A terrified heroine in a dim bungalow, suspenseful music, and thunder sounds build tension as footsteps approach. She trembles, her heart races, and then, there's a hand on her shoulder. Suddenly, lightning reveals the person's face, but the face would be revealed only in the sequel. A similar horror movie is being played in the Japanese bond market.

In mid-November 2025, Japan's 10-year government bond yield touched 1.8% — last seen in 2008. Instantly, some analysts concluded it's the ‘end of Japanese bond markets. But some are trying to guess the sequel's story - whether the “hand on the shoulder” is a villain, a hero, or someone else.

Markets Have Been Prepping Up

Japan is finally seeing inflation in their economy. After years of experimenting with policies, it finally crossed the target of 2% in 2022 due to Covid and the Russia-Ukraine war. What's more important is that for three years, inflation has remained above 2%. Japanese families are getting used to it and expect it to continue. That's crucial. When they expect inflation, they demand higher wages, and in turn, higher interest rates.

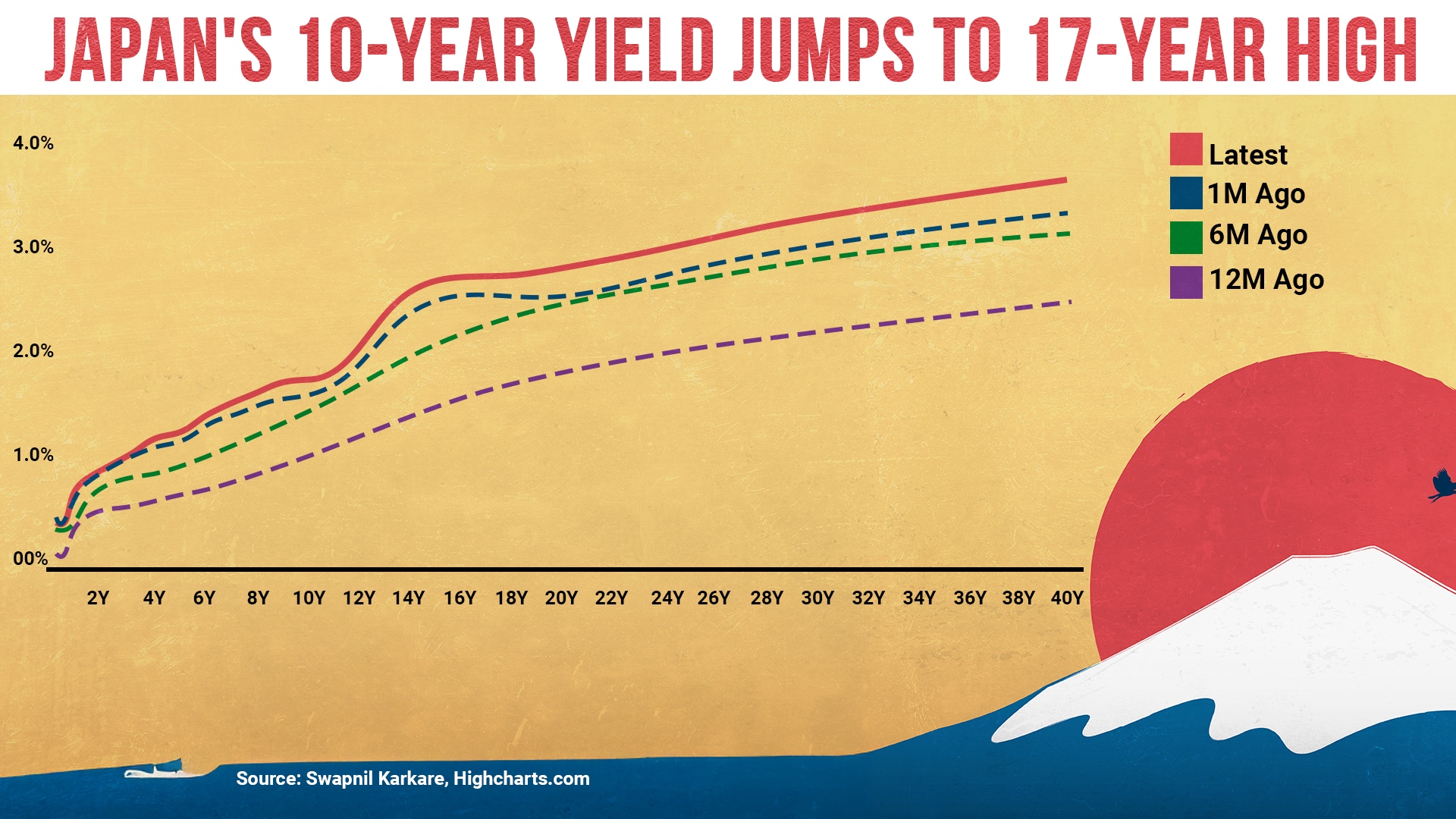

And markets have been preparing for this for a long time. Bond yields in Japan have been rising gradually for two years – the shape of the yield curve was already showing that this move was coming. Foreign investors, who had ignored Japan for decades because of low yields, started buying Japanese bonds. We've been hearing about yields being the “highest in 10 years” or “highest in 15 years” for a while now. So, the rise wasn't surprising — but the speed of the jump in November was.

Markets Are Disliking New PM's Comments

In October 2025, Sanae Takaichi took over as Japan's Prime Minister. Investors knew that she would spend more, which would, in turn, increase yields. But her spending plans - more than 25 trillion yen ($161 billion) - were much higher than earlier estimates and last year's plan ($92 billion). To make matters worse, she took a jibe at China by mentioning Taiwan in a speech, and China reacted by cancelling flights and banning seafood. The already nervous markets didn't welcome that.

Similarly, they didn't like Takaichi's remark about not raising interest rates. Given that inflation is nearing 3%, a rate hike is necessary. However, Bank of Japan Governor Kazuo Ueda made it clear that during a recent meeting with the PM, she did not oppose the move to raise interest rates, given the current environment. His remarks may help calm markets.

