Finance Minister Nirmala Sitharaman has presented the Union Budget 2025 today, Feb. 1 2025, in Parliament and she has made a huge announcement that those earning up to Rs 12 lakh don't have to pay any tax. Yes, you read that right! There will be zero tax due from them. Notably, there were huge expectations from the Modi government for income tax relief for the middle class. Now that the announcement has been made you should fix your attention on filing your income tax return this year.

This has put the spotlight on the fact that you need to file your income tax returns on basis of the changes made in last year's budget (2024-25) and not what FM has announced today. You will need to focus on all the relevant inputs to file your income tax returns this year and the perfect way to do that is to take the help of an income tax calculator.

Before that take a look at what the government announced regarding the huge income tax changes in the New Tax Regime.

Here is what the Government announced: Zero Income Tax till Rs 12 Lakh Income under New Tax Regime.

* Income tax slabs and rates being changed across the board to benefit all tax-payers.

* New structure to substantially reduce taxes of middle class and leave more money in their hands, boosting household consumption, savings and investment.

* ‘Nil tax' slab up to Rs 12 lakh (Rs 12.75 lakh for salaried tax payers with standard deduction of Rs 75,000).

You can check out all the income tax slabs tables below as well as know how much income tax you can save.

Paying Income Tax as per last year's rates - Check Income Tax Calculator Link In The Para Below

You can calculate your income status currently and know what else you need to do. All you have to do is check the NDTV Profit Income Tax calculator. Just click on the link here.

The best idea for a taxpayer is to prepare early to ensure there are no last minute glitches as well as to save as much tax as possible. Why pay when you can save the money in your bank account?

A taxpayer's focus should be on their tax-saving investments whether it is Section 80C & 80CCD(1B). There are many benefits available to income tax payers including HRA exemption, mediclaim policy, mediclaim policy for parents, house loan, education loan that the government has provided.

Do remember that this is for your income tax for the fiscal year 2024-25. And you can do that not just for the New Income Tax Regime, but also Old Income Tax Regime.

