The GIFT Nifty traded 126 points lower at 25,278 as of 6:50 a.m., indicating a fall for the benchmark Nifty 50 after market open.

Asian equities were trading mixed while contracts for the S&P 500 reversed their earlier gains and fell. The dollar rose.

S&P 500 futures down 0.5%

Euro Stoxx 50 futures down 0.6%

Markets On Home Turf

The Indian benchmark equity indices continued to fall for a second session on Thursday, dragged by share prices of Bharti Airtel Ltd., and HDFC Life Insurance Co.

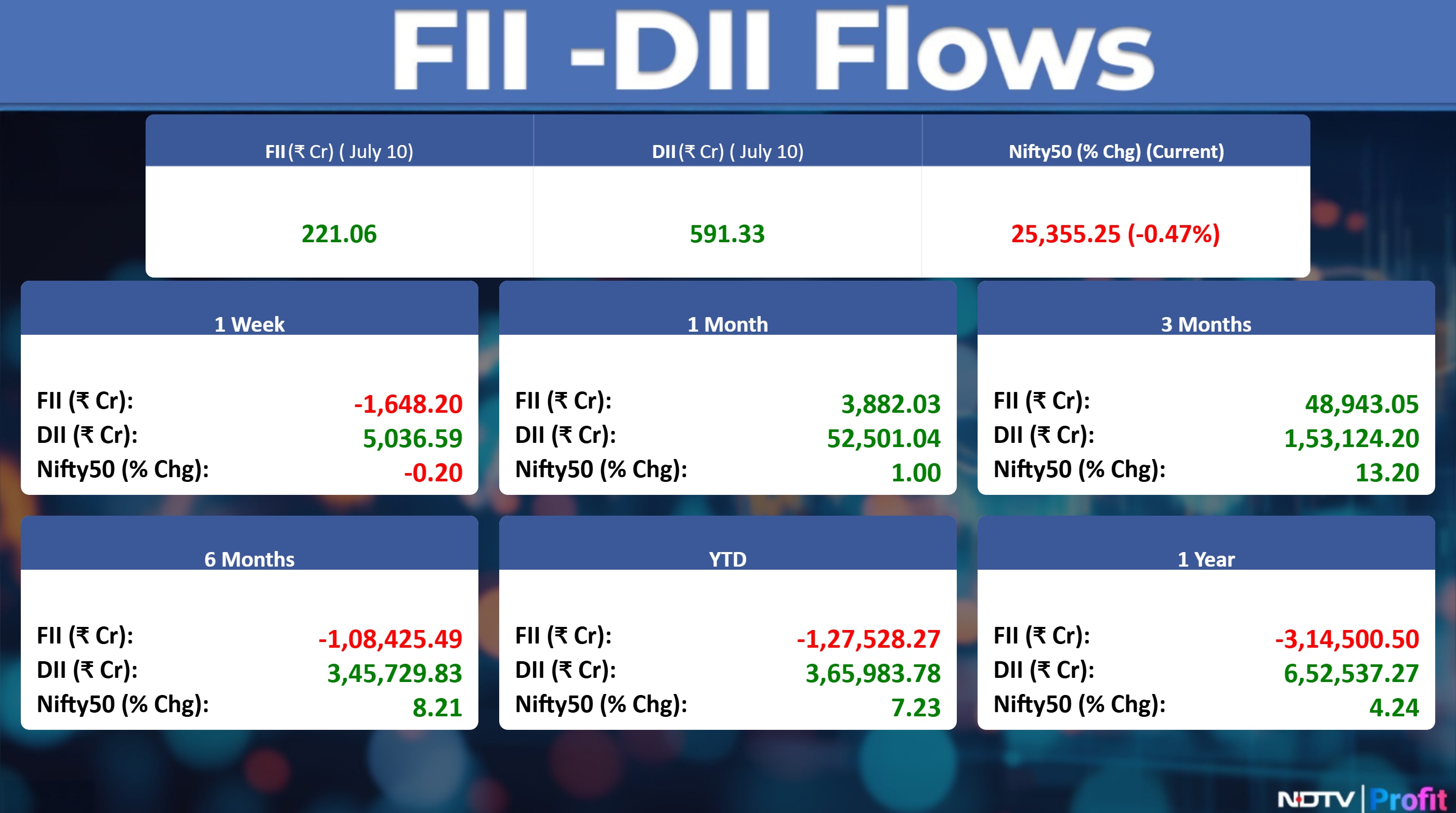

The NSE Nifty 50 ended 120.85 points, or 0.47% lower at 25,355.25, while the BSE Sensex closed 345.80 points, or 0.41% down at 83,190.28. During the day, Nifty fell 0.53% to trade at 25,340.45 and Sensex declined 0.48% to 83,134.97.

Wall Street Recap

US equities closed at a new all-time high on Thursday as investors parsed a slew of tariff headlines and looked ahead to corporate results that are due to start next week.

