Jefferies has downgraded Hero MotoCorp Ltd. to ‘underperform' and Bajaj Auto Ltd. to ‘hold' amid a weakening volume outlook for the two-wheeler sector. The brokerage, however, retained its ‘buy' calls on TVS Motor Co. Ltd. and Eicher Motors Ltd., citing strong market share gains and robust earnings potential.

India's two-wheeler sector, which had shown signs of recovery post Covid, is again witnessing demand pressure. Jefferies flagged muted retail registrations, high inventories, and weak enquiries from dealers as key concerns, despite upcoming demand tailwinds from income tax cuts and PSU wage hikes.

It has cut its industry volume growth estimates for fiscal 2026 and 2027 by 6 and 2 percentage points respectively, now forecasting an 8–11% growth path that implies a 10% compound annual growth rate through fiscal 2028.

Hero MotoCorp, Bajaj Auto, Ola: Losing Ground

Jefferies slashed its fiscal 2026-27 earnings estimates for Hero MotoCorp by 8–11% and for Bajaj Auto by 5–7% on lower volume assumptions. Hero MotoCorp's domestic market share dropped to a two-decade low of 28% in fiscal 2025, while Bajaj Auto's share in two-wheeler exports slid from 62% in fiscal 2015 to 40% in fiscal 2025.

The note also flagged Ola Electric Mobility Ltd.'s weakening grip on the electric two-wheeler space, with its market share falling sharply from 49% in the first quarter of fiscal 2025 to 19% by the fourth quarter.

TVS Motor, Eicher Motors: Market Share Winners

TVS Motor's domestic market share has hit an 18-year high of 18%, with gains across motorcycles, scooters, and electric vehicles. Jefferies expects TVS to deliver the strongest EPS compound annual growth rate of 28% over fiscal 2025-28. Its fiscal 2026-27 earnings forecast was cut by only 2–3%, cushioned by production-linked incentive benefits.

Eicher Motors, too, remains a preferred pick as it retains a 30% market share in the premium 125cc+ motorcycle segment. Jefferies sees a 14% EPS CAGR over fiscal 2025-28 for the company.

Outlook: Sector Growth Cut, But Recovery Ahead

India's two-wheeler industry volume forecast for fiscal 2026 and fiscal 2027 has been trimmed by 6 and 2 percentage points respectively, though Jefferies still expects a 10% CAGR through financial year 2028. The report cites continued pressure on affordability and a sluggish EV transition as structural drags.

EV adoption in two-wheelers has plateaued at 5-6% penetration for two years despite price cuts and newer models. Jefferies expects this to rise gradually to 10% by fiscal 2028, stressing that consumer trust remains a bottleneck for widespread adoption.

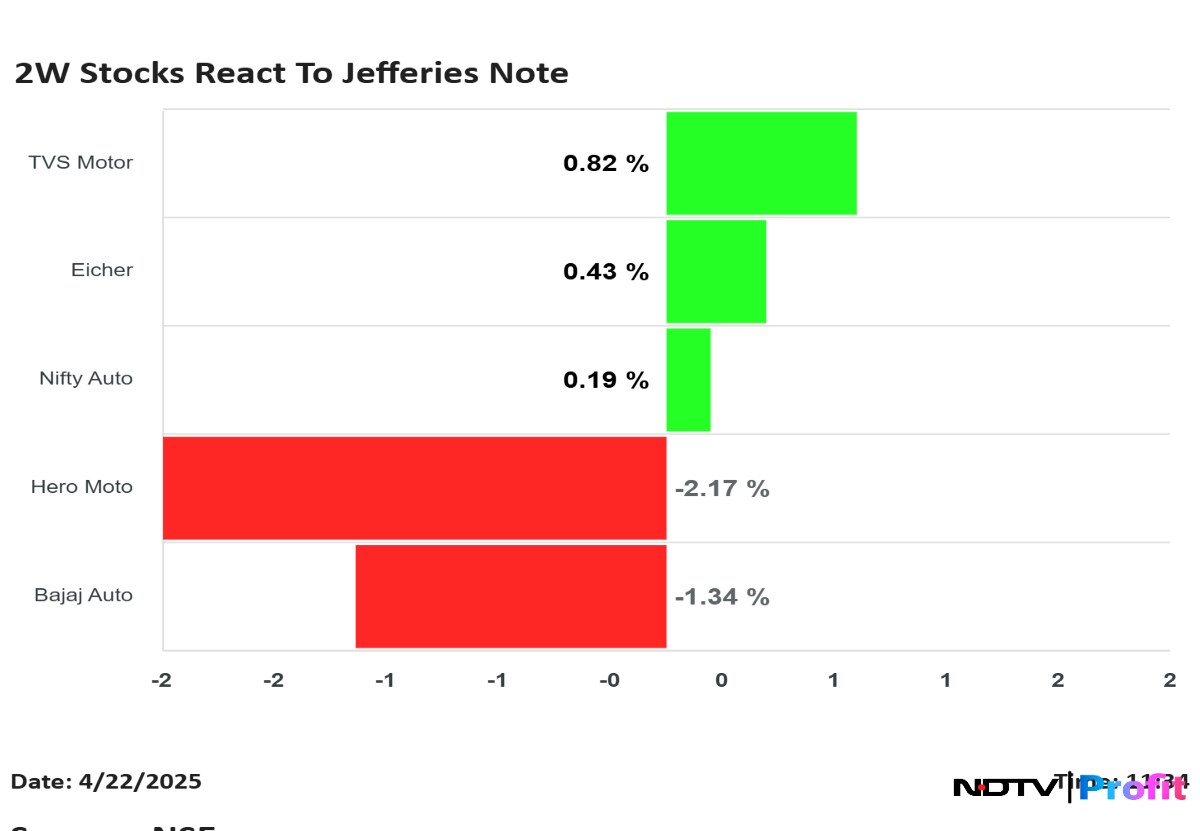

Stock Reaction

Hero MotoCorp shares fell as much as 2.45% to Rs 3,902.90.

Bajaj Auto shares declined 2.09% to Rs 8,075.

TVS Motor shares rose 1.31% to Rs 2,771.5.

Eicher Motors shares were up as much as 1.65% to Rs 5,906.5.

The benchmark Nifty 50 was up 0.29% and the Nifty Auto index was up 0.21% as of 11:27 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.