Good morning!

The GIFT Nifty was trading 41 points higher at 25,572 as of 8:20 a.m., indicating a positive start for the 50-stock benchmark on the NSE later in the morning. The weekly futures contract for the Nifty will expire today.

US stock futures held steady on Wednesday evening after the S&P 500 and Nasdaq reclaimed record highs, boosted by President Donald Trump's announcement of a trade deal with Vietnam. European contracts rose while Asian shares were mixed.

S&P 500 futures flat.

Euro Stoxx 50 futures up 0.15%.

Watch NDTV Profit Live

Markets On Home Turf

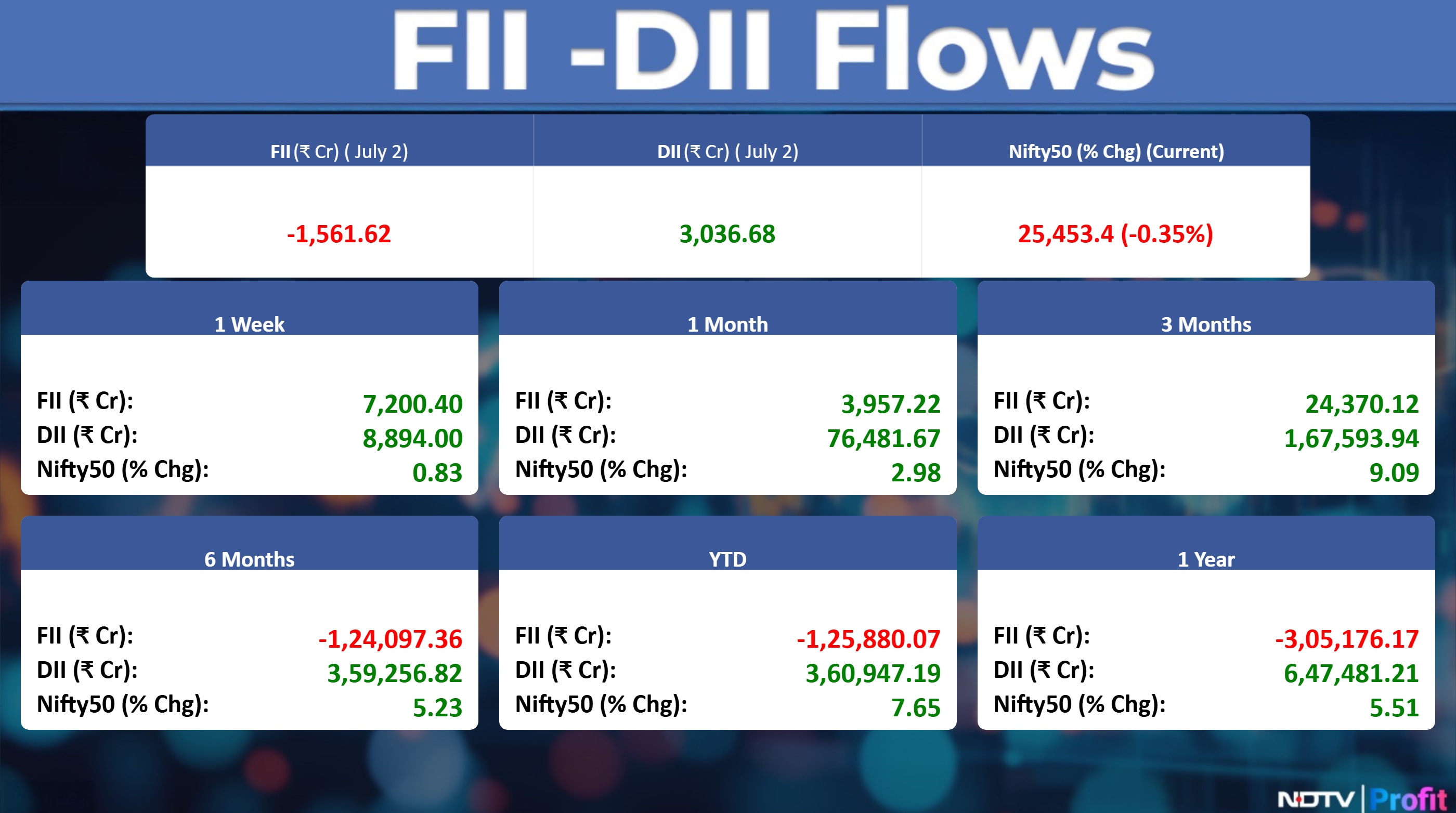

Indian benchmark equity indices closed lower on Wednesday, dragged by share prices of HDFC Bank Ltd. and Larsen & Toubro Ltd. The NSE Nifty 50 ended 88 points or 0.35% lower at 25,453.40, while the BSE Sensex closed 287.60 points or 0.34% down at 83,409.69.

Foreign portfolio investors stayed net sellers of Indian equities for the second consecutive day on Tuesday and sold shares worth Rs 1,970.1 crore. Domestic institutional investors stayed net buyers and acquired equities worth Rs 771.1 crore.

