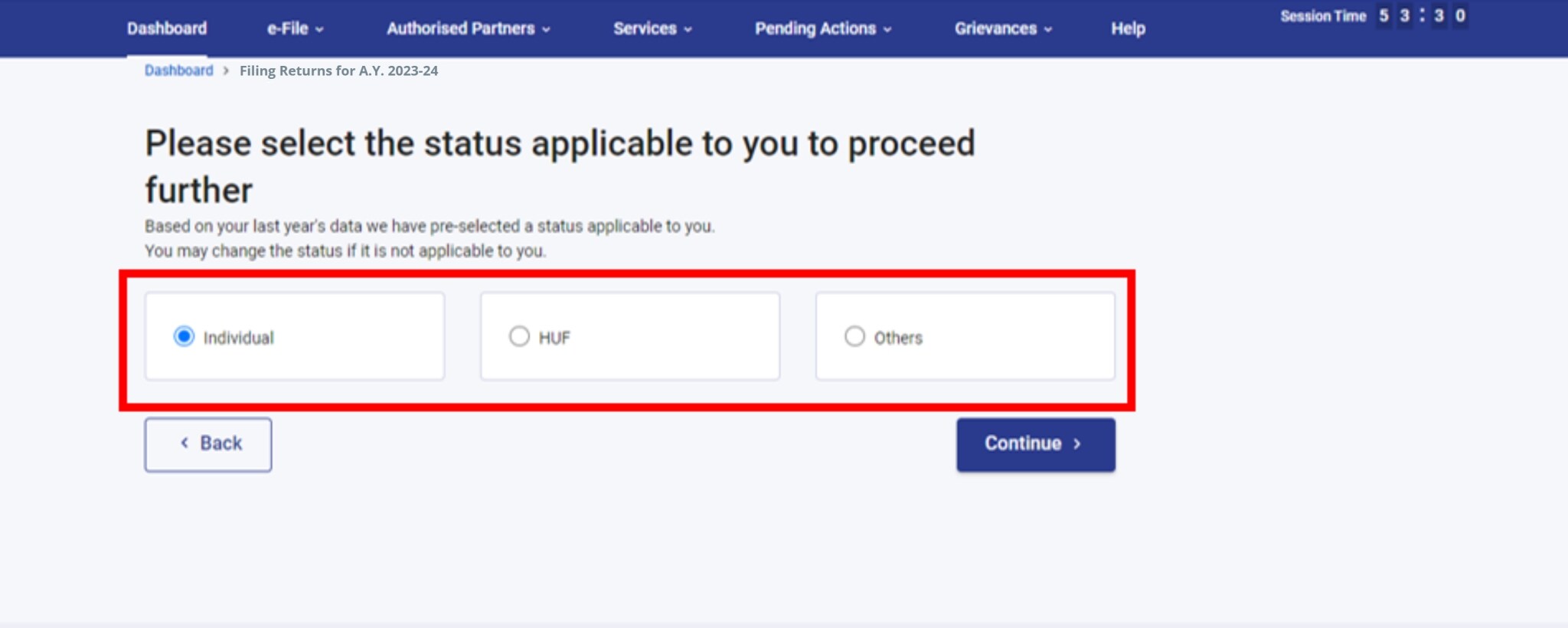

Step 6: Select the Status as applicable to you between Individual, HUF and others. Now, click on Continue to proceed further.

