Good morning!

The GIFT Nifty was down 1.41% at 24,643.50 as of 08:38 a.m., signaling a gap down start to Indian markets today.

Stocks declined sharply and investors sought refuge in safe-haven assets like US Treasuries following Israel's airstrikes on Iran. Equity-index futures for the S&P 500 dropped 1.5%, while Asian markets also retreated in response to the military action.

Israeli Defense Minister Israel Katz announced that Israel had declared a state of emergency after conducting "preemptive strikes." The attack has intensified concerns over the fragile diplomatic efforts aimed at resolving tensions surrounding Iran's nuclear program.

Meanwhile, the deadly crash of an Air India Boeing 787 Dreamliner occurred shortly after takeoff from Ahmedabad, India, resulting in over 240 fatalities.

Watch NDTV Profit Live

Markets On The Home Turf

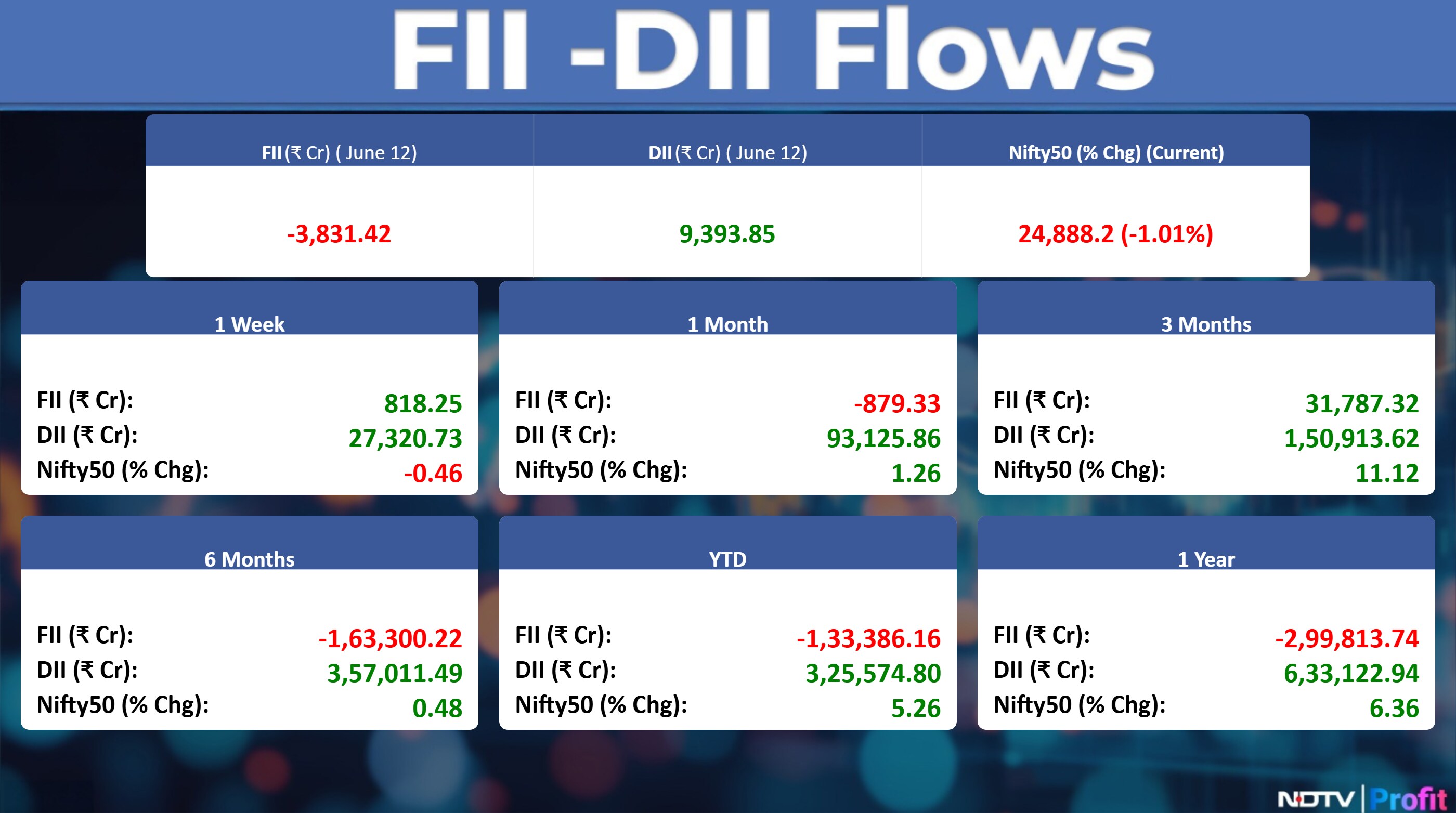

India's benchmark equity indices slumped sharply on Thursday in reversal of a week-long gaining momentum. The NSE Nifty 50 ended 253.2 points or 1.01% down at 24,888.2, and the BSE Sensex closed 823.16 points or 1% lower at 81,691.98.

