Trade Setup For June 23: Nifty Eyes 25,200 Breakout As Bulls Regain Momentum

On the downside, 24,700 remains the key swing low for Nifty 50, while 24,500–24,400 is a crucial support zone, a brokerage said.

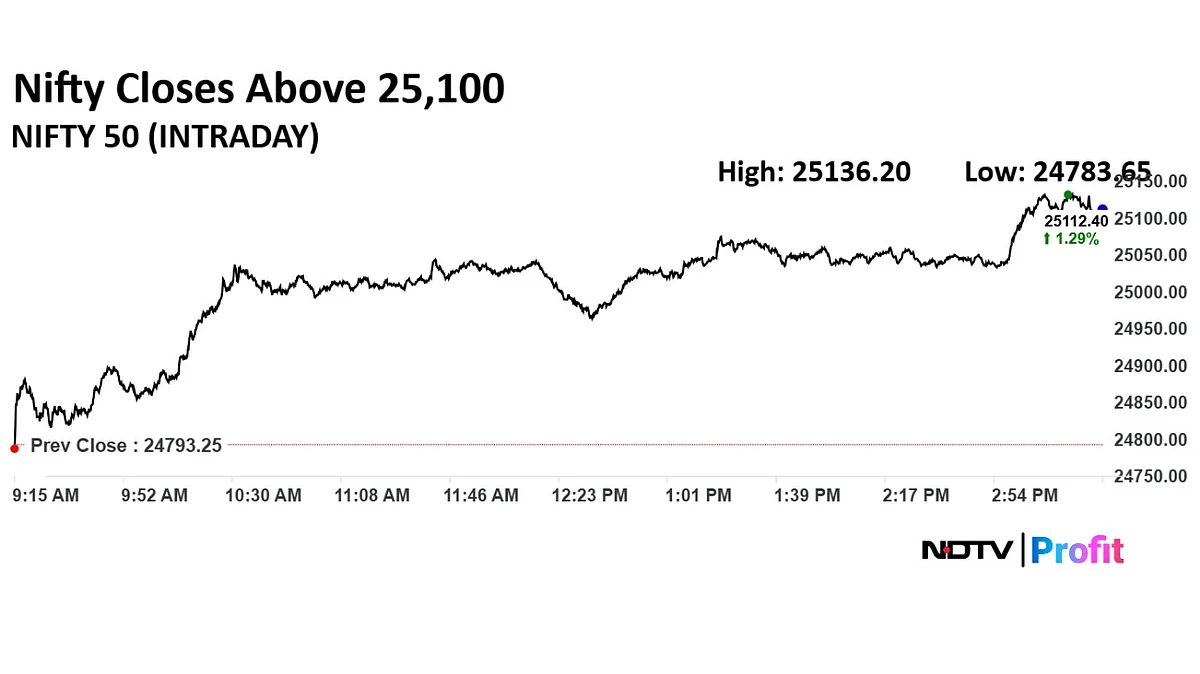

After spending most of the last week under pressure, the NSE Nifty 50 staged a comeback on Friday, closing firmly above the 25,000 level. Analysts say the index has now re-entered the upper half of its five-week consolidation band and could attempt a breakout if key supports continue to hold.

Bajaj Broking said the Nifty formed a sizeable bullish candle on Friday with a higher high and higher low, signalling the resumption of the uptrend after a brief corrective phase.

"The index closed above 25,000, showing strength. We expect a retest of the 25,200 level, which has capped rallies in recent weeks. A breakout above this could take the index to 25,500. On the downside, 24,700 remains the key swing low, while 24,500–24,400 is a crucial support zone, coinciding with the 50-day exponential moving average," the brokerage said.

Kotak Securities' Amol Athawale said both weekly and daily charts reflect a bullish bias, supported by a higher bottom structure and trade above the 20-day simple moving average.

"Short-term traders should watch for supports at 24,850 and 24,700. If the index sustains above these, we could see a move to 25,200 in the near term. Crossing 25,200 may open the gates to 25,400–25,500. However, a fall below 24,700 may expose the index to deeper cuts toward 24,400," he said.

