Swiggy Ltd. shares extended losses to the fifth straight day — their longest losing streak since listing — on Monday as shareholder lock-in periods came to an end. With increase in number of shares available for trading, the volumes were trading at nearly three times the 30-day average.

Swiggy saw close to 6.5 crore shares become eligible for trading with the lock-in period ending, according to a note by Axis Capital. This number accounts close to 3% of the company's outstanding shares.

Swiggy has fallen below its IPO price of Rs 390 on Feb. 6. It had broke below the listing price of Rs 420 on Jan. 22. The shares are nearly 20% lower than the listing price, whereas it is close to 7% below its IPO price.

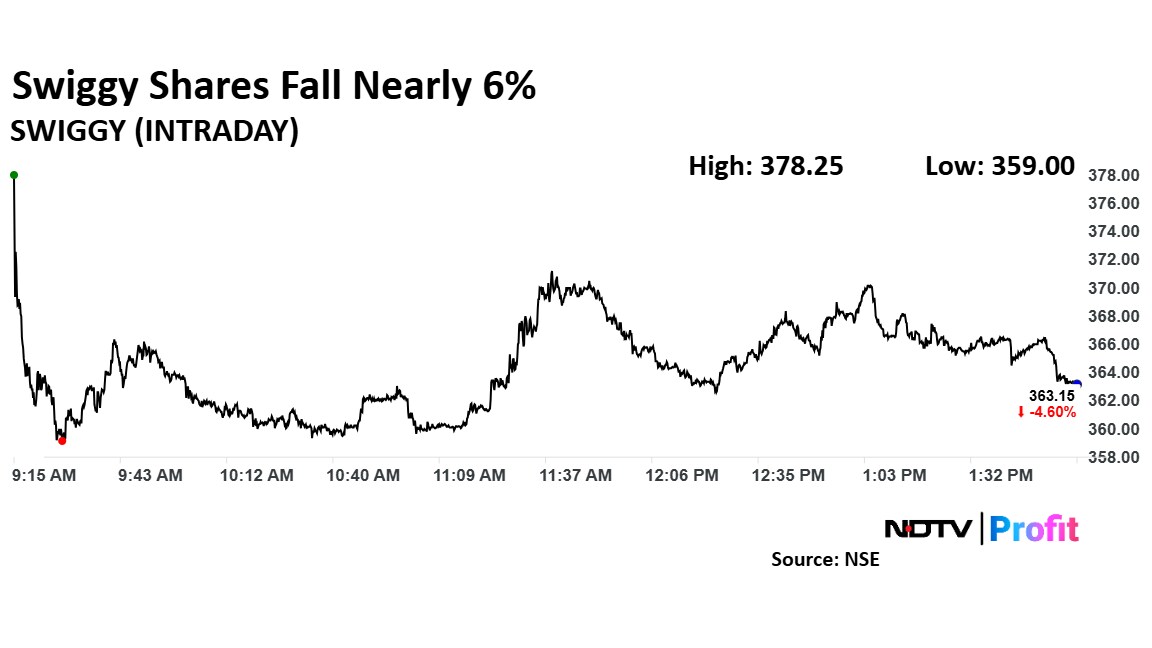

In the last five sessions the shares have seen a 20% decline. It fell over 5% on Feb. 4 a day prior to the company reporting its third quarter earnings. The quick commerce company's loss widened to Rs 799.08 crore in the October-December period, as compared to a loss of Rs 625.53 crore in the July-September quarter.

Revenue of the company rose 10.9% from the preceding quarter to Rs 3,993.07 crore. The operating loss or the losses before interest tax depreciation and amortisation stood at Rs 725.66 crore, wider from the Rs 554.17 crore clocked in the three months ending September.

However, Axis Capital on Monday picked Swiggy over Zomato in the quick commerce segment. The brokerage said that both the companies underperformed the Nifty index amid high competition in the segment. The note said that Zepto had the most aggressive pricing, while BlinkIt had the best assortment.

Axis Capital also said that the margin pressure would peak in two-three quarters and Swiggy will be more impacted by this in comparison to Zomato.

Swiggy Extends Fall

The shares of Swiggy fell as much as 5.69% to Rs 359 apiece, the lowest level since its listing. It pared losses to trade 3.9\% lower at Rs 365.80 apiece, as of 1:52 p.m. This compares to a 0.82% decline in the NSE Nifty 50 Index.

It has risen 20.23% in the last 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 32.

Out of 16 analysts tracking the company, 11 maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 46.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.