Kotak Institutional Equities has initiated coverage on Vishal Mega Mart, one of India's leading value-first offline retailers, with an 'add' rating and a fair value of Rs 110.

VMM targets middle and lower-middle income segments, offering a diversified range of products across apparel, general merchandise, and FMCG categories.

Kotak projects a steady revenue compound annual growth rate of 17% for VMM over FY25-28, driven by same-store sales growth of 9-13% and a retail area CAGR of 12.6%. The brokerage also expects an Ebitda CAGR of 18% and a profit after tax CAGR of 24% over the same period. VMM's efficient cost structure and asset-light model are highlighted as key factors ensuring healthy return ratios by the brokerage.

VMM operates a pan-India network of 668 stores, with approximately 30% located in tier 1 cities and 70% in tier 2 cities, covering 432 cities and towns. The average store area is around 18,000 sq. ft. VMM's diverse portfolio includes both own brands and third-party brands, with contract-manufactured own brands accounting for 72% of revenues in the first half of FY25.

Kotak expects VMM to add 80, 90, and 100 stores over financial years 2025, 2026, and 2027. Despite lower revenue per sq. ft compared to peers, VMM's best-in-class cost metrics are expected to drive operating leverage, boosting Ebitda margins from 14.0% in financial year 2025 to 14.2% in financial year 2028. The company's debt-free balance sheet and asset-light model are projected to drive a return on average capital employed of 9.2% by FY28.

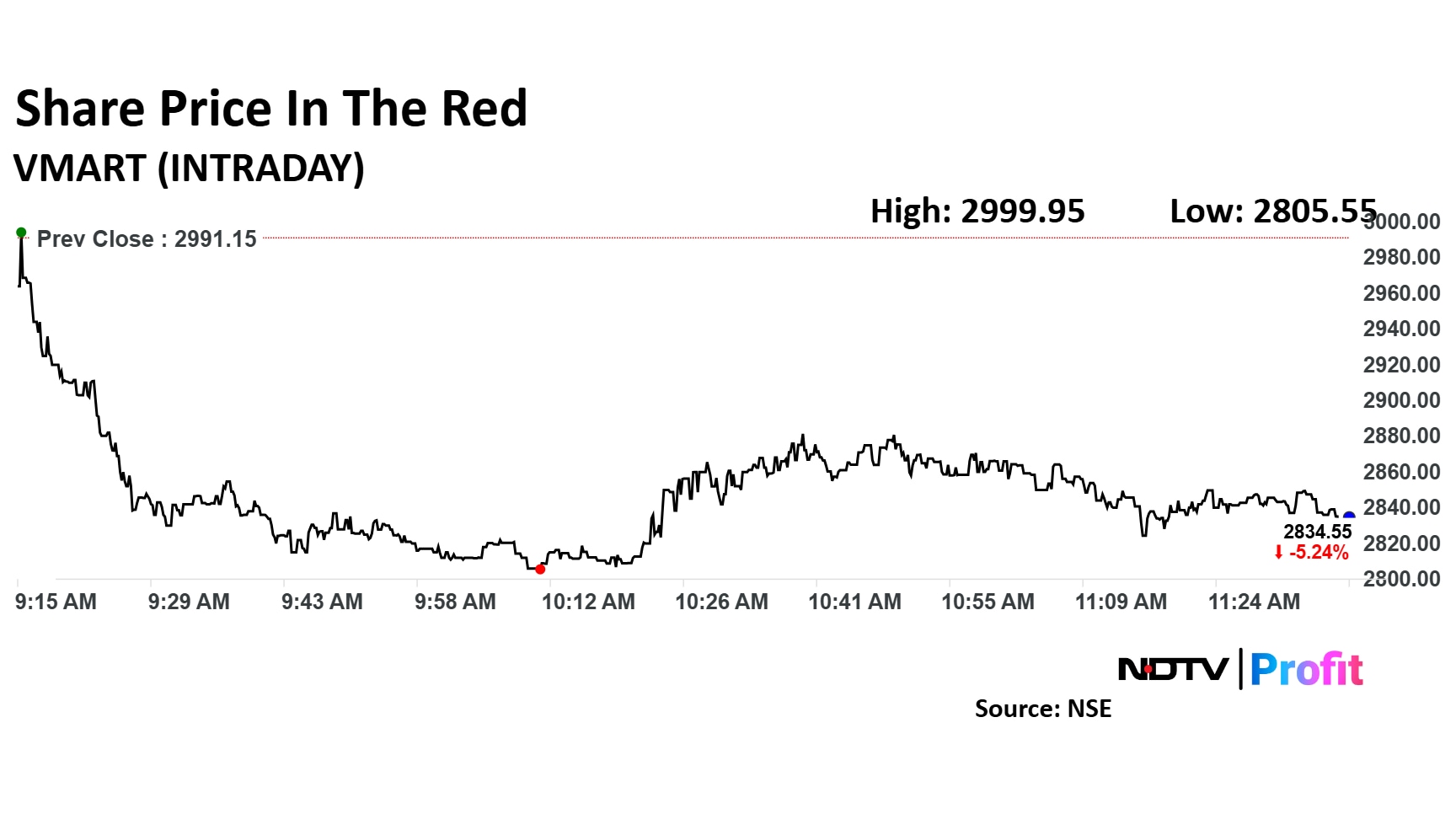

Vishal Mega Mart Share Price

The scrip fell as much as 6.20% to Rs 2,805 apiece. It pared losses to trade 4.46% lower at Rs 2,857 apiece, as of 11:43 a.m. This compares to a 0.43% decline in the NSE Nifty 50.

It has fallen 46.26% in the last 12 months. Total traded volume so far in the day stood at 0.20 times its 30-day average. The relative strength index was at 36.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.