Good morning!

The GIFT Nifty was down 0.1% at 25,193 as of 7:00 a.m., indicating a lower open for the benchmark Nifty 50.

US and European equity futures were trading mixed during Asian hours.

S&P 500 futures up 0.1%

Euro Stoxx 50 futures down 0.5%

Markets On Home Turf

India's benchmark equity indices closed in the red for a third straight session on Tuesday.

The NSE Nifty 50 ended 0.13% lower at 25,169.50 and the BSE Sensex closed 0.07% down at 82,102.10.

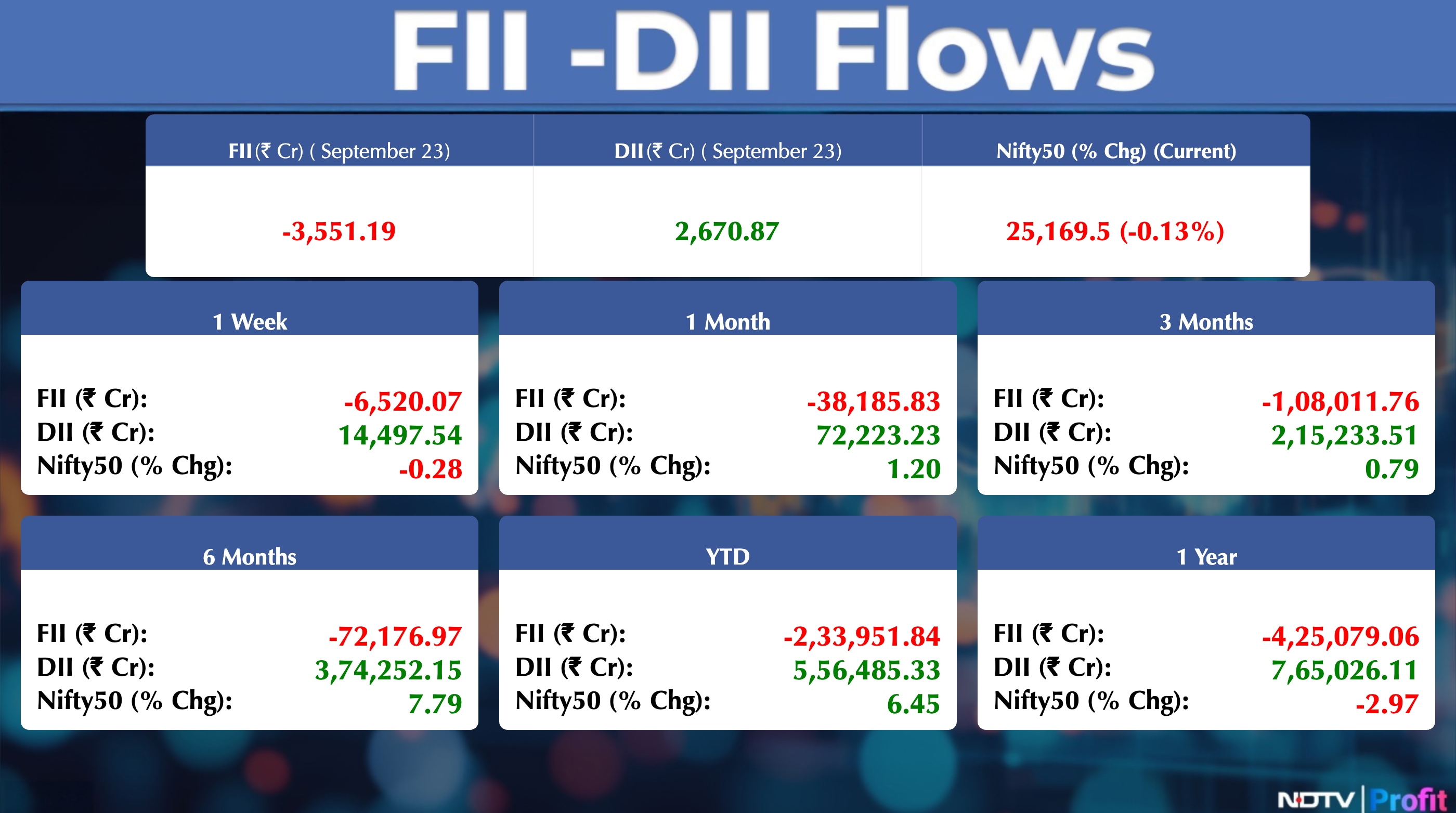

Foreign portfolio investors stayed net sellers of Indian shares for the second straight session on Tuesday amid the benchmark Nifty ending in the red for the third consecutive session. The FPIs sold stocks worth approximately Rs 3,551.19 crore, according to provisional data from the National Stock Exchange.

