Shares of One97 Communications Ltd., Bombay Stock Exchange Ltd. and Hindustan Petroleum Corp. were in focus on Wednesday, after the companies announced their fourth quarter results.

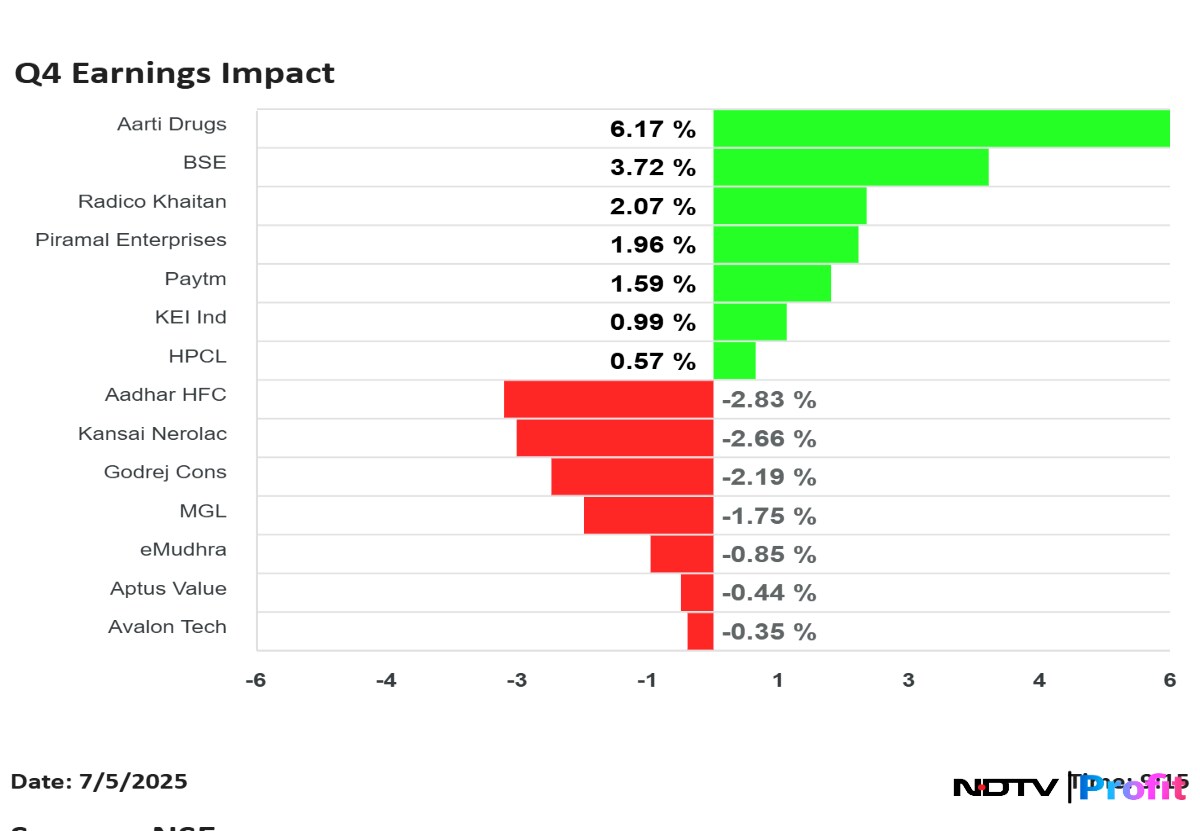

Aarti Drugs Ltd. shares rose the most, while Aadhar Housing Finance Ltd. fell the most, among the companies that announced their results for quarter ended March.

HPCL Q4 FY25 Highlights (Standalone, QoQ)

Share price rose 1.03% at Rs 400.90.

Revenue down 0.92% at Rs 1,09,492 crore versus Rs 1,10,505 crore (Bloomberg estimate: Rs 1,09,544 crore).

Ebitda down 2.78% at Rs 5,803 crore versus Rs 5,969 crore.

Ebitda margin down 10 bps at 5.29% versus 5.4%.

Net profit up 10.98% at Rs 3,354 crore versus Rs 3,022 crore.

Paytm FY25 Highlights (Consolidated, QoQ)

Share price rises 4.55% at Rs 851.90.

Revenue up 4.6% to Rs 1,911.5 crore versus Rs 1,827.8 crore (Bloomberg estimate: 2,035.2 crore).

