Good morning!

The GIFT Nifty is down 56 points or 0.22% at 25,063 as of 6:25 a.m., indicating a lower open for the benchmark Nifty 50.

US futures rose and European contracts were steady during Asian trading hours.

S&P 500 futures up 0.13%

Euro Stoxx 50 futures down 0.05%

Markets On The Home Turf

India's benchmark equity indices closed in the red for the fourth straight session on Wednesday.

The NSE Nifty 50 ended 0.45% lower at 25,056.90 and the BSE Sensex closed 0.47% down at 81,715.63.

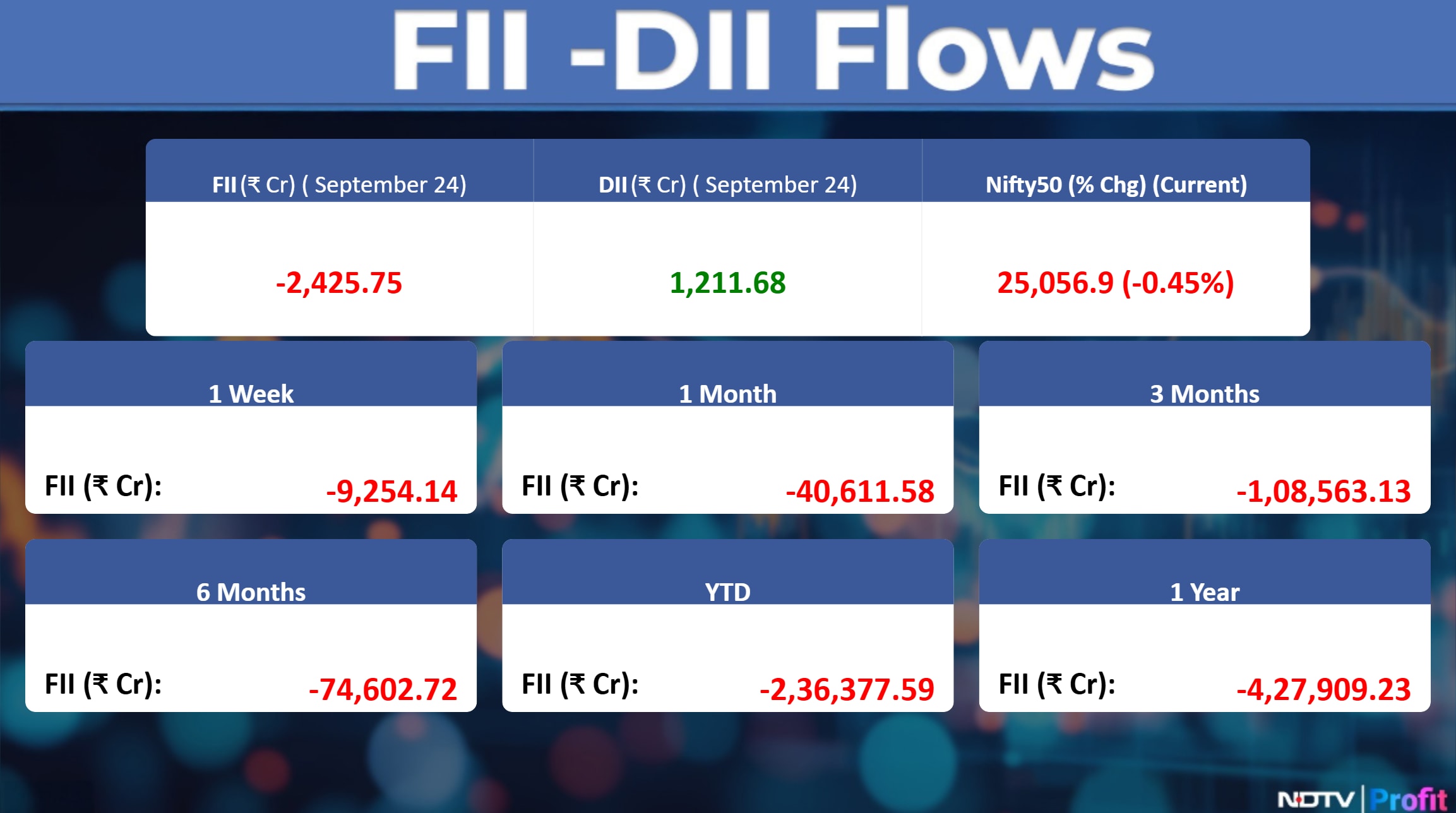

Foreign portfolio investors stayed net sellers of Indian shares for a third consecutive session on Wednesday after the benchmark Nifty 50 settled lower for the fourth day straight.

