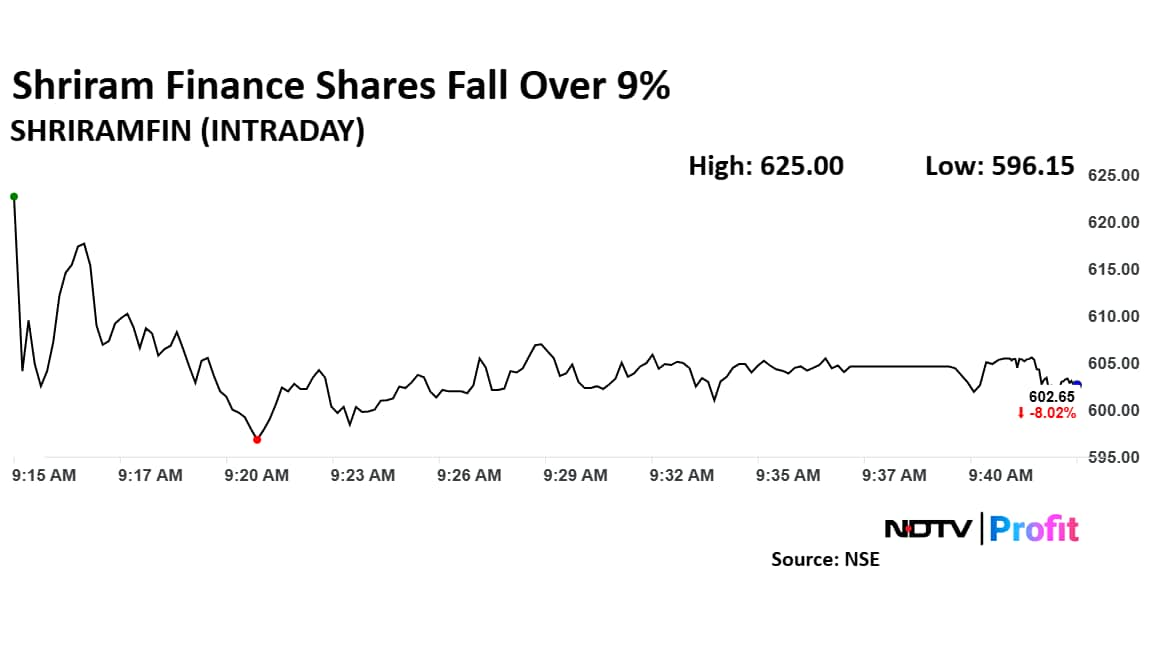

Shares of Shriram Finance Ltd. fell over 9% on Monday extending decline for the second day, after its fourth quarter net interest margin contracted. The stock fell 8.85% in the last trading session.

The company posted a profit of Rs 2,139.4 crore in the quarter ended March, 9.9% higher than Rs 1,945.87 crore in the same quarter last year. Analysts tracked by Bloomberg had a consensus estimate of Rs 2,137.5 crore.

The net interest margin for the quarter was lower at 8.25%, compared to 9% in the previous year.

The gross non-performing assets ratio was at 4.55% versus 5.38% in the previous quarter. The net NPA ratio is at 2.64% for the quarter. This compares to a 2.68% in the previous quarter.

Total income rose 20.7% to Rs 11,460.25 crore in the quarter ended March in comparison to Rs 9,497.85 crore posted in the same quarter in the previous fiscal. Net interest income also rose 13% to Rs 6,051.2 crore.

However, brokerages flagged concerns over net interest margin pressure, higher credit costs, and a sharp increase in gross stage-2 loans during the quarter. The company's NIMs were impacted by a higher liquidity buffer, with six months' worth of liquidity maintained on the balance sheet compared to the usual three months.

Management expects this to normalise over the next two quarters. Credit costs rose due to a 5.3% write-off of loans. Profit after tax was impacted by lower NIMs and higher credit costs, although this was partially offset by lower taxes.

Shriram Finance Shares Decline

Shares of Shriram Finance fell as much as 9% to Rs 596.15 apiece, the lowest level since April 7. It pared losses to trade 7.71% lower at Rs 604.70 apiece, as of 9:44 a.m. This compares to a 0.58% advance in the NSE Nifty 50.

The stock has risen 20.24% in the last 12 months and 4.04% year-to-date. Total traded volume so far in the day stood at 7.6 times its 30-day average. The relative strength index was at 38.97.

Out of 40 analysts tracking the company, 37 maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 21.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.