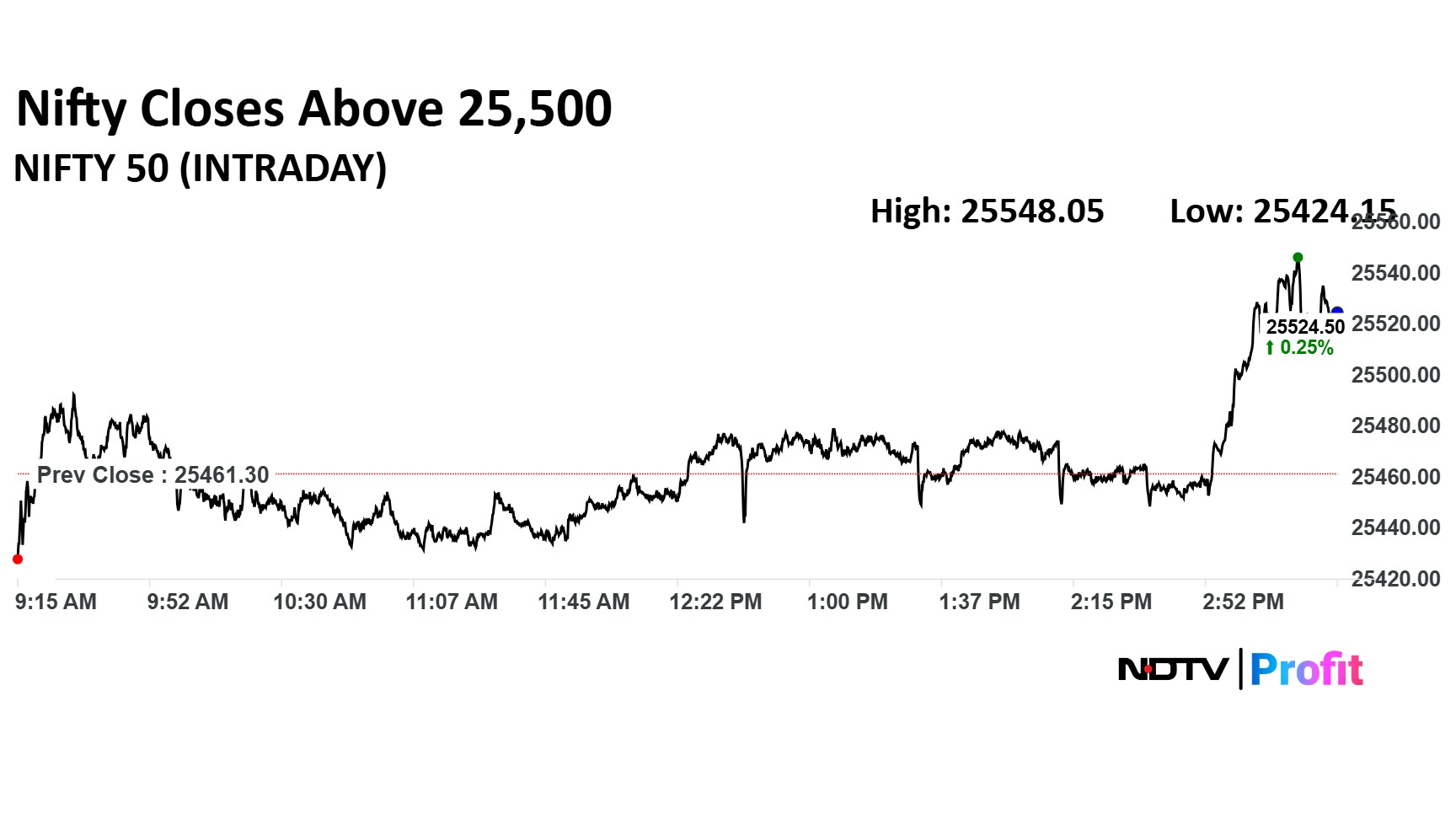

The NSE Nifty 50 may see a potential resumption of uptrend in the coming sessions, according to Rajesh Bhosale, equity technical analyst at Angel One.

It may find resistance at 25,650-25,700 levels and support at 25,450-25,300 levels, the analyst said.

The Nifty formed a bullish candlestick pattern, signalling a continuation of the consolidation with a positive bias for the third consecutive session, according to analysts from Bajaj Broking Research.

