Tata Technologies Ltd. shares fell over 6%, as the stock entered the Futures & Options segment with the commencement of the March series. This move marks a notable shift for the company, which now joins the ranks of other prominent stocks trading in the F&O segment.

Tata Technologies, a subsidiary of Tata Motors, has expertise in product engineering and digital transformation services. The company provides solutions to the automotive, aerospace, and industrial machinery sectors.

Entering the F&O segment means that Tata Technologies' shares can now be traded through futures and options contracts. These derivative instruments allow investors to buy or sell the stock at a predetermined price on a future date, providing opportunities for hedging and speculation. While this can lead to increased liquidity and trading volume, it also introduces higher volatility and risk.

Alongside Tata Technologies, four other stocks—IREDA Ltd., IIFL Finance Ltd., Patanjali Foods Ltd., and Titagarh Rail Ltd.—also began trading with F&O contracts at the start of the March series. This development is expected to attract more traders and investors, potentially impacting the stock prices of these companies in the coming weeks.

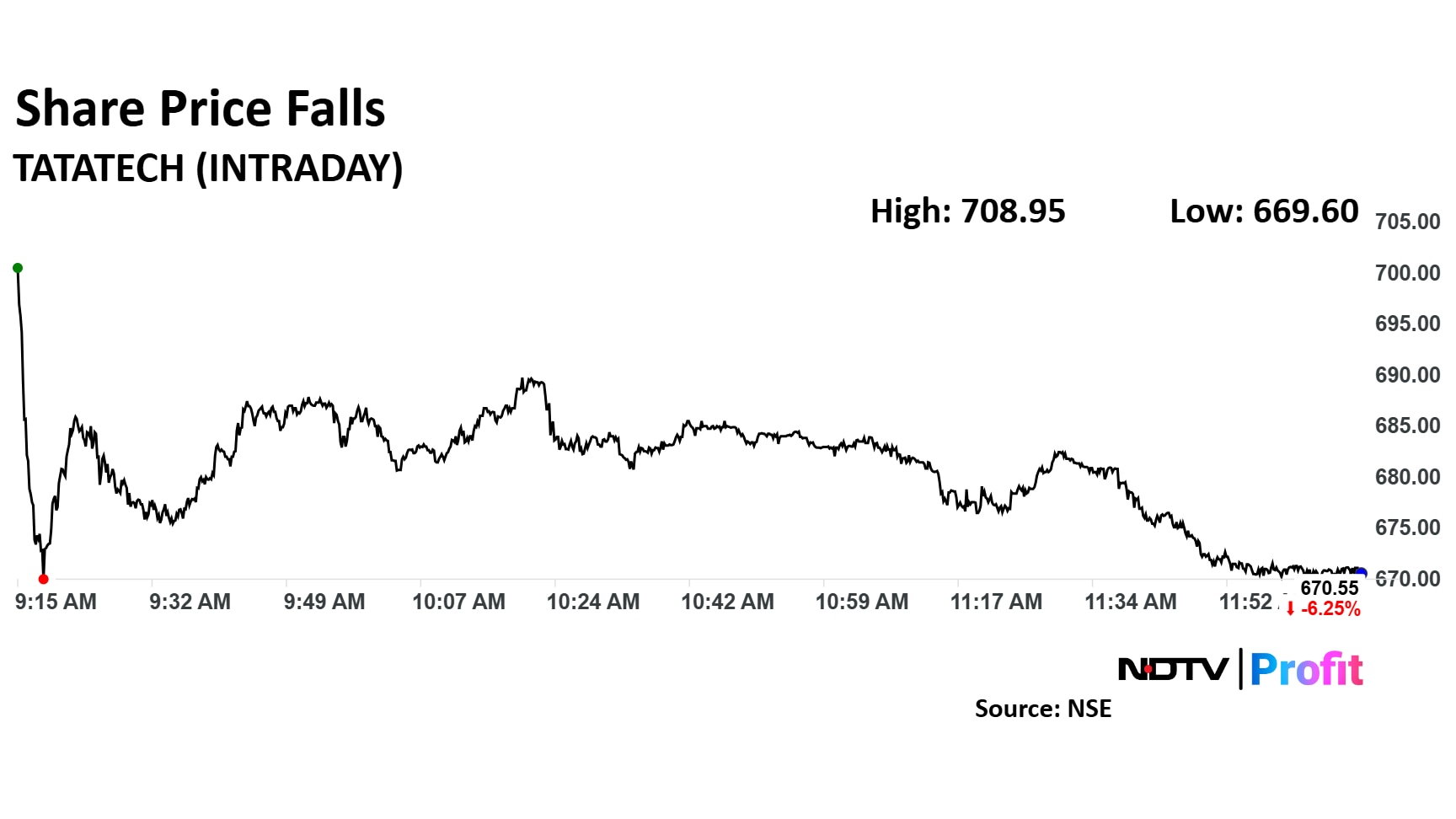

Tata Tech Share Price

The scrip fell as much as 6.38% to Rs 669.60 apiece. It pared losses to trade 3.58% lower at Rs 689.65 apiece, as of 12:08 p.m. This compares to a 1.44% decline in the NSE Nifty 50.

It has fallen 35.84% in the last 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. Relative strength index was at 50.

Out of 13 analysts tracking the company, five maintain a 'buy' rating, and eight suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 25.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.