Shares of SBI Life Insurance Co. rose to hit a six-month high on Friday after it posted a consolidated net profit of Rs 814 crore in the fourth quarter of the previous fiscal.

This compares with a consensus estimate of Rs 1,038 crore by analysts polled by Bloomberg. In the year-ago period, the company posted a net profit of Rs 811 crore.

The net premium income during the quarter under review slipped 5% year-on-year to Rs 23,861 crore, compared to Rs 25,116 crore in the corresponding quarter of the previous fiscal.

Despite the profit missing estimates, UBS has maintained its ‘buy' rating on SBI Life and raised the target price to Rs 1,915 from Rs 1,880. The hike in price came on the back of higher-than-expected value of new business. For fiscal 2025, annualised premium equivalent grew 9% year-on-year, while VNB rose by 7%, indicating stable margin performance.

UBS highlighted that growth in the bancassurance channel has stabilised, which supported overall premium expansion. However, a shift in the product mix impacted growth in the agency channel, suggesting the need for continued diversification and product alignment going forward.

SBI Life's solvency ratio increased to 1.96%, compared to 2.04% in the preceding quarter.

The 13th month persistency ratio rose to 86.64% from 85.76% in the year-ago quarter, whereas the 61st month persistency ratio improved to 61.51% from 57.8% in the year-ago period.

The company has maintained its leadership position in individual rated premium with 22.8% private market share in fiscal 2025.

SBI Life Insurance Shares Advance

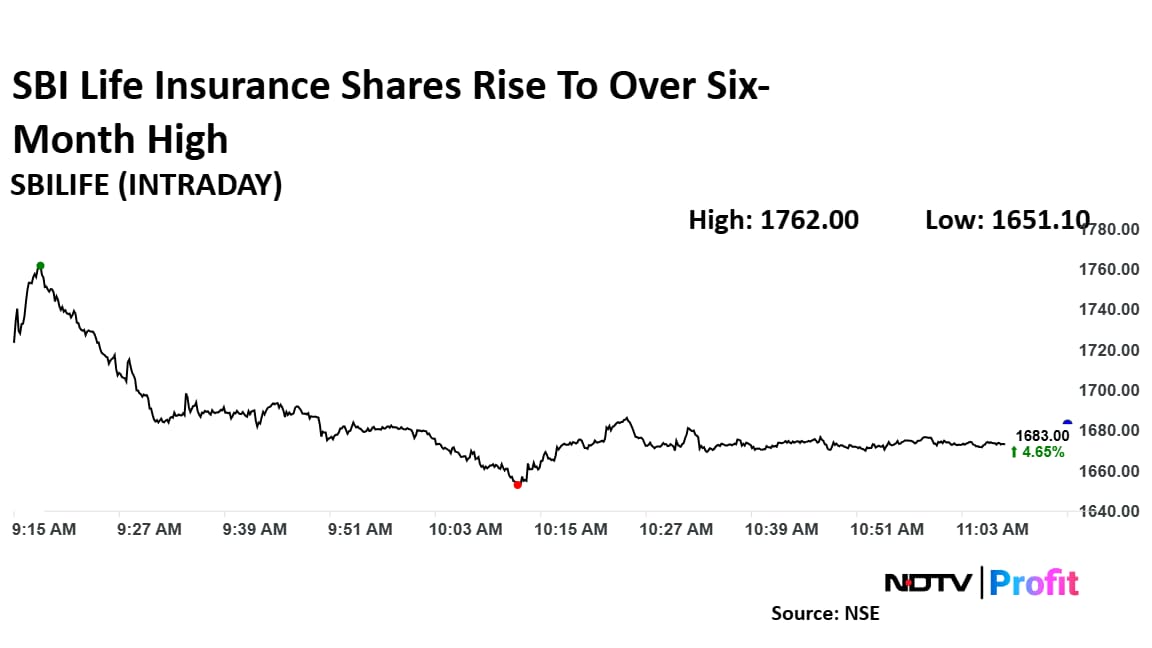

Shares of SBI Life Insurance rose as much as 9.56% to Rs 1,762 apiece, the highest level since Oct. 21, 2024. It pared gains to trade 4.38% higher at Rs 1,678.70 apiece, as of 11:13 a.m. This compares to a 1.27% decline in the NSE Nifty 50.

The stock has risen 16.47% in the last 12 months and 21.03% year-to-date. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 60.

Out of 36 analysts tracking the company, 33 maintain a 'buy' rating and three recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.