Good morning!

The GIFT Nifty was trading 34 points higher at 25,529, indicating a positive start for the benchmark 50-stock index later in the morning.

Asian shares traded in a tight range Friday as renewed trade tensions ahead of next week's deadline for higher levies outweighed a record-extending rally in US stocks.

Markets On Home Turf

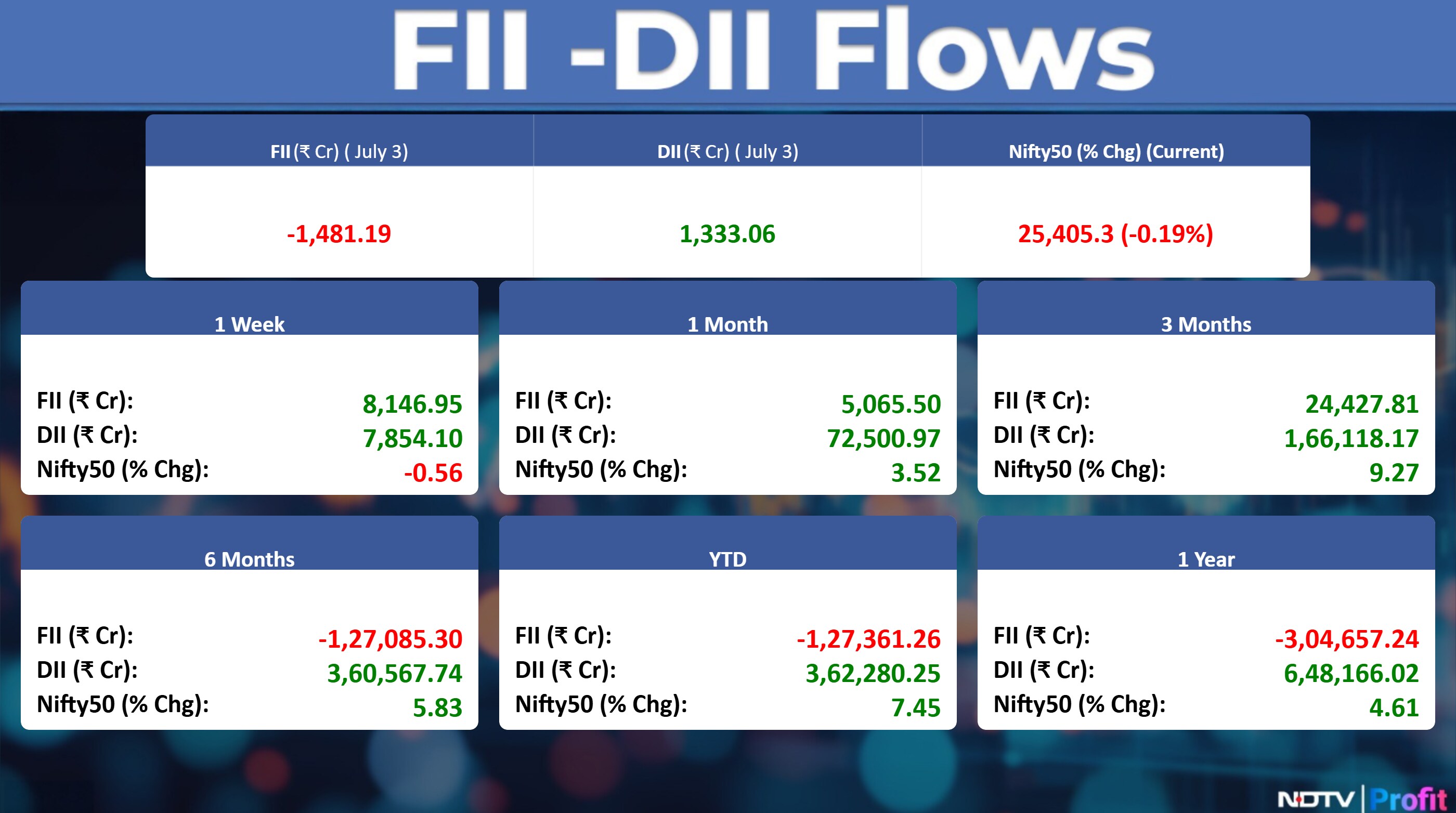

The Indian benchmark equity indices erased the intraday gains to close lower for the second consecutive day on Thursday. The NSE Nifty 50 ended 48.1 points or 0.19% lower at 25,405.30, while the BSE Sensex closed 170.22 points or 0.2% down at 83,239.47.

Asian Markets

Japan's Topix up 0.2%

Nikkei 225 up 0.26%

Hang Seng down 0.8%

Kospi down 0.8%

Australia's S&P/ASX 200 up 0.2%

Euro Stoxx 50 futures fell 0.2%

Wall Street Recap

US stocks reached a fresh record in a holiday-shortened session after data showed job growth exceeded expectations, boosting investors' confidence in the health of the economy even as it doused expectations for a July Federal Reserve interest-rate cut, reported Bloomberg.

