Good morning!

The GIFT Nifty traded 37 points or 0.15% up at 24,959 as of 8:05 a.m., indicating a higher open for the benchmark Nifty 50.

European index futures rose sharply while US contracts were subdued during Asian trading hours.

S&P 500 futures flat

Euo Stoxx 50 futures up 0.6%

Markets On Home Turf

India's benchmark equity indices closed in the red for a fifth straight session on Thursday.

The NSE Nifty 50 ended 0.66% lower at 24,890.85 and the BSE Sensex closed 0.68% down at 81,159.68.

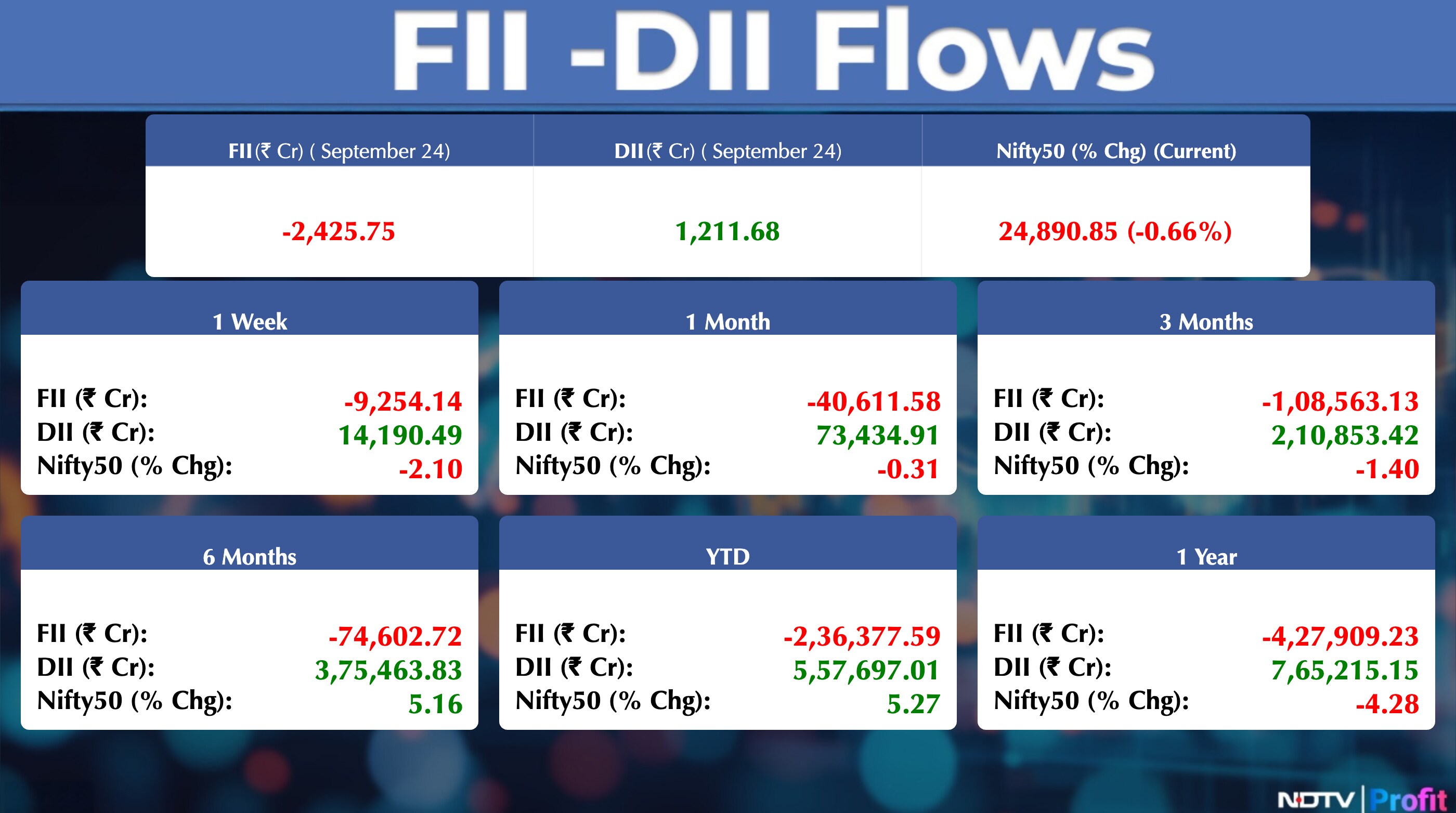

Foreign portfolio investors stayed net sellers of Indian shares for a fourth consecutive session on Thursday.

The overseas investors sold stocks worth approximately Rs 4,995.42 crore, according to provisional data from the National Stock Exchange. On the other hand, the domestic institutional investors remained buyers for the 23rd session and mopped equities worth Rs 5,103.01 crore.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Wall Street Recap

US stocks extended declines on Thursday as the latest round of economic data failed to restart a rally and investors turned their focus to an inflation report that may shape Federal Reserve policy.

