Good morning!

The GIFT Nifty was flat at 25,073 as of 7:50 a.m., indicating a muted open for the benchmark Nifty 50.

US index futures traded with marginal gains, mirroring European contracts. The S&P 500 futures were up 0.13%, while Euro Stoxx 50 futures up 0.11%.

Catch all the live updates on stock market developments here.

Markets On Home Turf

The benchmark equity indices closed higher on Wednesday, tracking gains in information technology stocks.

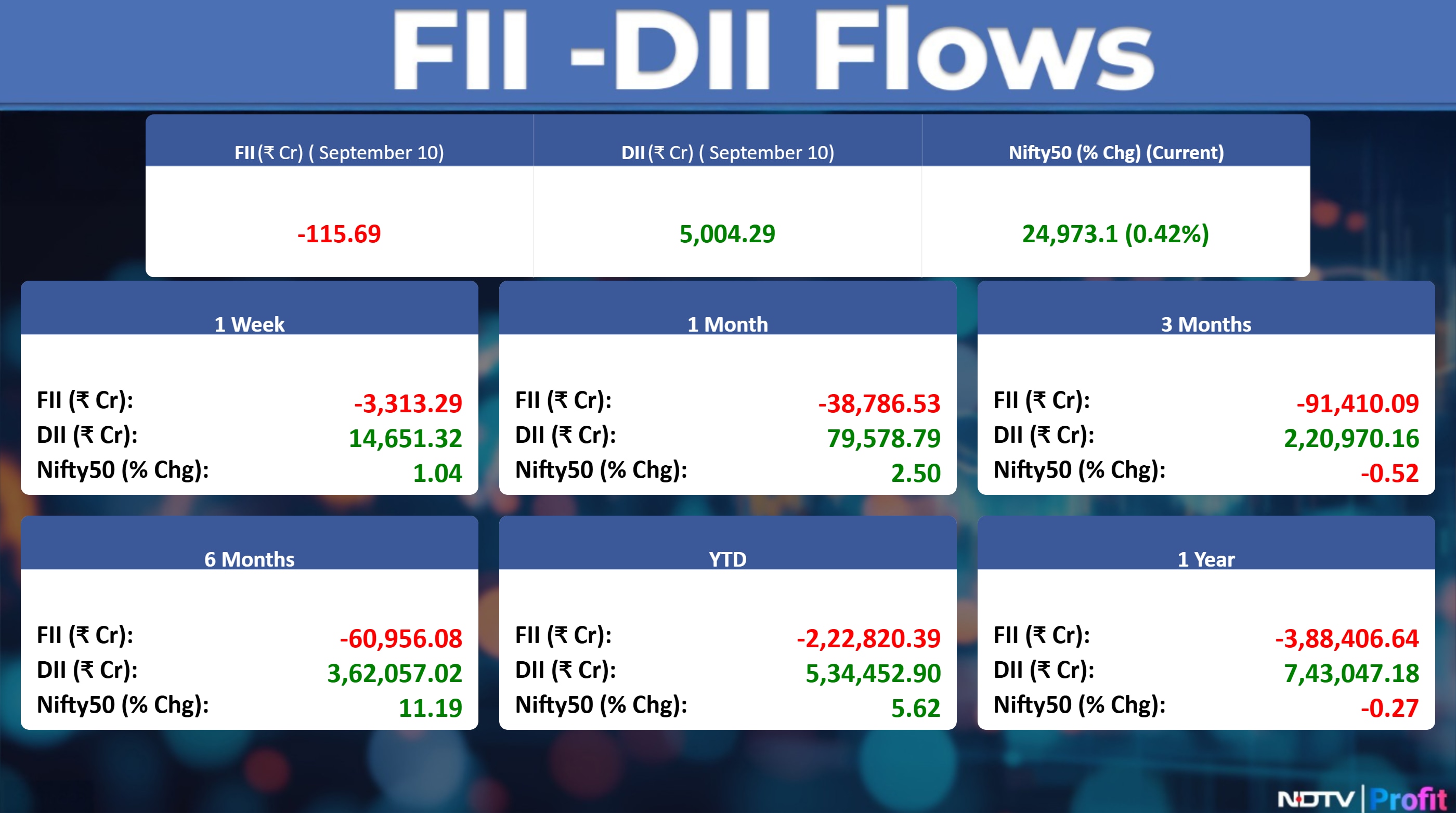

The NSE Nifty 50 settled 104.5 points or 0.42% higher at 24,973.1 and the BSE Sensex closed 323.83 points or 0.4% up at 81,425.15.