The S&P 500 Index gained 0.8% and the Nasdaq 100 rose 1%, with each reaching new highs, while the Dow Jones Industrial Average advanced 0.8%.

Commodities Check

Oil was little changed before an OPEC+ meeting that's set to deliver another oversized production hike, threatening to swell a glut forecast for later this year.

Brent traded near $69 a barrel after losing 0.4% on Thursday, while West Texas Intermediate traded above $67.

Key Events, Economic Data To Watch

United States -Market Holiday on account of Independence Day

1:00 p.m. Europe- ECB President Lagarde Speaks

1:30 p.m. Europe- ECB's Elderson Speaks

2:00 p.m. UK- Construction PMI

Stocks In News

Bharat Forge: The company has incorporated a step-down subsidiary named Agneyastra Energetics.

UCO Bank: The bank reported a 13.67% year-on-year growth in the April–June quarter of fiscal 2026, driven by expansion in its domestic loan book. Total business stood at Rs 5.24 lakh crore, up from Rs 4.61 lakh crore in the same period last year.

Vedanta: The company reported total aluminium production of 6 lakh tonnes, marking a 1% year-on-year rise. Zinc International production grew by 50% to 57,000 tonnes.

Bajaj Finance: The company delivered a strong first quarter financial year 2026 update. Its deposit book rose 15% year-on-year to Rs 72,100 crore. Assets under management increased 25% year-on-year to Rs 4.41 lakh crore.

PC Jeweller: The company reported an 80% year-on-year revenue jump in Q1, driven by strong festive and wedding demand despite gold price volatility. The company has reduced its bank debt by over 50% in FY25 and by 7.5% in Q1 alone. It aims to be debt-free by FY26 and continues to restructure and strengthen operations.

Yes Bank: The bank's loans and advances fell 2% quarter and quarter to Rs 2.41 lakh crore compared to the previous quarters Rs 2.46 lakh crore. Its deposits reduced 3% on a quarter-on-quarter basis to Rs 2.75 lakh crore from the March quarter's Rs 2.84 lakh crore.

Marico: The company's consolidated revenue grew in the low twenties year-on-year for the first quarter of this fiscal. Parachute saw a slight dip in volumes due to input cost pressures. Saffola Oils posted high-twenties revenue growth, backed by mid-single-digit volume growth. The company expects margin pressures to ease in second half of fiscal 2026, helped by falling crude oil derivatives and policy support.

Reliance Retail: The company has made a minority investment in UK-based FACEGYM and will introduce its signature facial workouts in India through selected Tira stores.

Alembic Pharma: The company has received a tax demand of Rs 33 crore, including interest, from the Sikkim tax authorities.

IEX: The company reported a 6.5% rise in electricity trading volumes to 10,852 million units in June. For the April–June quarter, volume increased by 15% to 32,382 million units.

Aegis Logistics: The company commissioned an LPG cryogenic terminal at Pipavav with a static storage capacity of 48,000 MT. This terminal will be transferred to Aegis Vopak Terminals.

ONGC: The company and Japan's Mitsui O.S.K. Lines signed a Heads of Agreement to build, own, and operate two Very Large Ethane Carriers to ship imported ethane to ONGC Petro Additions.

Punjab & Sind Bank: The bank's total business grew 10.9% year-on-year to Rs 2.3 lakh crore in June quarter. Deposits rose 8.8% to Rs 1.3 lakh crore, and gross advances increased 13.9% to Rs 99,946 crore. The credit-deposit ratio rose to 76.19% from 72.76% in the previous quarter.

ICICI Lombard: The company received relief from the Bombay High Court, which set aside a GST demand of Rs 1,902 crore for the period July 2017 to March 2022. The court has directed a rehearing.

L&T Finance: The company reported an 18% year-on-year rise in its retail loan book to Rs 99,800 crore for first quarter of this fiscal. Retail disbursements were up 18% at Rs 17,510 crore. Rural business finance dropped slightly to Rs 5,610 crore.

Defence Stocks: The Defence Ministry has approved Rs 1.05 lakh crore in capital acquisitions, all under the 100% indigenous category.

Jindal Steel and Power: The company received a letter of intent for the Roida-I iron ore and manganese block in Odisha.

Prime Focus: The company has approved the allotment of up to 43 crore shares for acquiring a stake in its arm DNEG S.a.r.l for Rs 5,161 crore. It also approved the allotment of 3.2 crore shares to raise Rs 390 crore.

RBL Bank: The bank reported 11% year-on-year deposit growth to Rs 1.1 lakh crore. Gross advances increased by 9% to Rs 96,704 crore. The CASA ratio stood at 32.5%, down from 34.1% in the previous quarter.