Why Does This matter?

The headlines about market crashes have been circulating because markets believe that Japanese investors will now pull money from overseas, over $3 trillion, and invest in Japan, given the higher interest rates there. If that happens, global markets will be under pressure immediately.

The ‘yen carry trade' — where Japanese investors borrow cheap yen and invest abroad — has been a major force in the world for years. So, even a small change in Japanese yields can trigger shifts in global capital flows.

What Should We Expect Now?

In situations like these, we cannot assume that markets will behave rationally. Thus, we need to understand the extent to which things would move.

The base case of yields moving up slowly has a higher probability. Since Japanese institutions have already adjusted their portfolios in anticipation of the central bank moving away from low low-interest-rate regime, investors won't suddenly bring all the money back. This might happen over the years. Global yields may move up slightly, while the yen may appreciate occasionally. Emerging markets, including India, may see temporary capital outflows too. The Indian rupee might be weaker against the yen. But the adjustment happens in steps, given that Japan's financial system remains stable.

The riskier scenario, the villain of our movie, is one where the yields jump sharply — say around 2-2.5%. Bank of Japan's policy miscommunication, politics, or fiscal concerns, anything can trigger this. If that happens, the moves that normally play out over years may happen within weeks or months. Investors won't get enough time to rebalance portfolios, money could exit emerging markets quickly, and the resulting volatility could feel like a global financial scare. But the probability of that happening is extremely low.

The Final Verdict

Japan's high yields are the product of years of expected change, but its abrupt rise has surprised everyone and thus, the panic. Now, the market is waiting for the sequel to the movie to find out whose hand it was.

That said, India's long-term story remains solid, irrespective of whatever happens in Japan. However, capital flow and interest rates may become volatile in the short term. So, please watch out for that.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.