The S&P 500 ended 0.5% down, extending its losing streak to three sessions in a row. The tech-heavy Nasdaq 100 closed 0.4% lower and Dow Jones Industrial Average shed 0.4%.

Asia Market Update

Asian stocks retreated at the open after strong US economic data and mixed signals from the Federal Reserve officials on rate cuts sparked worries about lofty valuations on Wall Street, Bloomberg reported. Shares in Japan, Australia and South Korea opened lower.

Nikkei down 0.4%

Kospi down 1.9%

S&P/ASX 200 down 0.1%

Commodities Check

Oil prices edged higher after fluctuating in the previous session as tensions between Russia and NATO intensified. Brent traded above $69 a barrel for a weekly advance of 4.4%, while West Texas Intermediate was at more than $65 a barrel.

Silver rose above $45 an ounce for the first time in 14 years and gold neared another record high of $3,774.2.

Key Events To Watch

The government and RBI officials will meet to decide on the fiscal

second-half borrowing plan.

The RBI will conduct Rs 1 lakh crore of 4-day variable rate repo

auction under liquidity adjustment facility.

The coal ministry will host a roadshow on coal gasification in New Delhi.

Stocks In News

Accenture: The company reported fourth-quarter FY25 revenue of $17.6 billion, beating estimates despite a 0.7% decline quarter-over-quarter. The company expects year-over-year revenue growth in constant currency of 1% to 5% for Q1 FY26, and for the full fiscal FY26 it forecasts growth in the range of 2% to 5% in CC terms.

Bharat Heavy Electricals, REC: The company's board of directors noted that the Department of Investment and Public Asset Management has not agreed to the proposal for forming a joint venture between BHEL and REC Power Development and Consultancy Limited.

Allcargo Logistics: The company plans to focus on digital execution with ROI-based investments to drive long-term value. As per merged financials, the company expects revenue and EBITDA to grow at a CAGR of 12% and 21% respectively by FY30.

NTPC: The company began commercial operations of its 167 MW Rajasthan project.

Exide Industries: The company invested Rs 80 crore in arm Exide Energy Solutions on a rights basis.

Electronics Mart: The company commenced commercial operations of a new multi-brand store in Andhra Pradesh.

JSW Energy: The company's arm filed an appeal before the Supreme Court challenging the Appellate Tribunal for Electricity order.

Rites: The company received a letter of award worth $18 million (Rs 153 crore) from South Africa's Talis Logistics to supply diesel electric locomotives.

ITCONS E-Solutions: The company was awarded a new order by HAL, Ministry of Defence, for providing manpower services. The aggregate size of the contract is Rs 3.8 crore.

Power Finance Corp: The company incorporated SPV Tumkur II RE Transmission.

IIFL Finance: The company's board approved enhancing the issue size for issuance of up to Rs 500 crore on a private placement basis.

Camlin Fine Sciences: The company mutually extended the timeline for the completion of the acquisition of Vinpai SA to November 30.

NTPC Green Energy: The company commissioned a 25 MW solar project in Gujarat. The project is part of a 37.5 MW solar project, with the remaining capacity yet to be commissioned.

Veranda Learning: The company transferred its entire vocational segment to SNVA EduTech for a 50% stake in the new entity. The new entity targets over Rs 250 crore revenue in FY26 and plans a separate public listing in the future.

Avenue Supermarts: The company opened a new store in Andhra Pradesh, taking the total store count to 430.

Carysil: The company clarified that there is no plan for a fresh QIP for the kitchen appliances assembly line at its Bhavnagar facility. The capacity expansion at the facility will be funded from QIP proceeds raised earlier.

Go Digit General Insurance: The company received a total tax demand of Rs 11.7 crore from the Mumbai tax authority.

Ashiana Housing: The company re-appointed Vishal Gupta as managing director for three years.

Insolation Energy: The company incorporated PJGN Green Infra as an SPV for setting up solar power plants.

Veranda Learning: The company's arm Brain4ce Education Solutions allotted nearly 6 lakh shares at an issue price of Rs 1,924.05 per share worth Rs 115 crore.

Capital India Finance: The company re-appointed Keshav Porwal as managing director for three years effective Nov. 27, and approved raising funds via debt securities.

Kalpataru Projects International: The company's arm Vindhyachal Expressway settled an arbitration award for a road project dispute.

Supreme Petrochem: The company commissioned two new lines of ABS compounding with an installed capacity of 20,000 TPA at its Amdoshi facility.

REC: The company incorporated arm Bellary Davanagere Power Transmission.

Monarch Networth Capital: The company received a certificate of registration from SEBI for ‘Monarch India Growth Fund' as a Category I foreign portfolio investor.

Waaree Energies: The company incorporated step-down arm Waaree Forever Energies Three for power projects.

IPO Offering

Anand Rathi Share & Stockbrokers: The company provides full-service broking facilities and is part of the Anand Rathi group, which carries out a diverse range of financial services. The public issue was subscribed 20.66 times on day 3, led by qualified institutional investors (43.80 times), non-institutional investors (28.60 times), retail investors (4.78 times) and employees (2.56 times).

