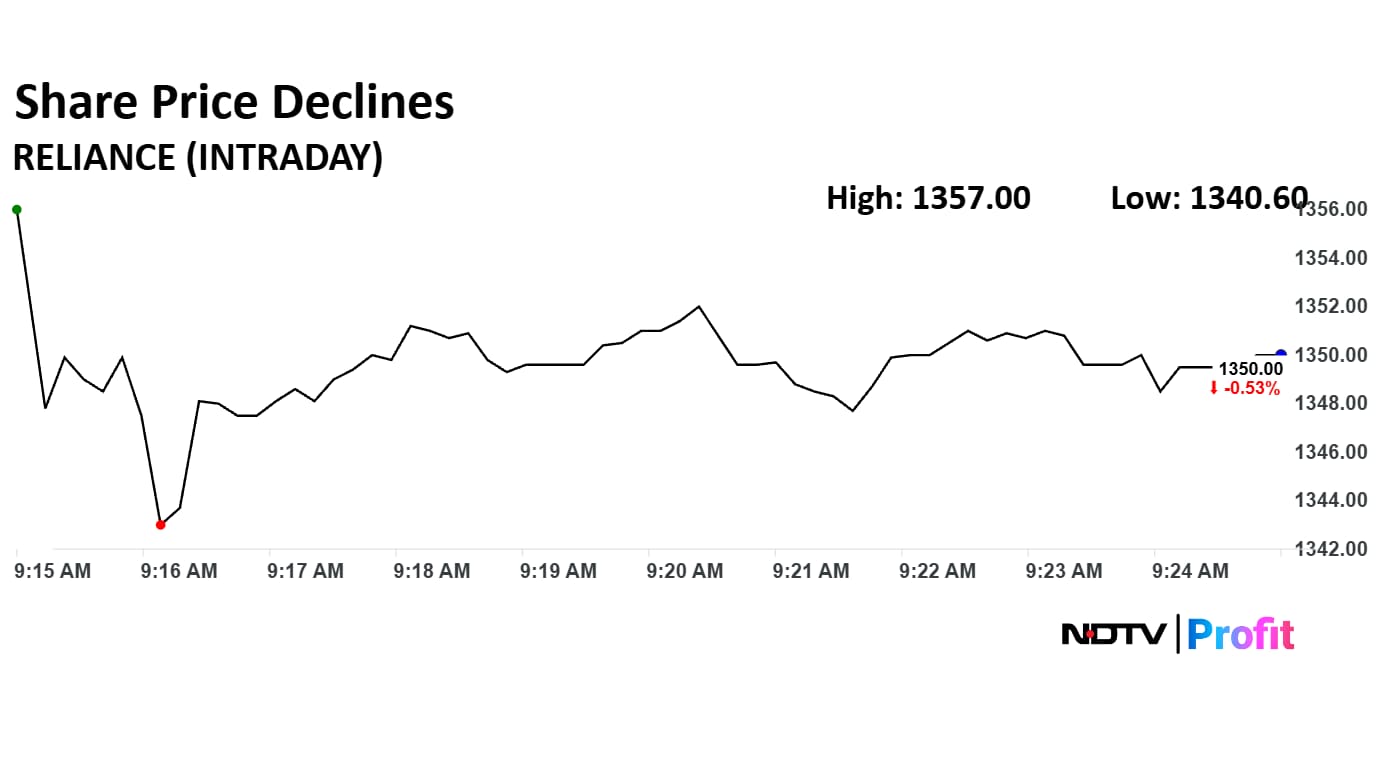

- Reliance Industries shares fell 1.22% in intraday trading on Monday morning

- Share price declined following the 48th AGM where Jio IPO plans were announced

- Jio is expected to be listed by the first half of financial year 2026

Reliance Industries' share price continued to fall for the second session on Monday morning as the stock hit an intraday low of 1.22%. The fall comes after the oil-to-technology conglomerate conducted its 48th annual general meeting on Aug. 29, in which the company's chairman Mukesh Ambani announced plans to list Jio by the first of the financial year 2026.

The stock was under pressure on Friday as well as it declined 2.55% intraday.

One of the main reasons for the decline in shares is that, through the IPO process the existing Reliance shareholders will not get any benefits. In addition to that, there will be a holding company discount that comes into play. For more details, click here.

Ambani also announced the formation of a new subsidiary, Reliance Intelligence under Reliance Industries, aimed at building India's AI infrastructure. The company plans to set up gigawatt-scale AI data centers powered by green energy. One is already in work in Jamnagar, with facilities expected to be delivered soon.

Amabni did not post any clarification on the oil business post 50% tariff slap by US President Donald Trump on India due to its continuous purchase of Russian crude.

The scrip fell as much as 1.22% to Rs 1,340 apiece. It pared gains to trade 0.33% lower at Rs 1,352.70 apiece, as of 09:28 a.m. This compares to a XX advance/decline in the NSE Nifty 50 Index.

It has declined 10.79% in the last 12 months. Total traded volume so far in the day stood at 0.17 times its 30-day average. The relative strength index was at 35.

Out of 37 analysts tracking the company, 34 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.