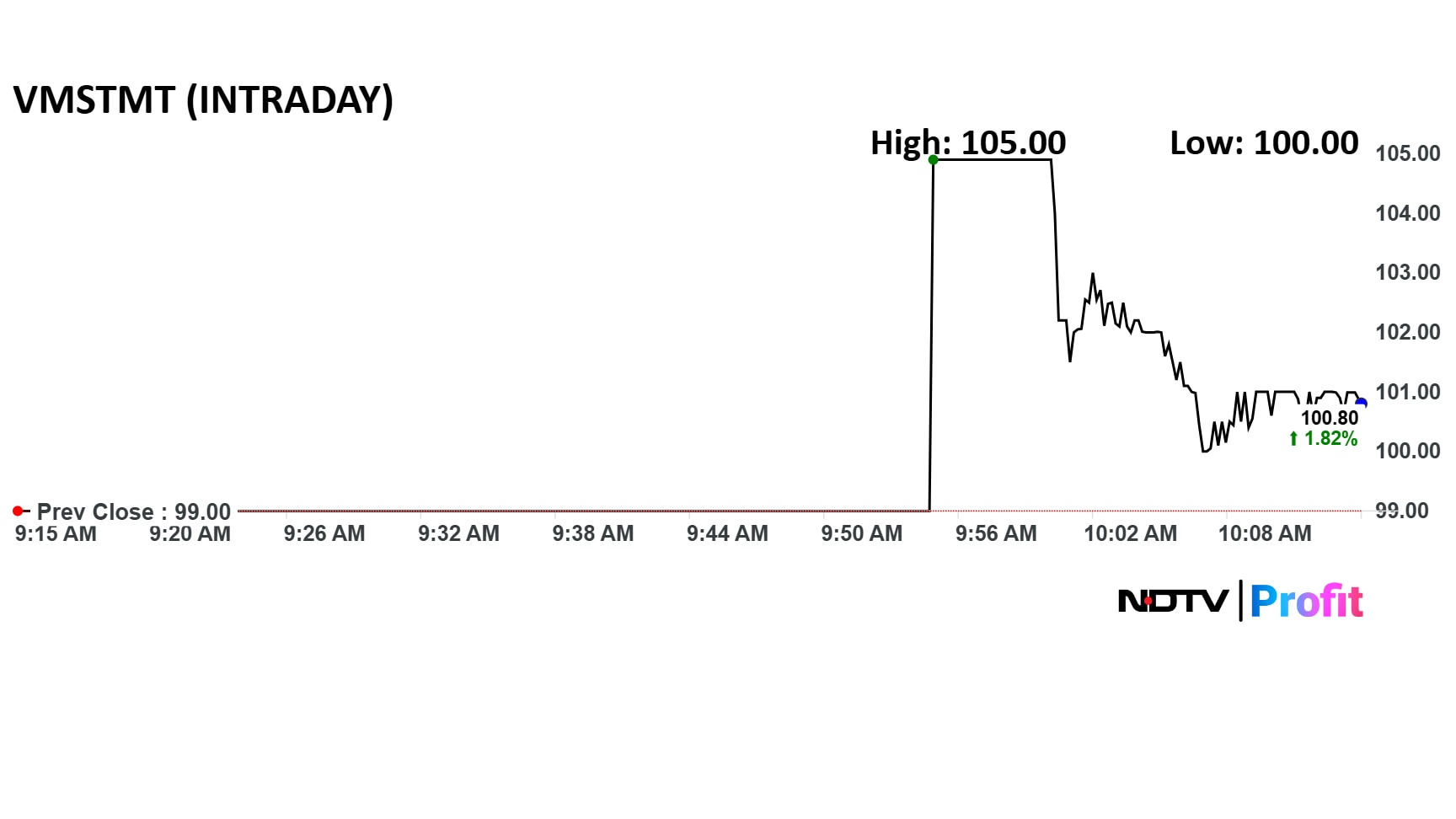

VMS TMT Ltd. listed at a 6% premium over its IPO price on Wednesday. The scrip opened at Rs 104.9 on the NSE and Rs 105 on the BSE, against an issue price of Rs 99 per share.

VMS TMT's initial public offering was oversubscribed 102.27 times on its final day of subscription on Sept. 19. That means for an offer of Rs 148.5 crore, investors placed bids worth Rs 12,452 crore.

The offering was entirely a fresh issue, comprising 1.23 crore shares. The demand was primarily driven by Non-Institutional Investors (NIIs).

The latest grey market premium for the VMS TMT IPO was Rs 11, implying an expected gain of around 11%, according to Investorgain.

VMS TMT was incorporated in 2013 and is engaged in the manufacturing of thermo mechanically treated (TMT) bars. It also trades in scrap and binding wires, supplying them across Gujarat and other states. The company's manufacturing facility is located in Bhayla village, Ahmedabad. As of July 31, 2025, the company has a distribution network comprising three distributors and 227 dealers.

The company has planned to utilise proceeds from the IPO for debt settlement and general corporate purposes.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.