The GIFT Nifty is trading 95 points or 0.38% down at 25,170.5 as of 8:20 a.m., indicating a lower start for the benchmark Nifty 50.

S&P 500 futures fell 0.2% after the index closed lower Tuesday. Asian indices were mixed.

Watch NDTV Profit Live

Markets On Home Turf

India's benchmark equity indices snapped four sessions of losses to close higher on Tuesday, led by gains in auto and financial stocks. HCL Technologies Ltd. took a beating after June quarter disappointment.

The NSE Nifty 50 ended 113.5 points or 0.45% higher at 25,195.8, while the BSE Sensex closed 317.45 points or 0.39% up at 82,570.91. Intraday, the Nifty tested the 25,100 level before positive momentum took over. The index gained as much as 0.65% during the session.

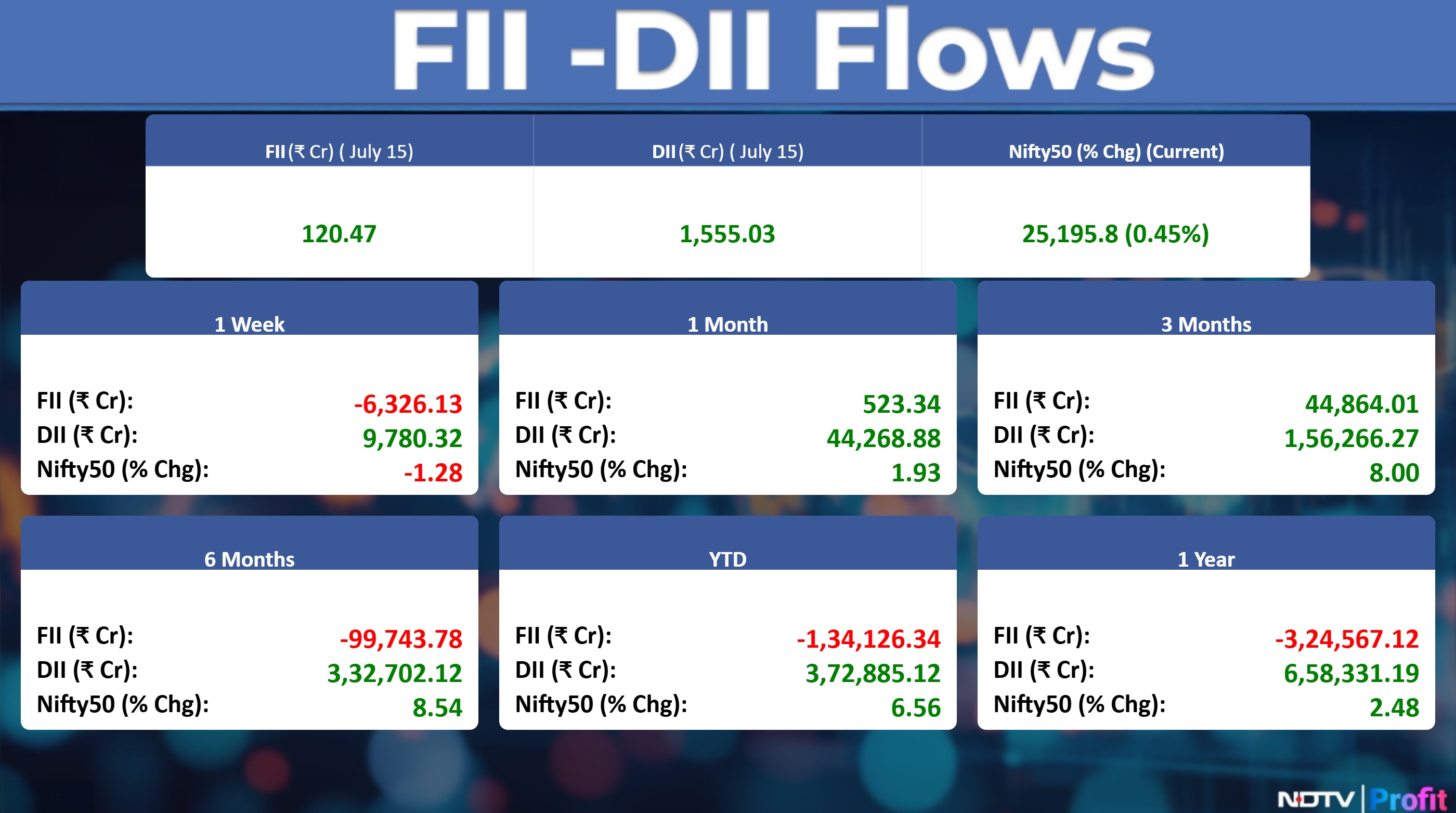

Foreign portfolio investors turned net buyers of Indian shares on Tuesday after two sessions of selling as they mopped up stocks worth Rs 104.5 crore, according to provisional data from the National Stock Exchange.

The domestic institutional investors, who remained buyers for the seventh straight session, bought stocks worth Rs 1,477.6 crore.

Wall Street Recap

The S&P 500 Index closed lower for the second time in three sessions on Tuesday, weighed down by financial companies as mixed earnings results from banks offset an upbeat report showing consumer prices are cooling.

The benchmark equities index fell 0.4%, after rising as much as 0.5% earlier to briefly eclipse the psychologically important 6,300 level after the opening bell. Meanwhile, the Nasdaq 100 Index rose 0.1% to notch a fresh closing record. Dow Jones Industrial Average sunk nearly 1%.

Asia Market Update

Asian stocks fell at the open on Wednesday after mixed US inflation data spurred traders to trim Federal Reserve interest rate-cut bets. The MSCI regional gauge dropped 0.4% with losses in Australia, Japan and South Korea.

Nikkei up 0.2%

Topix up 0.1%

Kospi down 0.7%

S&P/ASX down 0.7%

Hang Seng futures flat

Commodities Check

