Swiggy Ltd. just received its first ‘sell' rating since listing in early November 2024, as analysts flagged that it has lost its early lead in both food delivery and quick commerce, slipping to second and third place in each.

Ambit Capital, which initiated coverage on Swiggy in a note on Wednesday, said the company may have been a first mover—but it is now trailing. The brokerage expects Swiggy's food delivery market share to stabilise at around 42%.

It has set a target price of Rs 310 per share, implying a downside of over 20% from the last close. That's the second-lowest target among analysts tracked by Bloomberg, behind only Macquarie's ‘underperform' call with a target of Rs 260.

Ambit is also cautious on Swiggy's quick commerce arm, Instamart, pointing to a capped addressable market of just 30–50 cities, an overoptimistic outlook on ad-driven take-rate gains, and an underestimation of competitive risk.

The note said Instamart needs meaningful investment to close the gap with Blinkit and Zomato across scale, assortment, customer acquisition, advertising muscle, and dark store efficiency. JPMorgan, in contrast, sounded more upbeat this week, saying Swiggy is catching up with Zepto on store count.

Food Delivery: Profitability Lag Likely To Persist

Swiggy has been losing ground to Zomato in food delivery, with the latter ahead on platform reach, users and order volumes. The pace of share loss, however, has slowed, and Ambit expects market shares to now remain stable in the long run.

While Swiggy matches Zomato on average order value and subscriber penetration, its wider geographical spread drives up delivery costs. Ambit expects this profitability gap to narrow as Swiggy scales and reins in discounts—but Zomato's denser footprint is likely to keep it ahead.

Key Metrics:

Market share: 43%.

Gross order value: 25% below Zomato.

Revenue: Roughly 23% below Zomato.

Adjusted Ebitda margin (Q3FY25): Swiggy 2.5% versus Zomato 4.3%.

Expected margin gap by FY27: 100 basis points.

Quick Commerce: Instamart Faces Tough Competition

Instamart went from being the largest player in in the quick commerce space to trailing Blinkit and Zepto as only the third largest player, says Ambit.

The competitive landscape is also intensifying, with Swiggy squeezed between an “efficient” Zomato and an “aggressive” Zepto, while Flipkart and Amazon are expected to enter by year-end.

Additionally, Swiggy's initial focus was on a 30-minute delivery model and it was slower in catching up to peers Blinkit and Zepto, who prioritised faster 10-15 minute delivery times.

Moreover, Instamart's smaller product assortment, slower advertising scale-up, and a more expansive geographic footprint have all contributed to its slower growth relative to competitors.

Key Metrics:

Instamart Market Share: Roughly 22%.

Gross Merchandise Value: 50% smaller than Zomato.

Revenue: 57% smaller than Zomato.

Adjusted Ebitda Loss: Instamart at -14.8%, Blinkit at -1.3%.

Outlook

Ambit now expects Instamart to break even only by the fiscal year ending March 2029, two years later than company guidance. Cumulative losses are projected to hit Rs 7,800 crore over the five-year period ending March 2028. The brokerage also said current assumptions factored into market pricing appear stretched.

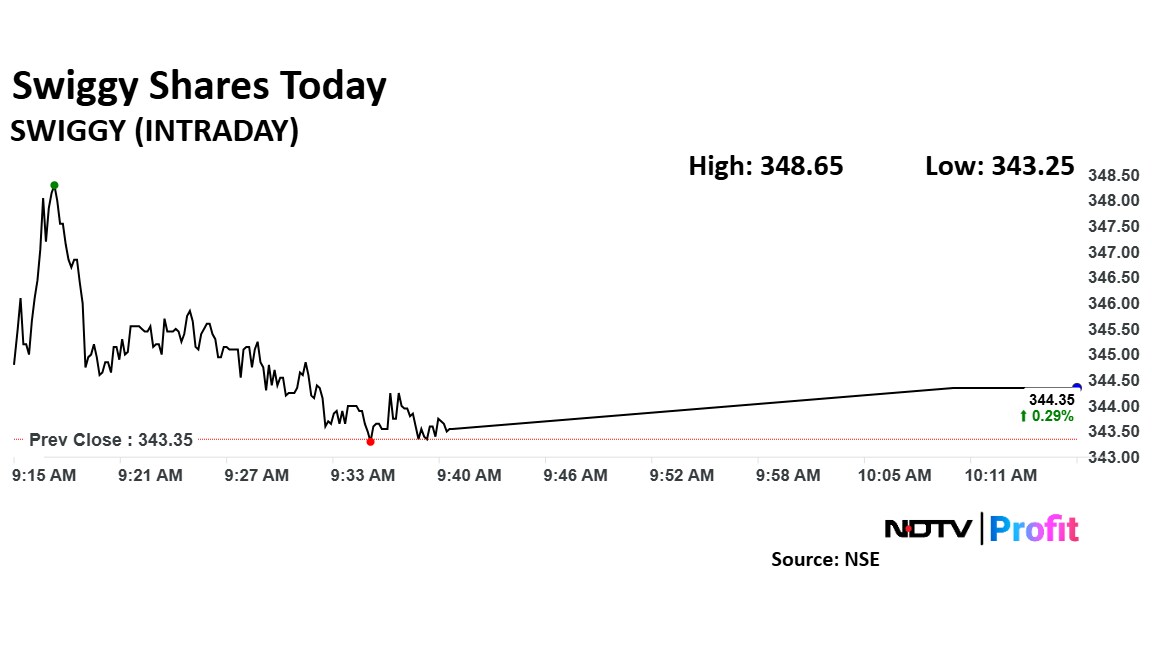

Shares of the food delivery player were up as much as 1.54% at Rs 348.65 apiece intraday but are off the day's high as of 10:17 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.