The FPIs sold stocks worth approximately Rs 2,425.75 crore. The domestic institutional investors extended their buying streak into the 22nd session and bought stakes worth Rs 1,211.68 crore.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Wall Street Recap

US equities declined for a second-straight session on Wednesday as early gains driven by renewed pledges of spending in artificial intelligence quickly faded, Bloomberg reported. The S&P 500 and Nasdaq 100 each dropped 0.3%, extending declines from the prior day. The Dow Jones Industrial Average sunk 0.4%.

Asia Market Update

Asian stocks traded in a tight range at the open after losses on Wall Street as signs of fatigue crept into the AI-fueled equity rally. Shares in Japan and Australia edged up while those in South Korea retreated.

Nikkei down 0.15%

Kospi flat

S&P/ASX 200 down 0.15%

Hang Seng up 1.4%

Commodities Check

Oil prices steadied after US President Donald Trump's increasingly hawkish rhetoric on Russia raised geopolitical risk. Brent traded above $69 a barrel after gaining 2.5% on Wednesday, while West Texas Intermediate was near $65.

Gold prices edged up to near $3,745 an ounce, just $50 shy of a record set on Tuesday. Traders weighed positive US economic data and divergent views by Federal Reserve officials this week that clouded the path for interest-rate cuts.

Copper prices soared after Freeport-McMoRan Inc. said force majeure was declared on contracted supplies from its giant Grasberg mine in Indonesia.

Stocks In News

Glenmark Pharmaceuticals: The company's arm, Glenmark Specialty, has entered into an exclusive licensing agreement with Hengrui Pharma for Trastuzumab Rezetecan (SHR-A1811), a HER2-targeting antibody drug conjugate.

Newgen Software Technologies: The company's arm has signed a five-year Master Service Agreement with Tata Consultancy Services N.V, valued at €4,222,683 (approximately Rs 44 crore).

Arisinfra Solutions: The company approved a proposal to incorporate five wholly-owned arms in Mumbai.

Max India: The company allotted 36 lakh fully convertible warrants at an issue price of Rs 222 per share, aggregating to Rs 80 crore.

P N Gadgil: The company opens a new store in Kolhapur. The total number of stores now stands at 60.

Kingfa Science and Technology (India): The company approves the allotment of 14 lakh shares at an issue price of Rs 3,470 per share, aggregating to nearly Rs 500 crore.

TGV Sraac: The company raises its total solar power generating capacity to 50.4 MW by adding 5 MW of solar power capacity.

Eimco Elecon (India): The company updates that promoter Tamrock Great Britain will exercise an oversubscription option of up to 7 lakh shares in addition to the base offer size.

Cipla: The company will report its second-quarter results on October 30.

Camlin Fine Sciences: The board will meet on September 29 to consider the issuance of equity shares via preferential allotment.

Lupin: The company gets tentative approval from the US FDA for Bictegravir, Emtricitabine & Tenofovir Alafenamide Tablets. This drug treats human immunodeficiency virus infection in adults.

Ipca Laboratories: The company enters into a tech transfer pact with Biosimilar Sciences USA. The tech transfer is for a monoclonal antibody biosimilar which supercharges Puerto Rico's biotech hub.

GPT Healthcare: The company updates that its executive chairman, Dwarika Prasad Tantia, has passed away.

Sterlite Technologies: The company has unveiled an advanced Unitube Single Jacket Indoor Optical Fibre Cable at Connected Britain 2025 that uses Multi-Core Fiber (MCF) technology.

SMC Global Securities: The company approves the issuance of bonus shares in a ratio of 1:1.

Hubtown: The company approves the conversion of 2.5 lakh compulsorily and mandatorily convertible debentures into an equal number of shares.

Quality Power Tools: The company's arm is in a pact with Hyosung T&D India for gas-insulated switchgear instrument transformers.

Allcargo Gati: The company updates that the NCLT reserves the matter for orders in connection with the scheme of arrangement among Allcargo Logistics and the arms of the demerged company.

Dalmia Bharat: The company's arm gets an order from the adjudicating authority under the Prevention of Money Laundering Act. The authority confirms a provisional attachment order for Rs 793.34 crore dated March 31, 2025.

Apollo Hospitals Enterprise: The company updates that the Competition Commission of India (CCI) has approved the proposed composite scheme of arrangement involving Apollo Hospitals Enterprise Limited, Apollo Healthco Limited, and Keimed Private Limited, with the transfer of assets to Apollo Healthtech.

Ethos: The company has inaugurated its 83rd boutique in India, a new exclusive watch boutique located in Nexus Mall, Hyderabad.

