Rupee ends at 90.73 against the US Dollar.

Rupee hits at record low of nearly 90.80 against US dollar in intraday trade.

Rupee falls over 2% against the US Dollar in last one month.

Thank you for tagging along. See you tomorrow.

The benchmark equity indices snapped two-day winning streak.

Intraday, both Nifty and Sensex had fallen nearly 0.50%.

Nifty ends 19.65 points or 0.08% lower at 26,027.30

Sensex ends 54.30 points or 0.06% down at 85,213.36.

Broader indices also closed mixed. Nifty Midcap 150 ended 0.07% lower; Nifty Smallcap 250 closed 0.36% higher.

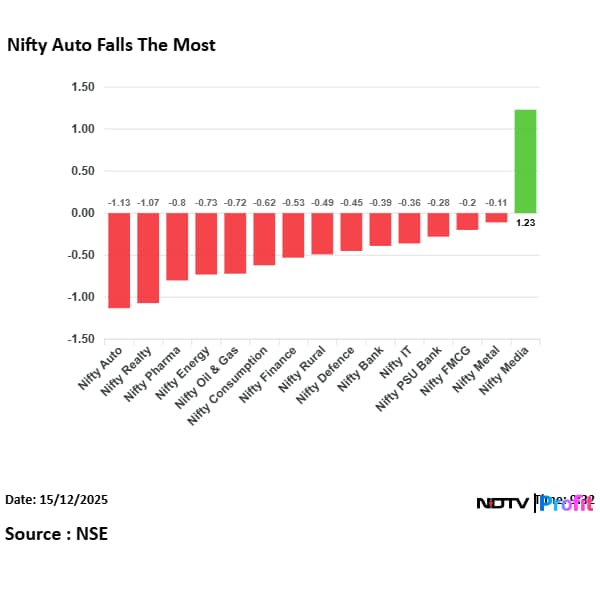

Most sectoral indices fell with Nifty auto leading the decline. Nifty Media and Nifty FMCG ended the day in green.

The market breadth was skewed in the favour of buyers, as 2,020 stocks declined, 2,244 advanced and 197 remained unchanged on the BSE.

HUL, ITC, IntergGlobe Aviation, L&T and HCLT emerged as the top gainers for the day.

On the other hand, HDFC Bank, Mahindra and Mahindra, Bharti Airtel, Eicher Motors and Maruti Suzuki were the worst performers of the Nifty 50 index.

The benchmark equity indices snapped two-day winning streak.

Intraday, both Nifty and Sensex had fallen nearly 0.50%.

Nifty ends 19.65 points or 0.08% lower at 26,027.30

Sensex ends 54.30 points or 0.06% down at 85,213.36.

Broader indices also closed mixed. Nifty Midcap 150 ended 0.07% lower; Nifty Smallcap 250 closed 0.36% higher.

Most sectoral indices fell with Nifty auto leading the decline. Nifty Media and Nifty FMCG ended the day in green.

The market breadth was skewed in the favour of buyers, as 2,020 stocks declined, 2,244 advanced and 197 remained unchanged on the BSE.

HUL, ITC, IntergGlobe Aviation, L&T and HCLT emerged as the top gainers for the day.

On the other hand, HDFC Bank, Mahindra and Mahindra, Bharti Airtel, Eicher Motors and Maruti Suzuki were the worst performers of the Nifty 50 index.

The sharp rally in Praveg Ltd. last year, driven by a series of high-profile tourism catalysts, appears to have lost momentum. The small-cap stock, which had surged on the back of the Ayodhya Ram Mandir inauguration, the Vibrant Gujarat Global Summit and the ‘Chalo Lakshadweep’ campaign, has corrected sharply since then. Over the past one year, the stock is down about 57%, highlighting how quickly sentiment has turned as the initial euphoria faded.

Birla Opus in focus —

Birla Opus remains solid force and is gaining market shares across segments

In spite of the exit of its CEO, we do not notice any impact on on-ground off-take

Dealers indicated that the confidence has increased in the brand quality as well as servicing

Many dealers believe Birla Opus has become the second major brand for them now

India’s corporate earnings are likely to see a meaningful revival in 2026 even as heavy equity supply remains a key overhang, Harish Krishnan, Co-CIO and Head of Equity at Aditya Birla Sun Life AMC, said.

"We do think earnings growth is likely to be revised upwards and there is going to be a stronger earnings growth coming through, primarily because of the tax cuts as well as the GST cuts, not to mention the rupee depreciation," he told NDTV Profit.

Former Yes Bank MD and CEO Rana Kapoor and Reliance Group chairman Anil Ambani allegedly entered into a 'quid pro quo' arrangement that caused significant financial losses to Yes Bank, Enforcement Directorate (ED) sources told NDTV Profit.