Seshaasai Technologies: The company specializes in payment solutions, as well as communications and fulfilment services. The public issue was subscribed 68.13 times on day 3, led by qualified institutional investors (189.63 times), non-institutional investors (49.89 times), retail investors (9.17 times) and employees (9 times).

Jaro Institute of Technology Management & Research: The company provides online higher education services and has a pan-India presence of over 22 offices-cum-learning centers. The public issue was subscribed 22.06 times on day 3, led by qualified institutional investors (35.35 times), non-institutional investors (35.48 times) and retail investors (8.71 times).

Solarworld Energy Solutions: The company is a solar energy solutions provider specializing in engineering, procurement, and construction (EPC) services for solar power projects. The public issue was subscribed 65.01 times on day 3, led by qualified institutional investors (70.43 times), non-institutional investors (64.73 times) and retail investors (49.15 times).

Epack Prefab Tech: The company offers prefab business and pre-engineered steel buildings, along with products such as light gauge steel frames, metal doors and aluminium windows. The public issue was subscribed 0.59 times on day 2, led by qualified institutional investors (0.46 times), non-institutional investors (0.46 times) and retail investors (0.72 times).

BMW Venture: The company is engaged in trading and distribution of steel products, tractor engines and spare parts, as well as manufacturing PVC pipes and roll forming. The public issue was subscribed 0.22 times on day 2, led by qualified institutional investors (1.08 times), non-institutional investors (0.05 times) and retail investors (0.27 times).

Jain Resource Recycling: The company is engaged in the recycling and manufacturing of non-ferrous metal products, including lead and lead alloy ingots, copper ingots and aluminium alloys. The public issue was subscribed 1.24 times on day 2, led by qualified institutional investors (1.61 times), non-institutional investors (0.49 times) and retail investors (1.28 times).

Trualt Bioenergy: The company operates in the production of biofuels, with a primary focus on the ethanol sector. The public issue was subscribed 0.44 times on day 1, led by qualified institutional investors (0.86 times), non-institutional investors (0.24 times) and retail investors (0.30 times).

Jinkushal Industries: The company is an export trading firm supplying construction machinery globally, operating in over 30 countries. The public issue was subscribed 2.29 times on day 1, led by qualified institutional investors (0.02 times), non-institutional investors (3.01 times) and retail investors (3.28 times).

New Listings

GK Energy: The company's shares will debut on the stock exchange on Friday at an issue price of Rs 153. The company provides EPC services for solar-powered agricultural water pump systems. The public issue was subscribed to 89.62 times on day three. The bids were led by Qualified institutional investors (186.29 times), non-institutional investors (122.73 times), retail investors (20.79 times).

Saatvik Green Energy: The company's shares will debut on the stock exchange on Friday at an issue price of Rs 465. The company is the manufacturer of modules and offers engineering, procurement and construction services. The public issue was subscribed to 6.57 times on day 3. The bids were led by Qualified institutional investors (10.84 times), non-institutional investors (10.04 times), retail investors (2.66 times), Employee Reserved (5.29 times).

Bulk Deals

Polycab: All transactions occurred at an average price of Rs 7,458 per share. Members of the Jaisinghani family sold a total of 22.19 lakh shares (3.99%). Additionally, Anil Hariram Hariani sold 1.14 lakh shares (0.20%). On the buying side, JPMorgan Fund ICVC bought 14.84 lakh shares (2.67%) and Morgan Stanley Asia Singapore Pte bought 3.65 lakh shares (0.66%). HDFC Standard Life Insurance Co. acquired 1.30 lac shares (0.23%). Other buyers with less than 0.50% stake included Kotak Mahindra Life Insurance Co, Societe Generale, Viridian Asia Opportunities Master Fund, Ghisallo Master Fund LP, Tata Equity Plus Absolute Returns Fund, and ASK Absolute Return Fund.

Trading Tweaks

Ex-Dividend: RM Drip and Sprinklers

Bonus Issue: Nazara Technologies (1:1)

Stock Split: Nazara Technologies (From Rs 4 to Rs 2)

Rights issue: 3i Infotech (2:9)

Price Band changed from 10% to 5% - Emkay Global Financial Services

List of securities shortlisted in Long Term ASM Framework Stage: Bil Vyapar, Globe International, Karma Energy, Setco Automotive

List of securities shortlisted in Short Term ASM Framework Stage: Tata Investment Corp, HVAX Technologies, HP Telecom, Sharp Chucks, Giriraj Civil, Aaradhya Disposal.

F&O Cues

Nifty Sep futures is down by 0.60% to 24.967 at a premium of 77 points.

Nifty Sep futures open interest down by 12%.

Nifty Options Sept. 30 Expiry: Maximum call open interest at 26,000 and Maximum put open interest at 24,000.

Securities in ban period: RBL Bank, Sammaan Capital

Currency/Bond

The rupee closed two paise stronger at 88.67 against the US Dollar. The yield on the 10-year bond ended one point higher at 6.50%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.