The GIFT Nifty is down 17 points at 25,177 as of 7:40 a.m., indicating a flat start to the benchmark Nifty 50 later in the morning.

US and European equity-index futures dropped and safe-haven assets edged up Monday following President Donald Trump's weekend declaration of a 30% tariff on goods from the European Union and Mexico.

S&P 500 futures down 0.4%

Euro Stoxx 50 futures down 1.2%

Watch NDTV Profit Live

Markets On Home Turf

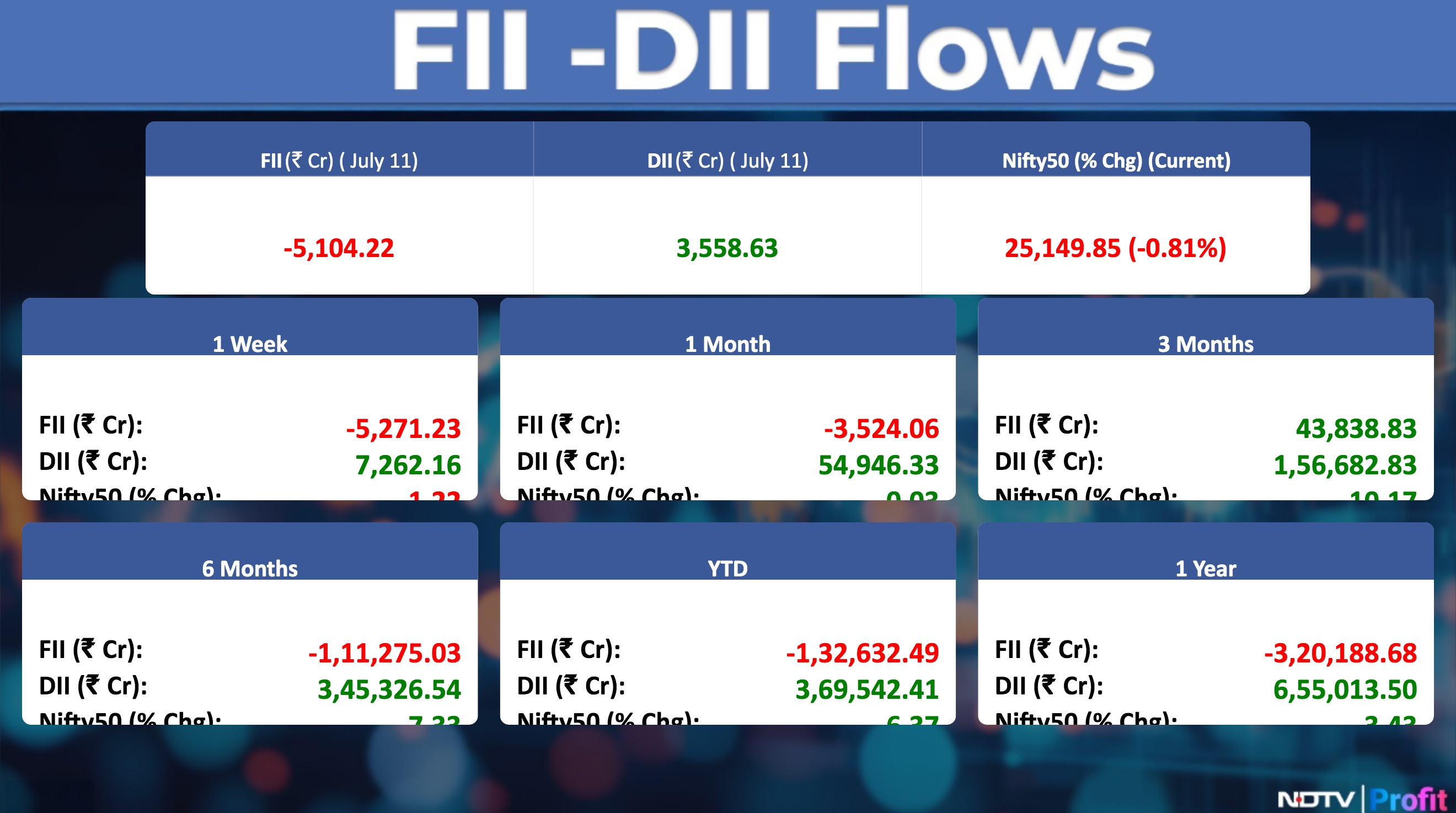

The Indian benchmark equity indices continued to fall for the third straight session on Friday, dragged by share prices of HDFC Bank Ltd., Reliance Industries Ltd. and Tata Consultancy Services Ltd.