Asian Market Update

Hang Seng futures flat.

Nikkei 225 up 0.06%.

Japan's Topix down 0.16%.

Kospi up 0.75%

Australia's S&P/ASX 200 down 0.2%.

Wall Street Recap

US stocks advanced to a new high, with technology companies leading the charge, after the US-Vietnam trade deal, a move that fueled optimism that more agreements are on the way.

The S&P 500 gained 0.5% to 6,227 points, led by energy, materials and information tech. The tech-heavy Nasdaq 100 rose 0.7% while the Dow Jones Industrial Average closed flat.

Commodity Check

Oil prices held firm after its biggest gain in almost two weeks, as Trump's announcement of a trade accord with Vietnam boosted optimism that further agreements will be made by July 9 deadline.

Brent traded near $69 a barrel early Thursday morning after surging by 3% a day prior, with West Texas Intermediate above $67.

Optimism over trade deals boosted metal prices. On the London Metal Exchange, here's how the other key commodities are doing:

Copper up 0.8%.

Aluminium up 0.8%.

Nickel up 0.6%.

Zinc up 1.6%.

Lead up 1%

Key Events, Economic Data To Watch

1:30 p.m. Europe- S&P Global Composite PMI

2:00 p.m. UK PMI

5:00 p.m. US Continuing Jobless Claims

6:00 p.m. Initial Jobless Claims

6:00 p.m. Nonfarm Payrolls

Stocks In News

Nykaa: The Banga family is looking to sell a 2.1% stake worth Rs 1,198 crore via a block deal, according to the term sheet accessed by NDTV Profit. The floor price is set at Rs 200 per share, implying a 5.5% discount to the last closing price.

V2 Retail: In the first quarter of financial year 2026, standalone revenue stood at Rs 628 crore, up 51% year-on-year from Rs 415 crore. Same-store sales growth was 5%, and 10% on a normalised basis. The company added 28 new stores in the first quarter, taking the total to 216.

Baazar Style Retail: In the first quarter of financial year 2026, standalone revenue came in at Rs 377 crore, up 37% year-on-year from Rs 275 crore. Same-store sales was 5%, and 11% on a normalised basis. The company added 22 new stores, raising the total to 664.

Avenue Supermarts: In the first quarter of financial year 2026 standalone revenue is estimated at Rs 15,932.1 crore, up 16% Same-store sales. The company has 424 stores as of June 30.

Hindustan Zinc: In the first quarter of financial year 2026, mined metal production rose 1% to 265 killo tonnes. Refined zinc production declined 4% to 202 KT, silver production fell 11% to 149 KT, while wind power generation increased 24% to 134 million units.

Max Financial: Axis Max Life has initiated an information security assessment and data log analysis. Investigation is ongoing with experts.

RBL Bank: Denied reports about NBD Bank seeking a minority stake. Shares fell 2% after the denial. The bank stated no disclosure was required.

Punjab National Bank: In the first quarter of financial year 2026, global deposits rose 12.8% year-on-year to Rs 15.9 lakh crore. Domestic deposits grew 12.2% year-on-year to Rs 15.4 lakh crore, while global advances rose 9.9% to Rs 11.3 lakh crore. Global business grew 11.6% year-on-year to Rs 27.2 lakh crore.

Indian Bank: In the first quarter of financial year 2026, deposits rose 9.3% year-on-year to Rs 7.4 lakh crore. Gross advances were up 11.3% year-on-year to Rs 6 lakh crore. Total business grew 10.2% year-on-year to Rs 13.4 lakh crore. Reduced its MCLR by 5 basis points for most tenures effective July 3.

Mahindra & Mahindra Finance: In the first quarter of financial year 2026, disbursements (excluding finance leases) are expected at Rs 12,800 crore. Assets under management grew 15% year-on-year to Rs 1.2 lakh crore. Collection efficiency is seen at 95%. Stage-3 assets estimated at 3.8–3.9%, Stage-2 at 5.8–5.9%. Liquidity remains strong at over Rs 9,600 crore.

Monte Carlo Fashions: Renamed its subsidiary to ‘MCFL Ventures' from ‘Monte Carlo Home Textiles'.

AIA Engineering: Brazil's trade department reduced countervailing duty from 6.5% to 2.9%.

KPI Green Energy: Government approved the incorporation of SPV ‘KPIN Clean Power Three LLP'.

Huhtamaki India: Denied media reports about pursuing a major M&A deal worth up to Rs 4,170 crore.

Voltas: Received a Rs 265 crore show-cause notice over alleged GST shortfall by Universal Comfort Products (merged in FY21) during financial year 2019–2021.

Akzo Nobel India: Received a show-cause notice with Rs 2.26 lakh tax liability from Maharashtra GST Department.

Aurobindo Pharma: CuraTeQ Biologics received EU marketing approval for breast cancer drug Dazublys. Pharmacin BV merged with Agile Pharma BV.

Best Agrolife: Appointed Surendra Sai Nallamalli as Whole-Time Director.