Oil ticked higher after a two-day drop, as traders assessed signs of near-term market strength ahead of US inventory figures.

Brent rose to $69 a barrel, while West Texas Intermediate was near $67. Crude's near-term market structure continues to point to tightness.

Industrial metal prices on the London Metal Exchange:

Copper up 0.3%

Aluminium down 0.4%

Nickel up 0.5%

Zinc down 1.2%

Lead up 0.4%

Key Data To Watch

UK is going to announce its core CPI numbers on Wednesday. Europe will also release its trade balance data, while US will release its industrial production and crude inventories. Among important speeches are Fed Vice Chair for Supervision Barr and FOMC Member Williams.

Earnings In Focus

Tech Mahindra, ITC Hotels, Angel One, D. B Corp, Le Travenues Tech, Kalpataru, and L&T Technology Services.

Earnings Post-Market Hours

HDFC Life Insurance Q1 Highlights (Standalone, YoY)

Net premium income up 15% at Rs 14,466 crore vs Rs 12,509 crore.

Annualised premium equivalent grew 12.5% to Rs 3,225 crore versus Rs 2,866 crore (NDTV Profit estimate: Rs 3,200 crore).

Value of new business advanced by 12.7% to Rs 809 crore versus 718 crore (NDTV Profit estimate: Rs 800 crore).

VNB margins came in at 25.1% (NDTV Profit estimate: 25%)

Net profit up 14% at Rs 546 crore versus Rs 478 crore.

HDB Financial Services Q1 Highlights (YoY)

Net interest income at Rs 2092 crore versus Rs 1769 crore versus Rs, up 18% year-on-year, up 6% quarter-on-quarter.

Operating profit at Rs1388 crore versus Rs 1179 crore year-on-year, up 18% year-on-year, up 5% quarter-on-quarter.

Provisions at Rs 670 crore versus Rs 412 crore year-on-year, up 63% year-on-year, up 6% quarter-on-quarter.

Profit at Rs 568 crore versus Rs 582 crore year-on-year, down 2% year-on-year, up 7% quarter-on-quarter.

ROA at 1.9% versus 2%, down 10bps quarter-on-quarter.

Gross NPA ratio at 2.56% versus 2.26%, up 30bps quarter-on-quarter.

Net NPA ratio at 1.11% versus 0.99%, up 12bps quarter-on-quarter.