The NSE Nifty 50 ended 205.4 points or 0.81% lower at 25,149.85, while the BSE Sensex closed 689.81 points, or 0.83% down at 82,500.47.

On a weekly basis, the Nifty declined 1.22% and Sensex over 1.12%. The Nifty lost Rs 1.77 lakh crore in market capitalisation on Friday.

Wall Street Recap

US equities closed lower on Friday, as President Donald Trump intensified his trade strategy. The S&P 500 fell 0.3%, with nine of the eleven sectors in the red. The benchmark also ended the week down 0.3% after being bombarded by a continuous stream of tariff news.

The Nasdaq Composite fell 0.2% and the Dow Jones Industrial Average retreated 0.6%.

Asian Markets Today

Asian equities are trading mixed on Monday, with benchmarks in Japan trading lower. Focus will soon shift to Chinese trade data to gauge the impact of US tariffs and the potential of front-loading of shipments.

Nikkei down 0.4%

Topix down 0.4%

Kospi up 0.5%

S&P/ASX 200 flat

Hang Seng futures up 0.2%

Commodities Check

Oil steadied after President Donald Trump escalated the trade war, with threats of 30% tariffs on goods from the European Union and Mexico hurting appetite for risk and the outlook for energy demand.

Global benchmark Brent was little changed above $70 a barrel, after gaining 3% last week, while West Texas Intermediate was above $68.

Prices of industrial metals on the London Metal Exchange due to trade tensions and a negative outlook for demand.

Copper down 0.4%

Aluminium down 0.2%

Nickel down 0.6%

Zinc down 1.4%

Lead down 1.1%

Key Data To Watch

The government will release retail as well as wholesale inflation data for the month of June.

The Consumer Price Index-based inflation is projected to ease to 2.33% in June, according to a median forecast of economists polled by Bloomberg. This is after it came in at 2.82% in May — the lowest in 75 months and below the central bank's target of 4%.

The Wholesale Price Index is estimated to rise by 0.53%, compared to 0.39% a month ago.

Earnings In Focus

HCLTech, Ola Electric, Rallis India, Tata Technologies, Tejas Networks, Kesoram Industries.

Earnings Post Markets

DMart Q1FY26 Highlights (Consolidated, QoQ)

Revenue up 16.3% to Rs 16,359.7 crore versus Rs 14,069.14 crore (Bloomberg estimate: Rs 16,583 crore).

Ebitda up 6% to Rs 1,299.04 crore versus Rs 1,221.25 crore (Bloomberg estimate: Rs 1,354 crore).

Ebitda margin at 7.9% versus 8.7% (Bloomberg estimate: 8.2%).

Net profit down 0.1% to Rs 772.81 crore versus Rs 77.68 crore (Bloomberg estimate: Rs 883 crore).

Stocks in News

GIC Housing Finance: The board approved the reclassification of properties previously held for sale, merging them with loans categorised as financial assets at amortised cost.

Gland Pharma: The company received a 'Good Manufacturing Practices' compliance certificate from the Danish Medicines Agency for aseptically prepared powder for injection, infusion and inhalation.

Wockhardt: The company is initiating a strategic realignment of its US operations to focus on its innovative portfolio. As part of this transition, it has decided to exit the US generic pharmaceutical segment. The company has filed for voluntary liquidation of its US subsidiaries Morton Grove Pharma and Wockhardt USA.

All Cargo Terminals: The company reported CFS volumes of 48,700 TEUs in June 2025, compared to 51,000 TEUs in May 2025.

RailTel Corporation: The company received an order worth Rs 10 crore from Indian Overseas Bank.

Ashiana Housing: In its first quarter business update, the company reported an increase in booked area to 5.95 lakh sq ft, up from 4.42 lakh sq ft a year ago. The value of area sold rose significantly to Rs 431 crore from Rs 235 crore. Ashiana Tarang Phase 6 in Bhiwadi saw 117 out of 192 units sold, while Ashiana Aravali in Jaipur launched with 30 out of 50 units sold. The company also allotted NCDs worth Rs 100 crore on a private placement basis.

Infosys: Subsidiary Infosys McCamish Systems entered into a stipulation and consent order with the Vermont Department of Financial Regulation (DFR) to resolve alleged violations of the Vermont Security Breach Notice Act. The order settles the matter without a formal hearing.

BEML: The board will meet on July 21 to consider a stock split.