Check more details here.

Despite being heavily bullish on Indian markets heading into 2026, Vikas Khemani believes investors should exercise caution when investing in IPOs and the renewable space.

Speaking to NDTV Profit, the Carnelian Asset Management and Advisors CIO and Co-Founder explained that the quality of IPOs have gone down significantly in recent years, while regulation changes don't quite inspire hope for renewables.

India's trade deficit narrowed in November, driven by higher exports and dip in exports. The combined trade deficit was $24.53 billion last month, compared to $31.92 billion in the same period last year, as per data released by the government on Monday.

As the year draws to a close and investors begin to pencil in their 2026 watchlists, attention is shifting from what worked to what could lead next. With valuations resetting and growth themes re-emerging, a clutch of names is catching analysts’ attention as potential outperformers in the coming year.

Check the list here.

Nifty and Sensex see a rebound as the indices have risen over 100 points from day’s low.

Nifty FMCG and IT indices lead the recovery.

Action Construction and Aarti Industries among top gainers in Nifty Smallcap.

AIA Engineering and Dixon Technologies among top gainers in Midcap, gains over 2.5% in trade.

Bharat Rasayan Ltd. said on Monday that that the Bonus Issue Committee of the Board of Directors authorised the allotment of 8,310,536 fully paid-up bonus equity shares.

The company had previously announced a 1:1 bonus share issue, effectively doubling its paid-up share capital following a committee meeting on Monday.

PVR Inox Ltd. shares rose nearly 8% on Monday after the release of Dhurandhar and the release Of Avatar Part 3 draws optimism.

While we give you live updates, let's take a break to tune into the conversation of two market experts where they discuss new age valuation.

Similar was the case of Bharti. The company was making losses when it IPO'd at around USD 1 billion mkt cap and investors would ask why we were investing in a loss making company.

— Samir Arora (@Iamsamirarora) December 14, 2025

And the funniest thing people do when the company just turns from loss to profit ( and therefore… https://t.co/7nVdiiBCHj

WPI Inflation at -0.32% versus -1.21% in October.

WPI Core Inflation at 1.5% versus 1.5% In October.

Sept WPI Inflation revised to 0.19% from 0.13% provisional.

Fuel & power Inflation at -2.27% versus -2.55% in October.

Manufactured products inflation at 1.33% versus 1.54% in October.

Primary articles inflation at -2.93% versus -6.18% in October.

Food Inflation at -2.60% versus -5.04% in October.

Indian equities were trading lower after snapping its two day winning streak. Nifty fell nearly 0.11% at 26,020 and Sensex fell over 238.74 points at 85,028.92 as of 12 p.m.

Intraday, both Nifty and Sensex fell nearly 0.50%.

Nifty fell 0.55% to 25,904.75.

Sensex was fell 0.50% to 84,840.32.

Broader indices were trading mixed. Nifty Midcap 150 fell 0.28%; Nifty Smallcap 250 was trading 0.19% higher.

Most sectoral indices fell, led by Nifty Auto and Nifty Pharma.

Nifty Bank rose 0.11%, Nifty IT was up 0.17%.