Source: Income Tax e-Filing Website

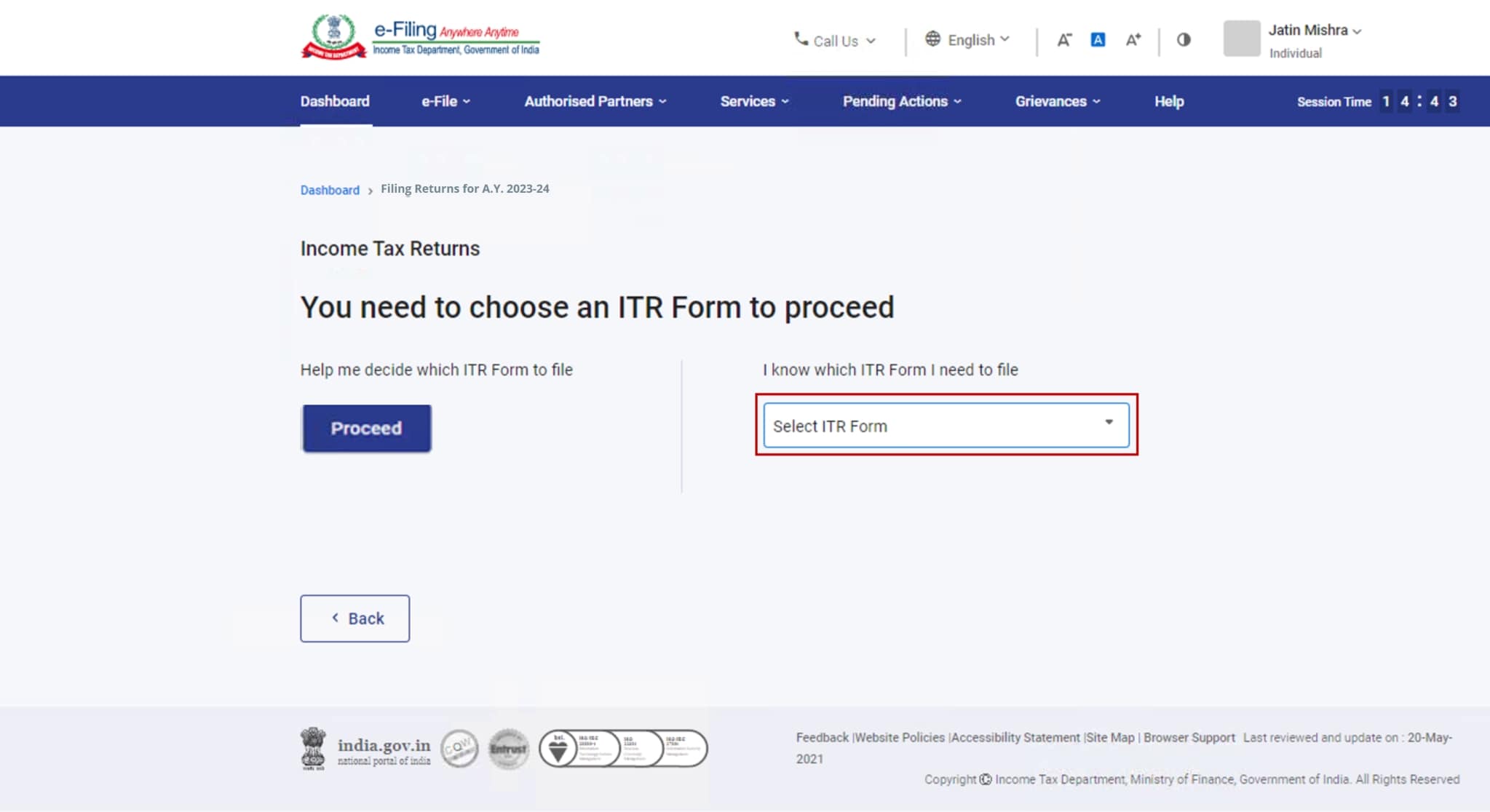

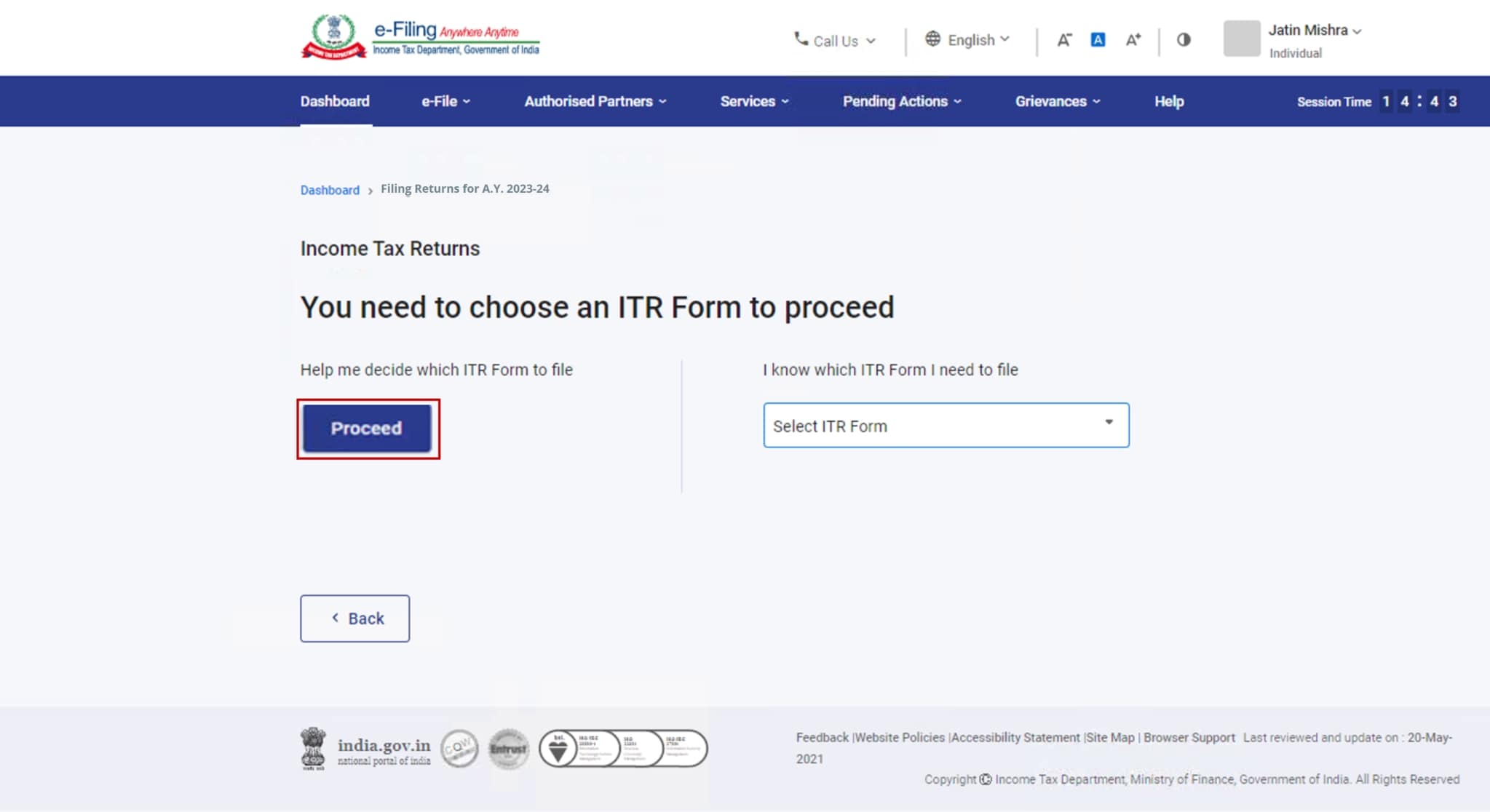

Step 7: Now, you need to select the type of ITR form you need to file. For this, you have two options:

Source: Income Tax e-Filing Website

If you are not sure which ITR form you need to file, you can click on the “Proceed” button below the “Help me decide which ITR Form to file” option. The wizard-based system will then help you decide which ITR form better suits you, then you can proceed with your ITR filing.

Source: Income Tax e-Filing Website

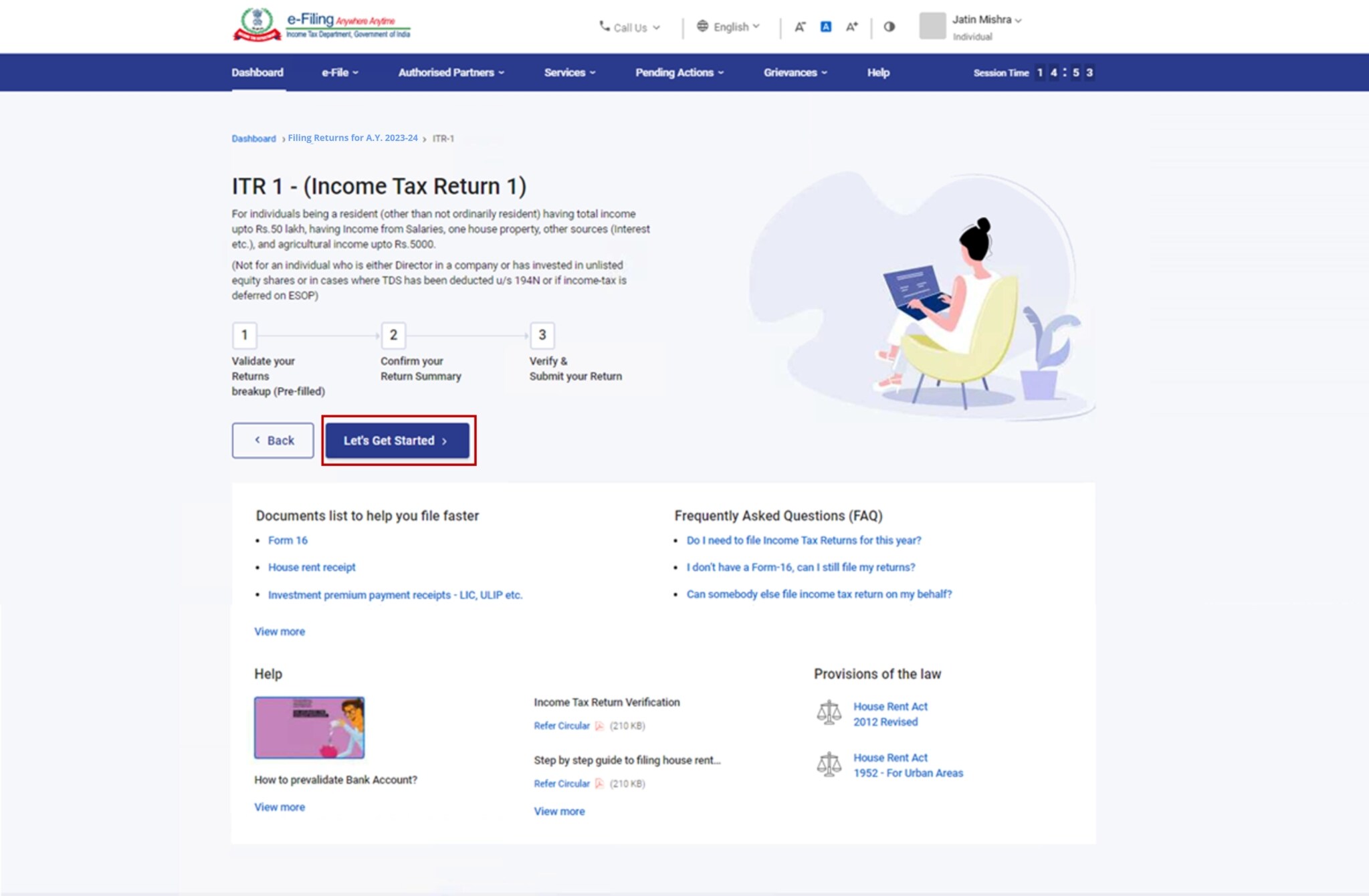

Step 8: Once you have selected the ITR form applicable to you, take note of the list of documents you need to file your Income Tax Return and click on the “Let's Get Started” button.