They identified resistance at 25,600-25,800 levels and key support at 25,200–25,000.

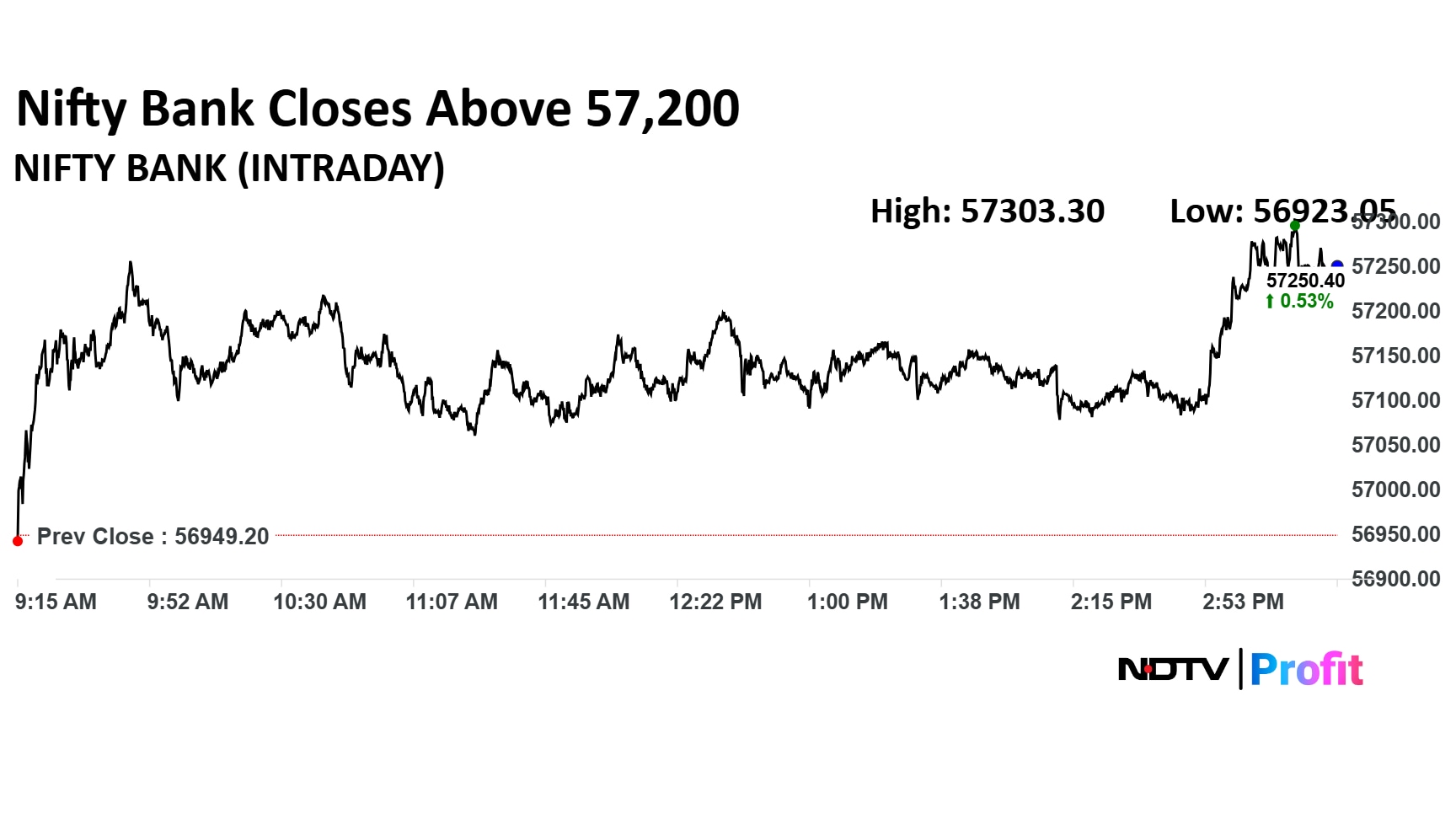

The Bank Nifty also formed a bullish candlestick pattern, signalling consolidation with positive bias for the third session in a row, analysts from Bajaj Broking Research said. Key resistance for the index was identified in the 56,500-57,600 area.

Bajaj Broking recommends a 'buy-on-dips' strategy to traders for both Nifty and Bank Nifty Indices.

