"The market is up! Should I move my emergency fund to a flexicap?"

If that question has crossed your mind, take a deep breath and… maybe step away from your investment app for a moment.

In a world where ‘return on investment' is everyone's favorite buzzword, it's easy to forget that sometimes, not investing in equity is the smartest move you can make. And if you've got goals in the next six months to two years, or simply want to sleep well at night, then your money needs a different kind of home.

Short-term goals, emergency funds, and overall capital preservation — many investors lump these into one mental box. Even worse, they often park both in volatile equity funds hoping to 'beat inflation'.

Let's Separate The Two Buckets

Short-term goals, like a car purchase in 18 months, a vacation in two years, or even a house down payment in three, require some form of planning and return, but low risk is still key. Emergency funds, on the other hand, are your personal shock absorber, meant for sudden medical bills, job loss, or even car repairs.

In other words, the closer the goal, the safer your money should be.

Equity Isn't Always Your Friend

Market or equity investments have been having a moment. Retail participation is soaring, Systematic investment plan or SIP inflows are at an all-time high, and it's easy to assume that every rupee should be chasing market highs.

But equity is volatile, and even a fundamentally sound mutual fund can be down 10-15% at the wrong time. As Nikhil Kothari of Etica Wealth puts it, "If your requirement is within three years or five years, depending upon the risk appetite and the type of investor you are, equity is not the asset class to invest in."

And he's not alone in that view. A 2024 Morningstar India report found that equity mutual funds had a 28% chance of delivering negative returns over any one-year period; not exactly ideal if your sister's wedding is next February.

The Ideal Setup: Bank, Liquid Fund & Credit Card

Kothari outlines a simple system for emergency preparedness:

- One month of expenses in your savings account

- The rest in a liquid mutual fund

- A credit card for additional liquidity buffer

"One month expenses has to be in savings account. Beyond that should be parked in liquid fund and... one should have a credit card so that any emergency happens, you can always swipe the credit card," says Kothari.

Used responsibly, credit cards can give your emergency fund a boost, with a 40-day credit free interest, and in that time, money is working for you. Just don't fall into the trap of thinking of it as free money.

He adds that, "If my limit is Rs 3 lakh, I'll always keep Rs 50 - Rs 60,000 unused, so that can be used in case of emergency."

Short-Term Goals: What Are Your Options?

Once your emergency fund is sorted, and you've defined your goal timeline, it's time to pick the right instrument.

For one year or less, you can opt for Liquid Funds, or Arbitrage Funds.

In liquid funds, you can withdraw the money in one day's time. With arbitrage funds, it may take T+1 day. These funds aim to preserve capital while giving marginally better returns than bank savings or short-term FDs.

For 1–3 years, Income + Arbitrage Funds are the key, because they help you save on taxation. These hybrid debt funds combine safety with a tax advantage if held for over 3 years, thanks to indexation benefits.

For 3–5 years, one can look at Equity Savings Funds. These are low-volatility funds with a small equity component, suitable for conservative investors looking for slightly higher returns.

Kothari suggests that the closer you get to your goal date, the more conservative your portfolio should become.

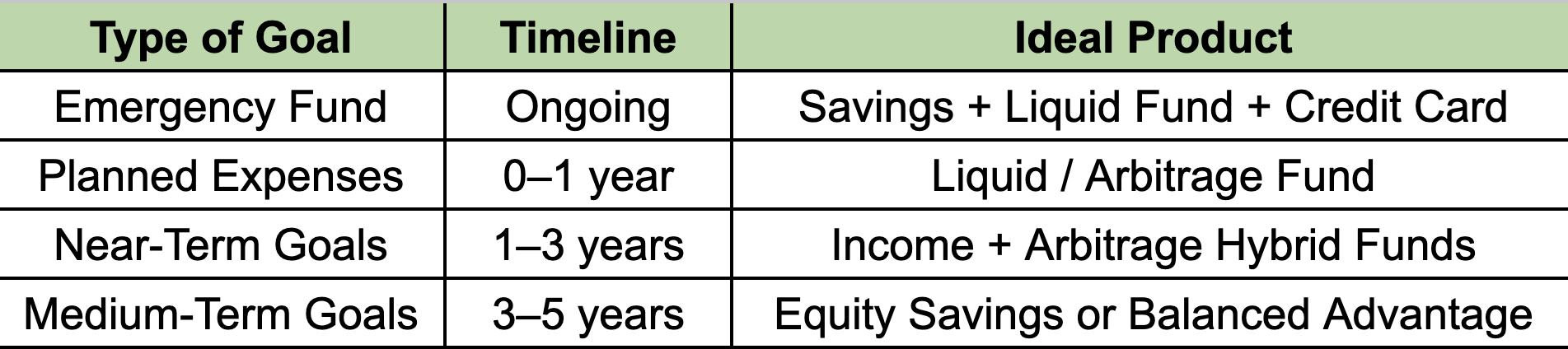

TL;DR: The Adulting Allocation

(Nikhil Kothari's Suggested Allocation)

Bonus Hack: SIP in Liquid Funds

Don't underestimate the power of habit. If you're struggling to set money aside consistently, Kothari suggests having a SIP in a liquid fund, "It's one of the best ways to have a forced saving."

"Make a SIP in a liquid fund on the 7th of every month," and that way, a portion of your salary is automatically parked in a liquid fund, no decisions, no delays.

Watch: Nikhil Kothari of Etica Wealth on Moneywise

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.