Force Motors: The company announced that the high court has set aside re-assessment notices and related proceedings for the financial years 2017–18 and 2019–20, which had previously been challenged.

Devyani International: Subsidiary Sky Gate completed the acquisition of additional stakes in Blackvelvet Hospitality and Say Chefs Eatery.

RVNL: The company received a letter of acceptance for an order worth Rs 213 crore from South Central Railway.

SBI: The bank sold a 2.02% stake in Tamilnadu Telecommunications via the open market.

IRB Infrastructure: June gross toll collection rose 5% year-on-year to Rs 545 crore, while first quarter fiscal 2026 gross toll collection increased 8% to Rs 1,680 crore.

Ajmera Realty: The company reported a 52% year-on-year increase in residential carpet area sold, reaching 63,244 sq ft. Residential sales value rose 65% to Rs 108 crore, and collections grew 42% to Rs 234 crore in quarter fiscal 2026.

HUL: The company clarified that Ritesh Tiwari continues to serve as Executive Director, Finance, IT and CFO.

Sarda Energy: A subsidiary has terminated its long-term agreement with Chhattisgarh State Power Distribution Company due to non-compliance.

Castrol India: The company won a Rs 4,131 crore MVAT tax dispute. CESTAT dismissed appeals from the Maharashtra Sales Tax Department for fiscal 2007–08 to 2015–16 and 2017–18.

Sula Vineyards: Revenue for first quarter of financial year 2026 declined by nearly 8% year-on-year to Rs 118.3 crore. Own brand sales fell 10.8% to Rs 102.3 crore. Wine tourism revenue rose 21.8% to Rs 13.7 crore, driven by higher footfalls and guest spending.

RITES: The company secured a Rs 46.8 crore order from the Department of Collegiate & Technical Education for work across various locations in Karnataka under the PM USHA scheme.

Religare Enterprises: The company plans to raise Rs 1,500 crore through contributions from promoters (Rs 750 crore) and 11 investors (Rs 750 crore). Warrants have been issued at Rs 235, a 13% discount. Promoter holding will increase to 29.6% from 25.7%.

DLF: The company settled an arbitration dispute involving Hubtown and others. Twenty-Five Downtown Realty will pay a specified amount in tranches over 24 months, with the first tranche of Rs 100 crore already received.

NCC: Received a letter of acceptance worth Rs 2,269 crore from the MMRDA for Mumbai Metro Line 6 – Package 1-CA-232.

VIP Industries: Promoters clarified that discussions on strategic opportunities are ongoing and no stake sale has been finalised, addressing recent market speculation.

Shriram Finance: The board approved purchase and repurchase of outstanding NCDs.

Man Infra: Approved conversion of 29.6 lakh convertible warrants into shares worth Rs 34 crore.

Manappuram Finance: Reappointed Harshan Kollara Sankarakuśy as Non-Executive Independent Director for a five-year term from 28 August.

Associated Alcohols & Breweries: Revised its franchisee arrangement with Inbrew Beverages for IMFL production to a Job Work Arrangement.

DCM Shriram: The UP Excise Commissioner has reinstated import/export fees on denatured alcohol with retrospective effect from FY19 to FY25. The estimated financial impact is Rs 40 crore.

Akzo Nobel: JSW Paints launched a Rs 3,929 crore open offer to acquire up to 25.2% stake at Rs 3,417.77 per share.

Power Grid: Subsidiary POWERGRID ER NER commissioned its Inter-State Transmission System from July 3.

HUDCO: Signed an agreement with Madhya Pradesh Urban Development Co for Rs 1 lakh crore in financial assistance for housing and infrastructure projects.

Ramky: Exited the trust and retention account mechanism following restructuring agreements. The company currently has no term loans.

Navin Fluorine: Approved allotment of 16 lakh shares to QIBs at Rs 4,680 per share, reflecting a Rs 118.2 discount to the floor price.

Jubilant FoodWorks: Subsidiary Fidesrus completed the transfer of its 100% stake in Pizza Restaurants LLC in Russia.

Marico: Expects its digital-first portfolio to reach 2.5x FY24's exit run rate by finacial year 2027.

Vintage Coffee & Beverages: Promoter Balakrishna Tati pledged 50 lakh shares (3.84%) to Nuezen Finance, raising his total pledged stake to 7.62%.

Ramco Cements: Disposed of non-core assets worth Rs 483.84 crore, part of its Rs 1,000 crore non-core asset monetisation plan.