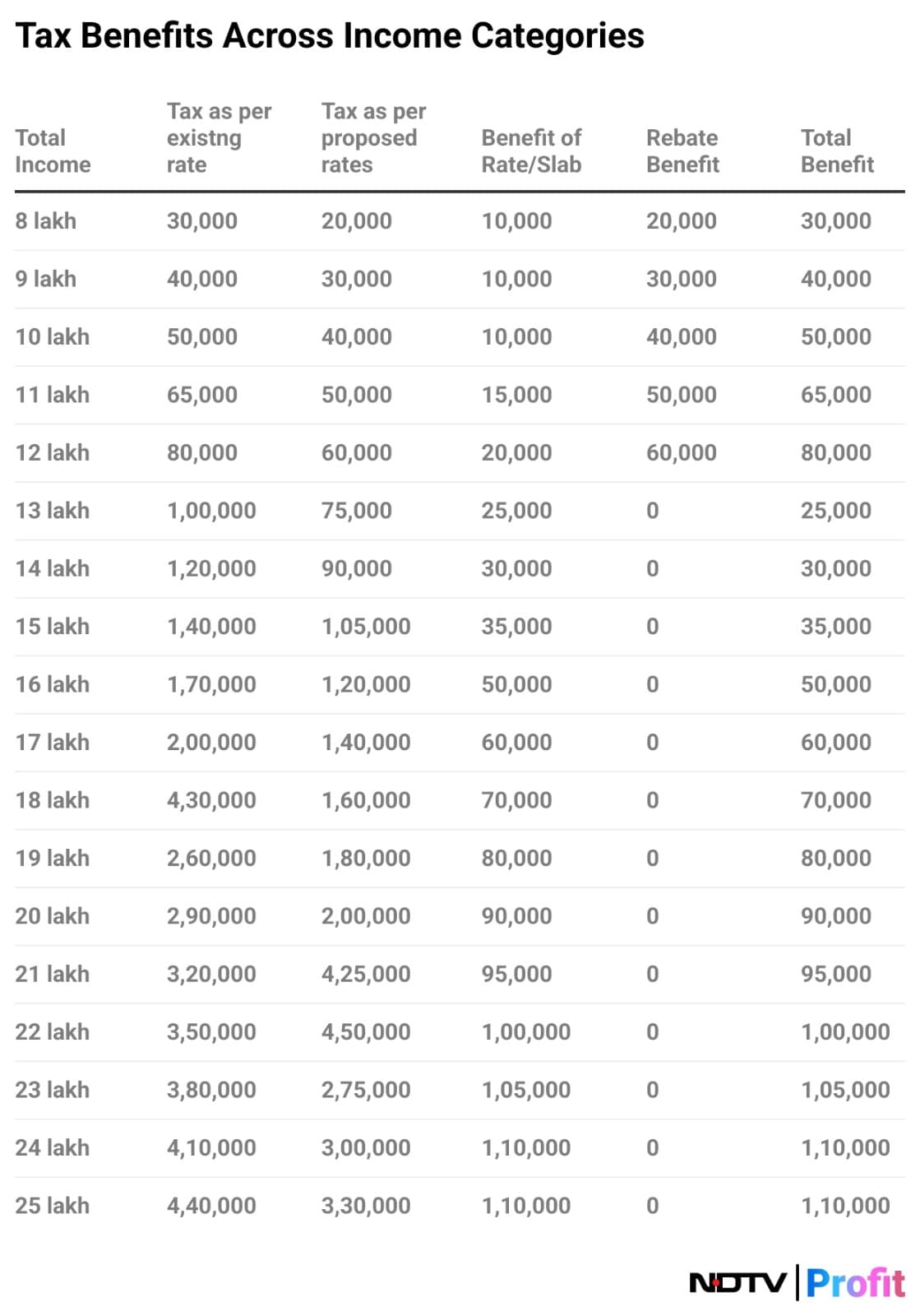

Check New Income Tax Regime Table As Per Revised Tax Structure Announced By FM Today On February 1 - How Much Money You Save

New Income Tax Rate Decoded (Under New Tax regime) - How Much You Save: Notably, an income tax payer who has an income of Rs 12 lakh will get a benefit of a whopping Rs 80,000. This is the exact amount that those earning Rs 12 lakh are paying as income tax. Ergo they will save this entire amount - they will pay zero.

Check the Income Tax table below

Income tax slab changes as declared by FM Nirmala Sitharaman today. Income tax payers who earn Rs 12 lakh need not pay tax. Know how much money the new income tax slabs will save for you in case you.

Income Tax Slabs Under New Tax Regime Announced Today By FM Nirmala Sitharaman:

Rs 0-4 lakh - nil

Rs 4-8 lakh- 5%

Rs 8-12 lakh - 12%

Rs 12-15- lakh- 15%

Rs 15-20- lakh- 20%

Rs 20-24 lakh- 25%

Above Rs 24 lakh- 30%

How much income tax will those earning Rs 18 lakh save under new tax regime

An income of Rs 18 lakh will benefit to the tune of Rs 70,000.

How much income tax will those earning Rs 25 lakh save under new tax regime

The income tax benefit, under the new income tax regime, to be paid by those earning Rs 25 lakh is Rs 1,10,000.

Notably, the government will forego revenue of Rs 1 lakh crore in direct taxes and Rs 2,600 cr will be foregone based on all the tax proposals.

Changes in Personal Income Tax under NEW TAX REGIME that were announced in Budget 2024

* Standard deduction for salaried employees increased from Rs 50,000 to Rs 75,000.

* Deduction on family pension for pensioners enhanced from Rs 15,000 to Rs 25,000.

Check revised income tax slab rate under the new tax regime as per Budget 2024:

0-3 lakh rupees - Nil

3-7 lakh rupees - 5%

7-10 lakh rupees - 10%

10-12 lakh rupees - 15%

12-15 lakh rupees - 20%

Above 15 lakh rupees - 30%

Salaried employee in the new tax regime stands to saved up to Rs 17,500 in income tax.

Note: The Finance Act 2023 has amended the provisions of Section 115BAC w.e.f. AY 2024-25 to make new tax regime the default tax regime. However, taxpayers have the option to opt out of new tax regime and choose to be taxed under old tax regime.

Old Income Tax Regime - Slabs And Rates

Tax Slab - Tax Rate

Up to Rs 2,50,000 - Nil

Rs 2,50,001 - Rs 5,00,000 - 5% above Rs 2,50,000

Rs 5,00,001 - Rs 10,00,000 - Rs 12,500 + 20% above Rs 5,00,000

Rs 10,00,001- Rs 50,00,000 - Rs 1,12,500 + 30% above Rs 10,00,000

Rs 50,00,001- Rs 100,00,000 - Rs 1,12,500 + 30% above Rs 10,00,000

Rs 100,00,001- Rs 200,00,000 - Rs 1,12,500 + 30% above Rs 10,00,000

Rs 200,00,001- Rs 500,00,000 - Rs 1,12,500 + 30% above Rs 10,00,000

Above Rs 500,00,000 - Rs 1,12,500 + 30% above Rs 10,00,000

What Is The Difference Between The Old And New Tax Regime?

In case you were wondering, then know that the income tax slabs and rates are different in old and new tax regimes. Most importantly, a number of deductions and exemptions are allowed in old tax regime to reduce the tax outgo.

However, the new income tax regime offers lower rates of taxes but permits only limited number of deductions and exemptions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.