Shares of Vishal Mega Mart was trading over 2% higher after the company posted a notable surge in profit for the first quarter. Vishal Mega Mart reported a rise of 37.3% in its consolidated net profit to Rs 206 crore, compared to Rs 150 crore in the corresponding period last year.

The hypermarket chain operator's topline (revenue from operations), grew 21% to Rs 3,140.3 crore, compared to Rs 2,596.2 crore in the year-ago period. On the operational front, the company's Ebitda increased by 25.6% to Rs 459 crore. The Ebitda margin for the quarter increased by 60 basis points from last year to 14.6%.

Margins for the quarter expanded despite higher other expenses, employee benefit expenses and finance costs. Gross profit margin for the quarter expanded by 20 basis points to 28.4% from 28.2% last year. Vishal Mega Mart is one of India's largest offline-first value retailers.

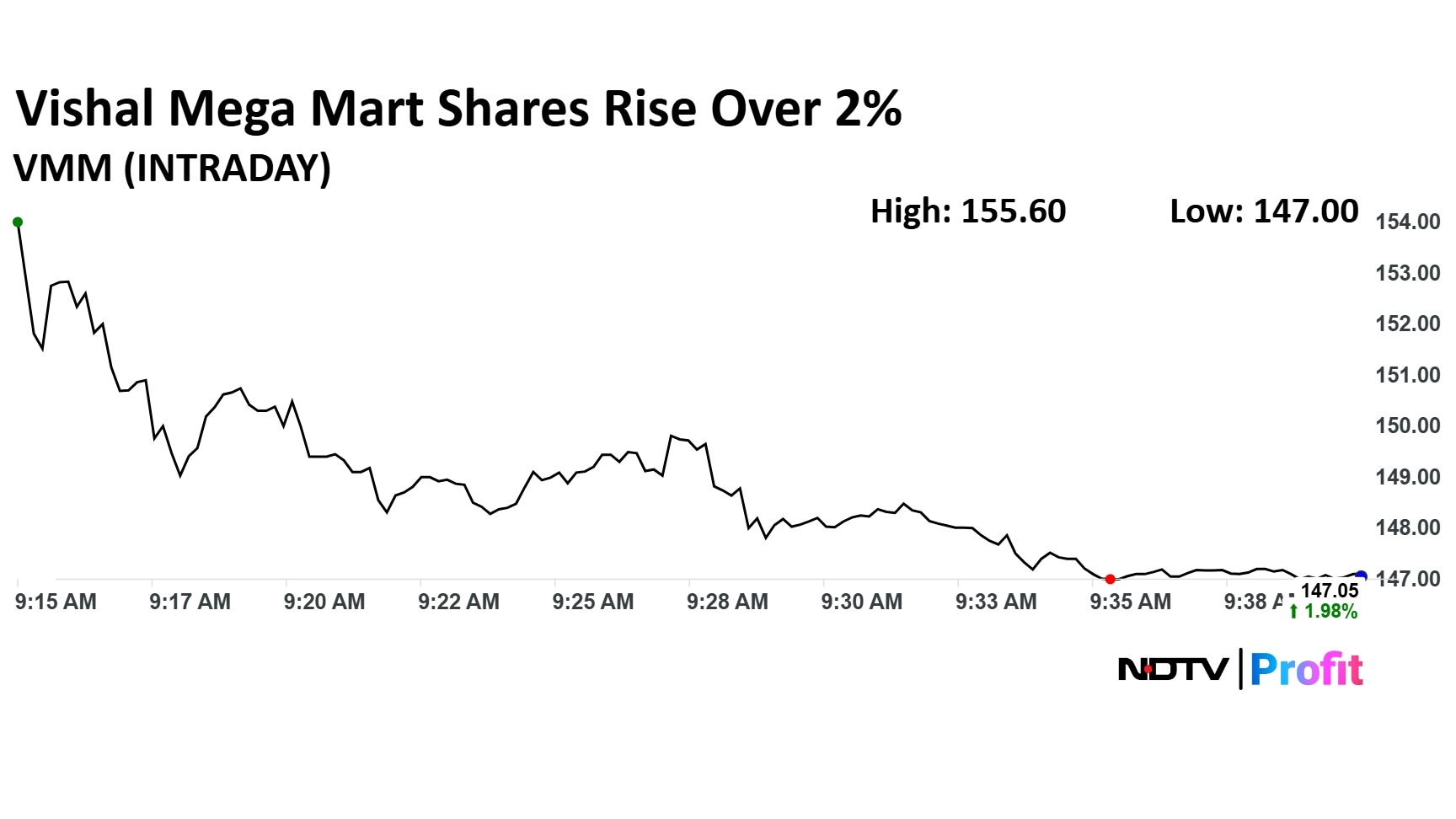

Vishal Mega Mart Share Price

Vishal Mega Mart stock rose as much as 7.91% during the day to Rs 155.6 apiece on the NSE. It was last trading 1.43% higher at Rs 146.22 apiece, compared to an 0.20% advance in the benchmark Nifty 50 as of 10:38 a.m. It has risen 36.97% on a year-to-date basis. The total traded volume so far in the day stood at 10 times its 30-day average.

The relative strength index was at 48.3. Nine out of the 12 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and one suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 147.1, implying a downside of 0.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.