The Domestic institutional investors stayed net buyers for the 21st session and bought stakes worth Rs 2,670.87 crore. In the last week, FPIs sold a stake worth Rs 1,192.80 crore.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Asia Market Update

Asian stocks fell after Wall Street retreated as mixed signals from US Federal Reserve policymakers clouded the path for interest-rate cuts. The MSCI Asia Pacific Index fell 0.2% with declines in Japan, which returned after a holiday, Australia and South Korea, Bloomberg reported.

Nikkei down 0.4%

Kospi down 0.4%

S&P/ASX 200 down 0.7%

Hang Seng down 0.3%

Wall Street Recap

A record-breaking rally in US equities came to a halt on Tuesday as interest-rate sensitive technology stocks extended an early decline after Federal Reserve Chair Jerome Powell gave no signs he would support a cut at the central bank's October meeting.

The S&P 500 closed 0.6% lower and tech-heavy Nasdaq 100 dipped 0.7%, with a majority of the Magnificent Seven seeing red.

Commodities Check

Oil extended the biggest gain in a week, as US President Donald Trump ramped up his rhetoric against Russia and traders watched for supply disruptions from the OPEC+ member. Brent rose toward $68 a barrel, while West Texas Intermediate was near $64.

Gold prices traded just below a record after a three-day advance, as investors assessed a raft of commentary from Federal Reserve policymakers. The bullion was steady near $3,761 an ounce.

Stocks In News

Muthoot Microfin: The company has successfully allotted 5,000 non-convertible debentures with a total value of Rs 50 crore.

Infosys: The company has extended its strategic collaboration with Switzerland's Sunrise to accelerate IT transformation and power AI-driven initiatives.

Minda Corporation: The company will start commercial production of EV components from the beginning of FY26.

HCL Technologies: The company has renewed and expanded its digital transformation pact with a Swedish auto manufacturer for AI services.

Havells India: The company has announced that Lloyd Kolors refrigerators are now available on Flipkart and other distribution channels, starting at Rs 18,990.

Latent View Analytics: The company has said it does not expect any major impact of the H-1B visa fee on its operations.

VIP Industries: The company has appointed Atul Jain as Managing Director, while Neetu Kashiramka has resigned as Managing Director effective October 31.

Dilip Buildcon: The company has been declared as L-1 bidder for a Rs 1,115.37 crore project by Kerala Industrial Corridor Development Corporation.

Hikal: The company has said that despite a challenging start to the year in Q1, it remains confident of delivering on FY26 guidance and expects recovery in Q3 and Q4.

Chalet Hotels: The company has approved allotment of commercial papers worth Rs 100 crore on a private placement basis and redeemed 6,000 preference shares aggregating to Rs 100 crore.

Rama Steel Tubes: The company has allotted 7.7 crore shares at an issue price of Rs 11.25 per share on a preferential basis.

Sonata Software: The company has achieved the 2025–2026 Microsoft AI Business Solutions Inner Circle Award.

Karur Vysya Bank: The company has filed a writ petition before the Madurai bench of Madras High Court challenging initiation of reassessment proceedings.

ICICI Bank: The company has received a show-cause notice for a tax demand of Rs 15.6 crore from the West Bengal tax body.

Tech Mahindra: The company's arm, Tech Mahindra London, has executed a share transfer pact to divest its entire 26.42% stake in Surance.

Meta Infotech: The company has received fresh and renewal purchase orders aggregating to Rs 127.74 crore.

Bhansali Engineering Polymers: The company has reduced its expansion plan from 200,000 TPA to 100,000 TPA, funded through internal accruals, to focus on high-margin specialty grades.

Shankara Building Products: The company has updated post-demerger cost of acquisition for shares of Shankara Building Products and Shankara Buildpro, advising an apportionment of 34.19% and 65.81%.

Eimco Elecon: The company has said promoter Tamrock Great Britain Holdings will sell up to 14.23 lakh shares worth a 24.68% stake via OFS on September 24–25 at a floor price of Rs 1,400 per share.

Electronics Mart India: The company has commenced commercial operations of a new multi-brand store in Telangana.

Neuland Laboratories: The company has said that Saharsh Rao Davuluri will be redesignated as CEO and MD from Vice Chairman and MD.