Source: Income Tax e-Filing Website

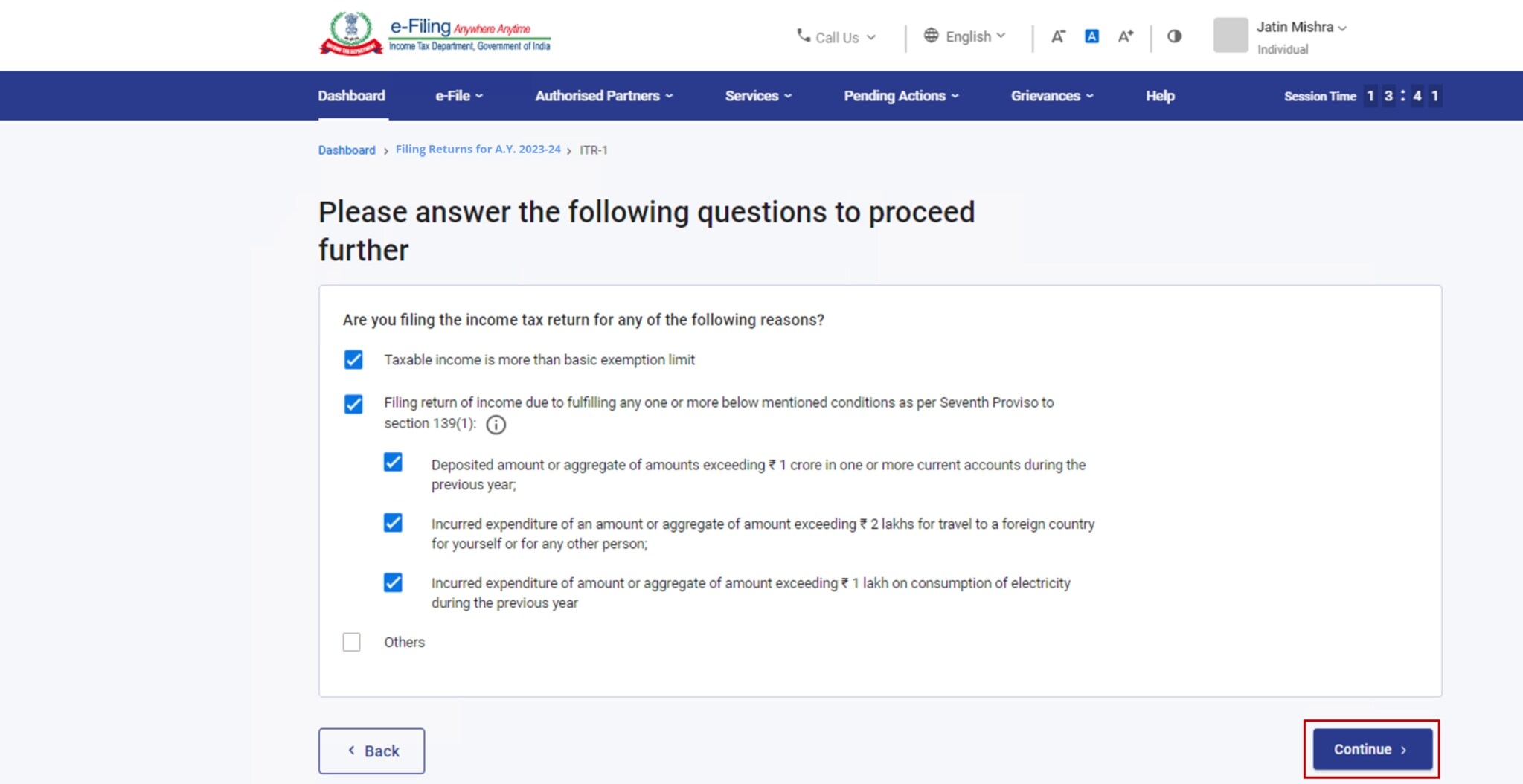

Step 9: Select all the checkboxes that apply to you regarding your various reasons for income tax filing and click on “Continue”.

Source: Income Tax e-Filing Website

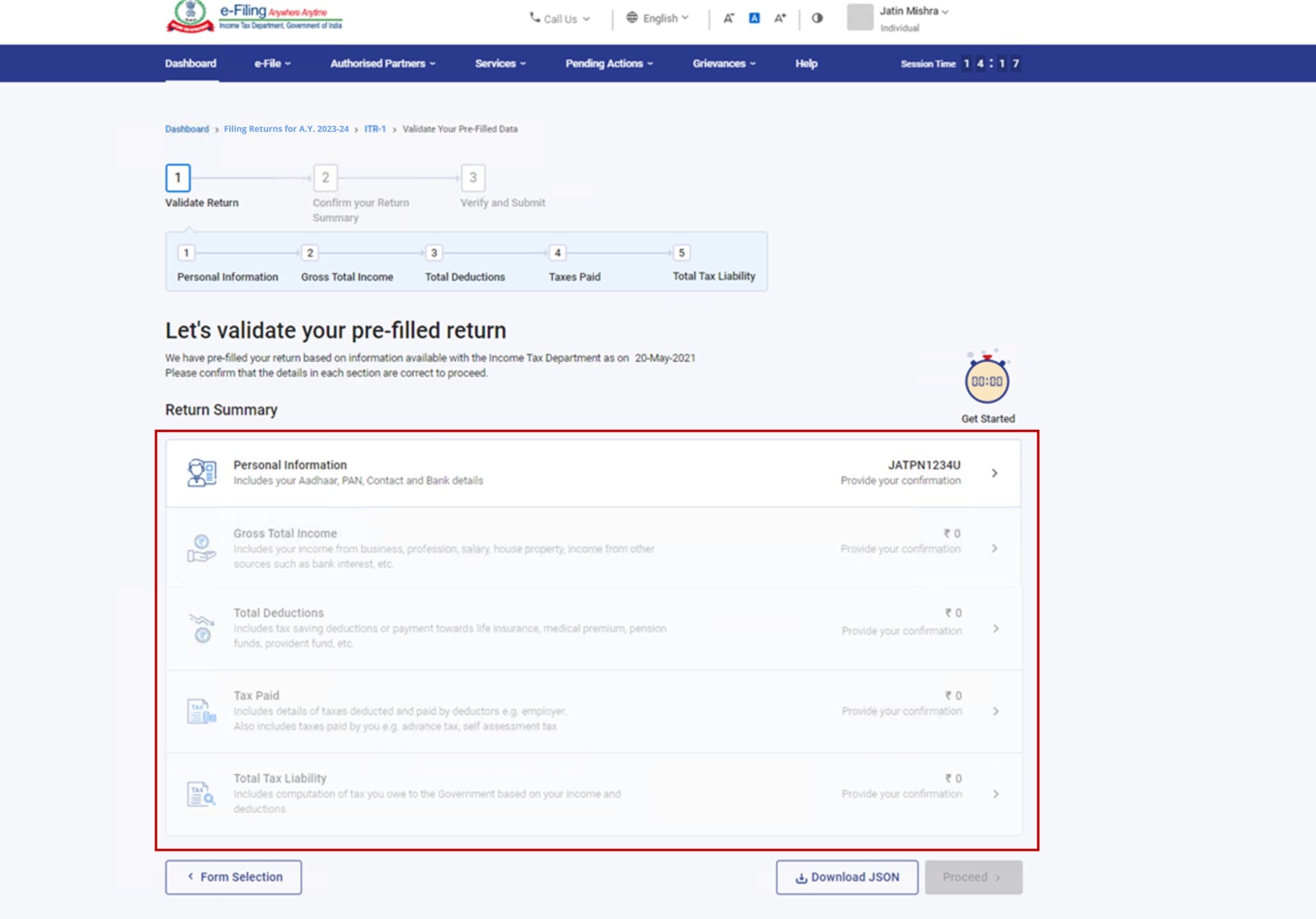

Step 10: If you wish to opt for New Tax Regime, select Yes in the Personal Information Section, if not, click on No and continue to the next section. Now, review all of your pre-filled data and edit it if and whenever necessary. Enter all the remaining or additional data (if required) and click on Confirm at the end of every section.