The Nifty rose as much as 0.67% during the day to 25,035.7, while the Sensex was up 0.67% to 81,643.88.

Wall Street Recap

The S&P 500 hit fresh all-time highs, with the artificial-intelligence trade in full swing after Oracle Corp.'s blockbuster cloud outlook sent the shares up 36% and spurred an industry surge. Two-year yields fell two basis points to 3.54%, Bloomberg reported.

The producer price index decreased 0.1% in August from a month earlier and July's figure was revised down. From the year before, it rose 2.6%. Economists pay close attention to PPI as some components are used to calculate the Fed's preferred measure of inflation. President Donald Trump called for the Fed to make a “big” rate cut after the data.

Asia Market Update

Asian equities were mixed Thursday after a rally on Wall Street drove stocks and bonds higher, as a drop in producer prices supported bets the Federal Reserve will resume cutting interest rates next week, Bloomberg reported.

Shares in Australia fell, while those in Japan edged higher and South Korea's Kospi index touched a fresh high. US futures inched upward after the S&P 500 rose 0.3% to a new record Wednesday. The tech-heavy Nasdaq 100 ended the session fractionally higher.

Commodities Check

Oil steadied after a three-day gain as investors weighed Donald Trump's latest comments regarding Russia and whether the US president will follow through with measures to punish Moscow for the Ukraine war.

Copper rose above $10,000 a ton on the London Metal Exchange, with traders weighing supply risks in Indonesia and signs that deflationary pressures are easing in China's industrial economy.

Key Events To Watch

Prime Minister Narendra Modi will host his Mauritius counterpart Navinchandra Ramgoolam, who is on a state visit to India, in Varanasi

Renewable Energy Minister Pralhad Joshi and Road Transport Minister Nitin Gadkari at the India Sugar & Bio-Energy Conference

Infosys to consider shares buy back plan.

Stocks In News

Reliance Industries: The company incorporates “Reliance Intelligence”, a wholly owned subsidiary of the Company.

Rajoo Engineers: The company has executed a definitive agreement to acquire a manufacturing company that produces machines for various industries.

Dr Reddy's Labs: The company will acquire Johnson & Johnson's Stugeron portfolio for $50.5 million or Rs 445 crore to foray into anti-vertigo segment.

Muthoot Capital: The company has successfully redeemed its commercial paper by making a payment of Rs 10 crore to the beneficiaries.

Optiemus Infracom: The company's Board of Directors has approved a further investment of Rs 7.69 crore in its wholly-owned subsidiary, Optiemus Electronics.

Shipping Corp. Of India: The company has taken physical delivery of a secondhand very large gas carrier of 54,534 MT DWT capacity – "SHIVALIK” (47,058 GT).

Sasken Technologies: The company informs that Chief Technology Officer Girish BVS has resigned.

Premier Explosives: The company has received an order worth Rs 7.83 crore from the Ministry of Defence for the procurement of Counter Measures.

Torrent Pharmaceuticals: The company has signed an agreement to subscribe to a 26% equity stake in Torrent Urja 27. This investment is for setting up a captive hybrid solar and wind power project in Gujarat.

Bank of Baroda: The bank has revised marginal cost of funds based lending rate cuts overnight by 10 basis points, to 7.85%, effective Sept. 12.

63 Moons Technologies : The company's arm 63sats cybertech raises Rs 180 crore via private placement.

Keystone Realtors: The company's Board of Directors has approved a plan to raise up to Rs 375 crore by issuing non-convertible debentures. The NCDs, with a face value of Rs 1 lakh each, will be issued on a private placement basis.

Hindustan Foods: The company to propose a merger of Avalon Cosmetics and Vanity Case India into the company.

