HSBC Global Research downgraded Tata Power Co. to 'reduce' from 'hold' as the brokerage is sceptical about the pace of the company's project execution. However, the brokerage raised the target price for the power producer with the launch of new initiatives and programmes.

Execution of projects is largely beyond the company's control, and investors could be disappointed, HSBC said in a May 9 note. This requires the orchestration of policy support from local municipal bodies, state governments and the central government, it said.

"We believe the sharp stock price run-up of 75% in the past six months is premised on the execution of large pumped storage capacity and the potential privatisation of state discoms (distribution companies)."

The brokerage has revised the target price from Rs 230 per share to Rs 300 per share. This implies a downside of 37% from the current market price.

Tata Power's earnings estimates and valuation have been updated to factor in lower coal prices, the start of new programmes like pumped storage, hybrid projects and changes in module prices, HSBC said.

The recent infusion of equity capital into the renewable business, increased power demand, and track record in power distribution make the company well placed to benefit from future opportunities, according to the brokerage.

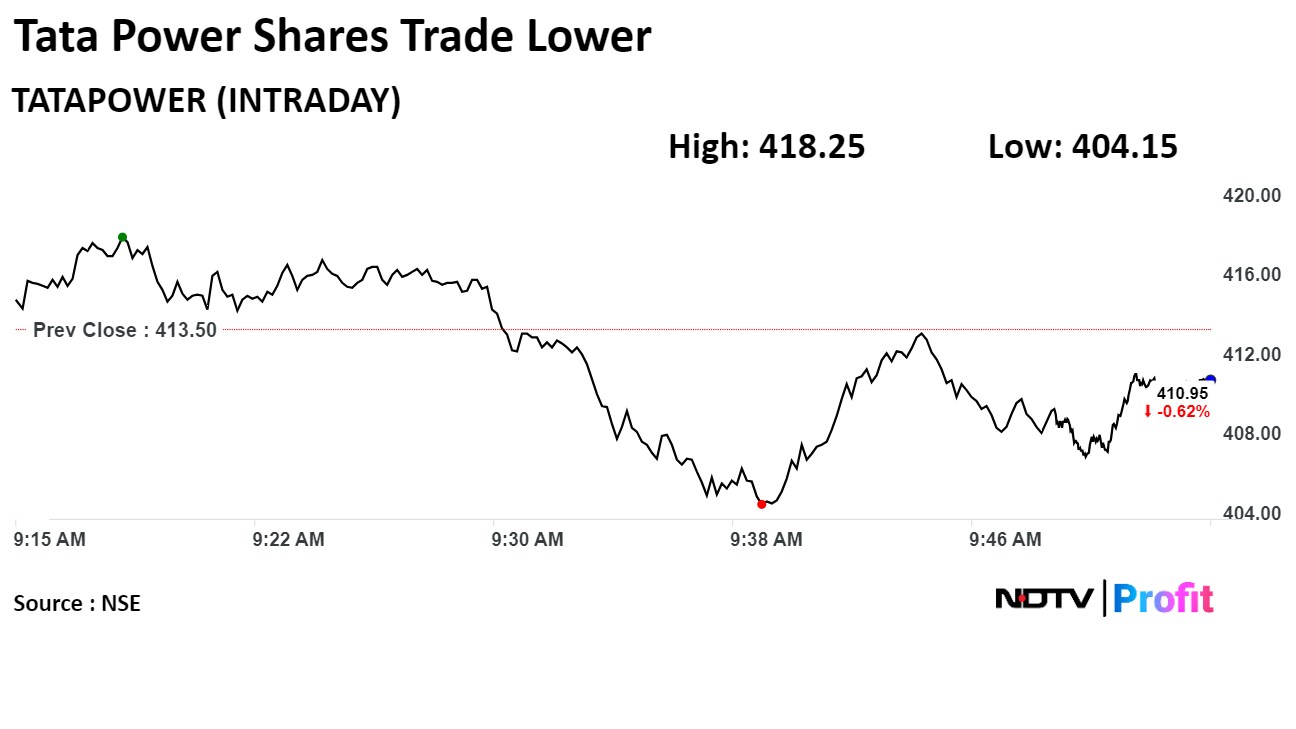

Shares of Tata Power fell as much as 2.26% before paring loss to trade 1.37% lower at 9:52 a.m., compared to 0.5% advance in the benchmark Nifty 50.

The stock has risen 99.7% in the last 12 months and 23% year-to-date. The relative strength index was at 39.

Of the 21 analysts tracking the company, eight have a 'buy' rating on the stock, two recommend a 'hold' and 11 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 13.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.