NIM at 7.7% versus 7.6%, up 10bps quarter-on-quarter.

Credit cost at 2.5% versus 2.4%, up 10bps quarter-on-quarter.

Cost to income at 42.7% versus 42.9%, down 20bps quarter-on-quarter.

Yield on advances at 14.2% versus 13.9%, up 30bps quarter-on-quarter.

Cost of funds at 6.4% versus 6.3%, up 10bps quarter-on-quarter.

ICICI Lombard Q1 Highlights (YoY)

Net Profit rises 28.7% to Rs 747 crore versus Rs 580 crore.

Total Income rises 13.7% to Rs 6,083 crore versus 5,352 crore.

Combined ratio at 102.9% vs 102.3% (YoY), and 102.8%.

GDPI flat at Rs 7735 crore vs Rs 7688 crore.

Just Dial Q1 Highlights (Consolidated, YoY)

Revenue up 6.42% at Rs 298 crore versus Rs 280 crore.

Ebitda up 7.66% at Rs 87.1 crore versus Rs 80.9 crore.

Ebitda margin up 33 bps at 29.22% versus 28.89%.

Net profit up 13.47% at Rs 160 crore versus Rs 141 crore.

Geojit Financial Services Q1 Highlights (Consolidated, QoQ)

Revenue down 13.33% at Rs 153.15 crore versus Rs 176.69 crore.

Net profit down 11.63% at Rs 27.29 crore versus Rs 30.89 crore.

Stocks in News

Rajoo Engineers: Opened its QIP and approved a floor price of Rs 114.42 per share.

Centrum Capital: Approved fundraise of Rs 172 crore through issuance of 5 crore shares at Rs 34.38 per share.

Somany Ceramics: Completed acquisition of a 51% stake in Dura Build Care for Rs 10 crore.

CFF Fluid Control: Signed an agreement with Garden Reach Shipbuilders to enhance its naval and marine systems portfolio.

Anupam Rasayan: The company will allot 39 lakh shares at Rs 945.11 per share upon conversion of 39 lakh warrants.

Utkarsh Small Finance Bank: Mukesh Singh Verma resigned as Chief Compliance Officer and Principal Officer.

InterGlobe Aviation: Appointed Michael G. Whitaker as Additional and Independent Director for five years.

MTNL: Defaulted on bank loans and interest payments amounting to Rs 8,585 crore.

Biocon: Arm Biocon Biologics expanded its diabetes portfolio with FDA approval of Kirsty, the first and only interchangeable rapid-acting

insulin aspart in the United States.

Lemon Tree Hotels: Launched a new 64-room hotel in Tamil Nadu.

UNO Minda: Acquisition of e-Drives business assets in Vietnam from Friwo is in progress; completion expected by July 22.

TCS: Partnered with MIT Sloan Management Review to launch a new research series on the next phase of human and AI collaboration in large enterprises.

Dixon Technologies: Signed a binding term sheet with Chongqing Yuhai Precision for a proposed joint venture to manufacture precision components for laptops and mobile phones.

Arisinfra Solutions: Signed an agreement with Wadhwa Construction for the next phase of the Wadhwa Wise City project in Panvel, adding a Rs 75 crore-project pipeline.

Yes Bank: Board to meet on July 19 to consider fundraising via equity or debt.

Godavari Biorefineries: Received a patent from China for 5-Hydroxy-1,4-Naphthalenedione, used in cancer treatment.

JTEKT: Proposed a rights issue of shares worth up to Rs 250 crore.

Thirumalai Chemicals: The company's arm TCL (Specialties) is building two major integrated plants at a single site.

Jupiter Wagons: Chief Financial Officer Sanjiv Keshri resigned due to personal reasons.

Zydus Lifesciences: Received final US FDA approval for Celecoxib Capsules, a nonsteroidal anti-inflammatory drug.

Cupid: Approved investment in GII Healthcare Investment, marking its first strategic entry into the Middle East market.

Infibeam Avenues: Approved allotment of 70 crore shares via rights issue, raising Rs 700 crore. The issue was oversubscribed 1.4 times. Funds will be used for investments in Phronetic.AI, expansion of RediffPay, and more.