REC: The company's arm has entered into a Share Purchase Agreement to transfer its entire shareholding of Davanagere Power Transmission to Power Grid.

Panacea Biotec: The company's arm has launched two new product lines in the domestic market: a 100% toxin-free baby skin care range under the brand 'NikoMom' and an Infant Milk Substitute (IMS) product under the brand 'Staart Prime'.

Eveready Industries India: The company informs that Mr. Suvamoy Saha shall complete his term as the managing director of the company on September 30, 2025.

Algoquant Fintech: The company will invest Rs.1.3 crore in its arm, Algoquant Global Securities, via a rights issue.

Birla Corporation: The company's arm has been declared as the preferred bidder by the Telangana government for the auction of the Kanpa-Junapani limestone block.

Tata Steel: The company acquires 457.7 crore shares of Tata Steel Holdings Pte, aggregating to Rs.4,054.7 crore.

TBO Tek: The company enters into a pact with Amadeus South Asia for an AI-driven travel platform.

NTPC: The company's arm, THDC India, commissions Unit II of Khurja STPP. The total installed and commercial capacity of the NTPC group increases to 83,696 MW.

Crisil: The company approves the acquisition of its arm, McKinsey PriceMetrix, for $38 million.

Wipro: The company's arm, Grove Holdings 2, transfers its entire stake in its arm, Capco Consulting Middle East FZE, to its arm, Wipro IT Services UK Societas, for the simplification of the overall group structure. Grove Holdings 2 and Capco Consulting are step-down arms of the company, and Wipro IT Services UK Societas is a wholly-owned arm of the company.

Gujarat Pipavav Port: The company gets a contract from ONGC for hiring port and storage facilities at Pipavav Port for five years, effective October 1.

Veedol Corporation: The company has launched a new range of fully synthetic engine oils under the brand 'Veedol', named 'SwiftPower' and 'SynthGlide', for the domestic market, with future plans for export.

Torrent Pharmaceuticals: The company has issued unsecured Commercial Papers (CPs) worth Rs 200 crore with a tenure of 90 days at an interest rate of 5.93% per annum.

Polycab India: The promoter will sell 1.2 million shares at an offer size of Rs 880 crore. Sellers are Inder T. Jaisinghani, Ajay T. Jaisinghani, Ramesh T. Jaisinghani, Girdhari Thakurdas Jaisinghani, Bharat Jaisinghani, Nikhil Ramesh Jaisinghani, and Anil Hariram Hariani. The floor price is Rs 7,300, a 3% discount to CMP.

Power Grid Corporation of India: The company acquires Davanagere Power Transmission for Rs 6.5 crore under the TBCB route.

Amic Forging: The company approves raising funds worth up to Rs 50 crore via a Qualified Institutional Placement (QIP).

Spice Lounge: The company approves an investment of up to $5 million in its arm, Teksoft Systems.

Fineotex Chemical: The board will meet on September 27 to consider an interim dividend, stock split, and bonus issue.

IFB Industries: The company approves a proposal for its Singapore arm to set up a facility in Europe.

Motilal Oswal Financial Services: The company's arm acquires 10.9 lakh preference shares and 16 lakh equity shares of Kusumgar for nearly Rs 100 crore.

Waaree Energies: The company invests Rs 300 crore in its arm, Waaree Energy Storage Solutions, via a rights issue.

Insolation Energy: The company incorporates its arm, GNPR Green Infra, as a Special Purpose Vehicle (SPV) to set up solar power plants.

The New India Assurance Company: The company's income tax department issues a refund of Rs 249.8 crore.

Aarti Drugs: The company distributed nearly Rs 278 crore in the form of a dividend and a buyback of shares over the last seven years. It elects to distribute nearly 15-30% of consolidated net profits.

Bank of Baroda: The company updates that the International Financial Services Centres Authority (IFSCA) allows the Bank of Baroda Gift City Branch to conduct bullion trading operations.

Eveready Industries India: The company informs that Suvamoy Saha will complete his term as managing director on September 30.

Max Financial Services: The company's arm allots 80,000 debentures worth Rs 800.12 crore on a private placement basis.

Newgen Software Technologies: The company gets a purchase order of Rs 21.24 crore from Kshema General Insurance.

Le Travenues Technology: The company re-appointed Aloke Bajpai as chairman, managing director, and group chief executive officer.

Mastek: Arvind Jonnalagadda resigns as global chief human resource officer. The company appoints Vimal Dangri as the new chief human resources officer.

IPO Offerings

Trualt Bioenergy: The company engaged in the production of biofuels, with a primary focus on the ethanol sector. The shares will open for bidding on Thursday. The price band is set Rs 472 to Rs 496 per share. The Rs 839 crore IPO has fresh issue of Rs 750 crore and offer for sale of Rs 89.28 crore.