Net loss at Rs 544.6 crore versus loss of Rs 208.5 crore (Estimate: Loss of Rs 178 crore).

Ebitda loss at Rs 88.6 crore versus loss of Rs 222.4 crore (Estimate: Loss of Rs 62.7 crore).

One-time loss of Rs 522 crore in Q4.

This one-time loss includes an accelerated charge of Rs 492 crore after CEO said they will forego ESOPs.

Net payment margin of Rs 578 crore. Excluding UPI incentive, net payment margin was Rs 508 crore, up 4% QoQ.

Gross merchant value up by 1% QoQ to Rs 5.1 lakh crore.

Financial services revenue increased to Rs 545 crore, up 9% QoQ.

Merchant subscriber base for devices has reached 1.24 crore as of March 2025, an addition of eight lakh QoQ.

Cash balance of Rs 12,809 crore.

Radico Khaitan Q4 FY25 Highlights (Consolidated, YoY)

Share price up 4.25% at Rs 2,645.

Revenue up 15% at Rs 1,304 crore versus Rs 1,078 crore.

Ebitda up 45% at Rs 178 crore versus Rs 122 crore.

Margin at 13.6% vs 11.3%

Net profit up 59.7% at Rs 90.7 crore versus Rs 56.8 crore.

Mahanagar Gas Q4 FY25 Highlights (Standalone, QoQ)

Share price down 4.30% at Rs 1,317.70.

Revenue up 5.7% to Rs 1,864.85 crore versus Rs 1,757.57 crore (Bloomberg estimate: Rs 1,803 crore).

Ebitda up 20% to Rs 378.37 crore versus Rs 314.41 crore (Bloomberg estimate: Rs 353 crore).

Margin at 20.3% versus 17.9% (Bloomberg estimate: 19.6%).

Net profit up 12% to Rs 252.19 crore versus Rs 225.37 crore (Bloomberg estimate: Rs 245.1 crore).

Kansai Nerolac Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 4.01% at Rs 243.20.

Revenue up 2.7% to Rs 1,816.65 crore versus Rs 1,769.39 crore.

Net profit down 6.5% to Rs 108.46 crore versus Rs 116.03 crore.

Ebitda down 7.4% to Rs 165.72 crore versus Rs 178.99 crore.

Margin at 9.1% versus 10.1%.

Aptus Value Housing Finance Q4 FY25 Highlights (Standalone, YoY)

Share price fell 1.51% at Rs 312.60.

Total income up 24.7% to Rs 370 crore versus Rs 296 crore.

NII up 11.39% at Rs 215 crore versus Rs 193 crore.

Net profit up 38.8% to Rs 170 crore versus Rs 122 crore.

AUM as of FY25 at Rs 10,865 crore, growth of 25% year-on-year.

GNPA at 1.18% vs 1.2% (QoQ).

NNPA at 0.88% vs 0.89% (QoQ).

Aim for Rs 25,000 crore AUM by FY28.

Avalon Tech Q4FY25 Highlights (Consolidated, YoY)

Share price falls 2.59% at Rs 830.85.

Revenue up 58% at Rs 343 crore versus Rs 217 crore.

Ebitda at Rs 41 crore versus Rs 17 crore.

Margin at 12% versus 7.9%.

Net profit at Rs 24.2 crore versus Rs 7 crore.

Order book has increased by 29.0% YoY.

India manufacturing representing 87% of revenue, delivered 14.2% Ebitda and 9.5% PAT in FY25.

EMudhra Q4FY25 Highlights (Consolidated, QoQ)

Share price falls 1.47% at Rs 733.10.

Revenue up 6% at Rs 149 crore versus Rs 141 crore.

EBIT up 21% at Rs 31 crore versus Rs 26 crore.

EBIT margin At 20.8% versus 18.2%.

Net profit up 13.8% at Rs 24 crore versus Rs 21 crore.

KEI Industries Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 2.41% at Rs 3,271.

Revenue up 25.1% to Rs 2,914.78 crore versus Rs 2,330 crore. (Estimate: Rs 2,914 crore)

Ebitda up 17% to Rs 301.27 crore versus Rs 258.35 crore.

Margin at 10.3% versus 11.1%.

Net profit up 34% to Rs 226.54 crore versus Rs 168.47 crore (Estimate Rs 226 crore).

