Shares of Tata Motors Ltd. extended gains for the second day after it emerged that the India-UK free trade agreement works to its advantage in more ways than one. The stock has risen over 7% in the last two sessions.

Certain Land Rover SUVs could get cheaper by as much as 50% in India as the India-UK FTA slashed auto tariffs to 10% from over 100% at present, at least three industry watchers told NDTV Profit on the condition of anonymity. If Tata Motors decides to make Jaguar electric cars at its Chennai plant, that would still be lucrative.

Citi has also backed this assesment. “JLR could see some market share gains in India,” said Arvind Sharma, director, equity research, India autos and transportation at Citi.

Additionally, Tata Motors can ship locally made auto components to the UK at reduced tariffs and use them on Land Rover SUVs made in that country. That would save costs further.

Jaguar Land Rover is the UK subsidiary of Tata Motors that still brings in two-thirds of revenue for its Indian parent. Land Rover has some assembly operations in Pune, but a majority of its Range Rover SUVs are made in Solihull and Halewood. Jaguar, which will turn into a fully electric brand in 2026, has its headquarters in Castle Bromwich.

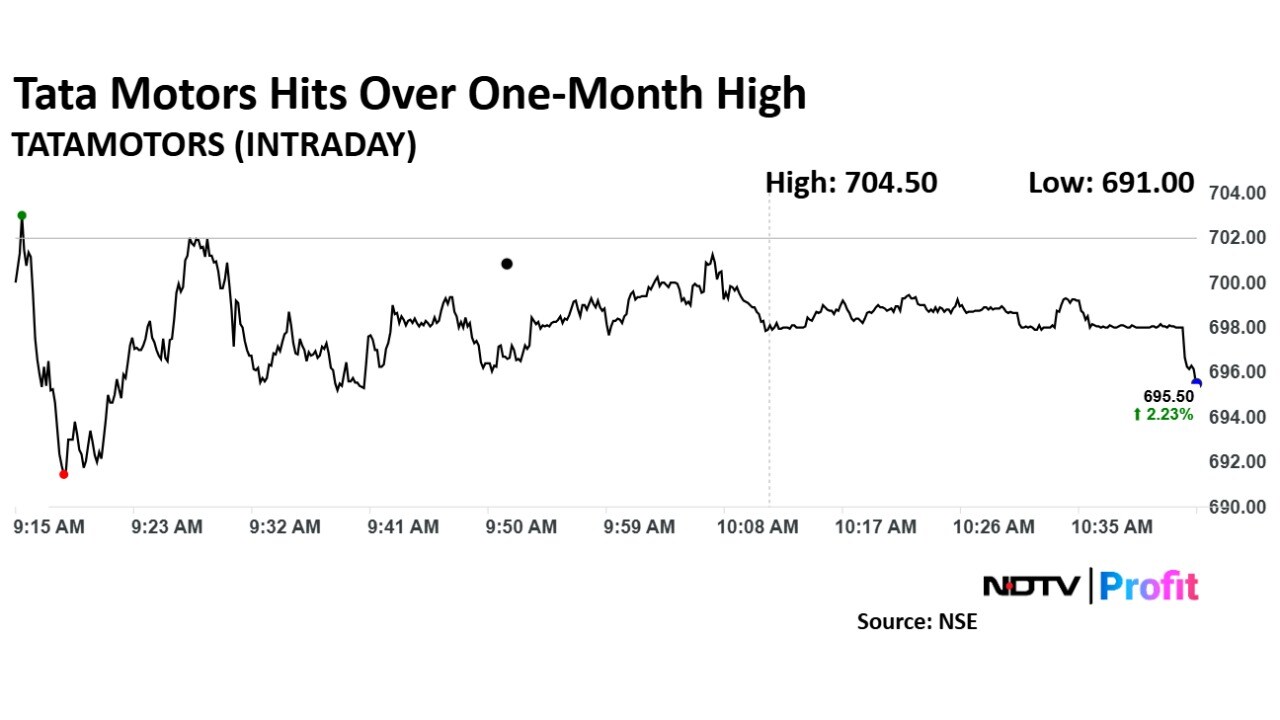

Tata Motors Share Price Rise

Shares of Tata Motors rose as much as 3.56% to Rs 704.50 apiece, the highest level since March 26. The stock pared gains to trade 2.62% higher at Rs 698.15 apiece, as of 11:21 a.m. This compares to a 0.03% decline in the NSE Nifty 50.

The stock has fallen 30.91% in the last 12 months and 5.51% year-to-date. Total traded volume so far in the day stood at 9.20 times its 30-day average. The relative strength index was at 52.98.

Out of 34 analysts tracking the company, 21 maintain a 'buy' rating, eight recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 30.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.