Urban Company Ltd.'s $215 million initial public offering, the most subscribed in India this year, is poised for a strong trading debut on Wednesday, according to indications in the gray market.

Shares of the tech startup, popular for providing services from plumbing and house cleaning to masseurs, are trading at a premium of at least 60% over 103 rupees ($1.17), the top end of its IPO range, according to Investorgain.com and IPOcentral.in, which track informal price activity in the unregulated market.

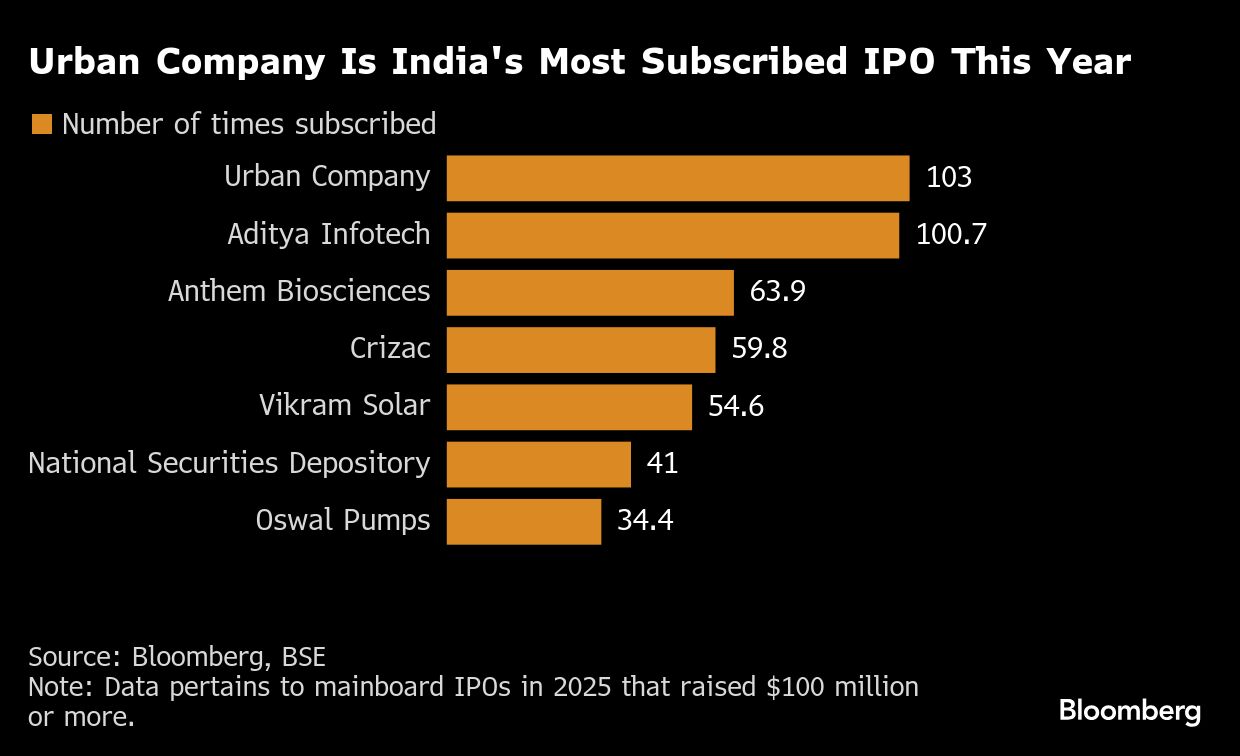

The high premium underscores robust demand from both institutional and retail buyers in the offering, which was more than 100 times subscribed last week — making it the most sought-after IPO of 2025 in India among deals of at least $100 million, according to data compiled by Bloomberg.

The surge in demand reflects investors' growing interest in domestic-focused companies, especially as India faces steep tariffs imposed by US President Donald Trump, among the highest globally. A panel of federal and state finance ministers earlier this month slashed consumption taxes in a bid to spur household demand.

Urban provides services that are central to India's rapid urbanization, and demand is set to grow as cities expand and nuclear families rise, said Astha Jain, an analyst at Hem Securities Ltd. Its overseas presence, where demand is even larger, has further fueled strong investor interest, she said.

A strong debut by Urban could reinvigorate India's IPO market, which has so far trailed last year's record $21 billion in fundraising. However, investment bankers anticipate a busy close to the year, with several high-profile offerings in the pipeline, including IPOs from Tata Capital Ltd., Billionbrains Garage Ventures Ltd., and the Indian unit of South Korea's LG Electronics Inc.

Although unregulated, gray market trading in India is often seen as a barometer of investor interest ahead of a company's debut. In these informal contracts, investors agree to trade shares soon after listing, with the difference from the offer price referred to as the gray market premium or discount.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.