The S&P 500 Index added 0.3%, with nine of the 11 sectors rising, led by consumer discretionary and energy. The Nasdaq 100 dipped 0.2%, and the Dow Jones Industrial Average jumped 0.4% to trade near its all-time high reached in December.

Asian Markets Now

Asian equities were mixed as the dollar strengthened after President Donald Trump ratcheted up trade tensions yet again by floating a higher “blanket tariffs” rate on most trading partners.

Nikkei up 0.3%

Topix up 0.7%

Kospi flat

S&P/ASX 200 flat

Hang Seng futures up 0.7%

Commodities Check

Oil steadied after falling more than 2% on Thursday as investors weighed the fallout from OPEC+ supply and President Donald Trump's tariffs. West Texas Intermediate was near $67 a barrel and Brent closed below $69 in the previous session.

Industrial metals' prices were up on the London Metal Exchange.

Copper up 0.7%

Aluminium up 0.4%

Nickel up 2%

Zinc up 1.3%

Lead down 0.6%

Earnings In Focus

Avenue Supermart and Elecon Engineering.

Earnings Post Markets

Tata Consultancy Services Q1FY26 Highlights (Consolidated, QoQ)

Revenue down 1.6% to Rs 63,437 crore versus Rs 64,479 crore (Bloomberg Estimate: Rs 64,627.9 crore).

EBIT down 1% at Rs 15,514 crore versus Rs 15,601 crore (Bloomberg Estimate: Rs 15,703 crore).

Margin at 24.5% versus 24.2% (Bloomberg estimate: 24.29%).

Net profit up 4.4% at Rs 12,760 crore versus Rs 12,224 crore (Bloomberg Estimate: Rs 12,251 crore).

Total contract value at $9.4 billion versus $12.2 billion (QoQ)

LTM IT services attrition rate at 13.8% versus 13.3% (QoQ)

K Krithivasan, CEO and MD said: Continued global macro-economic and geo-political uncertainties caused a demand contraction.

All the new services grew well.

Saw robust deal closures during this quarter.

Anand Rathi Q1 FY26

Revenue at Rs 274 crore versus Rs 222 crore up 23.42% quarter-on-quarter, 15% year-on-year.

Net profit at Rs 93.91 crore versus Rs 73.4 crore up 27.42% quarter-on-quarter, 27.87% year-on-year.

Profit at Rs 126 crore versus Rs 99.46 crore up 27.27% quarter-on-quarter, 27% year-on-year.

Other Income rises to Rs 10.24 crore from Rs 7.8 crore, but lower from Rs 19.43 crore quarter-on-quarter.

AUM grew by 27% year-on-year to Rs 87,797 crore.

Guidance for FY26: Revenue at Rs 1175 crore, profit at Rs 375 crore, AUM at Rs 1 lakh crore.

IREDA Q1 FY26 (Cons, YoY)

NII up 36.02% at Rs 691 crore versus Rs 508 crore.

Net profit down 35.67% at Rs 247 crore versus Rs 384 crore.

GNPA at 4.13% vs 2.45% (QoQ).

NNPA at 2.06% vs 1.35% (QoQ).

Impairment grew by 180% to 363 crore (QoQ).

Loan Book at 79,941 crore versus 63,207 crore up 26% (YoY).

Yield on Loan Assets 9.95% vs 10.03% (QoQ).

Cost of borrowings at 7.40% vs 7.61% (QoQ).

Net Interest Margin at 3.6% vs 3.27% (QoQ).

Tata Elxsi Q1 Result Highlights (QoQ)

Revenue down 1.8% to Rs 892.10 crore versus Rs 908.34 crore.

EBIT down 11% to Rs 162.44 crore versus Rs 182.97 crore.

Margin at 18.2% versus 20.1%.

Net Profit down 16% to Rs 144.37 crore versus Rs 172.42 crore.

Manoj Raghavan, CEO and MD said, "This quarter was challenging across key markets. Macroeconomic uncertainties, industry and customer specific issues impact R&D spend and decision-making cycles across geographies."

Segment Revenue: Media and Communication Business reported a decline of 5.5% QoQ in constant currency terms. Transportation business (50% of Revenues) reported a 3.7% growth QoQ in actual currency, and flat in cc terms.

Stocks In News

HUL: Rohit Jawa to step down as managing director and chief executive officer effective July 31. The company appointed Priya Nair as MD & CEO for 5 years, effective Aug. 1.

Glenmark Pharma: Arm IGI Therapeutics SA & AbbVie, a global biopharmaceutical company, announced an exclusive global licensing agreement for cancer and autoimmune drug ISB 2001. AbbVie to get exclusive rights to manufacture & commercialize ISB 2001 across North America, Europe, Japan, and Greater China. IGI will get an upfront payment of $700 million and is eligible to get up to $1.225 billion. ISB 2001 is currently in Phase I clinical trials in patients with relapsed/refractory multiple myeloma.