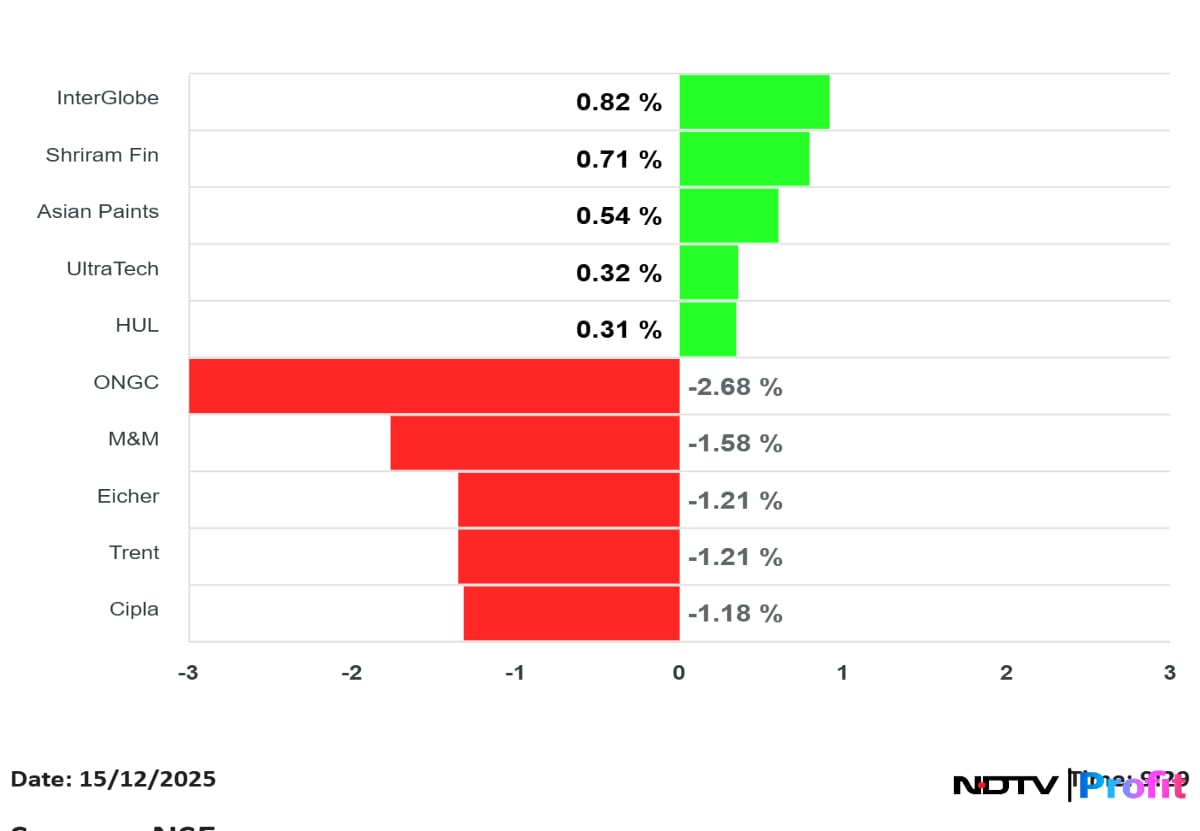

InterGlobe Aviation, SBI, ITC, HUL, Asian Paints were top Nifty gainers.

HDFC Bank, M&M, Bharti Airtel, ONGC, Eicher Motors were top Nifty losers.

The Indian rupee has slipped to a fresh record low of 90.72 against the US dollar on Monday, underscoring persistent currency pressure and marking the eighth consecutive year of sustained weakness. With the Indian currency under pressure sectors like IT, ancillaries, auto OEMs will be on the gaining side, while OMCs and Aviation will see some pressure.

Read more here.