Source: Income Tax e-Filing Website

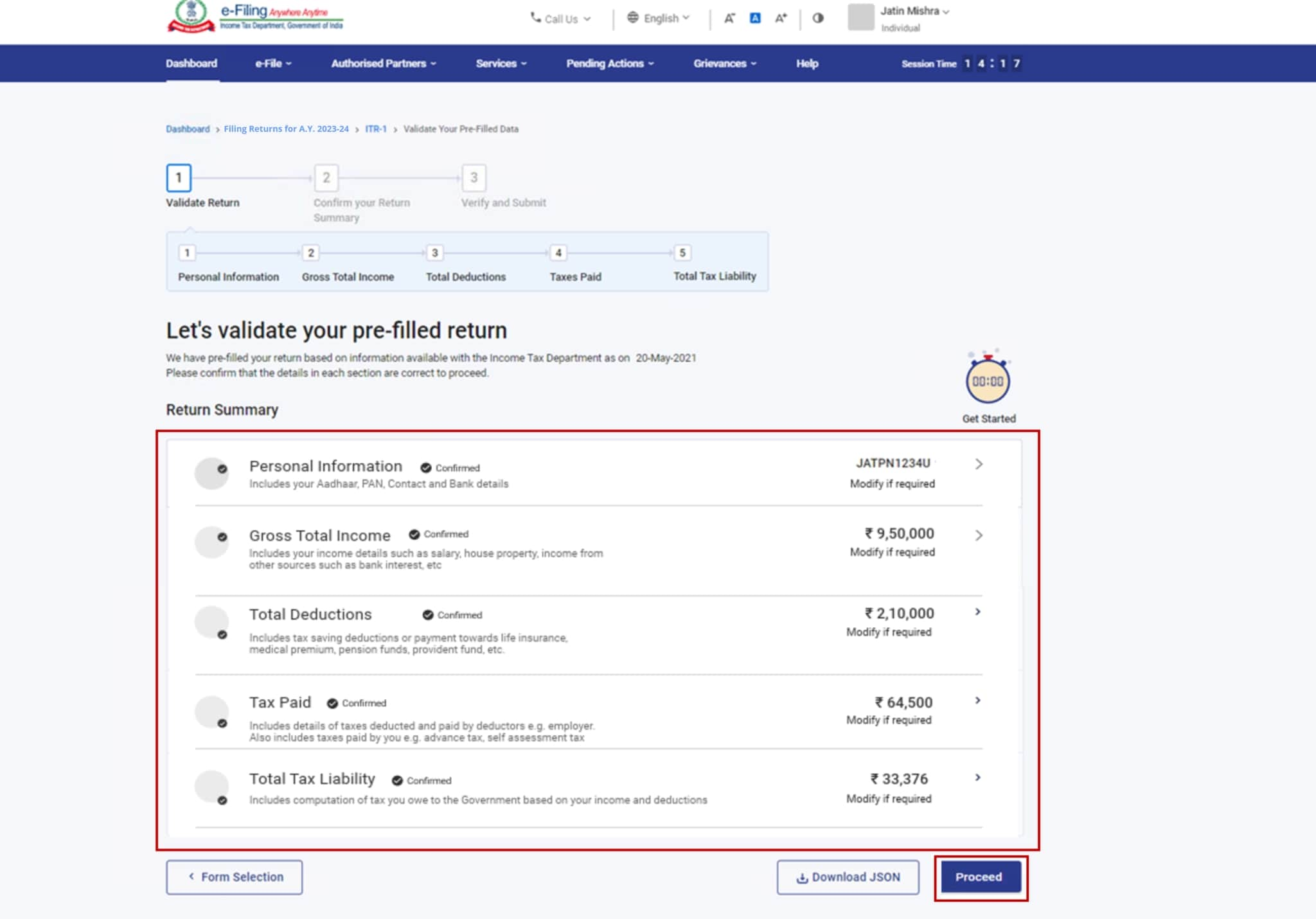

Step 11: Enter your Gross Total Income and tax deduction details in the various sections available. Review your Tax Paid and Total Tax Liability, and then click on “Proceed”.