Market Recap

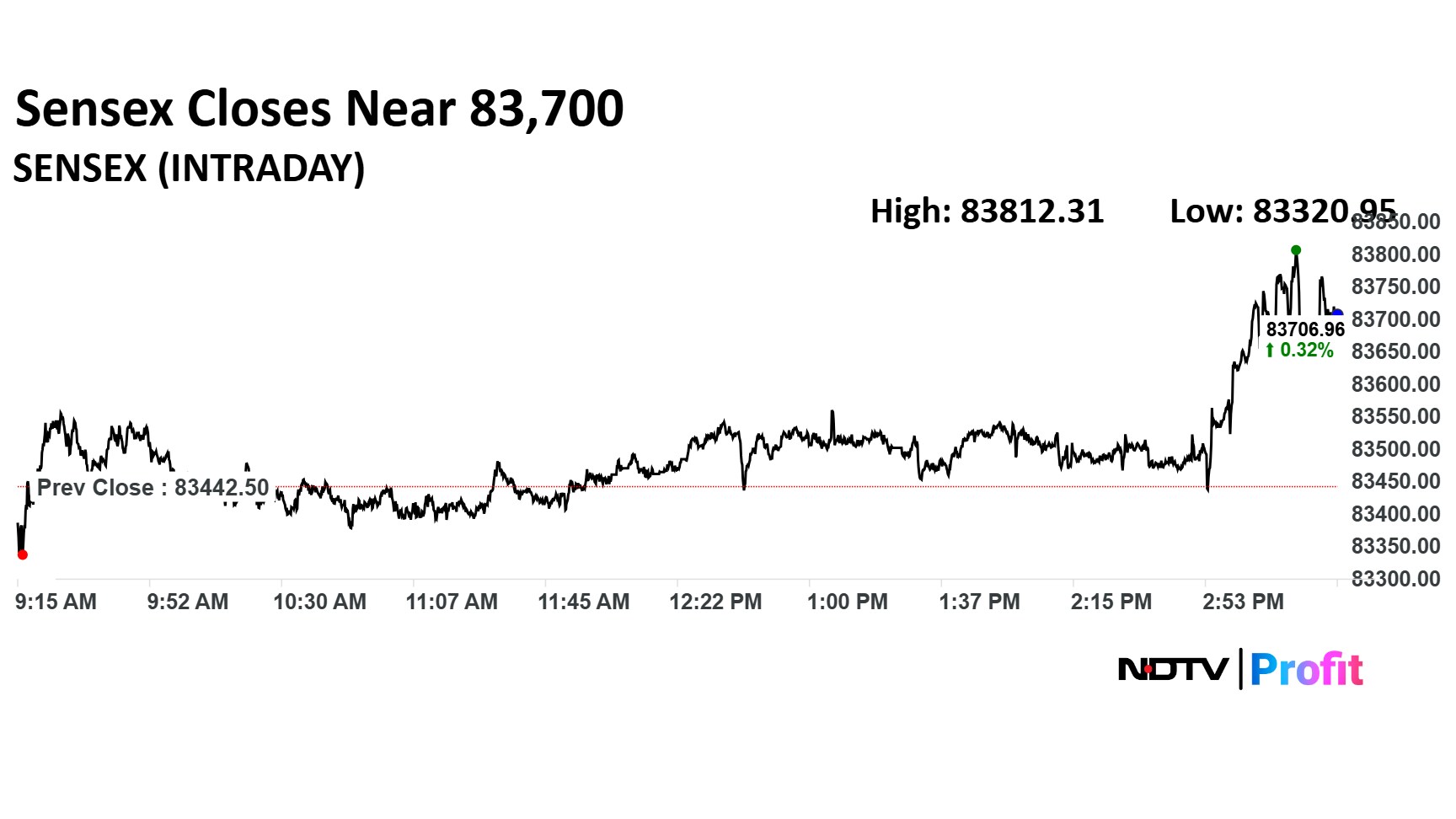

The benchmark indices ended in the green on Tuesday even as many traders remained on the sidelines awaiting clarity on US and India trade deal. The NSE Nifty 50 ended 61.2 points or 0.24% higher at 25,522.5 and the BSE Sensex ended 270.01 points or 0.32% higher at 83,712.51.

Currency Update

Rupee closed 16 paise stronger against US Dollar at 85.70. The local currency had closed at 85.86 a dollar on Monday.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.