Highway Infrastructure: The company has secured a Rs 69.77 crore contract from the National Highways Authority of India for the operation of the Muzaina Hetim toll plaza in Uttar Pradesh. The company has been awarded a Rs 18.96 crore contract from the National Highways Authority of India to collect user fees and maintain toilet blocks at a new toll plaza on the Delhi-Vadodara Greenfield Expressway.

Acme Solar Holdings: The company updates that no information has been received from the government regarding revocation of clean energy projects.

Rolex Rings: The company revises record date for stock split to Oct. 4.

Swelect Energy Systems: The company appoints Arulkumar Shanmugasundaram as CEO & MD.

Muthoot Finance: The company has infused additional equity into its subsidiary, Muthoot Homefin by subscribing to and being allotted 2.6 crore equity shares.

Tega Industries: The company has entered into a term sheet with Apollo Management Singapore and AIP MC Holdings to acquire a 100% stake in Molycop through a newly formed consortium for enterprise value of $1.48 billion. The company is also to consider raising funds via QIP, preferential allotment, or other means.

GOCL Corp: The company becomes eligible to participate in future Coal India and other PSU tenders.

Rainbow Childrens Medicare: The company has opened a new, 100-bed hospital in Rajahmundry, Andhra Pradesh, bringing its total bed capacity to 2,285. The project, costing approximately Rs 60 crore, was funded through internal accruals.

Shyam Metalics: The company has entered the crash barrier manufacturing segment, beginning production at its Giridih facility and planning a new Rs 50 crore plant in Sambalpur with a capacity of 60,000 MTPA to achieve an 8-10% market share.

Astral: The company has approved the acquisition of the remaining 20% equity shares of its subsidiary, Astral Coatings, for Rs 75 crore.

MedPlus Health: The company's arm Optival health has received a seven-day drug license suspension order from the Drugs Control Administration. The company estimates a potential revenue loss of approximately Rs 1.21 lakh.

Sterling and Wilson Renewable Energy: The company's arm Sterling and Wilson Solar has filed a litigation with the American Arbitration Association against Array Technologies seeking approximately $10 million.

Jyothy Labs : The company has received Bangladeshi Taka 3.01 crore from Kallol Enterprise as the sale consideration for its entire 75% equity stake in Jyothy Kallol Bangladesh.

Rail Vikas Nigam: The company has secured a Rs 169.48 crore domestic order from West Central Railway for the design, supply, erection, testing, and commissioning of a 220/132kV/2X'25 kV Scott connected Traction Sub.

SMS Pharmaceuticals: The company has approved the allotment of 50 lakh new equity shares following the conversion of an equal number of warrants. The conversion, which has increased the company's paid-up share capital from Rs 8.86 crore to Rs 9.36 crore.

Ugro Capital: The Board of Directors has approved the allotment of unlisted commercial papers worth Rs 25 crore.

Eicher Motors: The Company's arm VE Commercial has announced that it will pass on the full benefit of the recent GST reduction to its customers. The GST on Company's diesel, CNG, and LNG trucks and buses has been reduced from 28% to 18%.

Mazagon Dock Shipbuilders: The company updates that negotiations between the company and the Indian Navy have commenced regarding the Submarine Project-P75(I).

Vesuvius India: The company updates that Chief Financial Officer Rohit Baheti has tendered his resignation from the services.

Mahindra Holidays & Resorts: The company updates that Tanvi Choksi has tendered her resignation from the position of Chief Human Resources Officer of the Company.

Bajaj Finserv: Bajaj Allianz General Insurance reported a gross direct premium underwritten at Rs 2,063.2 crore for August. Its gross direct premium underwritten for the period up to August 2025, was at Rs 9,335.6 crore.

AYM Syntex: The company incorporates wholly-owned arm Innovative Yarns LLC in the US.

Jupiter Wagons: The company's arm Jupiter Tatravagonka Railwheel Factory has received a Letter of Acceptance from the Ministry of Railways, Railway Board, for an order worth approximately Rs 113 crore to supply 9,000 LHB axles.

Gujarat Gas: The Ministry of Corporate Affairs has approved a composite scheme of arrangement and amalgamation involving Gujarat State Petroleum Corp, Gujarat State Petronet, GSPC Energy, and Gujarat Gas.