Market Recap

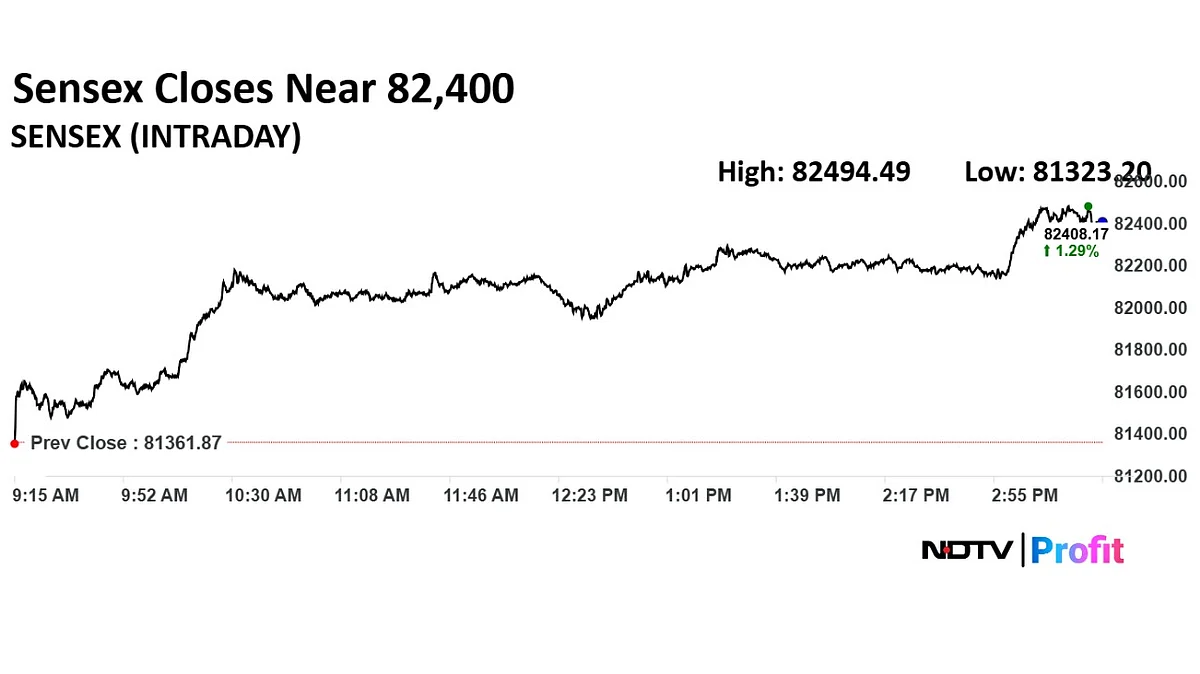

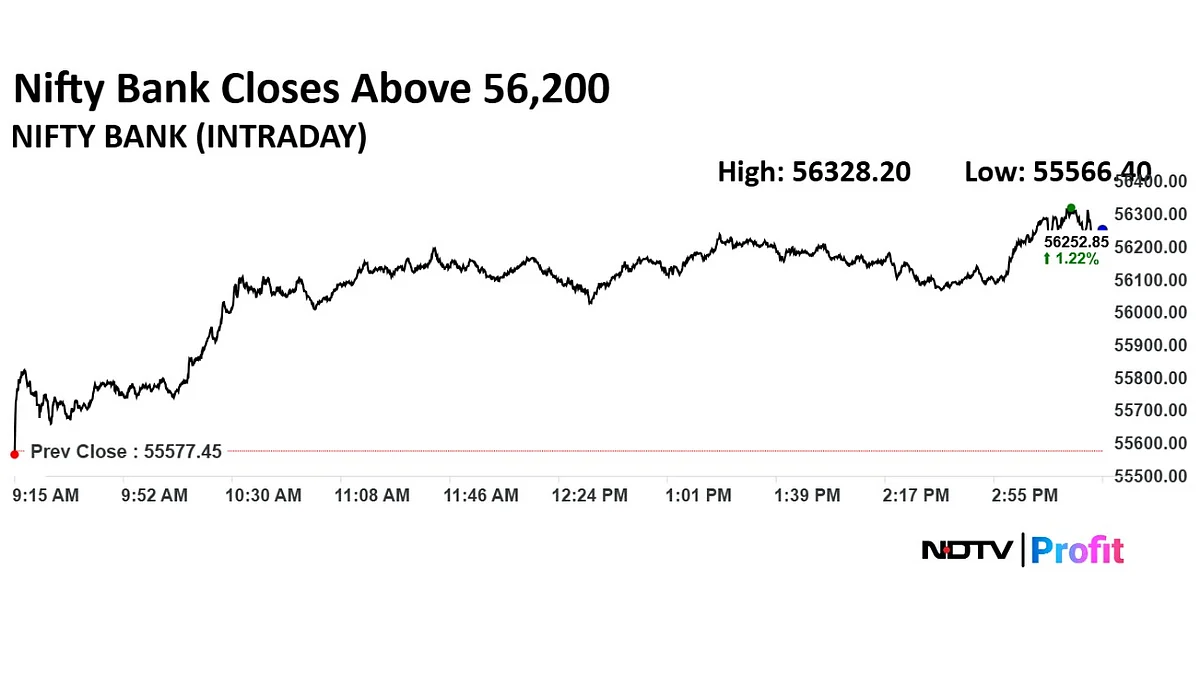

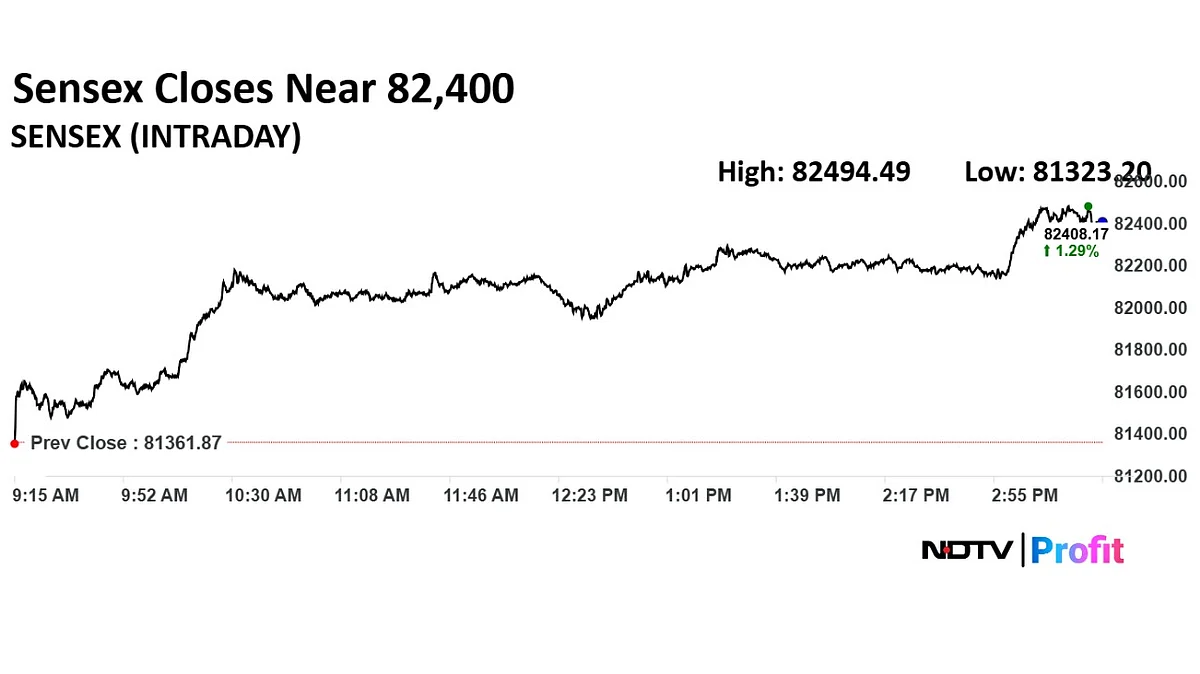

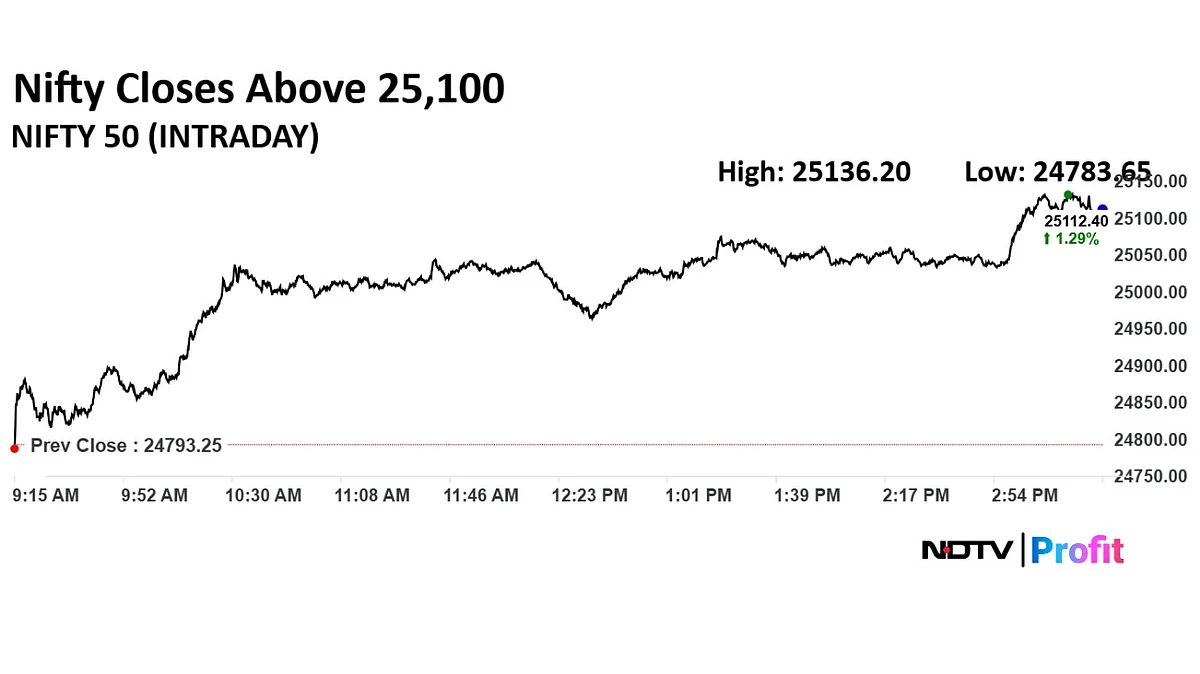

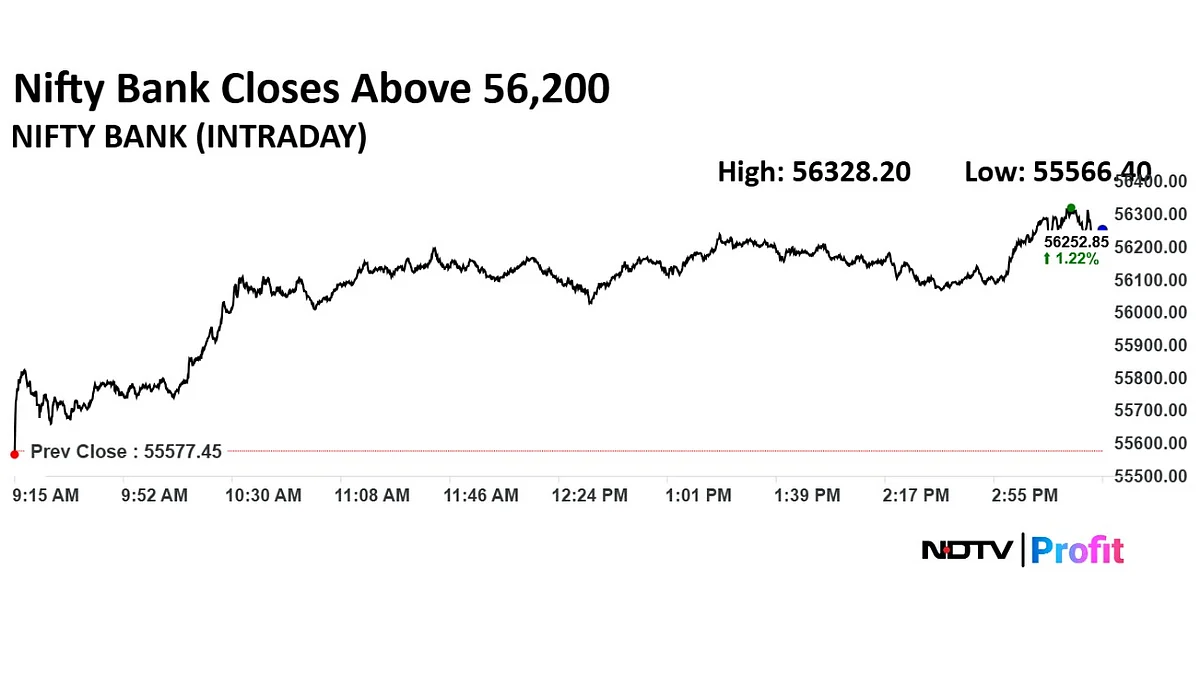

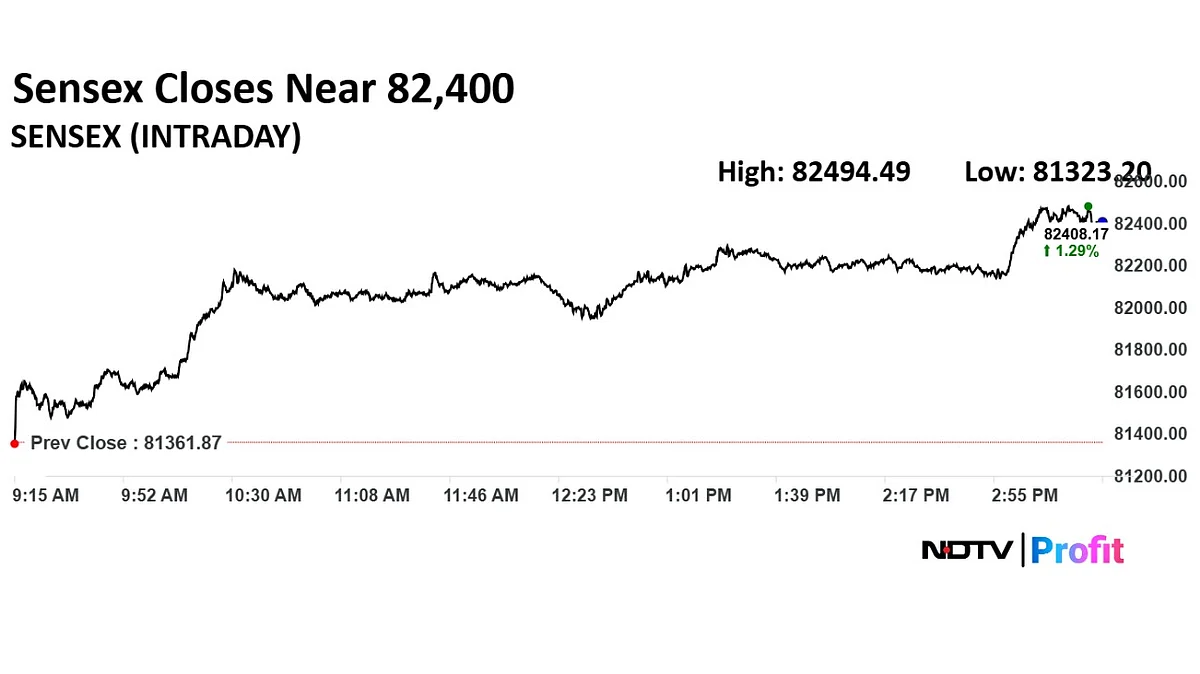

The benchmark indices snapped their losing streak and ended the week on a high. The Nifty 50 rose 319.15 points or 1.29% to close at 25,112.40, while the Sensex surged 1,046 points or 1.29% to 82,408. Intraday, both indices climbed over 1.3%.

Globally, markets were volatile amid mixed economic data and rising geopolitical tensions. The US Federal Reserve kept rates unchanged, while tensions in the Middle East pushed Brent crude above $76 a barrel.

In Asia, China’s industrial production surprised on the upside but retail sales disappointed. Indian markets remained subdued through the week before Friday’s rebound, supported by strong macro data, investor appetite for block deals and QIPs, and resilient sentiment despite higher crude prices.

Currency Update

The Indian rupee ended 14 paise higher at 86.59 against the US dollar on Friday, recovering from Thursday’s close of 86.73. The currency opened stronger at 86.63, bouncing back after touching a three-month low in the previous session.

The rebound came despite persistent global uncertainty and geopolitical tensions. Meanwhile, Brent crude futures eased 2.12% to $77.18 per barrel after a volatile week, as supply concerns remained elevated even as Iran continued exports.