- Wipro's shares rose 4.34% after its Q1 FY26 earnings announcement

- Profit dropped 7% sequentially to Rs 3,336 crore, near market estimates

- Revenue fell 1.65% to Rs 22,134 crore, slightly exceeding analyst forecasts

Wipro Ltd. saw its shares surge 4.34% on Friday, buoyed by investor optimism following the company's first-quarter earnings for FY26. Despite a decline in profit and margins, the IT major's performance largely met market expectations, and strong deal wins have prompted brokerages to maintain a positive outlook for the second half of the fiscal year.

The tech firm reported a 7% sequential drop in profit to Rs 3,336 crore for the quarter ended June, aligning closely with the Rs 3,588 crore consensus estimate tracked by Bloomberg. Revenue came in at Rs 22,134 crore, down 1.65% from the previous quarter but slightly above analyst projections. Operating profit fell 9.09% to Rs 3,548 crore, with margins contracting by 128 basis points to 16.02%.

Despite the muted financials, brokerages including Jefferies, Morgan Stanley, and Macquarie remain upbeat. Analysts cited Wipro's robust deal pipeline as a key driver of future growth. Morgan Stanley noted signs of stabilisation in key geographies, while Macquarie retained its rating, pointing to deal wins during the quarter.

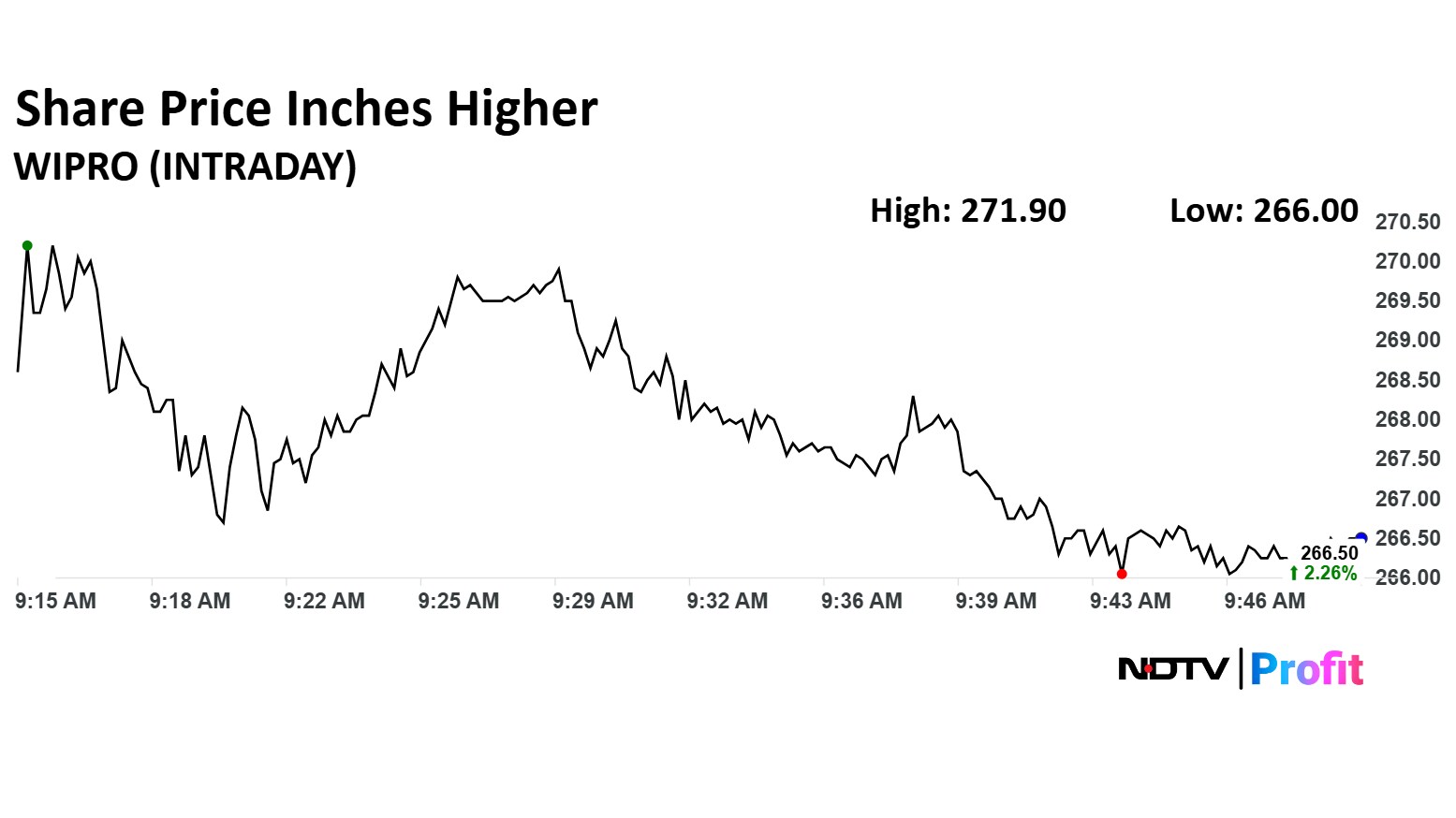

The scrip rose as much as 4.34% to Rs 271.90 apiece. It pared gains to trade 2.28% higher at Rs 266.55 apiece, as of 09:46 a.m. This compares to a 0.31% decline in the NSE Nifty 50 Index.

It has fallen 7% in the last 12 months. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 55.

Out of 48 analysts tracking the company, nine maintain a 'buy' rating, 18 recommend a 'hold,' and 19 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.8%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.