Torrent Pharma: The company acquired 2.4% equity in JB Chemicals for Rs 620 crore at Rs 1,600 per share and may acquire an additional 0.4%.

Godawari Biorefineries: The company secured a European patent for a novel anticancer molecule.

Signpost India: The company received a Karnataka High Court order permitting it to resume advertising operations in Bengaluru.

Veranda Learning Solutions: The company approved the allotment of 11 lakh shares at Rs 221 each, raising Rs 26 crore.

AWL Agri: The company reported a 2% decline in edible oil volumes for first quarter of fiscal 2026 due to palm oil weakness. Total volumes declined 4% year-on-year. However, revenue grew 21% year-on-year, driven by alternate channels and non-edible segments. Quick commerce sales rose 75% year-on-year, and revenue from alternate channels crossed Rs 3,900 crore.

LIC: The insurance company launched two new insurance products and one rider product.

S H Kelkar: The company reported consolidated revenue of Rs 574 crore, a 14% rise from the fire-hit first quarter. European operations remained stable. Margins held steady due to stable input costs. Net debt as of June 30 stood at Rs 666 crore.

SRF: The company re-appointed Ashish Bharat Ram as Chairman and Managing Director.

Bank of Baroda: The bank reported 10.7% year-on-year growth in global business to Rs 26.4 lakh crore in the first quarter. Global deposits rose 9.1% to Rs 14.4 lakh crore, and global advances increased 12.6% to Rs 12.1 lakh crore. Domestic advances and deposits grew by 12.5% and 8.1%, respectively.

Bajaj Housing Finance: The company saw a 24% rise in AUM to Rs 1.2 lakh crore in first quarter of 2026. Disbursements were Rs 14,640 crore, up from Rs 12,004 crore a year ago.

Suryoday Small Finance Bank: The bank's gross advances rose 20% to Rs 10,846 crore in the first quarter. Disbursements increased by 30% to Rs 2,261 crore. Total deposits grew 39% to Rs 11,321 crore. CASA ratio fell to 17.7% from 20.9%.

Master Trust: Master Capital Services, a subsidiary of the company, has entered the mutual fund business.

Deccan Gold Mines: The company has completed documentation to avail additional debt funding of Rs 30 crore from Godawari Power and Ispat.

Infibeam Avenues: Phronetic the subsidiary of the company has signed an MoU with Nawgati Tech to co-develop AI-powered solutions.

Kaynes Tech: The company approved an investment of up to $17 million to acquire 1.7 crore shares of its subsidiaries.

Emcure Pharma: The company's investor BC Investments will sell 45.5 lakh shares (2.4% equity) via block deal on Friday at Rs 1,225 per share, amounting to Rs 551 crore.

Medplus Health: The company received two suspension orders for drug licences affecting stores in Chhattisgarh and Karnataka.

Arisinfra Solutions: The company secured a Rs 100 crore order from Village Wave in Bengaluru for development management.

IPO Offering

Crizac: The public issue was subscribed to 2.75 times on day 2. The bids were led by Qualified institutional investors (0.15 times), non-institutional investors (6.28 times), retail investors (2.72 times).

Bulk Deals

Mangalam Cement: Pilani Investment and Industries sold 5 lakh shares (1.81%) at Rs 758 apiece, Rambara Trading Private Limited bought 2.5 lakh shares (0.9%) at Rs 758 apiece, Vidula Consultancy Services Limited bought 2.5 lakh shares (0.9%) at Rs 758 apiece.

Ellenbarrie Indus Gases: Motilal Oswal Mutual Fund bought 9 lakh shares at Rs 567 apiece.

Indogulf Cropsciences: AU Small Finance Bank sold 3.79 lakh shares at Rs 111 apiece, Rajasthan Global Securities sold 3.79 lakh shares at Rs 111 apiece, South Indian Bank sold 3.77 lakh shares at Rs 111.17 apiece, Satish Singhal bought 3.6 lakh shares at Rs 111 apiece.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage - I: Raymond.

List of securities to be excluded from ASM Framework: Orient Cement.

Ex-Dividend: Axis Bank, Bharat Forge, Biocon, Central Bank of India, Control Print, Dhampur Bio Organics, DCB Bank, Escorts Kubota, Jupiter Lifeline Hospitals, Mahindra & Mahindra, Max Healthcare Institute, Nippon Life India.

F&O Cues

Nifty July Futures down by 0.18% to 25,500 at a premium of 95 points.

Nifty July futures open interest down by 2.73%.

Nifty Options July 10 Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Currency/Bond Update

The Indian rupee closed 39 paise higher at 85.32 against the US dollar on Thursday

The yield on the benchmark 10-year government bond ended flat at 6.34%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.