Asian stocks retreated at the open after strong US economic data and mixed signals from the Federal Reserve officials on rate cuts sparked worries about lofty valuations on Wall Street.

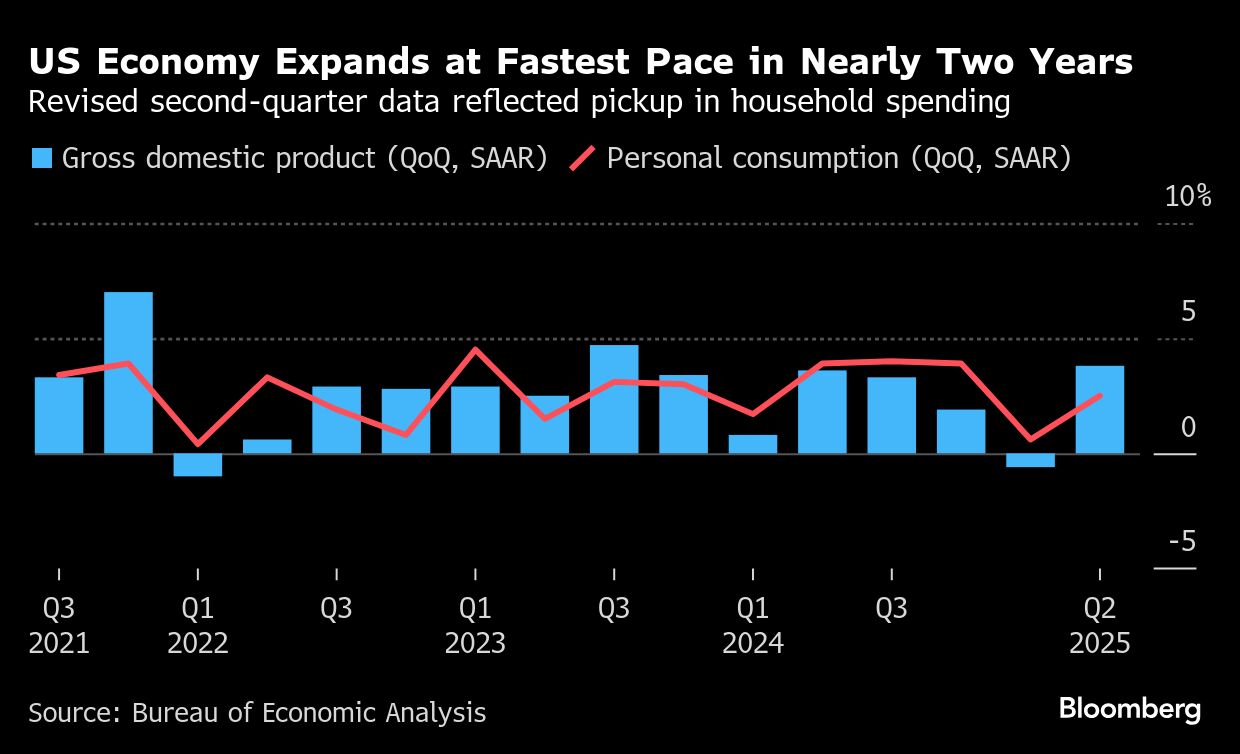

Shares in Japan, Australia and South Korea opened lower after the S&P 500 dropped for a third straight session, the longest slide in a month. The dollar held its gains. Short-end Treasury yields rose Thursday after data showed US gross domestic product grew at the fastest pace in nearly two years. The yen edged lower on Friday, hovering near the 150-a-dollar level.

S&P 500 futures pared earlier gains to trade little changed after President Donald Trump announced a 25% tariff on truck imports from Oct. 1. Trump also proposed 100% levy on branded, patented pharma products.

Following a $15 trillion rebound in global equities from this year's lows, traders now face a wall of uncertainty. The Fed's next policy move, a pivotal earnings season, and the threat of a US government shutdown are weighing on sentiment. Attention now turns to Friday's inflation report after the strong GDP data complicated the outlook for further easing after last week's Fed rate cut.

“We agree that the economy is strong and growing,” said Chris Zaccarelli at Northlight Asset Management, “but a lot of that good news is already priced in. Where we have our largest concern is with valuations.”

Following the rally, the S&P 500's 12-month forward price-to-earnings ratio recently touched a high of 22.9, a level that this century was exceeded in just two prior instances: the dot-com bust and the pandemic rally in the summer of 2020 when the Fed reduced rates to near zero.

Money markets slightly reduced bets on rate cuts after the GDP data, projecting about 40 basis points of Fed reductions before the year is over. Divisions within the Fed over the path of rates added to the uncertainty.

Fed Governor Stephen Miran said the US central bank risks damage to the economy by not moving rapidly to lower interest rates, dissenting against the decision to lower rates last week by a quarter percentage point, favoring a half-point cut.

“I don't think the economy is about to crater,” Miran said Thursday on Bloomberg Surveillance. But given the risks, “I would rather act proactively and lower rates as a result ahead of time, rather than wait for some giant catastrophe to occur,” he said.

Michelle Bowman, the Fed's top bank cop, said inflation is close enough to the central bank's target to justify more rate cuts because the job market is weakening.

Fed Bank of Chicago President Austan Goolsbee expressed continued concern about tariff-driven inflation and pushed back against any call for “front-loading” multiple rate cuts. His Kansas City counterpart Jeff Schmid signaled the central bank may not need to cut again soon.

Fed Bank of Dallas President Lorie Logan said the US central bank should abandon the federal funds rate as its benchmark in implementing monetary policy, and consider an overnight rate tied to the more robust market for loans collateralized by US Treasuries.

In Asia, South Korea is moving to open its foreign-exchange market on a 24-hour basis and ease restrictions on won trading between non-residents, the Finance Ministry said.

Investors will turn their focus to Friday's inflation data. The Fed's preferred gauge of underlying inflation likely grew at a slower pace last month, offering policymakers some breathing room to address jobs cooling.

A report on Friday is forecast to show the personal consumption expenditures price index excluding food and energy rose 0.2% in August, compared with 0.3% in July. On an annual basis, the so-called core measure is seen holding at a still-elevated 2.9%.

In other corners of the market, oil edged higher on Friday after fluctuating in the previous session as tensions between Russia and NATO intensified. Silver rose above $45 an ounce for the first time in 14 years and gold neared another record high. The crypto slump intensified ahead of a $22 billion options expiry.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:17 a.m. Tokyo time

Hang Seng futures fell 0.6%

Japan's Topix was little changed

Australia's S&P/ASX 200 fell 0.2%

Euro Stoxx 50 futures rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1662

The Japanese yen was little changed at 149.85 per dollar

The offshore yuan was little changed at 7.1443 per dollar

The Australian dollar was little changed at $0.6534

Cryptocurrencies

Bitcoin was little changed at $109,292.14

Ether rose 0.1% to $3,893.78

Bonds

The yield on 10-year Treasuries was little changed at 4.17%

Japan's 10-year yield was unchanged at 1.645%

Australia's 10-year yield advanced four basis points to 4.39%

Commodities

West Texas Intermediate crude rose 0.4% to $65.24 a barrel

Spot gold was little changed

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.