Foreign portfolio investors remained net sellers of Indian equities on Thursday, offloading stocks worth Rs 3,831.4 crore, according to the provisional data from the NSE. Domestic institutional investors continued to stay net buyers for the 20th straight session as they obtained equities worth Rs 9,393.9 crore.

Ahmedabad Plane Crash

Air India's Flight AI-171, operating from Ahmedabad to London Gatwick on 12 June, crashed shortly after takeoff. The aircraft was a 12-year-old Boeing 787-8 Dreamliner carrying 230 passengers and 12 crew.

Air India has confirmed 241 fatalities out of the 242 people on board. One survivor is undergoing treatment in hospital.

Asian Markets Update

S&P 500 futures fell 1.61%.

Hang Seng index futures were down 1.01%.

Futures for the Nikkei 225 fell 0.54%.

Japan's Topix index dipped 1.24%.

Australia's S&P/ASX 200 index fell 0.42%.

Euro Stoxx 50 futures were down 1.73%.

Commodity Check

West Texas Intermediate crude rose 7.73% to trade at $73.30 per barrel.

Spot gold advanced by 1.25% to $3,429.20 per ounce.

London Metal Exchange

Copper rose 0.56%, reversing losses.

Nickel was down 0.23%, extending losing streak.

Aluminium was up 0.08%, extending gains.

Zinc was down 0.41%, extending losses.

Lead advanced 0.45%, extending gains.

US Market Updates

Stocks edged higher on Thursday amid geopolitical concerns briefly weighing on markets as Israel-Iran tension skyrocket. The S&P 500 rose 0.4%, the Nasdaq 100 gained 0.2%, and the Dow Jones Industrial Average increased 0.2%.

US inflation data for May showed muted price increases, with the Producer Price Index rising just 0.1% from the previous month. Trump reiterated his dissatisfaction with the Fed's pace on rate cuts but said he does not plan to fire Fed Chair Jerome Powell, despite suggesting he would soon name a new nominee to lead the central bank.

Key Data To Watch

The government will release India's external trade data for May. Bloomberg estimate projects a trade deficit of $20.5 billion.

Stocks To Watch

Reliance Industries, Asian Paints: RIL sold 3.64% equity in Asian Paints via arm Siddhant Commercials for Rs 7,703 crore. SBI Mutual Fund was the sole buyer in the transaction.

Jubilant Pharmova: The company approved sale and transfer of company's active pharmaceutical ingredients business to arm. The active pharmaceutical ingredients business achieved turnover of Rs 609 crore representing 8.35% of the consolidated turnover of the Company for the FY25.

Sasken Tech: The company announced partnership with Microsoft through the Microsoft Devices Ecosystem Platform. This collaboration positioned Sasken at the forefront of intelligent device innovation.

Canara Bank: The company approved capital raising plan for FY26 amounting up to Rs 9,500 crore via debt instruments.

HCLTech: The company collaborated with Volvo Cars to drive engineering transformation.

NBCC: The company received work orders in four states aggregating Rs 518.5 crore.

Torrent Power: Arm Torrent Green Energy received letters of award of Rs 2,650 crore for 300 MW wind projects.

DCM Shriram: The company approved an agreement to acquire Hindusthan Speciality Chemicals for Rs 375 crore.

ICRA: The company grants approval to acquire Fintellix India for $26 million via secondary purchase.

CSB Bank: The company received RBI approval for reappointment of Pralay Mondal as MD and CEO effective Sept. 15.

Dixon Tech: The company executed a JV agreement with Signify to carry out the OEM business of lighting products and accessories. The share capital of the joint venture company will be held in the proportion of 50:50 by the company and signify.

Capri Global: The company closed its QIP and approved the issue price of Rs 146.5 per share for allotment of 13.65 crore shares to Eligible QIBs. Approved the allotment of 13.65 crore worth Rs 2,000 crore to eligible QIBs.

ONGC: Gushes of gas observed from Rudrasagar field well in Assam. No fire or Injuries to any personnel have occurred and the situation is now fully under control.

NMDC: Steel Ministry appointed Ashish Chatterjee as Govt director on Board of Directors.