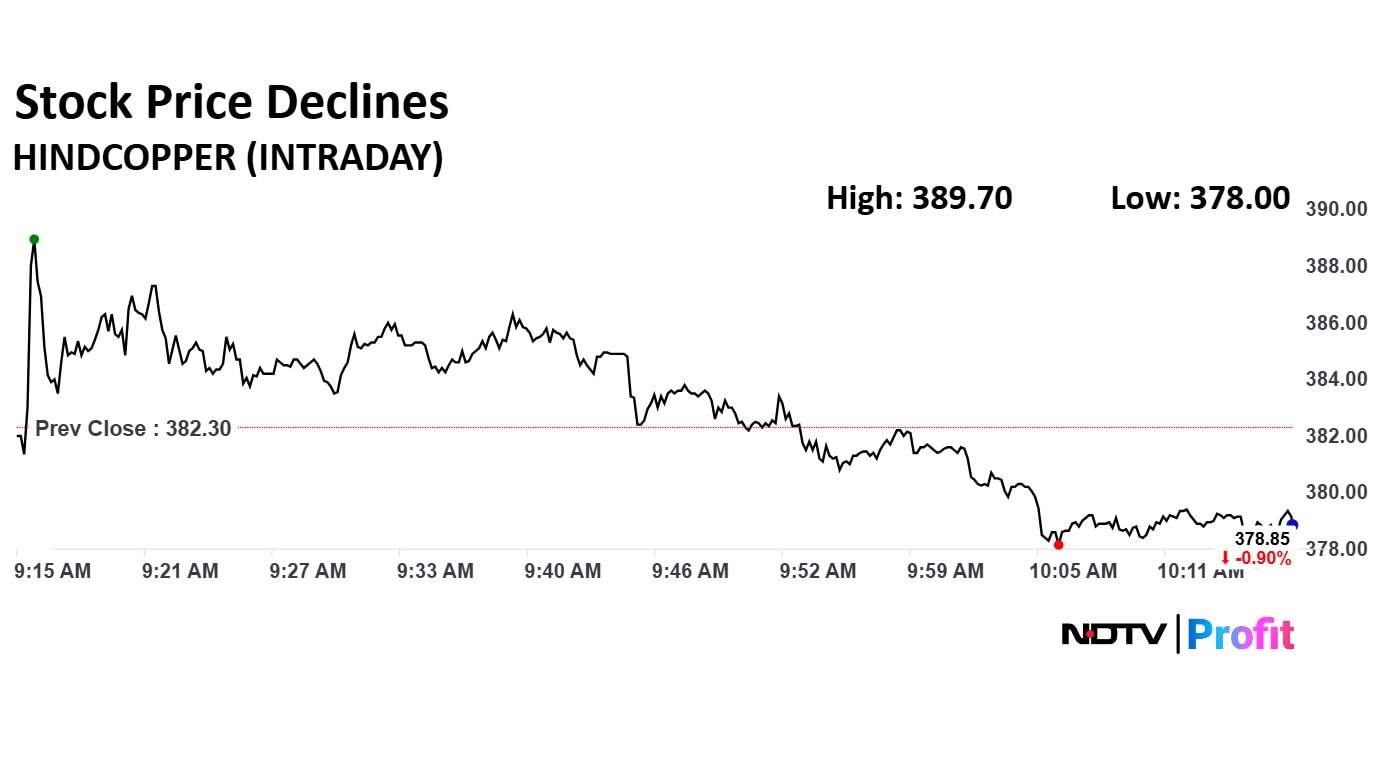

Hindustan Copper Ltd.'s stock opened lower on Monday but later gained nearly 2% before giving up gains to trade 1.12% lower on the exchanges.

Hindustan Copper Ltd.'s stock opened lower on Monday but later gained nearly 2% before giving up gains to trade 1.12% lower on the exchanges.

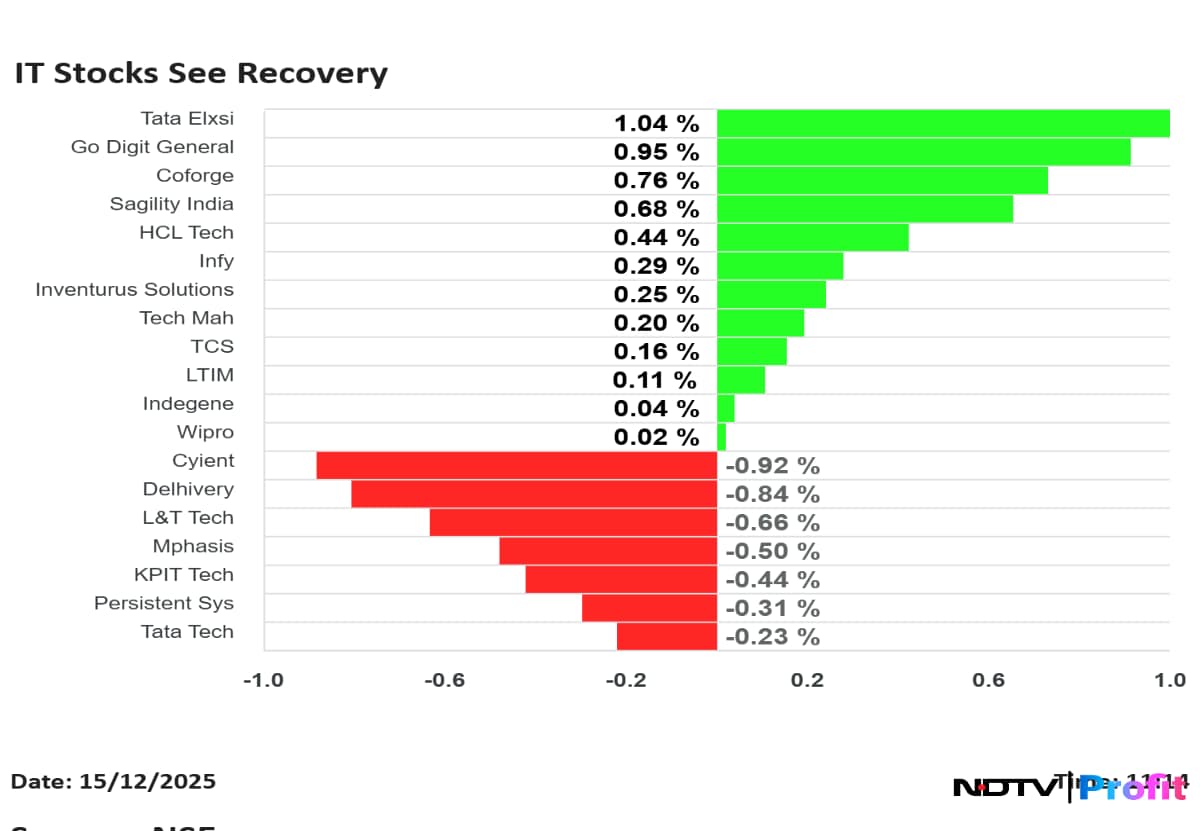

As Rupee hits fresh low, IT companies see recovery with Tata Elxsi and Go Digit General leading the gains.