Kotak Mahindra Bank: Phani Shankar resigned as President and Chief Credit Officer, effective July 21.

Spandana Sphoorty: Approved rights issue of shares worth up to Rs 400 crore.

Himadri Speciality Chemical: Approved incorporation of a wholly owned subsidiary in the UAE named “Alliance Worldwide LLC” to expand overseas operations.

Brigade Enterprises: Its office arm BuzzWorks launched a 50,000 sq ft centre at Mindspace Business Park, Hyderabad, adding 1,000 desks.

Patel Engineering: Bombay High Court dismissed its appeal against a Rs 26.56 crore arbitration award related to Neotown Project in Bangalore.

Kalpataru Projects: The company's subsidiary issued termination notice to NHAI citing contractual defaults; Rs 351 crore concession agreement stands terminated with immediate effect.

IPO Offering

Anthem Biosciences: The public issue was subscribed to 3.29 times on day 2. The bids were led by Qualified institutional investors (0.59 times), non-institutional investors (9.72 times), retail investors (2.08 times) and reserved for employees (2.58 times).

Stocks On Brokerage Radar

Bernstein On Aditya Birla Lifestyle Brands

Initiate 'Market-Perform' with a target price of Rs 170.

The company is resetting its growth agenda with strong brands and new investments.

Lifestyle brands operate in a well-penetrated category, which constrains their growth potential.

Emerging brands are in industry segments offering tailwinds, but they have struggled to grow against larger competitors.

Expect to deliver approximately 9.5% growth over FY25-30.

Bullish on a strong legacy brand portfolio and capital and management focus on growth.

Bearish as the legacy business is swimming against the tide in a slow-moving category. Emerging categories need to establish a right to win against larger, more established competitors.

MOSL On Vishal Mega Mart

Initiate 'Buy' with a target price of Rs 165.

The company is positioned as a play on the rising aspirations in Tier 2+ India.

It is described as a one-of-a-kind retailer addressing a significant Rs 70 trillion market opportunity.

Healthy store economics provide ample room for accelerated store expansions.

A well-diversified portfolio enhances the total addressable market and increases the share of wallet.

The multi-category, own-brand portfolio acts as a strong moat.

It is identified as the lowest-cost retailer with significant potential to improve revenue productivity.

Block Deals

MAS Financial Services: Business Excellence Trust III sold 20 lakh shares (0.11%) at Rs. 305 apiece, Nippon India Mutual Fund bought 20 lakh shares (0.11%) at Rs. 305 apiece

TVS Infrastructure Trust: AMBIT Wealth sold 53.2 lakh shares at Rs.101.97 a piece, Larsen & Toubro sold 13.7 lakh shares at Rs.100.52 a piece, Phillip Services India sold 4 lakh shares at Rs.102 a piece while Sargam Retails bought 19.2 lakh shares at Rs.102 a piece, Phillip Services India bought 13 lakh shares at Rs.100.5 a piece , Harshvardhan Properties bought 10 lakh shares at Rs.102 apiece and Yashvardhan Estate and Developers bought 10 lakh shares at Rs.102 apiece.

Trading Tweaks

List of securities shortlisted in Short-Term ASM Framework Stage - I: Jaiprakash Power Ventures, Prime Focus, Univastu India.

List of securities to be excluded from ASM Framework: PC Jeweller.

Price Band change to 5% from 10%: Rajoo Engineers

Price Band change to 2% from 5%: Kesoram Industries, SKM Egg Products Export (India)

Ex-Dividend: Anant Raj, Piramal Pharma, TCI Express, TCS, Avadh Sugar and energy.

Ex-bonus Issue: Ashok Leyland (1:1)

F&O Cues

Nifty July futures up by 0.46% to 25,283 at a premium of 88 points.

Nifty July futures open interest down by 0.28%.

Nifty Options 17 July Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: Glenmark Pharma, Hindustan Copper, RBL Bank.

Currency & Bond Markets Update

The Indian rupee appreciated by 18 paise against the US dollar, closing at 85.81 on Tuesday. The yield on the benchmark 10-year bond settled one basis point lower at 6.31% on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.