Bajaj Electricals: The company's board has approved a proposal to acquire the ‘Morphy Richards' brand and related intellectual property rights for Rs 146 crore in India and neighboring territories from Glen Electric Limited, subject to approvals.

Puravankara: The company has said that Deepak Rastogi has resigned as Group CFO, and Niraj Kumar Gautam has been elevated from Deputy CFO to CFO effective tomorrow.

Swiggy: The company's board has approved transferring quick commerce operations under the brand ‘Instamart'. The company will also divest 10 equity shares and 1.64 lakh convertible preference shares in Rapido for Rs 1,968 crore and sell 35,958 compulsorily convertible preference shares in Rapido to Setu AIF Trust for Rs 431 crore.

Schloss Bangalore: The company has updated that its name has been changed to Leela Palaces Hotels & Resorts effective today.

Torrent Power: The company will acquire a 49% stake in Newzone India and a 100% stake in Newzone Power Projects for Rs 211 crore.

Lemon Tree Hotels: The company has launched a 44-room property in Andhra Pradesh.

Torrent Pharmaceuticals: The company has said that South Africa's Competition Commission has approved its acquisition of a controlling stake in JB Chemicals & Pharmaceuticals from KKR.

Aarti Pharmalabs: The company has said it is expected to commission Phase 1 at its Atali Greenfield site with 450+ KL reactor capacity in 2025.

360 One Wealth Asset Management: The company has said NCLT's Mumbai bench has approved the amalgamation of its arm Mavm Angels Network with and into its arm 360 One Distribution Services.

SEPC: The company has said the tenure of NK Suryanarayanan as MD & CEO has ended, but he continues to hold office as a non-executive director.

Poly Medicure: The company's arm has signed a share purchase agreement with Wellinq Holdings B.V., Amsterdam, to acquire shares of Pendracare Holdings B.V. and Wellinq Medical B.V.

Gandhar Oil Refinery: The company has said it will terminate its joint venture pact with partner Espe Oils FZC.

Karnataka Bank: The company has appointed Raghavendra Srinivas Bhat as MD & CEO.

Arihant Capital: The company has approved allotment of 5 lakh shares at an issue price of Rs 87 per share, raising Rs 4.35 crore.

Jagran Prakashan: The company has said it faces a legal dispute after Director Shailendra Mohan Gupta filed a petition against the company and its promoter group.

Akzo Nobel India: Imperial Chemical Industries will sell 23 lakh shares, or a 5% stake, in Akzo Nobel India via a bulk deal at Rs 3,261.80 per share, a 4% discount to CMP, for a total deal size of Rs 742.7 crore.

IPO Offering

IDES EPC Services: The company provides EPC services for solar-powered agricultural water pump systems. The public issue was subscribed 89.62 times on Day 3, led by Qualified Institutional Investors (186.29 times), Non-Institutional Investors (122.73 times), and Retail Investors (20.79 times).

Saatvik Green Energy: The company is a manufacturer of modules and offers engineering, procurement, and construction services. The public issue was subscribed 6.57 times on Day 3, led by Qualified Institutional Investors (10.84 times), Non-Institutional Investors (10.04 times), Retail Investors (2.66 times), and Employee Reserved (5.29 times).

Ganesh Consumer Products: The company is an FMCG player and a leading brand of wheat-based derivatives such as maida, sooji, and dalia in East India. The public issue was subscribed 0.41 times on Day 2, led by Qualified Institutional Investors (0.51 times), Non-Institutional Investors (0.23 times), Retail Investors (0.43 times), and Employee Reserved (1.06 times).

Atlanta Electricals: The company is a leading manufacturer of power, auto, and inverter duty transformers in India. The public issue was subscribed 3.07 times on Day 2, led by Qualified Institutional Investors (1.48 times), Non-Institutional Investors (5.55 times), Retail Investors (2.94 times), and Employee Reserved (1.43 times).

Anand Rathi Share & Stock Brokers: The company provides full-service broking facilities and is part of the Anand Rathi Group, which offers a wide range of financial services. The public issue was subscribed 0.41 times on Day 1, led by Qualified Institutional Investors (0.01 times), Non-Institutional Investors (0.53 times), Retail Investors (0.53 times), and Employee Reserved (1.42 times).

Seshaasai Technologies: The company specializes in payment solutions as well as communications and fulfilment services. The public issue was subscribed 0.99 times on Day 1, led by Qualified Institutional Investors (0.01 times), Non-Institutional Investors (1.86 times), Retail Investors (1.15 times), and Employee Reserved (2.25 times).