Five-Star Business Financee: The shareholders of the company have approved the issuance of non-convertible debentures worth up to Rs 4,000 crore through private placement.

Indian Metals & Ferro Alloys: The company has cancelled its previous Power Purchase and Shareholder agreements with JSW Green Energy One and Seven and has entered into new agreements with JSW Renew Energy Twelve to supply 70 MW of hybrid renewable power.

Veranda Learning Solutions: The company has completed the acquisition of the remaining 24% equity stake in its subsidiary, Veranda XL Learning Solutions, for a combination of cash and a share swap, making VXL a wholly-owned subsidiary.

Adani Ports and Special Economic Zone: The company through its subsidiary Mandhata Build Estate, has completed the acquisition of a 100% stake in Dependencia Logistics for a cash consideration of Rs 37.77 crore.

Insolation Energy: The company's arm Insolation Green Energy incorporates three wholly-owned subsidiaries.

Lloyds Enterprises: The company approves allotment of 25.4 crore shares on rights basis to eligible shareholders worth Rs 992 crore.

Deepak Fertilizers and Petrochemicals Corp: The company signs a pact to acquire 26% stake in Murli Solar Energy for solar power captive consumption. The company also signs a pact to acquire 26% stake in Sunsure Solar Park Fifty One for wind power captive consumption.

IPO Offering

Shringar House of Mangalsutra: The company manufactures and designs Mangalsutras in India. The public issue was fully subscribed on day one. The bids were led by non-institutional investors (1.33 times), retail investors (1.42 times).

Dev Accelerator: The company provides flexible office spaces, including co-working environments. The company's business model focuses on providing flexible workspace solutions tailored to the evolving needs of modern businesses. The public issue was subscribed to 3.27 times on day one. The bids were led by qualified institutional investors (1.00 times), non-institutional investors (2.43 times), and retail investors (11.59 times).

Urban Company: Urban Company is a technology-driven, full-stack online marketplace offering home and beauty services. The public issue was subscribed to 2.04 times on day one. The bids were led by qualified institutional investors (0.87 times), non-institutional investors (2.59 times), retail investors (4.68 times)

Bulk & Block Deals

Healthcare Glob: Aceso Company Pte sold 79.4 lakh shares at an average price of Rs 695 apiece. Morgan Stanley Asia Singapore bought 8.8 lakh shares (0.63%) at Rs 695 apiece. Nippon India Mutual Fund bought 44 lakh shares (3.16%) at Rs 695 apiece. Plutus Wealth Management bought 7.2 lakh shares (0.52%) at Rs 695 apiece. Axis Mutual Fund bought 9.5 lakh shares at Rs 695 apiece.

Kotak Mahindra Bank: Sumitomo Mitsui Banking Corporation sold 3.2 crore shares (1.62%) at an average price of Rs 1,940.80 apiece.

Bajel Projects: HDFC Mutual Fund sold 18.9 lakh shares at an average price of Rs 195.01 apiece.

Prataap Snacks: Saravana Securities' D Sathyamoorthi sold 1.3 lakh shares at Rs 998.81 apiece.

Paisalo Digital: Equilibrated Venture Cflow bought 46 lakh shares at Rs 37.48 apiece.

Corporate Actions

Interim Dividend: Century Plyboards, Capri Global Capital, Gulshan Polyols, Datamatics Global Services, Edelweiss Financial Services, Pondy Oxides & Chemicals, and Ircon International

Bonus Issue: Patanjali Foods

Pledge Shares

Geojit Financial Services: BNP Paribas SA, a promoter, disposed of 43,251 shares.

Usha Martin: Peterhouse Investments, a promoter group entity, disposed of 2 lakh shares.

Paisalo Digital: Equilibrated Venture Cflow, a promoter group entity, acquired 46 lakh shares.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage – I : Jtekt India, Prime Focus

F&O Cues

Nifty Sep futures is up by 0.52% to 25,079 at a premium of 106 points.

Nifty Sep futures open interest up by 1.77%.

Nifty Options Sept. 16 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: RBL Bank

Currency/Bond

The rupee settled flat at 88.10 against the US dollar on Wednesday. The yield on the 10-year bond, went down one basis point to close at 6.48%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.