Source: Income Tax e-Filing Website

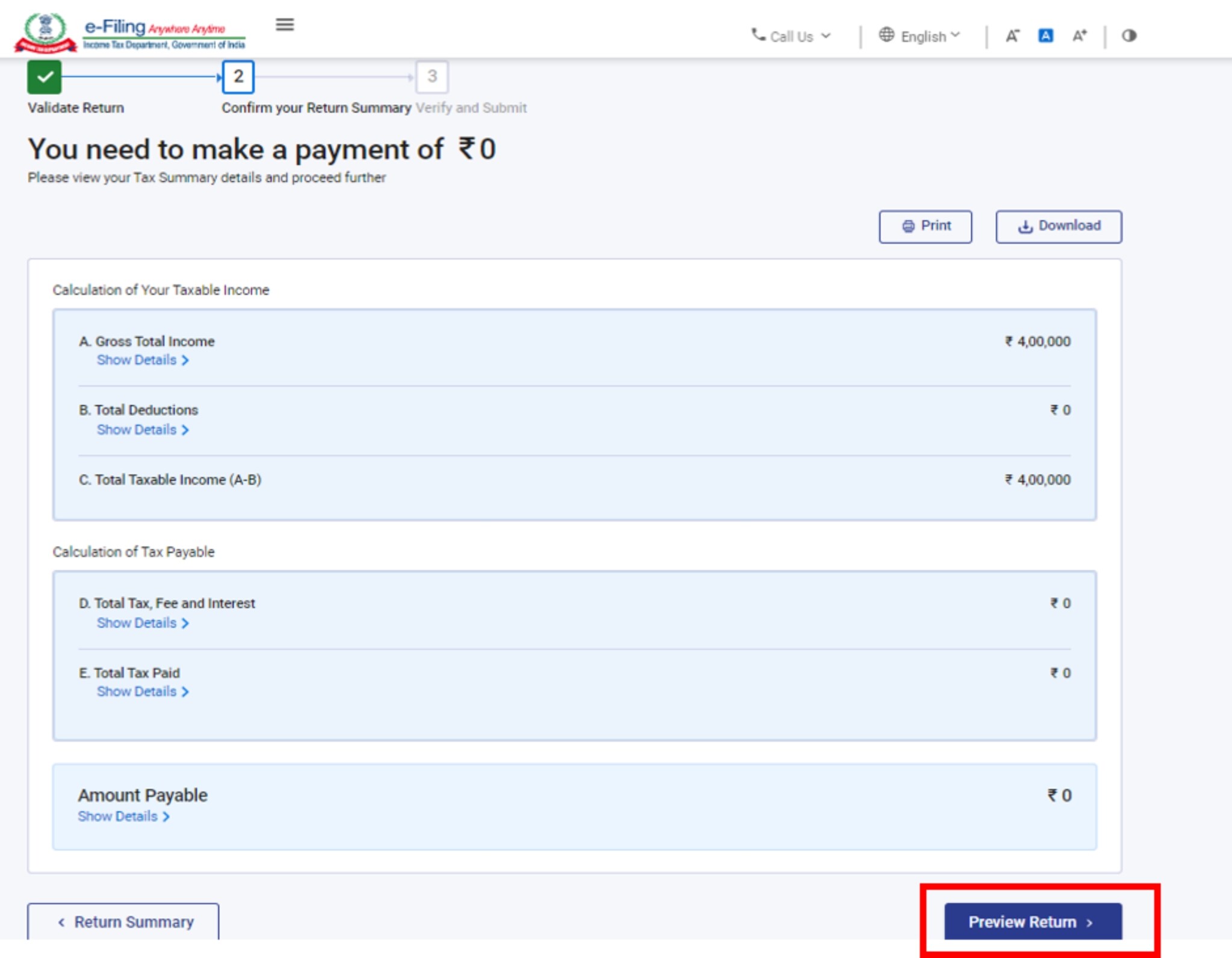

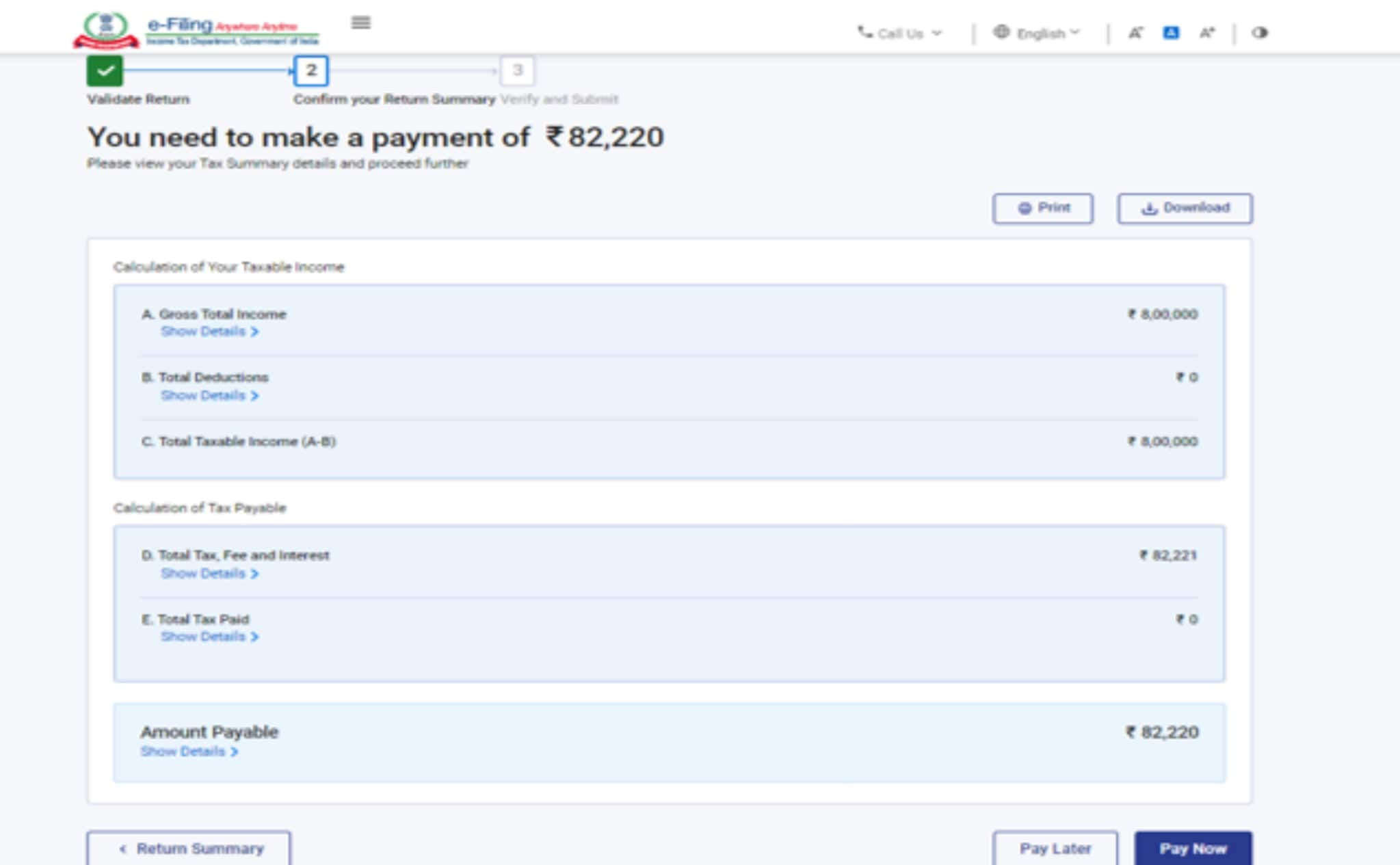

Step 12: Now there can be two scenarios based on your Tax Liability for the Assessment Year.

Source: Income Tax e-Filing Website

If there is no tax liability (No Demand/No Refund) or if you are eligible for a refund, click on “Preview Return”. If there is no tax liability payable, or if there is a refund you'll be getting based on your tax computation, you will be taken to the “Preview and Submit your return” page.

Source: Income Tax e-Filing Website

If there is a tax liability payable based on your tax computation, you'll get the “Pay Now” and “Pay Later” options at the bottom of the page. It is suggested to click on “Pay Now” and immediately pay your taxes to avoid any delays or errors in the future.