As Rupee hits fresh low, IT companies see recovery with Tata Elxsi and Go Digit General leading the gains.

Overall subscription at 1.04x as of 10:45 a.m. on the second day.

QIBs lead with 1.97x subscription as of 10:45 a.m. on 2nd day.

NII subscription at 1.34x as of 10:45 a.m. second day of issue.

Over 42 million shares of Geojit Financial were traded via six block deals on Monday. The share of Geojit Financial fell as much as 3.48% to Rs 67.49 apiece before it rose to 8.70% to Rs 76 per share.

Rupee falls past the 90.70 mark on Monday. It opened at 90.57 against US Dollar.

The Indian currency had closed at 90.41 on Friday.

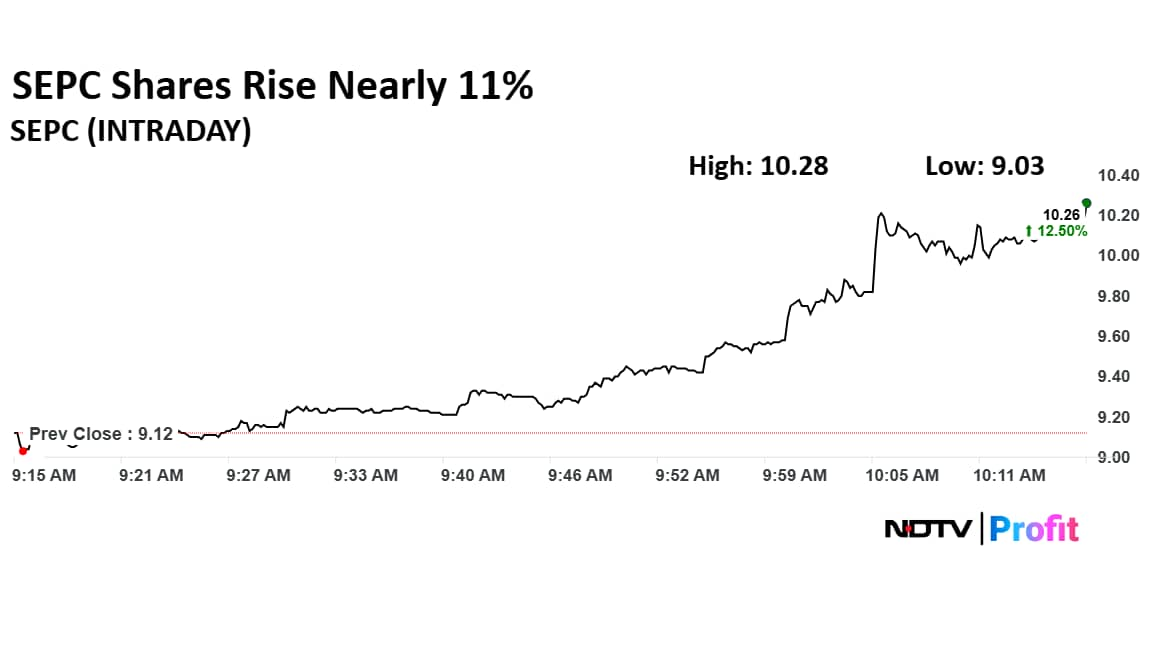

SEPC shares have risen nearly 11% on Monday after the company secures entry into Rs 3,300 crore Mining Consortium Project in Madhya Pradesh. The MoU was awarded by South Eastern Coalfields

The company has executed a MoU with Jai Ambey Roadlines & Avinash Transport, SEPC said in its exchange filing.

SEPC shares have risen nearly 11% on Monday after the company secures entry into Rs 3,300 crore Mining Consortium Project in Madhya Pradesh. The MoU was awarded by South Eastern Coalfields

The company has executed a MoU with Jai Ambey Roadlines & Avinash Transport, SEPC said in its exchange filing.