Aadhar Housing Finance Q4FY25 Highlights (Standalone, YoY)

Share price fell 4.33% at Rs 444.55.

Total income up 20.5% to Rs 833.75 crore versus Rs 691.73 crore.

NII up 21.79% at Rs 408 crore versus Rs 335 crore.

Net profit up 22% to Rs 245.24 crore versus Rs 201.15 crore.

AUM up 21% at Rs 25,531 crore versus Rs 21,121 crore.

Gross NPA at 1.08% versus 1.42% (QoQ).

NNPA at 0.71% versus 0.92% (QoQ).

Board increased the borrowing powers limits up to Rs 30,000 crore.

Godrej Consumer Products Q4 FY25 Highlights (Consolidated, YoY)

Share price down 3.14% at Rs 1,211.50.

Revenue up 6.2% to Rs 3,598 crore versus Rs 3,385 crore (Bloomberg estimate: Rs 3,616.94 crore).

Ebitda up 0.4% to Rs 759 crore versus Rs 756 crore (Estimate: Rs 739.02 crore).

Margin at 21.1% versus 22.3% (Estimate: 20.4%).

Net profit at Rs 412 crore versus loss of Rs 1,893 crore (Estimate: Rs 490.78 crore).

Segmental breakup

Home care grew by 14%.

Personal care grew by 4%.

Household insecticides grew in double digits.

Aarti Drugs Q4 FY25 Highlights (Consolidated, YoY)

Share price rose 8.95% at Rs 381.20.

Revenue up 9% to Rs 676 crore versus Rs 620 crore.

Ebitda up 8% to Rs 93.2 crore versus Rs 86.1 crore.

Margin at 13.8% versus 13.9%.

Net profit up 33% to Rs 63 crore versus Rs 47.4 crore.

BSE Q4 FY25 Highlights (Consolidated, QoQ)

Share price up 6.75% at Rs 6,666.50.

Revenue up 7.7% to Rs 846.6 crore versus Rs 786 crore (Bloomberg estimate: Rs 770.04 crore).

Net profit up 127% to Rs 493 crore versus Rs 217 crore (Bloomberg estimate: Rs 409.84 crore).

Operating Ebitda including Core SGF at Rs 593.6 crore versus Rs 235 crore.

Operating Ebitda margin including Core SGF at 70% versus 31%.

Alert: SGF is Settlement Guarantee Fund.

NSE Q4 (Consolidated, QoQ)

Revenue from operations at Rs 3,771 crore vs Rs 4,349 crore down 18% YoY, 13% QoQ.

Operating Ebitda at Rs 2,799 crore vs Rs 3,398 crore, down 8% YoY, 18% QoQ.

Operating Ebitda margin 74% vs 78%.

PAT at Rs 2,650 crore vs Rs 3,834 crore, down 31% QoQ, up 7% YoY.

FY25

Cash Market volume grew by 40%.

Equity Futures volume grew by 40%.

Equity Options volume grew 2%.

Currency Derivatiives volume degrew 81%.

Q4

Cash Market volume degrew by 13%.

Equity Futures volume degrew by 9%.

Equity Options volume degrew 31%.

Currency Derivatives volume degrew 81%.

Piramal Enterprises Q4 Highlights (Consolidated, YoY) — Below Estimates

Share price rose 4.28% at Rs 1,004.

Total income up 20% to Rs 3,032.6 crore versus Rs 2,528.16 crore.

Net profit down 25% to Rs 102.44 crore versus Rs 137 crore (Bloomberg estimate: Rs 126.5 crore).

GNPA at 2.8% versus 2.8%.

NNPA at 1.9% versus 1.5%.

Total assets under management of Rs 80,689 crore, up 36%.

Retail AUM up 35% YoY (80% of total AUM).

Outlook for FY26

AUM growth of 25% (YoY).

Growth AUM to grow by 30%.

Retail AUM to grow to 85%.

PAT at Rs 1,300-1,500 crore.

Kansai Nerolac Q4 FY25 Highlights (Consolidated, YoY)

Share price up 4.01% at Rs 243.20.

Revenue up 2.7% to Rs 1,816.65 crore versus Rs 1,769.39 crore.

Ebitda down 7.4% to Rs 165.72 crore versus Rs 178.99 crore.

Margin at 9.1% versus 10.1%.

Net profit down 6.5% to Rs 108.46 crore versus Rs 116.03 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.