Jaro Institute of Technology Management & Research: The company provides online higher education services and has a pan-India presence with over 22 offices-cum-learning centers. The public issue was subscribed 0.87 times on Day 1, led by Qualified Institutional Investors (0.47 times), Non-Institutional Investors (1.82 times), and Retail Investors (0.70 times).

Solarworld Energy Solutions: The company is a solar energy solutions provider specialising in EPC services for solar power projects. The public issue was subscribed 1.23 times on Day 1, led by Non-Institutional Investors (1.45 times) and Retail Investors (4.57 times), while QIB participation stood at 0.00 times.

Listing Day

VMS TMT: The company is engaged in the manufacturing of Thermo Mechanically Treated Bars (TMT Bars) and deals in scrap and binding wires, sold within Gujarat and other states. The company will debut on exchange on Wednesday at a issue price of Rs. 99 per share. The public issue was subscribed to 102.26 times on day three. The bids were led by Qualified institutional investors (120.8 times), non-institutional investors (227.09 times), retail investors (47.88 times).

IPO Incoming

Epack Prefab Tech: The company offers pre-fabricated business solutions and pre-engineered steel buildings, along with products such as light gauge steel frames, metal doors, and aluminium windows. The company will open its Rs 504 crore IPO for bidding on Wednesday, with a price band of Rs 194–204 per share. The issue comprises a fresh issue of Rs 300 crore and an offer for sale of Rs 204 crore.

BMW Ventures: The company is primarily engaged in the trading and distribution of steel products, tractor engines, and spare parts, as well as the manufacturing of PVC pipes and roll forming. The company will launch its Rs 231.66 crore IPO for bidding on Wednesday, with a price band of Rs 94–99 per share. The issue is entirely a fresh issue.

Jain Resource Recycling: The company is engaged in recycling and manufacturing non-ferrous metal products, with a portfolio that includes lead and lead alloy ingots, copper ingots, and aluminium and aluminium alloys. The company will open its Rs 1,250 crore IPO for bidding on Wednesday, with a price band of Rs 220–232 per share. The issue consists of a fresh issue of Rs 500 crore and an OFS of Rs 750 crore.

Bulk & Block Deals

Energy Infrastructure Trust: Rapid Holdings 2 sold 3.6 crore shares at Rs 82 apiece. On the buy side, Neo Infra Income Opportunities picked up 60.75 lakh shares, B Arunkumar Capital & Credit Services bought 14 lakh shares, Pico Capital acquired 24.75 lakh shares, and Neo Wealth Partners purchased 2.62 crore shares.

NDR InvIT Trust: Infra India Opportunities sold 2.64 crore shares at Rs. 115 apiece. Buyers included Aryaman Jhunjhunwala (58 lakh shares), Damani Radhakishan (87 lakh shares), Nishtha Jhunjhunwala (28.75 lakh shares), Star Union Dai-ichi Life Insurance (26 lakh shares), Tara Emerging Asia (17.5 lakh shares), Tara Institutional (8.75 lakh shares), and ValueQuest Investment (38.5 lakh shares).

Agi Infra: Chungath Karunakaran Padma Kumar bought 6.81 lakh shares at Rs 1,170 apiece, while Setu Securities sold 1.4 lakh shares at Rs 1,183.11 apiece.

Sammaan Capital: Plutus Wealth sold 1.16 crore shares at Rs 137.26 apiece.

Wheels India: HDFC Mutual Fund bought 1.27 lakh shares at Rs 809 apiece.

Corporate Actions

Interim Dividend: SMS Lifesciences India

Demerger: Shankara Building Products is separating the trading, Retail and Distribution business into the new entity, Shankara Buildpro. Shankara Building Products Shareholders will receive shares in new entity in a 1:1 ratio.

Board Meeting: Piccadily Agro Industries

Shares to Exit Anchor Lock-in: Mangal Electricals (4%)

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Adani Power, Adani Total Gas, Emkay Global Financial Services

Price Band:

Shankara Building Products: The company has revised its price band change from 20% to 5%.

Emkay Global Financial: The company has revised its price band change from 20% to 10%.

Pledge Share Details

Paisalo Digital: Equilibrated Venture, the promoter group, acquired 39.5 lakh shares.

F&O Cues

Nifty Sep futures is down by 0.10% to 25,252 at a premium of 83 points.

Nifty Sep futures open interest down by 2.70%.

Nifty Options 30th Sep Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank, Sammaan Capital, HFCL

Currency/Bond

The rupee closed 44 paise lower at 88.76 against the US Dollar, a new low. The yield on the 10-year bond ended two places lower at 6.47%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.