Shares of Swiggy Ltd. plunged on Wednesday as anchor investors offloaded the stake they held before the quick commerce platform went public last month.

The Bangalore-headquartered delivery platform had raised Rs 5,085 crore by allocating 13.03 crore shares to high-profile anchor investors, including Fidelity and Blackrock. Sizeable participation from domestic investors was also seen in the anchor investment, a day before the initial public offering opened for retail investors.

The first lock-in period for these investment institutions ended on Dec. 10 with 50% of these shares being available for trade from Wednesday. The lock-in for the remaining shares held by anchor investors will end on Feb. 09.

Meanwhile, Swiggy's loss widened to Rs 626 crore in the second quarter of the current financial year versus a loss of Rs 611 crore in the last quarter. However, quick commerce grew 31% and supply-chain and distribution grew 14%.

The platform's quick commerce business is under a hypergrowth phase and could see the category zoom to about $40-50 billion in the coming years, according to its top executives.

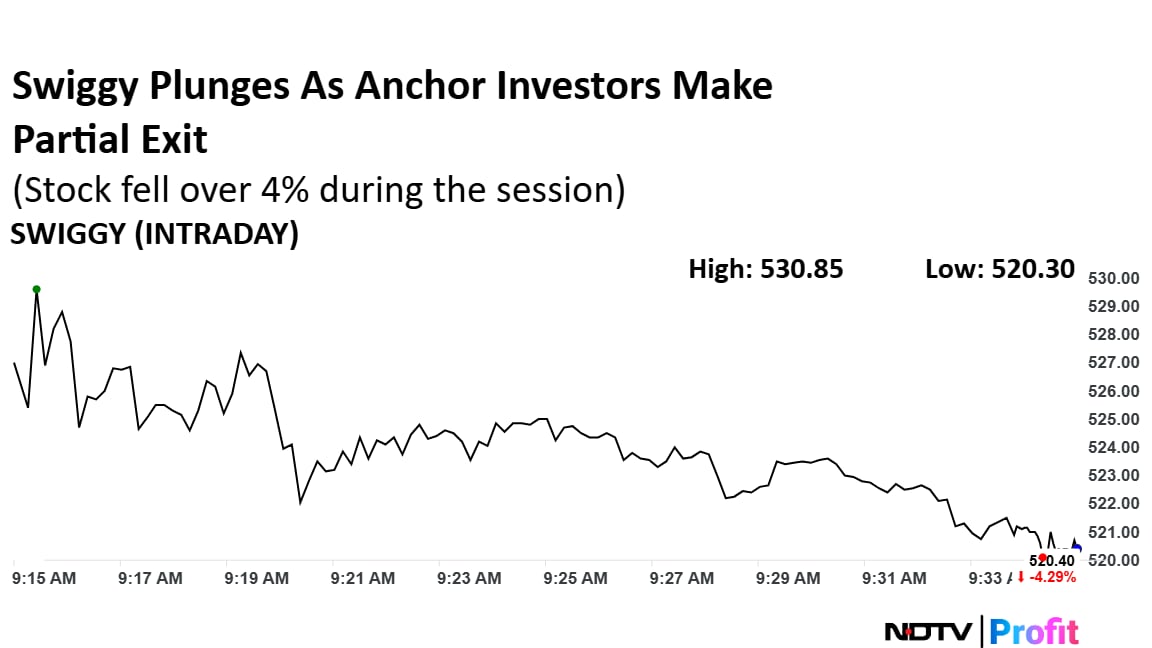

Swiggy's share price fell as much as 4.22% during the day to Rs 520.8 apiece on the NSE. It was trading 3.7% lower at Rs 523.6 apiece, compared to a 0.05% advance in the benchmark Nifty 50 as of 09:31 a.m.

Swiggy's shares opened at a gap down and broke through the key support for the stock at Rs 529, indicating a further plunge towards the immediate support at Rs 511 level. The counter is trading below the 9-simple moving average and 21-day exponential moving average. If the stock fails to find comfort at the first support level, the stock could tumble to Rs 486 mark.

It has risen 14% since the company's debut on the national bourses on Nov. 13. The total traded volume so far in the day stood at one time its one-day average. The relative strength index was at 59.

Three out of the eight analysts tracking the company have a 'buy' rating on the stock, two suggest a 'hold' and three have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.