Vedanta Ltd. shares took a hit on Wednesday after the National Company Law Tribunal deferred the hearing on the proposed demerger.

Certain objections were raised by the Securities and Exchange Board of India and the central government. The matter will now be heard on Sept. 17.

Vedanta Group is currently undergoing proceedings to get the regulatory approvals to demerge into four listed entities. These are to focus on aluminium, power, gas, oil and base metals. These plans were first announced in Sept 2023.

SEBI informed the tribunal that Vedanta had made changes to the scheme of arrangement without disclosing them to the regulator or getting any prior permission. The market watchdog then issued an administrative warning letter dated Aug 13 to the company.

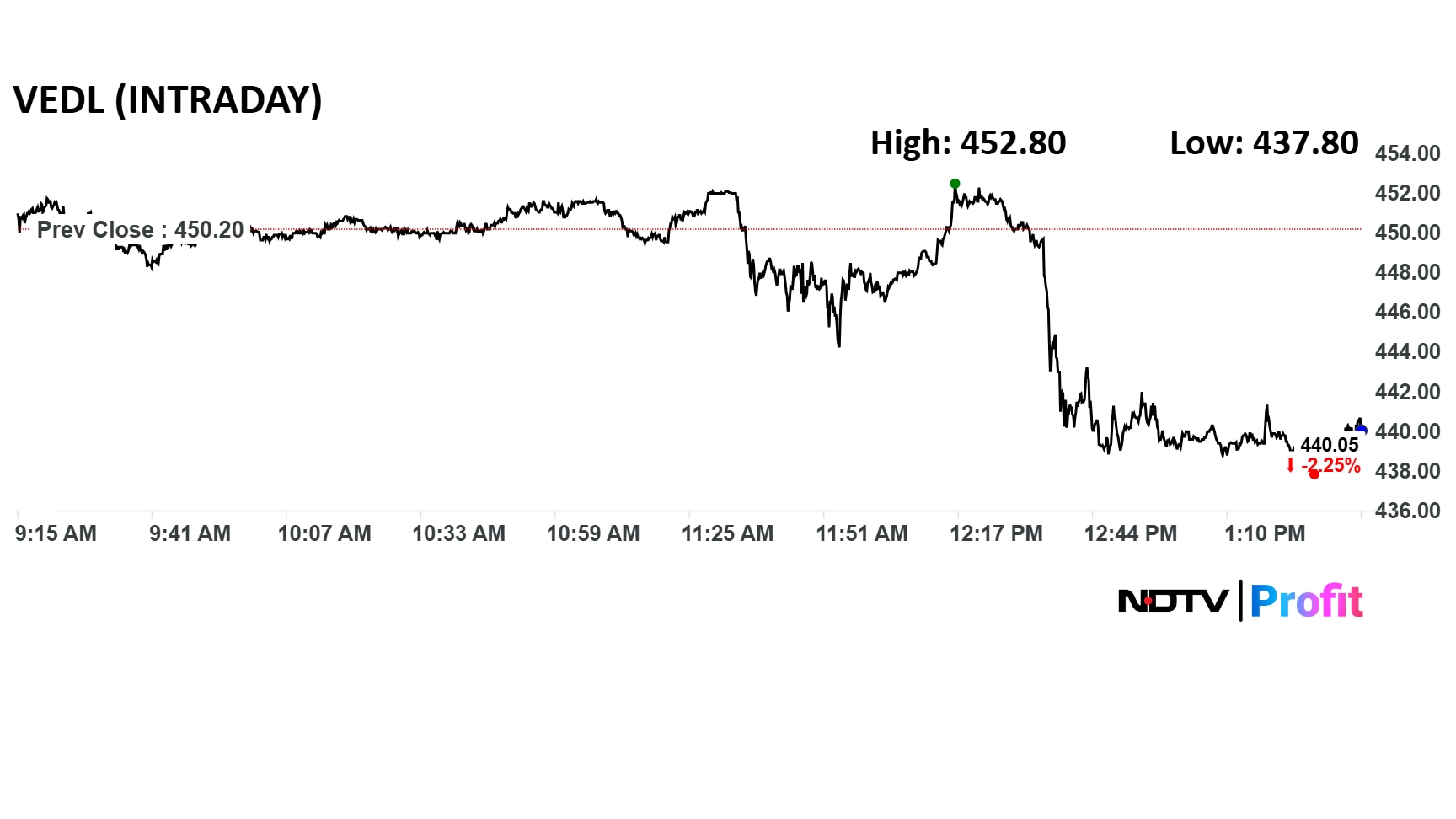

Vedanta share price declined 2.75% intraday to Rs 437.8 apiece.

Vedanta share price declined 2.75% intraday to Rs 437.8 apiece. The benchmark NSE Nifty 50 was up 0.3%. The total traded volume so far in the day stood at 2.3 times its 30-day average with a turnover of Rs 630 crore. The relative strength index was at 56.

The stock has been flat in the last 12 months and fallen 1.3% on a year-to-date basis.

Anil Agarwal On Vedanta Demerger

Last month, Chairman Anil Agarwal said that the company's demerger is progressing steadily and should be completed by September. It will involve splitting the group into individual entities in the aluminium, oil and gas, power, and base metals segments.

“We expect the process to get the required approvals shortly,” he said at the company's Annual General Meeting on Thursday. “Once implemented, for every share held in Vedanta Ltd, each shareholder will receive one share in each of the four demerged companies.”

Each of these businesses has the potential to evolve into a $100 billion enterprise, the chairman said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.