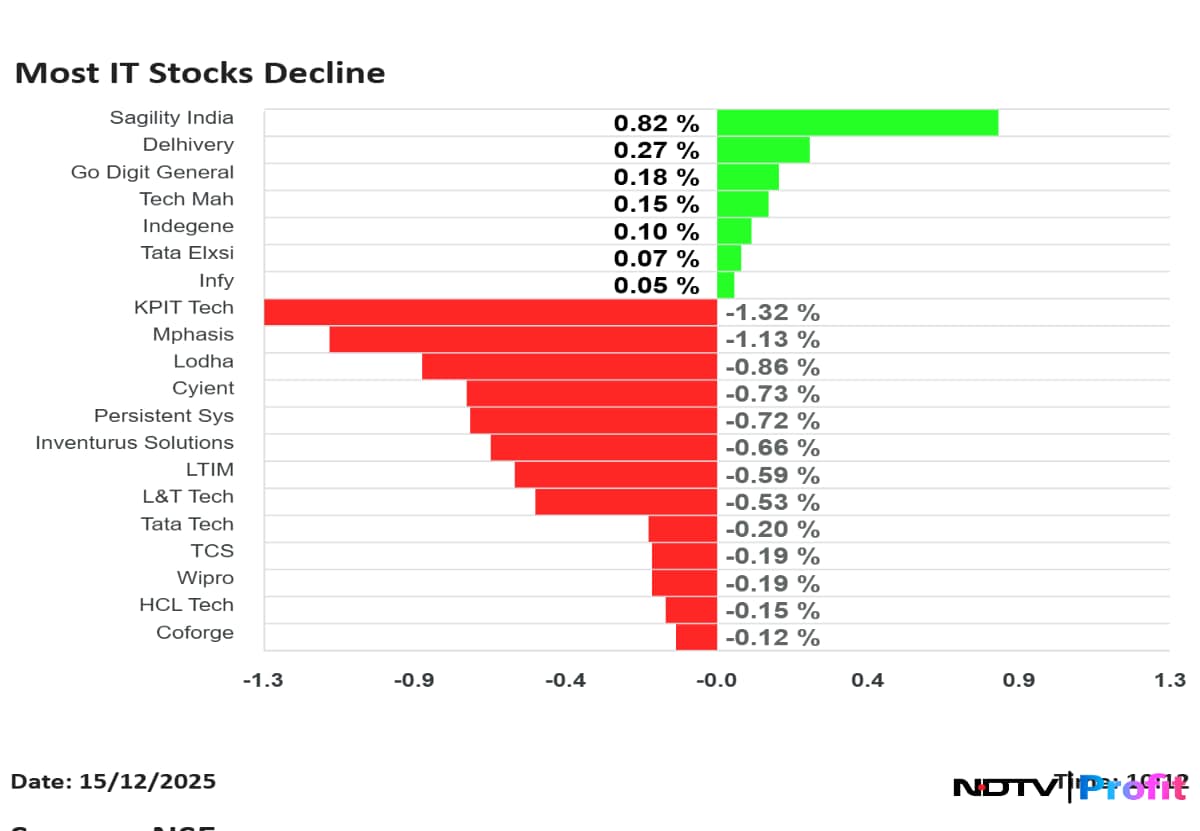

As the markets trade lower most IT stocks were trading in the red with KPIT Technologies, Mphasis and Cyient leading the decline.

As the markets trade lower most IT stocks were trading in the red with KPIT Technologies, Mphasis and Cyient leading the decline.

Shares of Wakefit Innovations listed on the National Stock Exchange at Rs 195 per share, marking a flat listing over their IPO price.

The company's stock was listed at Rs 194.1 on the BSE, which is lower than the IPO price of Rs 195.

Corona Remedies Ltd. listed on the National Stock Exchange on Monday at Rs 1,470 apiece, a premium of 38.42% over its issue price of Rs 1,470 apiece.

On the BSE, the stock debuted at Rs 1,452, a 36.72% premium.

