Recently listed value retailer, Vishal Mega Mart Ltd., got a 'buy' rating from ICICI Securities as the brokerage initiated coverage on the stock, on the back of improving efficiency and market expansion. It sees an upside of 32% for the stock.

The brokerage has a target price of Rs 140 per share. ICICI Securities expects a revenue CAGR of 19%, aided by strong same-store sales growth and increasing operational efficiency over fiscal 2024-27.

Despite competitive pressures and supply-chain complexities, the company is well placed for sustained growth, given the strong financials, efficient cost management and robust free cashflow, it said in a note on Jan. 29.

The value retailer created a strong brand identity by consistently offering prices significantly below competitors, across categories like apparel, FMCG, and general merchandise.

The company has only tapped about 30% of the addressable tier two-four market, "leaving substantial room for growth", ICICI Securities said. "We expect it to grow its store network at a 12% CAGR, targeting 861 stores by fiscal 2027, with an annual addition of 80-90 stores."

Operating margin is projected to reach 15% by fiscal 2027 — higher than its peers. While, a free cashflow generation of Rs 3,800 crore is expected between fiscal 2024-27, the note said. "This financial strength not only supports its aggressive expansion plans but also ensures resilience in a competitive market."

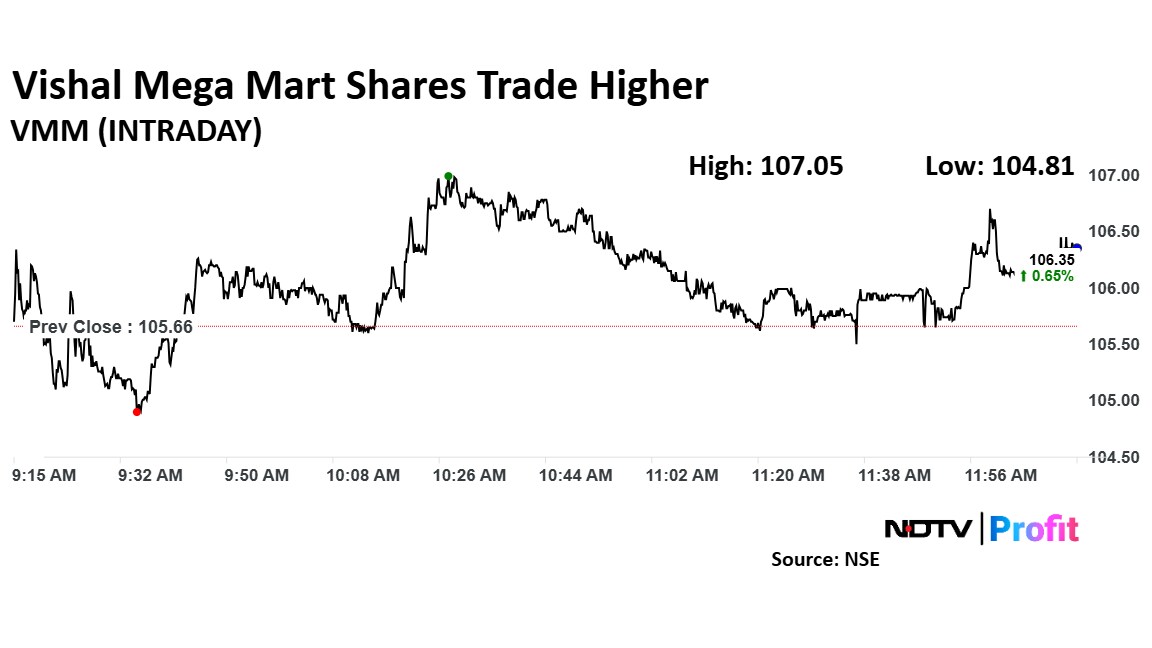

Vishal Mega Mart Share Price Today

Vishal Mega Mart stock rose as much as 1.32% during the day to Rs 107.05 apiece on the NSE. It was trading 0.54% higher at Rs 106.2 apiece, compared to a 0.46% advance in the benchmark Nifty 50 as of 12:10 p.m.

It has risen 2% since its listing on Dec. 18. The relative strength index was at 48.

Four out of five analysts tracking the company have a 'buy' rating on the stock, and one suggests a 'hold', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 27%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.