Source: Income Tax e-Filing Website

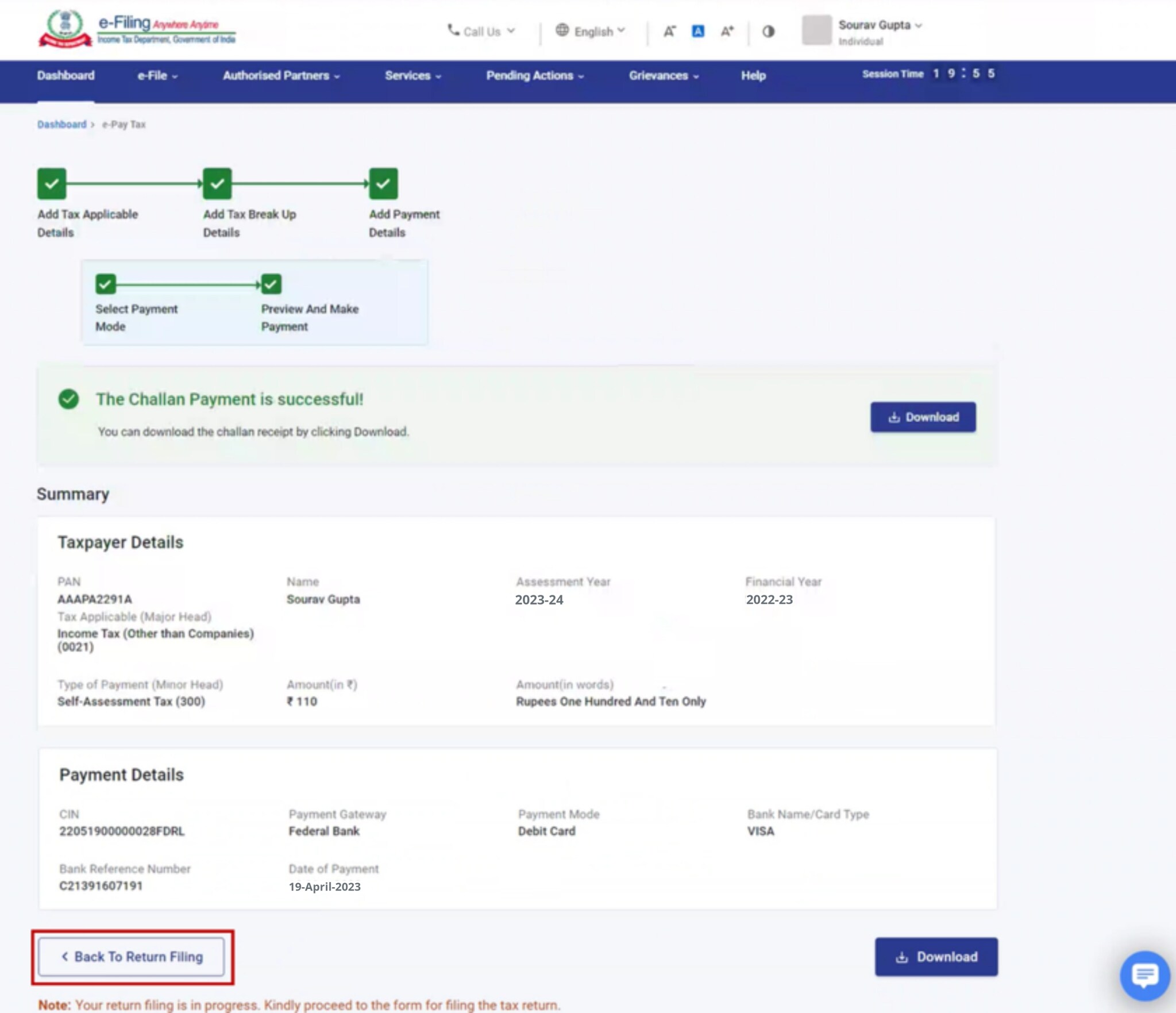

Follow the instructions on the screen and pay your taxes. Once you're done, click on “Return to Filing” and then on “Preview Return” to reach the “Preview and Submit your return” page.

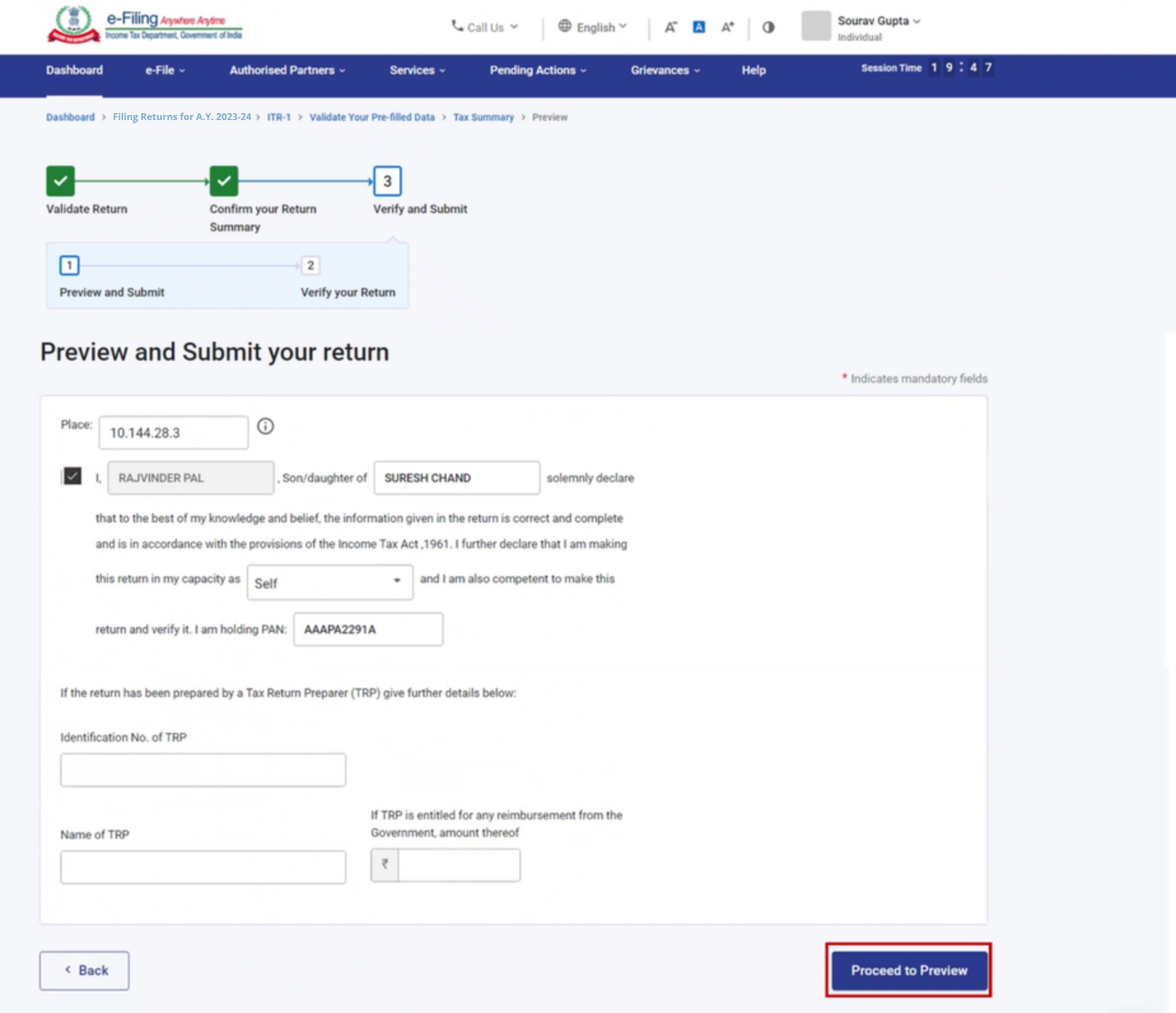

Step 13: Now that you're on the “Preview and Submit your return” page, go over all the details, select the declaration checkbox and click on “Proceed to Preview”.