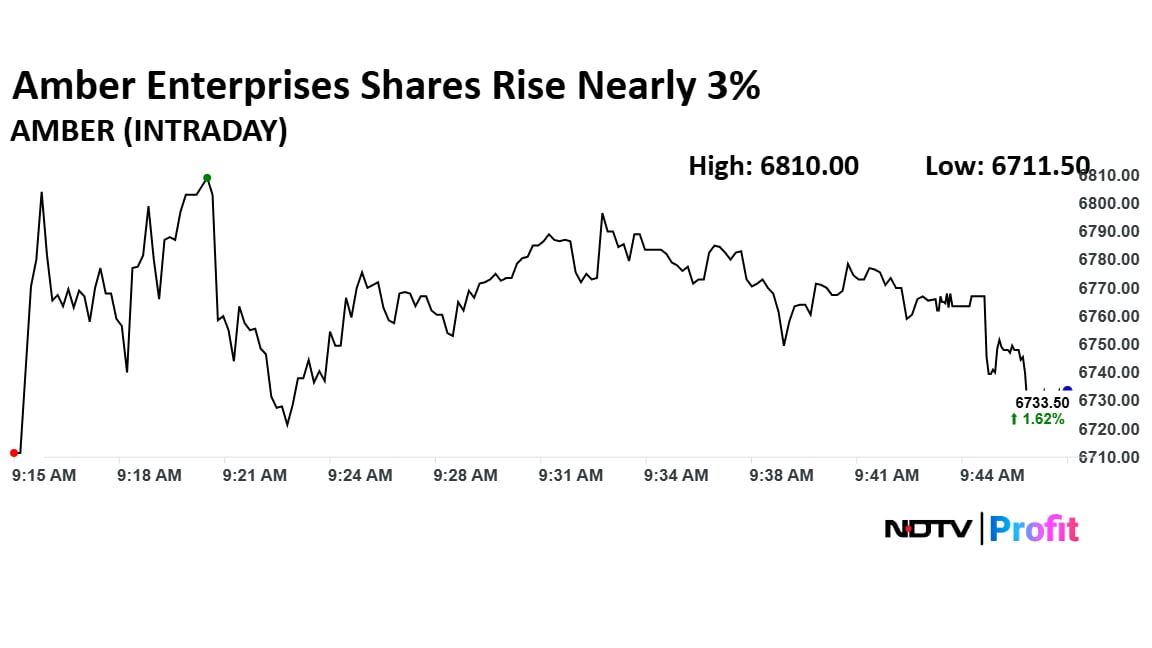

The shares of Amber Enterprises rose nearly 3% on Monday after Kotak Securities upgraded it to 'Buy' with a target price of Rs 8,100. However, Motilal Oswal cut its target price to Rs 8,000, while maintaining its buy rating.

The shares of Amber Enterprises rose nearly 3% on Monday after Kotak Securities upgraded it to 'Buy' with a target price of Rs 8,100. However, Motilal Oswal cut its target price to Rs 8,000, while maintaining its buy rating.

On NSE, 13 of the 14 sectors were in the red. The Nifty Auto was the worst performing sector after the open on Monday, while Nifty Media was the only sector in the green.

Broader markets were trading in red, with the NSE Midcap 150 was trading 0.47% lower and NSE Smallcap was trading 0.08% lower.

On NSE, 13 of the 14 sectors were in the red. The Nifty Auto was the worst performing sector after the open on Monday, while Nifty Media was the only sector in the green.

Broader markets were trading in red, with the NSE Midcap 150 was trading 0.47% lower and NSE Smallcap was trading 0.08% lower.

ONGC, Mahindra & Mahindra, Eicher Motors and Trent weighed on the Nifty 50 index.

InterGlobe Aviation, Shriram Finance, Asian Paints, UltraTech and HUL added to the Nifty 50 index.

ONGC, Mahindra & Mahindra, Eicher Motors and Trent weighed on the Nifty 50 index.

InterGlobe Aviation, Shriram Finance, Asian Paints, UltraTech and HUL added to the Nifty 50 index.

Shares of Vodafone Idea are gaining in trade on Monday following media reports of a potential relief from the government surrounding its massive adjusted gross revenue (AGR) liabilities.

The stock is currently trading at Rs 11.97, which accounts for gains of up almost 3% against Friday's close of Rs 11.64. The stock has gained almost 50% on a year-to-date basis.

