With the warmest January and February recorded in India, the volume growth for Voltas Ltd. looks rather promising. But HSBC has cut its target price on the stock as margin recovery concerns, rising cost and competition may hold back the summer-led volume spike.

The target price was slashed by 15% to Rs 1,630 per share. Both HSBC and Investec maintained a 'hold' rating. While, UBS and Citi maintained their 'buy' rating on the stock.

UBS' target price for the company is Rs 2,200, while Citi has set it at Rs 1,850. Investec set a target price of Rs 1,230 on the scrip, while Nomura maintained ‘neutral' rating with a price target of Rs 1,404.

Cost And Manufacturing

Structural margin headwinds for the company include increased sales through low margin retail and e-commerce, and higher sales from consumer financing schemes that impact profitability. This is also weighted by the promotional costs the company has to incur due to competition.

Citi notes Voltas is evaluating various options for compressor sourcing, including in-house manufacturing that includes a tie-up with a global player, royalty model and entering into long-term contracts.

UBS also notes challenges in compressors but said that the company is navigating this with limited volume impact. The major factors adding to cost along with compressors are copper prices, refrigerant gas inflation and currency depreciation.

Meanwhile, in-house manufacturing in their own plants adds headwinds this season due to margins, according to analysts. UBS notes that the firm is ramping up its Chennai plant utility as well to improve the issue.

Volume Growth Over Margin Recovery

The summer ahead will bring volume growth not margin recovery, according to HSBC. Analysts at Investec also highlighted that margin pressure for the company may continue due to a few factors.

The increasing production cost, depreciating currency and competitive pricing in the sector may prolong the pressure on margins. The company is expected to continue gains through cost leadership, as the warm months ahead promise a strong demand for cooling products, Citi said.

"Voltas wants to be a mass player and hence is focusing on volume growth, market share gain and absolute growth in profitability over margin expansion. There are headwinds from higher compressor cost, currency movement and higher copper prices," said Citi.

Headwinds from higher costs for compressor purchase specifically are noted by multiple analysts as a major concern going ahead.

The company is prepared for demand and should not face any shortage, according to the management, Citi said. UBS also notes the high base of growth that is present for the sector and the company.

Prices And Outlook

There were no meaningful price hikes since May 2024, UBS noted. Investec also said that the company does not intend to take prices higher despite the uptick in cost.

Volumes play into stable pricing as well, Nomura noted, while nothing Voltas' inability to hike prices due to competition.

Investec, on the other hand, points that Room AC demand has been healthy. However growth in the segment has been lower compared to peers, according to Citi. Voltas is likely to lag behind peers, due to the rising cost, according to analysts.

Investec notes that pricing power and brand loyalty in the industry is weak. Nomura cites that the company is focussed on market share gains over margin recovery. HSBC is expecting a 15% volume growth for Voltas while Nomura predicts the high base growth to normalise to 10%.

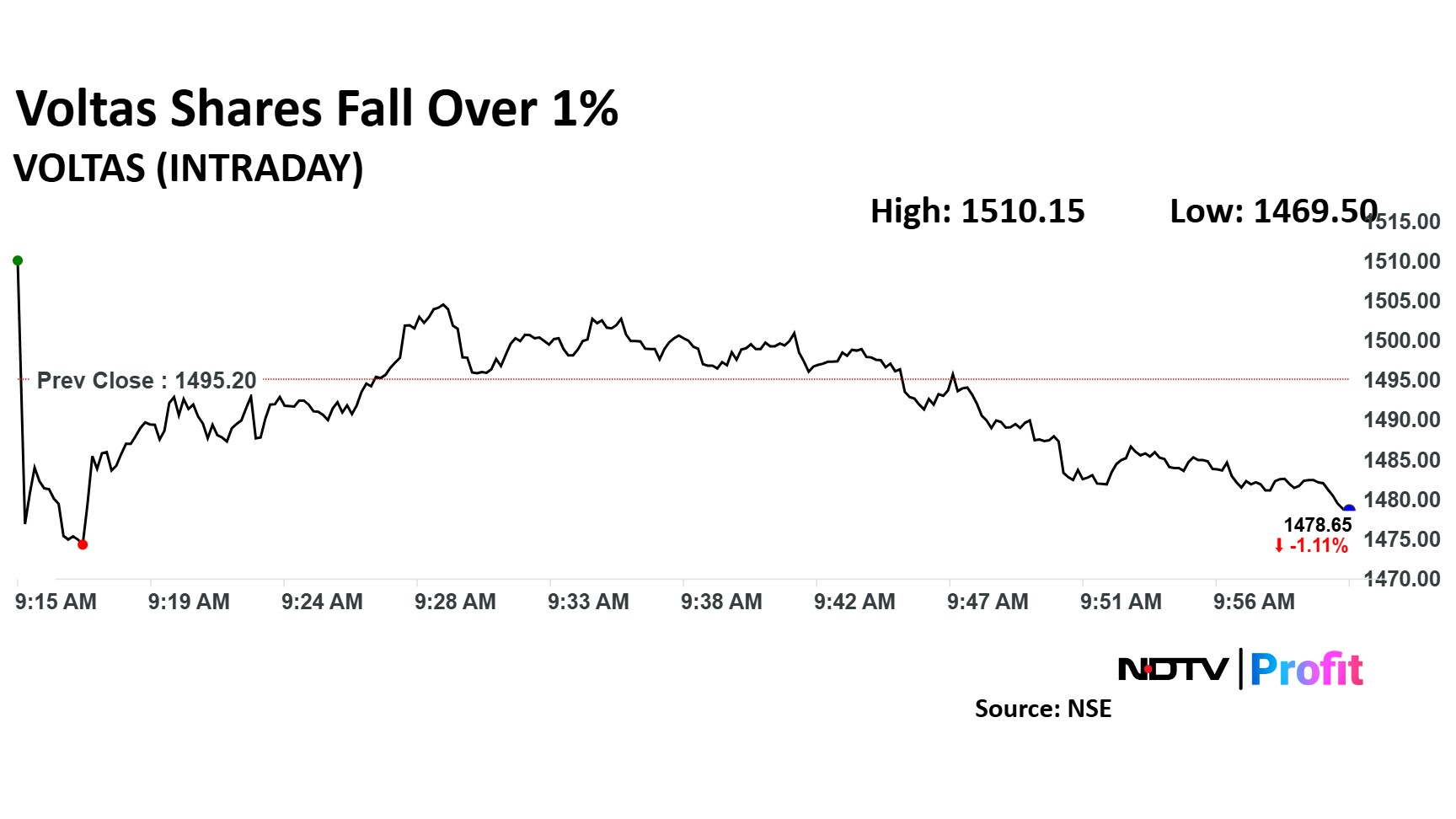

Voltas Share Price

Voltas stock fell as much as 1.72% during early trade to Rs 1,469 apiece on the NSE. It was trading 0.83% lower at Rs 1,481 apiece, compared to a 0.52% advance in the benchmark Nifty 50 as of 9:58 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.