Source: Income Tax e-Filing Website

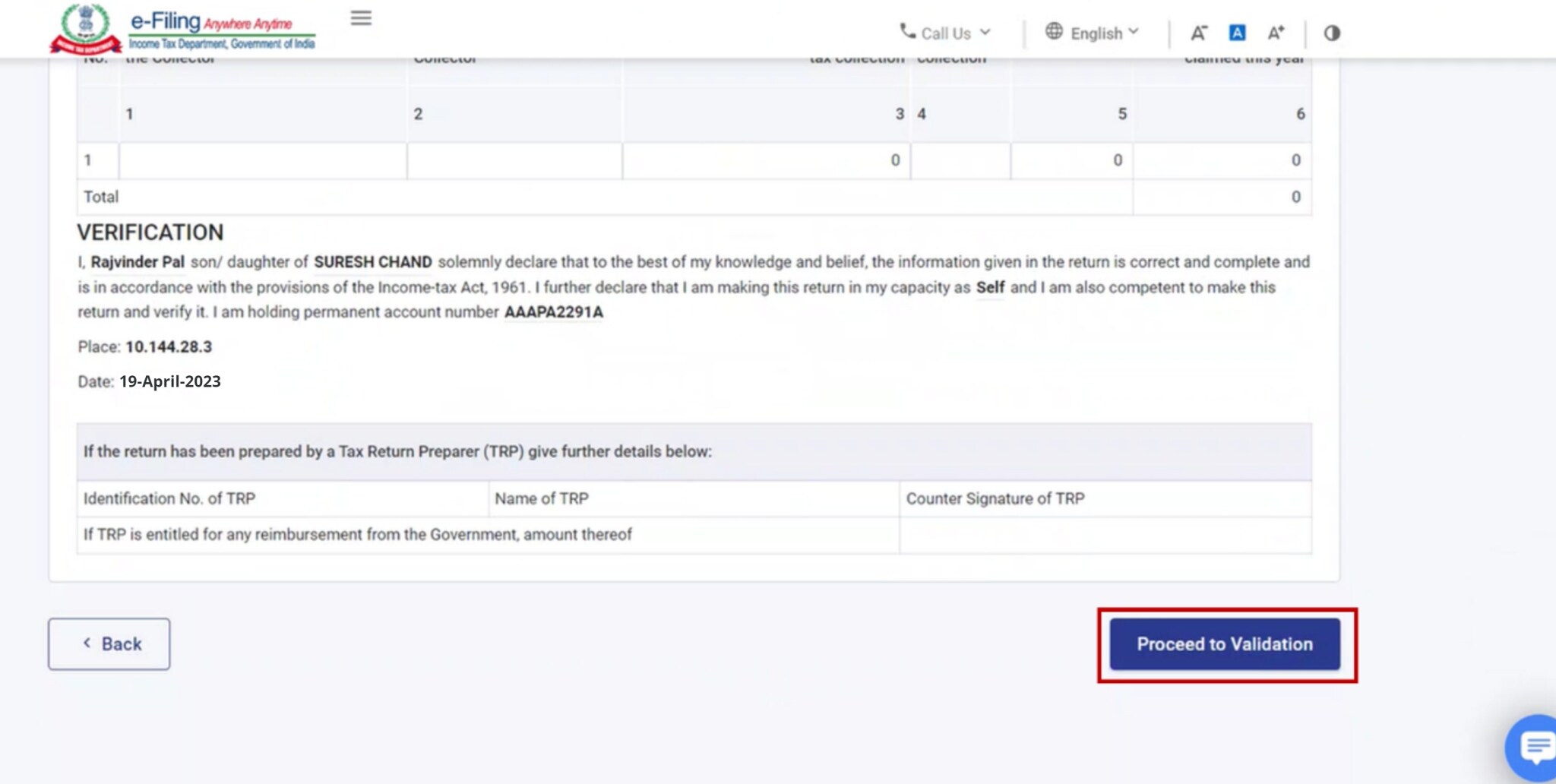

Step 14: Preview your return, check your verification details and click on “Proceed to Validation”.

Source: Income Tax e-Filing Website

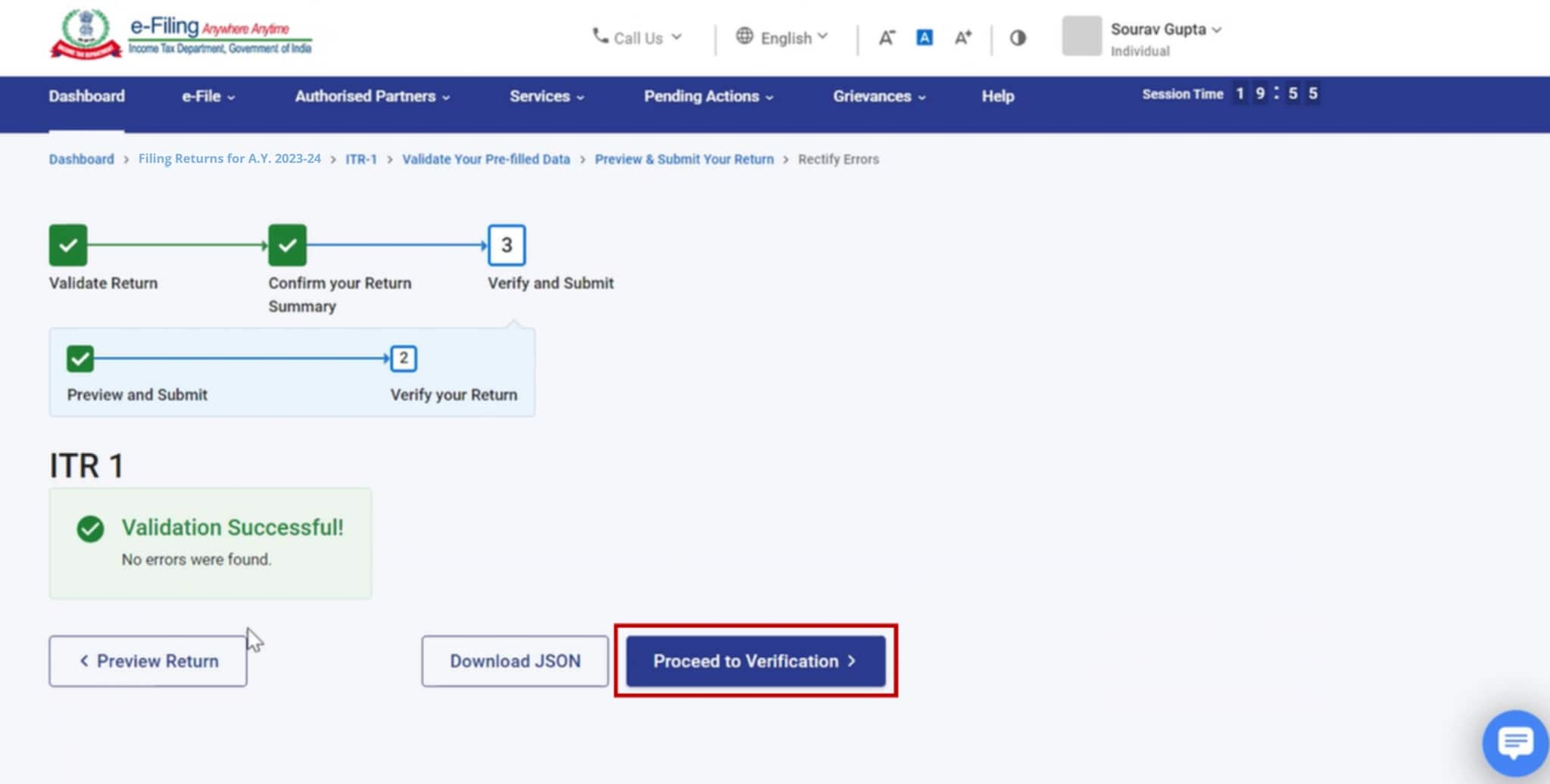

Step 15: Once you complete the Preview and Submit step, click on “Proceed to Verification” to verify your return.

Source: Income Tax e-Filing Website

Note: If you see any errors displayed on your screen, go back and rectify those and then click on “Proceed to Verification”.