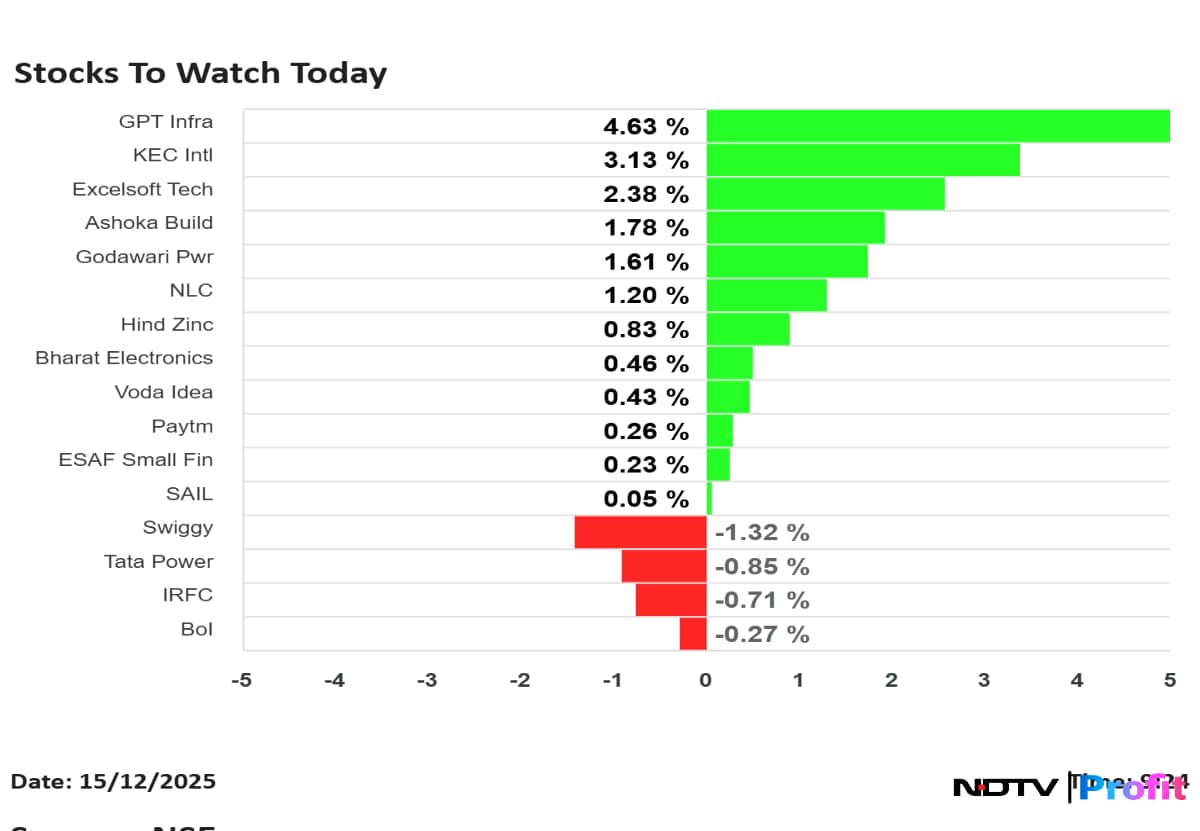

GPT Infra shares rose over 5% while Swiggy fell over 1% few minutes after the open.

GPT Infra shares rose over 5% while Swiggy fell over 1% few minutes after the open.

The NSE Nifty 50 and BSE Sensex opened lower on Monday. The Nifty 50 opened 0.45% lower at 25,930.05 snapping its two-day gaining streak and Sensex opened 0.44% down at 84,891.75.

At pre-open, the NSE Nifty 50 was trading 116.90 points or 0.45% lower at 25,930.05. The BSE Sensex was down 0.38% or 324.62 points at 84,943.04.

Rupee weakened 14 paise to hit new low of 90.57 against US Dollar.

It closed at 90.41 on Friday.

Source: Bloomberg

In what could be a massive development for Vodafone Idea, the government is poised to offer an interest-free moratorium for the company on account of its massive adjusted gross revenue (AGR) liabilities, reports The Economic Times.

The report points out that the government is planning a relief package that would cover the telecom operator's pending statutory dues, amounting to over Rs 83,000 crore.

After predicting Nifty to reach 28,800 levels in 2026, CLSA technical analyst Laurence Balanco believes Nifty mid-cap stocks are offering a major buy signal and could deliver gains of up to 22%.

In his latest Price Action note for CLSA, Balanco highlighted that the Nifty Midcap index has pulled back to a key confluence of support. This means the index is currently an attractive entry point for investors.

Jefferies on Monday has initiated coverage on Hindustan Zinc Ltd. with a Buy rating and a target price of Rs 660 due to attractive play on rising silver and zinc prices, supported by the company’s first-decile zinc mining costs and strong cash generation. The target price implies an upside of around 22%, including a dividend yield of about 4%.

Read full story here.

Nifty 16 Dec futures are up 0.53% to 26,145 at a premium of 99 points.

Nifty 16 Dec futures open interest up by 0.10%.

Nifty Options Dec Expiry: Maximum Call open interest at 26,500 and Maximum Put open interest at 26,000.

The US Dollar index is down 0.03% at 98.37.

Euro was down 0.02% at 1.1738.

Pound was down 0.04% at 1.3366.

Yen was up 0.13% at 155.61.

Asian stocks opened lower in the final full trading week of 2025, as growing doubts about the earnings outlook for technology companies — and the scale of their spending on artificial intelligence — weighed on risk appetite.

MSCI Inc.’s gauge of regional equities slid 0.4%, with South Korean shares — a bellwether for AI optimism — tumbling more than 2%. Futures tied to major US equity indexes swung between modest gains and losses on Monday, following a Wall Street session on Friday where technology stocks led declines. Bitcoin edged lower to trade near $88,000, extending a slide that has seen the cryptocurrency fall in six of the past seven weeks, reports Bloomberg.

Good morning.

The GIFT Nifty was trading above 26,000 early on Monday. The futures contract based on the benchmark Nifty 50 fell 0.31% at 26,053 as of 7:10 a.m. indicating a muted start for the Indian markets.

In the previous session on Friday, the benchmark equity extended their gains for the second day. The NSE Nifty 50 ended 148.40 points or 0.57% higher at 26,046.95, while the BSE Sensex closed 449.53 points or 0.53% higher at 85,267.66.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.