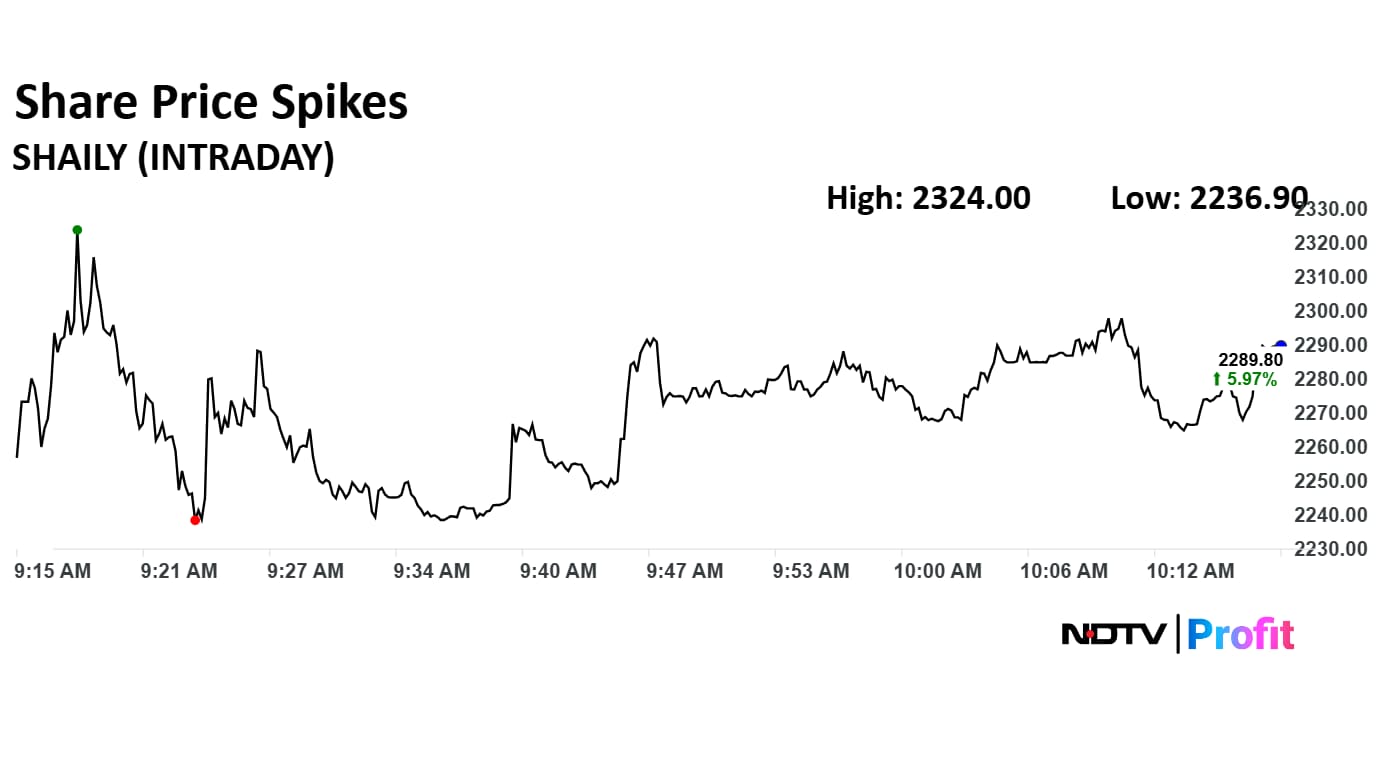

Shaily Engineering Plastics Ltd. share price rose above 7% on Tuesday to trade higher at Rs 2,324 apiece. The stock had gained 2.45% on Monday before declining nearly 1% at market close.

The stock has risen 3.26% in last one month and 40.42% in last three months. Similarly in the past six months the scrip has risen 53.90%

The company was established in 1987 by Mike Sanghvi and is now India's largest exporter of plastics components, the company said on its website.

The company employs over 2000 employees across seven manufacturing units and have over 200 injection molding machines, with precise, high speed automated and robotic production lines, it further said.

The company manufactures and supplies goods to some of the biggest names across various industries. They supply products for the medical, healthcare and consumer sectors, as well as critical components for the automotive industry. Alongside commodity polymers, the company specialises in high and ultra high performance polymers and are the only licensed processor of Torlon in India, the company's website said.

The scrip rose as much as 7.55% to Rs 2,324 apiece. It pared gains to trade 5.13% higher at Rs 2,271.60 apiece, as of 10:17 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has risen 142.84% in the last 12 months. Total traded volume so far in the day stood at 45 times its 30-day average. The relative strength index was at 56.

Out of four analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.