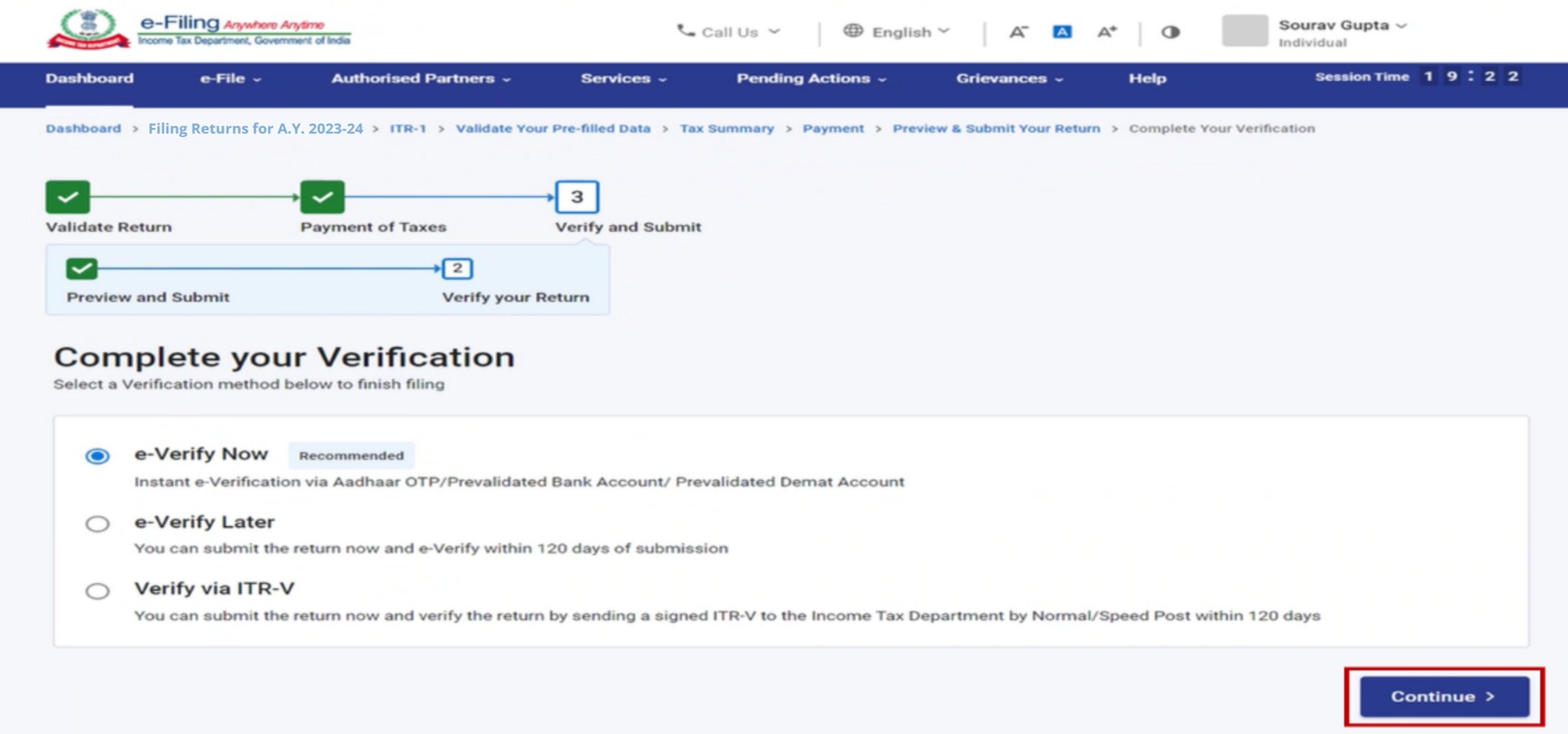

Step 16: Click on any of the options to complete your ITR filing verification and then on “Continue”.

Source: Income Tax e-Filing Website

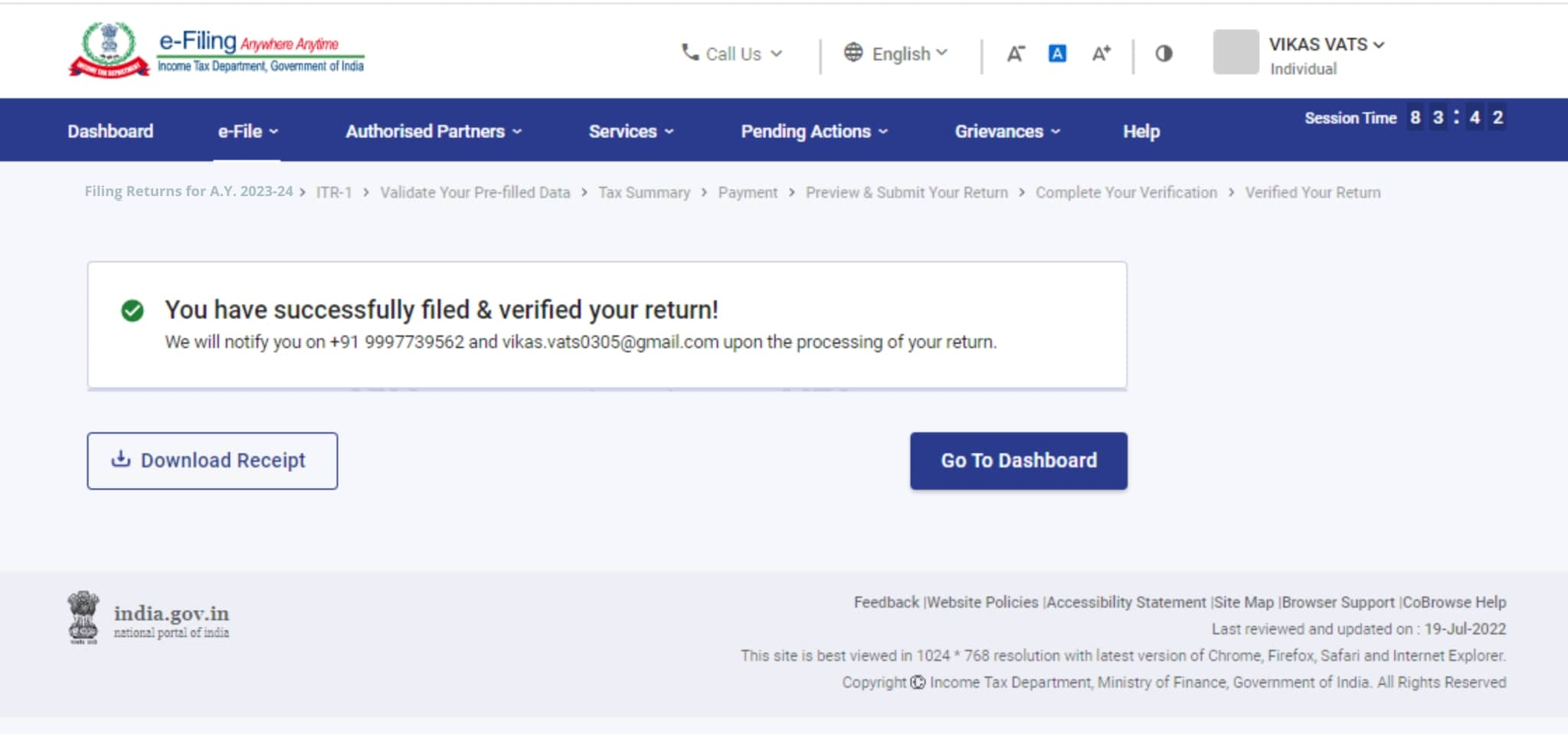

Step 17: Verify your income tax returns to complete your ITR filing process. Once done, you'll see a message pop up on your screen that says your ITR has been successfully filed and verified. Now you can download the receipt or simply “Go To Dashboard”.

Source: Income Tax e-Filing Website

That's it, your income tax e-Filing is done!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.