Coromandel International: Received CCI approval to acquire a 53.13% stake in NACL Industries.

Adani Energy Solutions: Amiya Chandra resigned as Non-Executive and Independent Director.

Esaar India: Chief financial officer Mithlesh Jaiswal resigned.

Sheela Foam: Chief executive officer Nilesh Sevabrata Mazumdar resigned.

Bliss GVS Pharma: Received a show cause notice regarding Rs 6.6 crore IGST refund reclaimed in financial year 2019.

GMR Airports: TDSAT quashed the AERA's earlier calculation of Hypothetical Regulated Asset Base.

Motilal Oswal Financial Services: Motilal Oswal AMC crossed Rs 1.5 lakh crore in AUM.

Nestlé India: Added a new Maggi noodles production line, investing Rs 105 crore at its Sanand factory in Gujarat.

RVNL: Appointed Chandan Kumar Verma as CFO.

CFF Fluid: Launched a fixed-price FPO at Rs 585 per share. Issue opens on July 9 and closes on July 11.

Escorts Kubota: Launched a new pick-and-carry crane, ‘Hydra 12', in the construction equipment segment.

Veranda Learning: Approved allotment of 2.1 lakh shares at Rs 221 per share, aggregating to Rs 47 crore.

Listing Day

Indogulf Cropsciences: The company's shares will debut on the stock exchange on Thursday at an issue price of Rs 111 apiece. The Rs 200-crore IPO was subscribed 86.04 times on its third and final day.

IPO Offering

Crizac: The public issue was subscribed to 0.46 times on day 1. The bids were led by Qualified institutional investors (0.09 times), non-institutional investors (0.62 times), retail investors (0.6 times).

Bulk Deals

Raymond Realty: Negen Capital Services bought 3.88 lakh shares at Rs 921 apiece.

Insider Trading

Genus Power Infrastructures: Promoter Kailash Chandra Agarwal created a pledge for 16 lakh shares.

Asahi India Glass: Promoter Ashok Kanhayalal Monga sold 12,000 shares.

Star Cement: Promoter Vinay and Co. sold 1228 shares, Promoter Suchita Agarwal sold 9,500 shares.

Axiscades Technologies: Promoter Jupiter Capital Pvt. sold 1 lakh shares.

Brokerage Notes

Macquarie On Financials

IndusInd Bank – Downgrade to Underperform from Outperform; Cut target price to Rs 650 from Rs 1,210.

HDFC Life – Downgrade to Underperform from Neutral; Hike target price to Rs 720 from Rs 570.

Kotak Mahindra Bank – Downgrade to Neutral from Outperform; Hike target price to Rs 2,300 from Rs 2,200.

SBI Cards – Downgrade to Neutral from Outperform; Hike target price to Rs 1,040 from Rs 1,000.

PB Fintech – Upgrade to Neutral from Underperform; Hike target price to Rs 1,945 from Rs 1,530.

Financials - Stable, strong, and resilient: Mid-teen EPS growth.

Margin issues are transient; expect banks to deliver solid 15% EPS CAGR over the next three years.

Prefer large private banks, selective risk-reward for NBFCs.

PSU banks losing market share on deposits; expect EPS decline in FY26E and sharp ROE compression in the near term.

NBFCs: NIMs to expand, growth to decline.

Insurance: see regulatory overhang; positive on general insurance and negative on life insurance.

Top picks: HDFC Bank, Axis Bank, Aditya Birla Capital, PFC, Shriram Finance and LIC.

Morgan Stanley On M&M Finance Q1 Business Update

Maintain 'Equal-weight' with target price of Rs 282.

Muted performance, on expected lines.

AUM growth continued to moderate.

Lack data on write-offs and coverage, which are needed to estimate slippages as well as credit costs.

Growth and asset quality remain muted.

See downside risks to FY26 Pre-Provision Operating Profit and weak return on assets.

Citi On Punjab National Bank Q1 Update

Maintained 'sell' with a target price of Rs 101.

Advances growth of 1.3% QoQ; deposits growth of 1.4% QoQ.

Overseas advances were broadly flat in Q1, the same as those in Q4.

Expects retail, agriculture, and MSME segments to be the primary growth drivers.

Building in 2% QoQ fall in NII and 12 bps QoQ fall in NIMs, given the higher External Benchmark Lending Rate book.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: Gabriel India, Sterlite Technologies, Prime Focus.

Price Band change from 20% to 10% band: Gabriel India.

Price Band change from 20% to 5% band: Linc

Price Band change from 20% to 10% band: Prime Focus.

Price Band change from 5% to 20% band: Siemens Energy India

Ex-Dividend: VST Industries.

F&O Cues

Nifty July Futures down by 0.4% to 25,539 at a premium of 87 points.

Nifty July futures open interest down by 3.17%.

Nifty Options July 3 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Currency/Bond Update

The Indian rupee closed 9 paise weaker at 85.68 against the US dollar on Wednesday

The yield on the benchmark 10-year government bond ended flat at 6.34%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.