Shares of Tata Consultancy Services Ltd., were trading lower on Monday after reporting weak first quarter results for the current fiscal. India's largest information technology services giant's net profit rose 4% to Rs 12,760 crore in the April-June quarter of FY26, compared to Rs 12,224 crore in the preceding January-March quarter of FY25.

On Friday, TCS share price fell over 2%, after opening lower on the stock exchanges, a day after reporting weak first quarter results for the current fiscal.

Tata Consultancy Services announced an interim dividend of Rs 11 per equity share for the first quarter of fiscal 2026. The company will distribute nearly Rs 4,000 crore to shareholders in the fourth quarter of this fiscal.

The board has fixed July 16 as the record date for the purpose of dividend payment, the company said in an exchange filing on Thursday. Additionally, the company will pay the interim dividend on Aug. 4, it added.

TCS's order pipeline has stayed robust even as the demand scenario remains uncertain amid US trade policy issues, said Chief Executive Officer and Managing Director K Krithivasan.

"(Economic) uncertainty has continued throughout the quarter," he told NDTV Profit after the release of the first quarter results. "Till trade discussions are concluded, it will persist. This will weigh on consumer businesses."

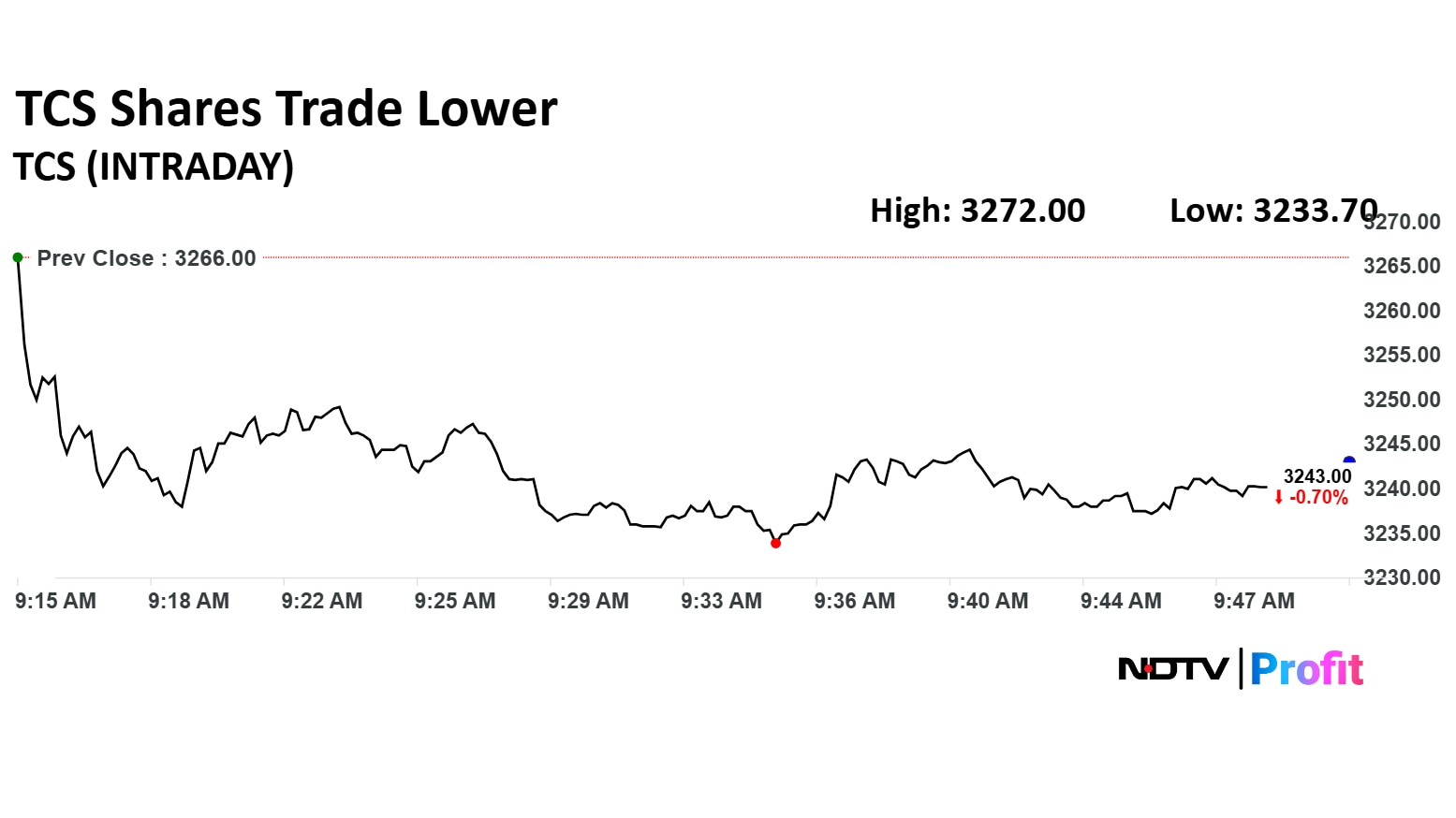

TCS Share Price

Shares of TCS fell as much as 0.99% to Rs 3,233.70 apiece. They pared losses to trade 0.70% lower at Rs 3,243 apiece, as of 9:52 a.m. This compares to a 0.36% advance in the NSE Nifty 50.

The stock has fallen 22.49% in the last 12 months and 20.82% year-to-date. Total traded volume so far in the day stood at 2.60 times its 30-day average. The relative strength index was at 60.91.

Out of 50 analysts tracking the company, 31 maintain a 'buy' rating, 14 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 15%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.