Jinkushal Industries: The company export trading company supplying construction machinery globally. Operating in over thirty countries. The company will offer shares for bidding on Thursday. The price band is set Rs 115 to Rs 121 per share. The Rs 116 crore IPO has fresh issue of Rs 104.54 crore and offer for sale of Rs 11.61 crore.

Ganesh Consumer Products: The public issue was subscribed 2.67 times on day 3. The bids were led by Qualified institutional investors (4.18 times), non-institutional investors (4.34 times), and retail investors (1.15 times).

Atlanta Electricals: The public issue was subscribed 70.63 times on day 3. The bids were led by Qualified institutional investors (194.92 times), non-institutional investors (54.21 times), and retail investors (10.42 times).

Anand Rathi Share & Stock Brokers: The public issue was subscribed 1.11 times on day 2. The bids were led by Qualified institutional investors (0.02 times), non-institutional investors (1.88 times), and retail investors (1.37 times).

Seshaasai Technologies: The public issue was subscribed 3.09 times on day 2. The bids were led by Qualified institutional investors (1.13 times), non-institutional investors (5.99 times), and retail investors (2.92 times).

Jaro Institute of Technology Management & Research: The public issue was subscribed 1.95 times on day 2. The bids were led by Qualified institutional investors (0.68 times), non-institutional investors (3.49 times), and retail investors (2.02 times).

Solarworld Energy Solutions: The public issue was subscribed 4 times on day 1. The bids were led by Qualified institutional investors (0.02 times), non-institutional investors (5.53 times), and retail investors (13.64 times).

Epack Prefab Tech: The public issue was subscribed 0.30 times on day 1. The bids were led by Qualified institutional investors (0.46 times), non-institutional investors (0.12 times), and retail investors (0.29 times).

BMW Ventures: The public issue was subscribed 0.11 times on day 1. The bids were led by Qualified institutional investors (1.08 times), non-institutional investors (0.2 times), and retail investors (0.13 times).

Jain Resource Recycling: The public issue was subscribed 0.73 times on day 1. The bids were led by Qualified institutional investors (1.11 times), non-institutional investors (0.12 times), and retail investors (0.51 times).

Listing Day

iValue Infosolutions: The company will debut on the stock exchanges on Thursday with an issue price of Rs 299. The public issue was subscribed to 1.82 times on day 3. The bids were led by qualified institutional investors (3.18 times), non-institutional investors (1.26 times), retail investors (1.28 times).

Bulk And Block Deals

Energy Infrastructure Trust: Rapid Holdings 2 sold 1.21 crore share and Neo Infra Income Opportunities bought 60.75 Lk Shares, Trust Investment Advisors bought 60.5 lakh shares at Rs. 82 each.

Akzo Nobel India: Imperial Chemical Industries sells 22.7 lakh shares (5%) and Goldman Sachs Funds bought 4.49 lakh shares (0.99%), Nippon India Mutual Fund bought 8.1 lakh shares (1.79%) and WF Asian Smaller bought 5.28 lakh shares (1.16%) at Rs. 3,358.80 a piece.

Paradeep Phosphates: Zuari Maroc Phosphates bought 97.5 lakh shares at Rs. 182.06 a piece.

Board Meeting

Afcons Infrastructure

Gayatri Projects

RCF

Pledge Shares Details

Asahi India Glass: LANS Business LLP, promotor group acquired 50 k shares

Bengal & Assam Company: The promotor group Bharat Hari Singhania, Raghupati Singhania, Anshuman Singhania Karta disposed 19.45 lakh shares and promotor group YPL Enterprises acquired 19.45 lakh shares.

Usha Martin: Promotor group Peterhouse Investments disposed 2.5 lakh shares.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage I: Gujarat Mineral Development Corporation.

List of securities to be excluded from ASM Framework: Emkay Global Financial, HBL Engineering, Knowledge Marine & Engineering Works, MSP Steel & Power.

Shares to exit anchor lock-in: EllenBarrie Industrial Gases (2%), Kalpataru (4%), and Globe Civil Projects (4%).

F&O Cues

Nifty Sept futures is down by 0.57% to 25,113 at a premium of 57 points.

Nifty Sept futures open interest down by 1.03%.

Nifty Options Sept. 30 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in the ban period: RBL Bank Ltd., Sammaan Capital Ltd., HFCL Ltd.

Currency Update

The rupee closed 30 paise lower at 89.06 against the US Dollar, a new low. The yield on the 10-year government bond ended two basis points higher at 6.49%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.