JB Chemicals: Torrent Pharma launched a Rs 6,843 crore open offer to acquire 4.2 crore shares (26%) at Rs 1,639.18 per share.

Share India Securities: Received no adverse observations from BSE for its merger with Silverleaf Capital Services.

Kolte Patil Developers Q1 Business Update: Value of new area sales down 13.3% at Rs 616 crore and olume of new area sales down 12.5% at 0.84 million sq ft. Realisation per sq ft down 0.9% at Rs 7,337 and collections down 10.1% at Rs 550 crore.

Ceinsys Tech: Received a letter of intent worth Rs 5.8 crore from Nashik Municipal Corporation for PMC services for sewage management.

Apeejay Surendra Park Hotels: Signed an MoU to acquire and manage four properties in Goa, Manali, Shimla and Dharamshala on a 12-year lease, covering 138 rooms.

Reliance Infrastructure: Board to consider a fundraising plan on 16 July via equity shares or NCDs.

Vishnu Prakash R Punglia: Received a Rs 77.9 crore construction order from Jaipur Development Authority.

Neogen Chemicals: Approved raising Rs 200 crore through issuance of NCDs on a private placement basis.

Adani Green Energy: Allotted 2.24 crore convertible warrants to Ardour. Ardour opted to convert 1.08 crore into shares. Ardour is a promoter group entity.

AGI Infra: Received RERA approval for a 1,095-unit housing project ‘Urbana Township Extension' in Jalandhar.

Amber Enterprises India: Approved an enabling resolution to raise up to Rs 2,500 crore via permissible securities.

TGV SRAAC: Approved setting up of a 40 MW solar power plant near the factory at a cost of Rs 120 crore, funded through internal accruals.

Hindustan Copper: The company stated that any 50% US tariff on copper may not affect the company, as it sells copper concentrate primarily within India.

Titagarh Rail: Entered a 99-year lease agreement with the West Bengal Governor for 40 acres of land at a total cost of Rs 126.63 crore.

Andhra Paper: Management revoked the lockout at its Rajahmundry unit in Andhra Pradesh.

Zydus Lifesciences: US arm Zydus Pharmaceuticals USA Inc. incorporated a new subsidiary, Zylidac Bio LLC, which is now a related party.

Tata Motors: Jaguar Land Rover North America recalls about 21,000 US vehicles over torn passenger airbags.

Power stocks: They will remain in focus as the government's FGD rule relaxation to cut electricity cost by 25-30 paise a unit.

VIP Industries: Promoter to sell 32% stake to multiple private equity investors.

NLC India: Firm to invest Rs 1.25 lakh crore capex by 2030, as it bets big on renewable energy.

IPO Offering

Smartworks Coworking Spaces: The public issue was subscribed to 1.15 times on day 2. The bids were led by Qualified institutional investors (0.63 times), non-institutional investors (1.79 times), retail investors (1.18 times) and reserved for employees (1.01 times).

Anthem Biosciences: The company will offer shares for bidding on Monday. The price band is set from Rs 540 to Rs 570 per share. The Rs 3395-crore IPO is entirely an offer for sale. The company raised Rs 1,106 crore from anchor investors.

Block Deal

Dr Agarwals Health Care L: Bofa Securities Europe SA bought 2.7 lakh shares (0.09%) at Rs 436 apiece, while Morgan Stanley Asia Singapore PTE sold 2.7 lakh shares (0.09%) at Rs 436 apiece.

Bulk Deal

Cupid: P.G. Infraprojects sold 18.4 lakh shares (0.68%) at Rs. 115.51 apiece

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: Lloyds Engineering Works, Sambhv Steel Tubes, Veranda Learning Solutions.

List of securities to be excluded from ASM Framework: Jeena Sikho Lifecare.

Price Band change to 5% from 20%: Rossell Techsys.

Price Band change to 5% from 10%: Securekloud Technologies

Ex-Dividend: Crafts Automations, Persistent Systems, R R Kabel, Wendt (India), GHCL Textiles.

F&O Cues

Nifty July futures down by 0.84% to 25,208 at a premium of 59 points.

Nifty July futures open interest down by 0.11%.

Nifty Options 17 July Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 24,000.

Securities in ban period: Glenmark Pharma, Hindustan Copper, RBL Bank.

Currency & Bond Markets Update

The Indian rupee slipped after a three-week gaining streak against the US dollar, ending 0.5% lower for the period ending July 11. The benchmark yield on the 10-year bond settled one flat at 6.32% on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.