Zee Entertainment: Zee Entertainment Enterprises shareholders on Thursday rejected proposal to raise Rs 2,237 crore via warrants issuance to promoters. The resolution was rejected as number of votes cast in favour was less than three times the number of votes cast against it. While 32.47 crore, or 59.5%, of the votes came in favour of the resolution, 22.09 crore votes were cast against it, which translated to rejection from 40.5% of the shareholders.

Spandana Sphoorthy: The board is to meet on July 15 to consider the proposal for raising funds.

Senores Pharma: The company acquired 2.97% stake in Havix Group Inc.

Centrum Capital: The board is to meet on July 15 to approve the proposal for raising funds via equity or any other means.

Western Carriers: The company completed construction of the Gati Shakti Multi Modal Cargo Terminal in Gujarat.

Prestige Estates: The company issued issuing Corporate Guarantee towards Term Loan Facility being availed by Thomsun Realtors, JV.

PC Jeweller: The company raised Rs 500 crore by preferential allotment of shares & warrants on a private placement basis.

Ircon International: SA Yadav initiates a claim of Rs 72.9 crore against the company in the Arbitral Tribunal.

PDS: Arm acquired a 60% stake in GSC Link. The acquisition received the requisite approval from the relevant regulatory authorities in Hong Kong today, and the transaction is effective from July 1, 2025. Consequently, GSCL has become a step-down subsidiary of the company with effect from the same date.

Popular Vehicles: Arm received a letter of intent for setting up Ather facilities in Chennai.

Mphasis: Arm acquires a 26% stake in Aokah, a Delaware-based Corp. in the US for $4 million.

Consolidated Construction: The company received Rs 200 crore order for the construction of buildings and factories.

GTPL Hathway: The company reappointed Anirudhsinh Jadeja as MD for a further three years.

South Indian Bank: The board is to meet on July 17 to consider raising funds via equity.

Aegis Logistics: The company agrees to transfer the Pipavav LPG cryogenic terminal to Aegis Vopak Terminals for Rs 428 crore.

Tourism Finance Corp: The board approved splitting one existing share into five.

State Bank of India: The board is to meet on July 16 to consider raising funds via issuance of Basel III capital bonds.

M&M Financial Services: The company approved the issuance of NCDs worth up to Rs 100 crore on a private placement basis.

Bank of Baroda: The bank reduced its overnight MCLR rate by 5 basis points effective July 12.

Birla Corp: The company emerged as a preferred bidder for the grant of a mining lease for Tadas limestone Block-II district, Nagaur, Rajasthan.

SBI Cards: Shantanu Srivastava tenders' resignation from the post of Chief Risk Officer, effective Oct. 6.

Krystal Integrated: The company received Rs 20.3 crore facility management contract for the New Terminal at Patna Airport.

JSW Infra: The creditors approved the company's resolution plan for NCR rail Infrastructure.

Lemon Tree: The company signed two new properties in Maharashtra.

Titagarh Rail Systems: The company to raise up to Rs 200 crore via issuing f 21 lakh convertible warrants. The floor price is Rs 945 per share.

Eicher Motors: Arm VECV receives demand cum show cause notice of Rs 168 crore from Ujjain GST body for financial year 2018.

Tata Steel: The company acquired 124.6 crore shares aggregating to Rs 1,074 crore in foreign arm T steel holdings Pte.

TBO Tek: The company incorporated step-down arm in Poland.

IPO Offering

Smartworks Coworking Spaces: The public issue was subscribed to 0.5 times on day 1. There were no bids were led by Qualified institutional investors, non-institutional investors (1 times), retail investors (0.57 times) and reserved for employees (0.47 times).

Bulk Deals

Scoda Tubes: Saravana Securities D.Sathyamoorthi sold 6 lakh shares (1%) at Rs 206.69 apiece.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage - I: J.G Chemicals

List of securities to be excluded from ASM Framework: Cupid.

Price Band change to 20% from 5%: Dreamfolks Services

Ex-bonus Issue: Dynamic cables (1:1), Roto Pumps (2:1)

Ex-Dividend: Atul, Roto Pumps, Can Fin Homes, Nucleus Software Exports, D-Link (India), Mahindra Logistics, IDFC First Bank, Apollo Tyres, Shriram Finance, Sobha, Balkrishna Industries.

F&O Cues

Nifty July futures down by 0.57% to 25,414 at a premium of 59 points.

Nifty July futures open interest up by 0.07%.

Nifty Options July Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 24,000.

Securities in ban period: Hindustan Copper, RBL Bank.

Currency & Bond Markets Update

Rupee closed three paise stronger against US Dollar at 85.65. It closed at 85.68 against the greenback on Wednesday. The benchmark yield on the 10-year bond settled one basis points higher at 6.32% on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.