Crompton Greaves: Received letter of award worth Rs 101 crore for commissioning of 4500 Off-grid Solar project from Maharashtra Energy Body.

IPO Offering

Oswal Pumps: The company will offer shares for bidding on Friday. The price band is set from Rs 584 to Rs 614 per share. The Rs 1,387-crore IPO is a combination of fresh issue of Rs 890 crore and rest offer for sale. The company raised 416 crores from anchor investors.

Brokerage Radar

Morgan Stanley On Boeing Co

The Air India Dreamliner crash increases regulatory scrutiny on Boeing.

Event derails the positive momentum in the stock.

JPMorgan On Oil Markets Weekly

Oil surged 5% on heightened security risks in the Middle East.

Prices reflect a 7% probability of a worst-case scenario.

Maintain base case for oil prices in the low-to-mid $60s for the rest of 2025, $60 in 2026.

An attack on Iran could spike oil prices to $120, driving US CPI to 5%.

Closure of Hormuz is a low-risk event as Iran would be damaging its own position.

Main players in the Middle East have strong incentives to keep the conflict contained.

BofA On Household Consumption

India's consumption indicators set to drive growth.

Expect private consumption growth to outperform GDP growth.

Wage growth appears to be stabilising in urban areas, remains elevated in rural areas.

See real wages improving materially, can lead to greater discretionary spending.

Sharp pickup in wage growth unlikely, but see room for stability in wage growth.

Personal credit growth improvement likely, should aid household consumption trends.

See score for household disposable incomes to grow by one percentage point higher than nominal GDP growth.

Reduction in taxes will create multiplier effect of Rs 2.5 lakh crore.

Catch all brokerage calls on Friday here.

Block Deals

Asian Paints: SBI Mutual Fund bought 3.5 crore shares (3.64%) at Rs 2,201 apiece, while Siddhant Commercials sold 3.5 crore shares (3.64%) at Rs 2,201 apiece.

Eternal: Marshall Wace Investment Strategies - Eureka sold 60.93 lakh shares (0.06%) at Rs 257.07 apiece, while Societe Generale bought 60.93 lakh shares (0.06%) at Rs 257.07 apiece.

Bulk Deals

C.E. Info Systems: Phonepe sold 27.21 lakh shares (4.99%) at Rs 1786.22 apiece, while Tata Mutual Fund bought 4.48 lakh shares (0.82%), Motilal Oswal Mutual Fund bought 4.2 lakh shares (0.77%), ICICI Prudential Mutual Fund bought 4.2 lakh shares (0.77%) at Rs 1785 apiece.

Shankara Building Product: Rajasthan Global Securities sold 1.53 lakh shares (0.63%) at Rs 1034.62 apiece, while Wtcnam Common Trust Funds Trust Emerging Markets Opportunities Portfolio bought 1.36 lakh shares (0.56%) at Rs 1021.68 apiece

Insider Trades

NCL Industries: Promoter P S Raju sold 5000 shares.

Bliss GVS Pharma: Promoter Gagan Harsh Sharma bought 48,627 shares.

Ultramarine & Pigments: Promoter Narayan S sold 5000 shares.

Usha Martin: Promoter Peterhouse Investments India Ltd. sold 6 lakh shares.

Sterlite Technologies: Promoter Ankit Agarwal bought 197390 shares.

D. B. Corp: Promoter D B Power bought 81,743 shares.

Star Cement: Promoter Vinay and Co. sold 7100 shares.

Inox Green Energy Services: Promoter Devansh Trademart LLP bought 45000 shares.

Trading Tweaks

Price Band change from 10% to 5%: Aartech Solonics, Focus Lighting and Fixtures.

Stocks included in ST-ASM: Concord Biotech, Lloyds Enterprises.

List of securities to be included from LT-ASM Framework: Camlin Fine Sciences.

List of securities to be excluded from ASM Framework: Exxaro Tiles

Stocks in LT-ASM: Aartech Solonics.

Ex- Dividend: Apcotex Industries, Canara Bank.

F&O Cues

Nifty June Futures down by 1.2% to 24,909 at a premium of 21 points.

Nifty June futures open interest down by 0.13%.

Nifty Options June 12 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Aditya Biral Fashion, Birlasoft, CDSL, Chambal fertilizer, Hindustan Copper, IEX, IREDA, RBL Bank, Titagarh.

Currency/Bond

The rupee weakened eight paise to close at 85.60 against US dollar.

The yield on the benchmark 10-year government bond ended three basis points lower at 6.34%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.