Oil ticked higher after a two-day drop, as traders assessed signs of near-term market strength ahead of US inventory figures.

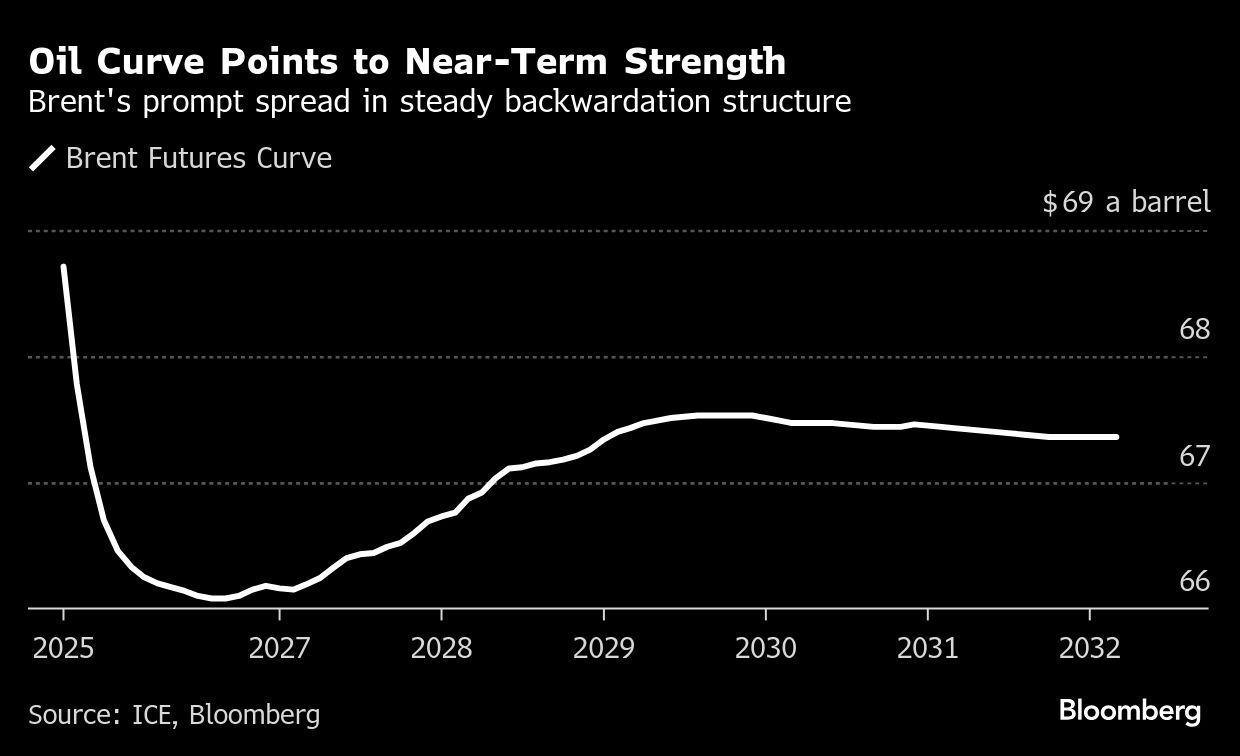

Brent rose to $69 a barrel, while West Texas Intermediate was near $67. Crude's near-term market structure continues to point to tightness. Brent's prompt spread — the difference between its two nearest contracts — remains more than 90 cents a barrel in backwardation, a pattern that shows traders need to pay a premium to secure more immediate supply.

Meanwhile, a US industry estimate showed a small build in nationwide crude inventories, with official data due later Wednesday. Traders are likely to pay close attention to shifts in distillates — a category that includes diesel — with holdings recently touching their lowest level since 2005.

Oil has gained ground so far in July, after rising in May and June. The advance has come despite market jitters triggered by US President Donald Trump's aggressive bid to reshape the global trading system, as well as a series of output hikes from OPEC+. Earlier this week, Goldman Sachs Group Inc. raised its Brent forecast for this half, although it remained cautious about 2026.

“In the very near term, price risks for crude still point higher,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp., adding that initial signs are showing that global crude inventories are increasing again on increased production. “Thus we see the inventory story weighing on prices, adding to the ‘cap' on Brent above the $70 level.”

While global crude inventories have been swelling in recent months, the bulk of the accumulation has come in markets that have relatively little impact on futures prices, according to Morgan Stanley.

“The Brent futures curve remains firmly in backwardation across the first four-to-six months — a structure that usually points to market tightness,” analysts including Martijn Rats said in a note, which highlighted what they described as an uneven distribution of inventory increases. “The builds have been in the Pacific, but Brent is priced in the Atlantic,” they said.

Prices:

Brent for September settlement gained 0.4% to $69 a barrel at 8:47 a.m. in Singapore

WTI for August delivery added 0.6% to $66.90 a barrel

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.