IDFC First Bank Revises Savings Rates — Check New Structure And Categories

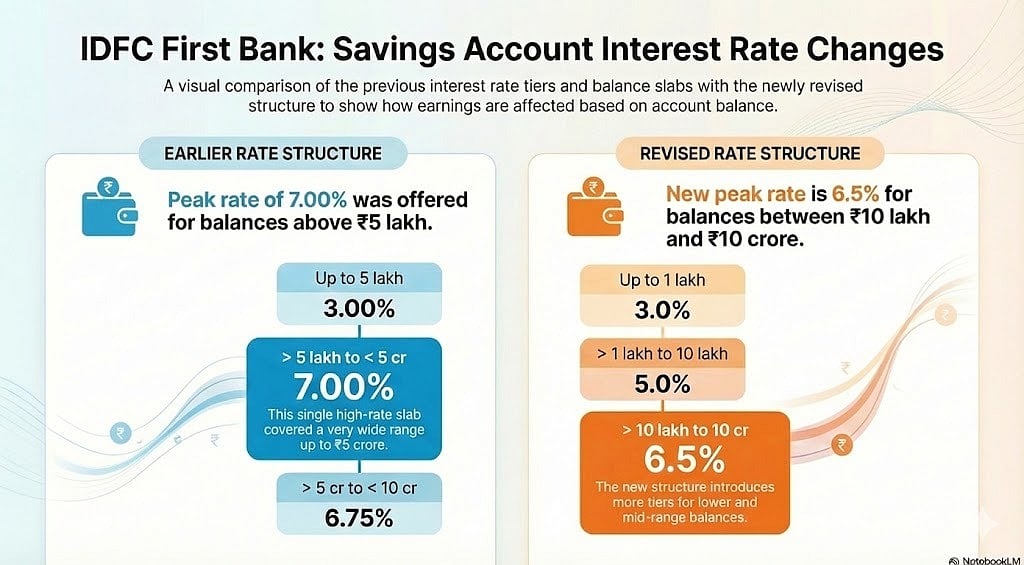

The highest savings account rate has been cut to 6.5% per annum, down from the earlier 7%, marking a notable pullback after the bank’s aggressive high-rate strategy.

IDFC First Bank has rolled out another revision to its savings account interest rates, effective January 9, 2025, lowering the headline rate by 50 basis points and reshuffling balance slabs — changes that will directly impact depositors tracking returns on idle cash.

The highest savings account rate has been cut to 6.5% per annum, down from the earlier 7%, marking a notable pullback after the bank’s aggressive high-rate strategy. Alongside the rate cut, the bank has also reworked its account balance categories, altering how interest is calculated for different deposit sizes.

What's Changed In The New Structure?

Under the revised structure, interest continues to be calculated on a progressive basis and credited monthly, but the slabs are now narrower at the lower end and flatter at the top:

• Up to Rs 1 lakh: 3.0%

• Above Rs 1 lakh to Rs 10 lakh: 5.0%

• Above Rs 10 lakh to Rs 10 crore: 6.5%

• Above Rs 10 crore to Rs 25 crore: 6.0%

• Above Rs 25 crore to Rs 100 crore: 5.0%

• Above Rs 100 crore: 4.0%

This is a departure from the earlier framework, where balances above Rs 5 lakh earned a flat 7% up to Rs 5 crore. The revised structure now rewards mid-sized balances more gradually, while high-value deposits see a sharper tapering of returns.

How Progressive Interest Works

As before, IDFC First Bank applies slab-wise interest, not a single rate on the entire balance. For instance, if a customer maintains Rs 10 lakh, they earn 3% on the first Rs 1 lakh and 5% on the remaining Rs 9 lakh.

Similarly, a Rs 1 crore balance earns interest at 3%, 5%, and 6.5% across applicable slabs — not 6.5% on the full amount.

For retail customers with balances above Rs 10 lakh, the 50 bps cut at the top end reduces overall yield, even though monthly crediting remains unchanged. Meanwhile, smaller savers may see limited impact, as rates up to Rs 10 lakh remain relatively competitive.

With interest calculated on daily end-of-day balances and rounded to the nearest rupee, account holders may want to reassess whether surplus cash should continue sitting in savings accounts or be partially deployed into higher-yielding alternatives, depending on liquidity needs and risk appetite.